Lien Codified Laws For Unmarried Parents

Description

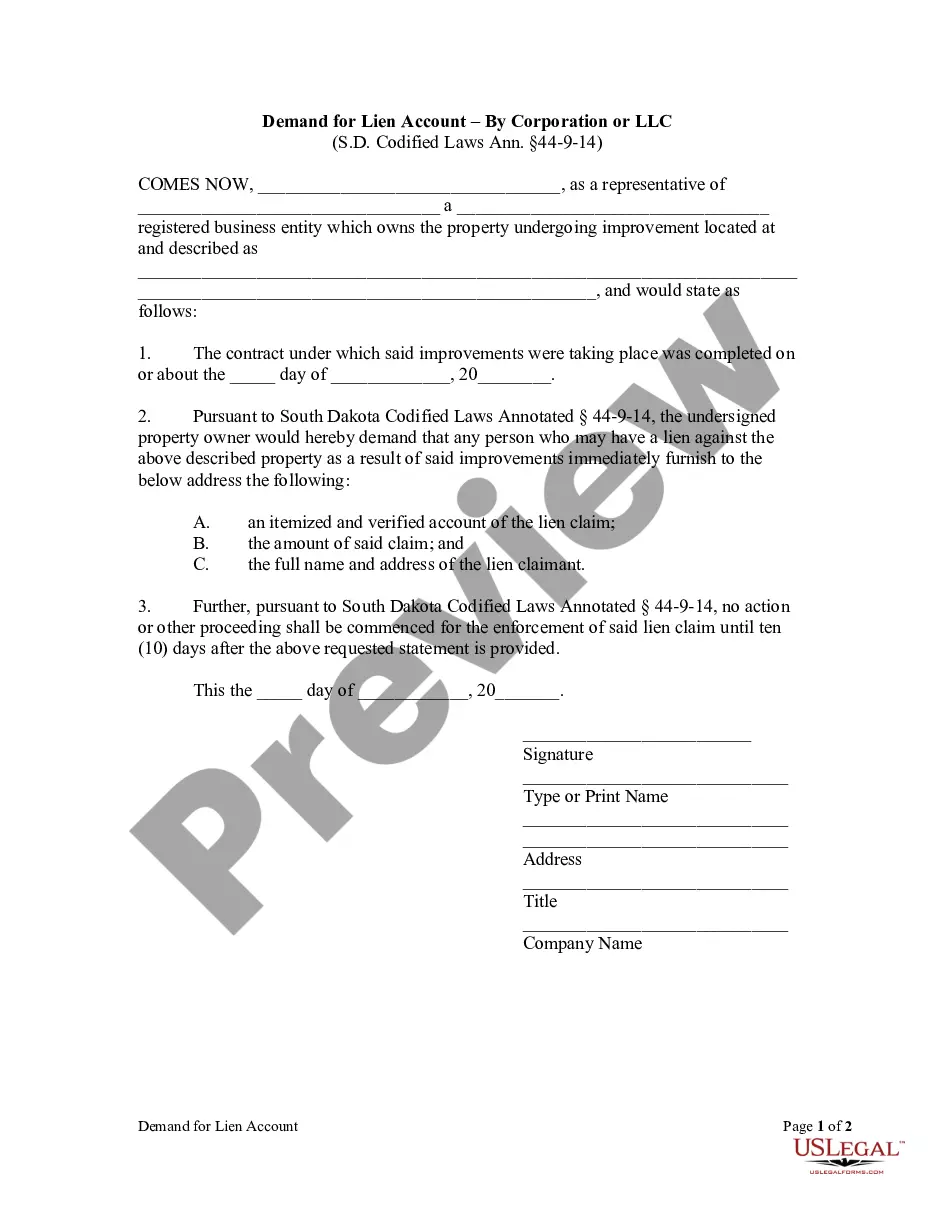

How to fill out South Dakota Demand For Lien Account By Corporation?

It's clear that you cannot transform into a legal expert instantly, nor can you quickly learn how to prepare Lien Codified Laws For Unmarried Parents without possessing a specialized education.

Assembling legal documents is a lengthy endeavor that demands specific training and expertise. Therefore, why not entrust the drafting of the Lien Codified Laws For Unmarried Parents to the experts.

With US Legal Forms, which has one of the most comprehensive collections of legal templates, you can discover everything from court documents to in-office communication formats.

If you require a different form, initiate your search again.

Create a complimentary account and choose a subscription plan to purchase the template. Click Buy now. Once the payment is completed, you can download the Lien Codified Laws For Unmarried Parents, complete it, print it out, and send or mail it to the necessary parties or organizations.

- We understand the importance of compliance and adherence to federal and state statutes and regulations.

- This is why all templates on our site are location-specific and current.

