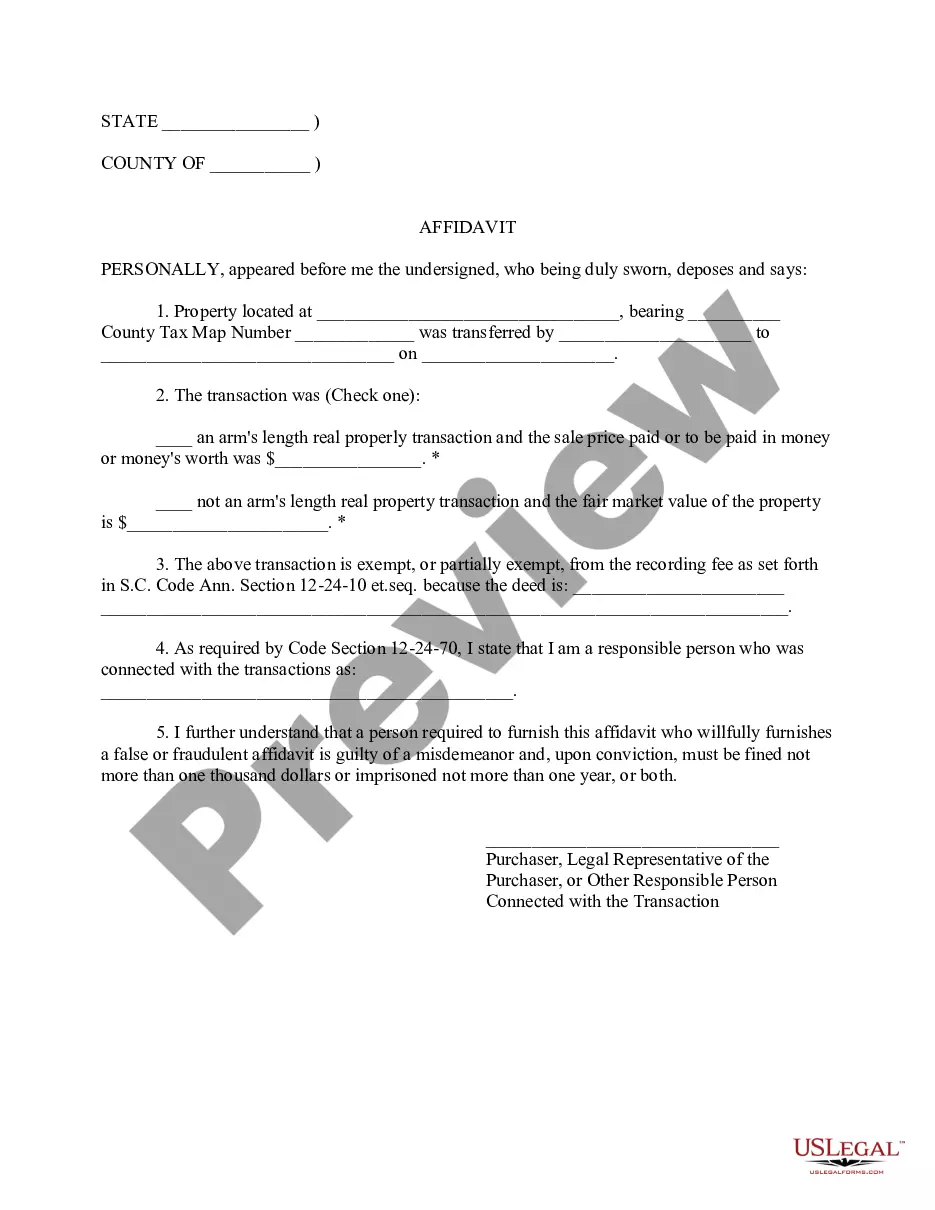

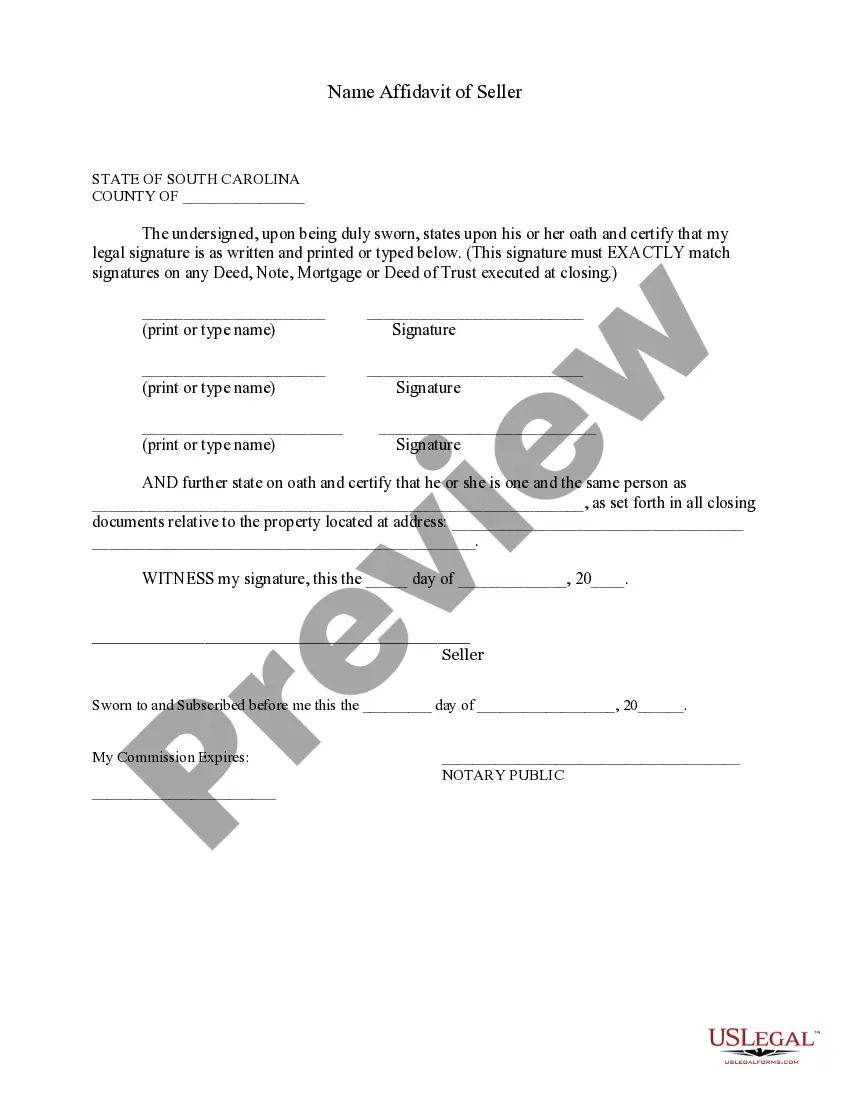

Affidavit Of Service South Carolina Withholding

Description

How to fill out South Carolina Affidavit Of Service?

Steering through the red tape of traditional documents and formats can be challenging, particularly when one is not engaged in such tasks professionally.

Moreover, locating the appropriate template for an Affidavit Of Service South Carolina Withholding will consume a significant amount of time, as it must be accurate and precise down to the last detail.

However, you will invest considerably less time discovering a suitable template from a dependable source.

Acquire the correct document in a few straightforward steps: Enter the name of the document in the search box. Identify the appropriate Affidavit Of Service South Carolina Withholding among the outcomes. Review the sample description or preview it. If the template fulfills your requirements, click Buy Now. Next, select your subscription plan. Use your email to create a security password for your account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template on your device in your preferred format. US Legal Forms can save you time and effort in verifying whether the document you found online fits your needs. Set up an account to gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the process of finding the right documents online.

- US Legal Forms is a single source you need to obtain the latest samples of documents, seek advice on their utilization, and download these documents for completion.

- This is a repository containing over 85,000 forms relevant to various fields.

- When searching for an Affidavit Of Service South Carolina Withholding, you won't need to doubt its validity as all the documents are authenticated.

- Having an account at US Legal Forms guarantees that all necessary samples are at your fingertips.

- You can archive them in your history or add them to the My documents section.

- Your saved documents can be accessed from any device by simply clicking Log In on the library's website.

- If you do not yet possess an account, you can always search for the template you require.

Form popularity

FAQ

When your Federal income tax withholding is calculated, you are allowed to claim allowances to reduce the amount of the Federal income tax withholding. In 2017, each allowance you claim is equal to $4,050 of income that you expect to have in deductions when you file your annual tax return.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.