- Start by visiting our website to acquire the form you need in just minutes.

- Find the necessary form using the search bar at the top of the page.

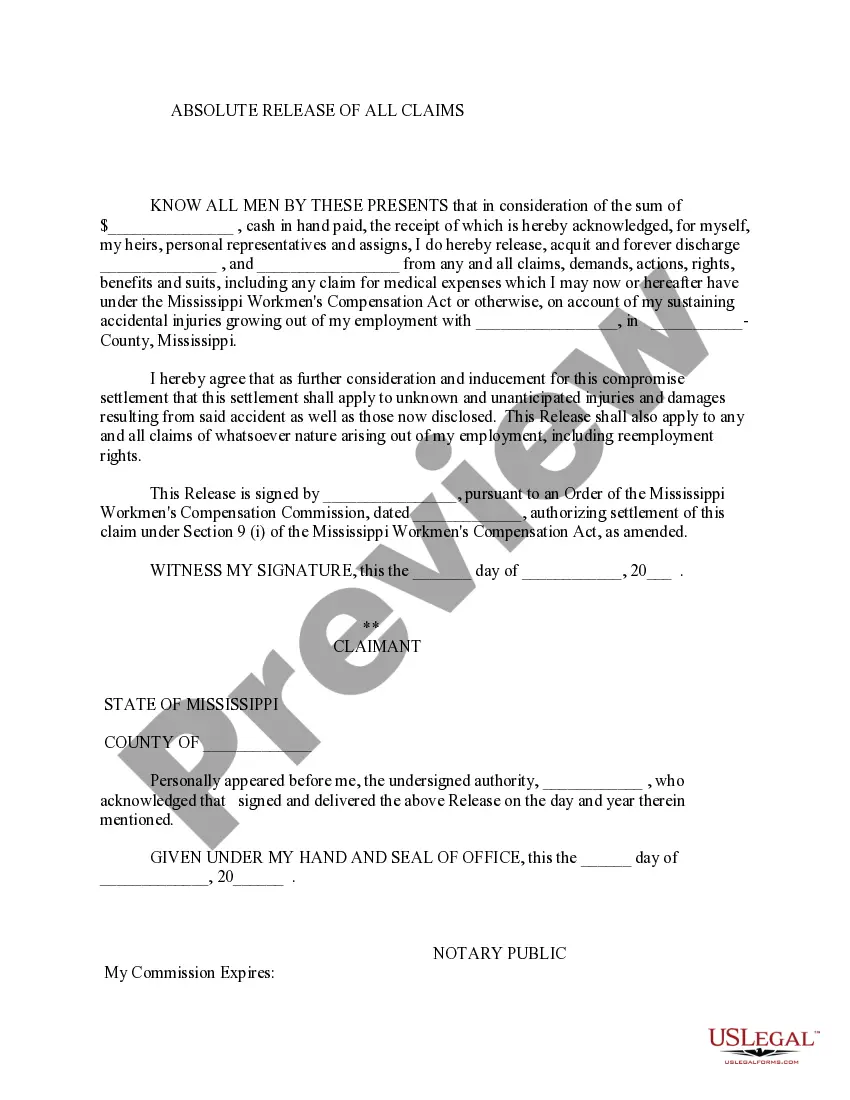

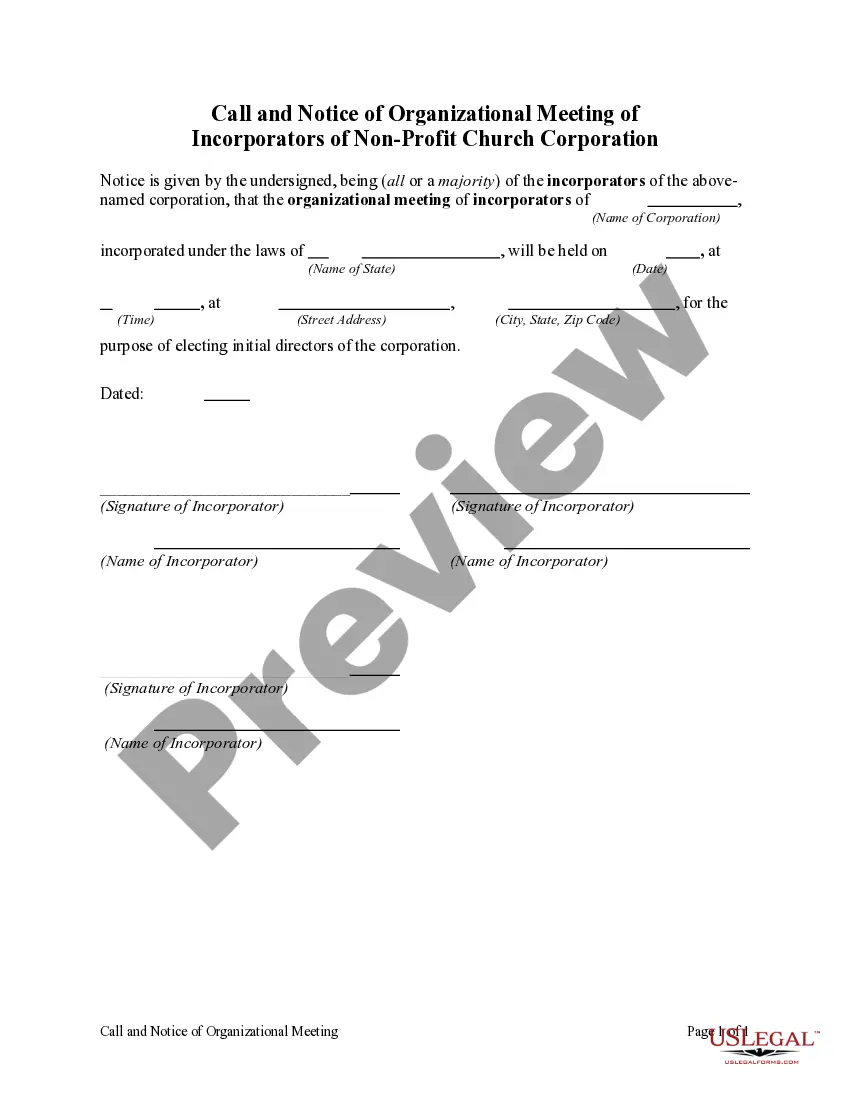

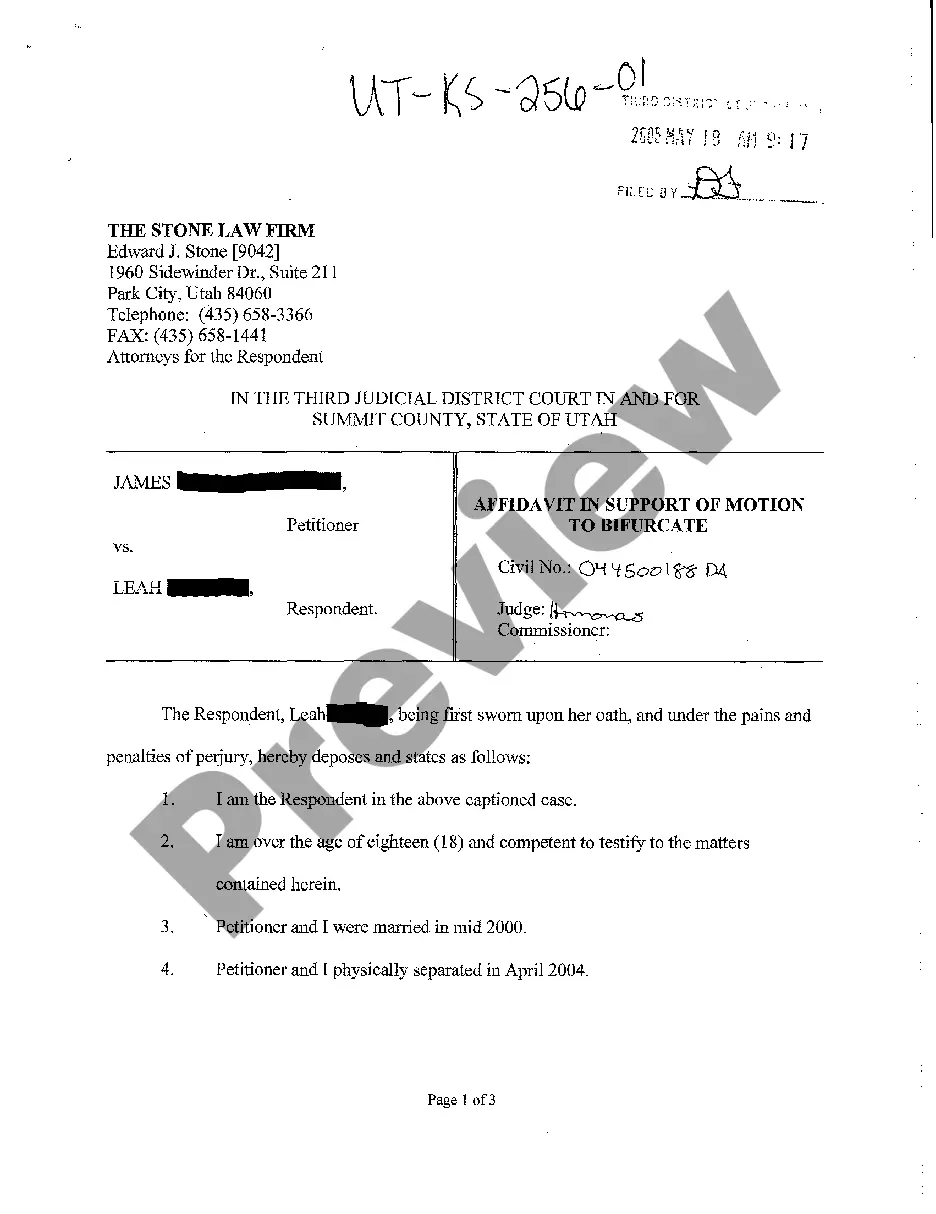

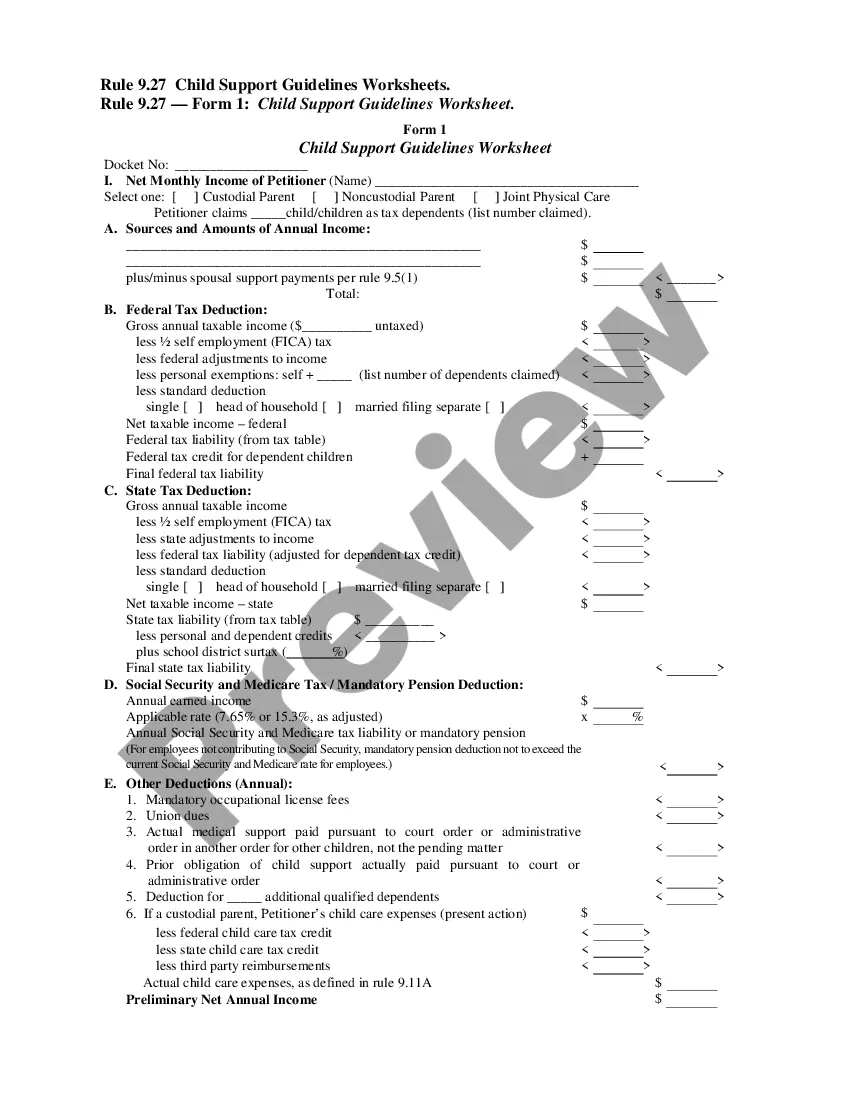

- Preview it (if available) and review the accompanying description to see if Lien Codified Laws For Unmarried Parents fits your requirements.

Form popularity

FAQ

The amended FDCPA allows debt collectors to use newer technologies, such as email and text messages, to communicate with consumers regarding their debts, subject to certain limitations, which protect consumers against harassment or abuse.

One such recent development impacting consumer debt collections is the newly enacted Regulation F. Effective November 30, 2021, the Consumer Financial Protection Bureau (?CFPB?) enacted Regulation F to the Fair Debt Collection Practice Act (FDCPA). The full text of the Rule can be found here.

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

You have the right to send what's referred to as a ?drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

You can sue the debt collector for violating the FDCPA. If you sue under the FDCPA and win, the debt collector must generally pay your attorney's fees and may also have to pay you damages. If you're having trouble with debt collection, you can submit a complaint with the CFPB.

The truth is that there are no magic words to stop a debt collector from collecting the debt. In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its ?Please cease and desist all calls and contact with me immediately.?