South Carolina Affidavit Form Withholding Tax

Definition and meaning

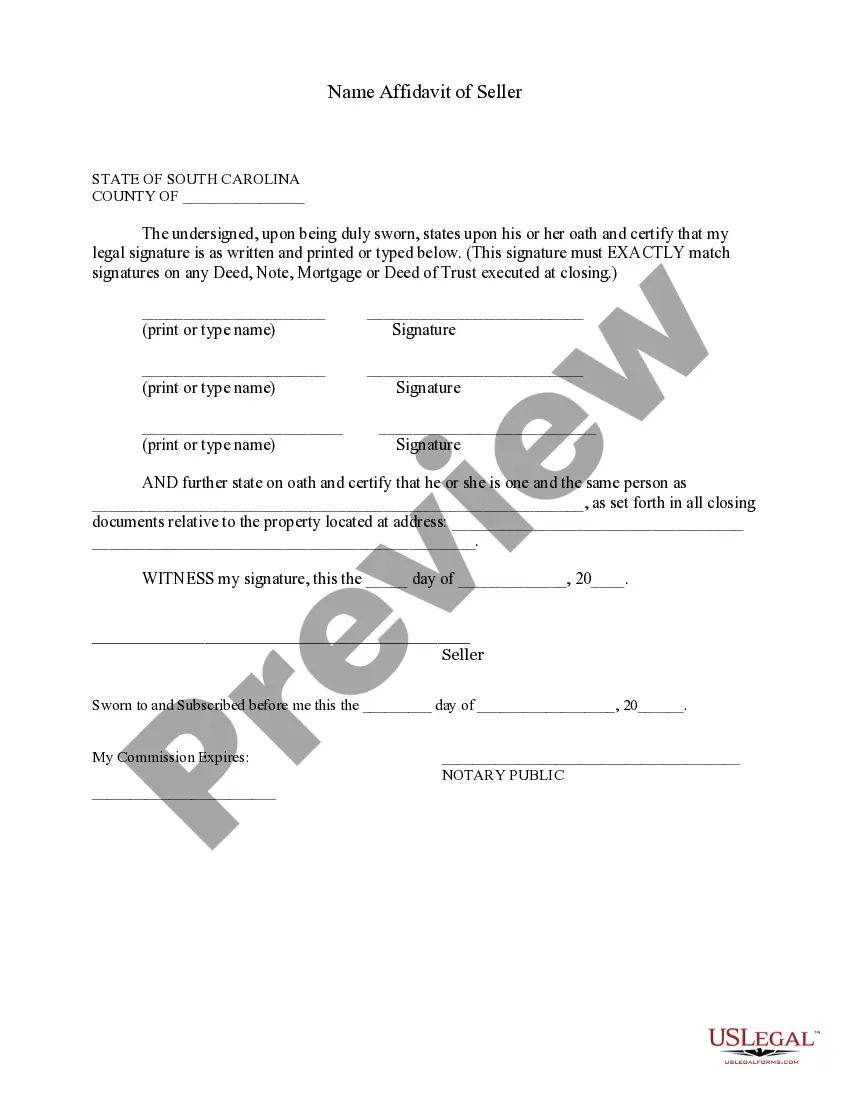

The South Carolina Affidavit Form Withholding Tax is a legal document used by individuals or businesses to affirm certain facts related to withholding tax obligations in South Carolina. This form serves as an affirmation that all required taxes have been withheld appropriately and reported as per the law.

How to complete a form

Completing the South Carolina Affidavit Form Withholding Tax is straightforward. Follow these steps:

- Begin by clearly filling out your name and contact information.

- Provide relevant details about the tax period you are affirming.

- Sign the form in the designated area, ensuring your signature matches the one on any related documents.

- Include the date of completion.

Always ensure all sections are filled out accurately to avoid delays or issues with processing.

Who should use this form

This form is intended for individuals or businesses operating in South Carolina who need to confirm their compliance with withholding tax regulations. It is particularly useful for employers, independent contractors, or anyone who handles payments subject to withholding tax.

Legal use and context

The South Carolina Affidavit Form Withholding Tax is often required by the South Carolina Department of Revenue as part of tax compliance checks. It is crucial to use this document when filing taxes to verify that the correct amount of tax has been withheld and reported, helping to avoid potential penalties or legal issues.

Common mistakes to avoid when using this form

When filling out the South Carolina Affidavit Form Withholding Tax, be mindful of these common errors:

- Neglecting to match your signature with other documents.

- Leaving fields blank, especially contact information.

- Incorrectly stating the tax period, leading to misreporting.

Double-check all entries before submission to ensure accuracy and completeness.

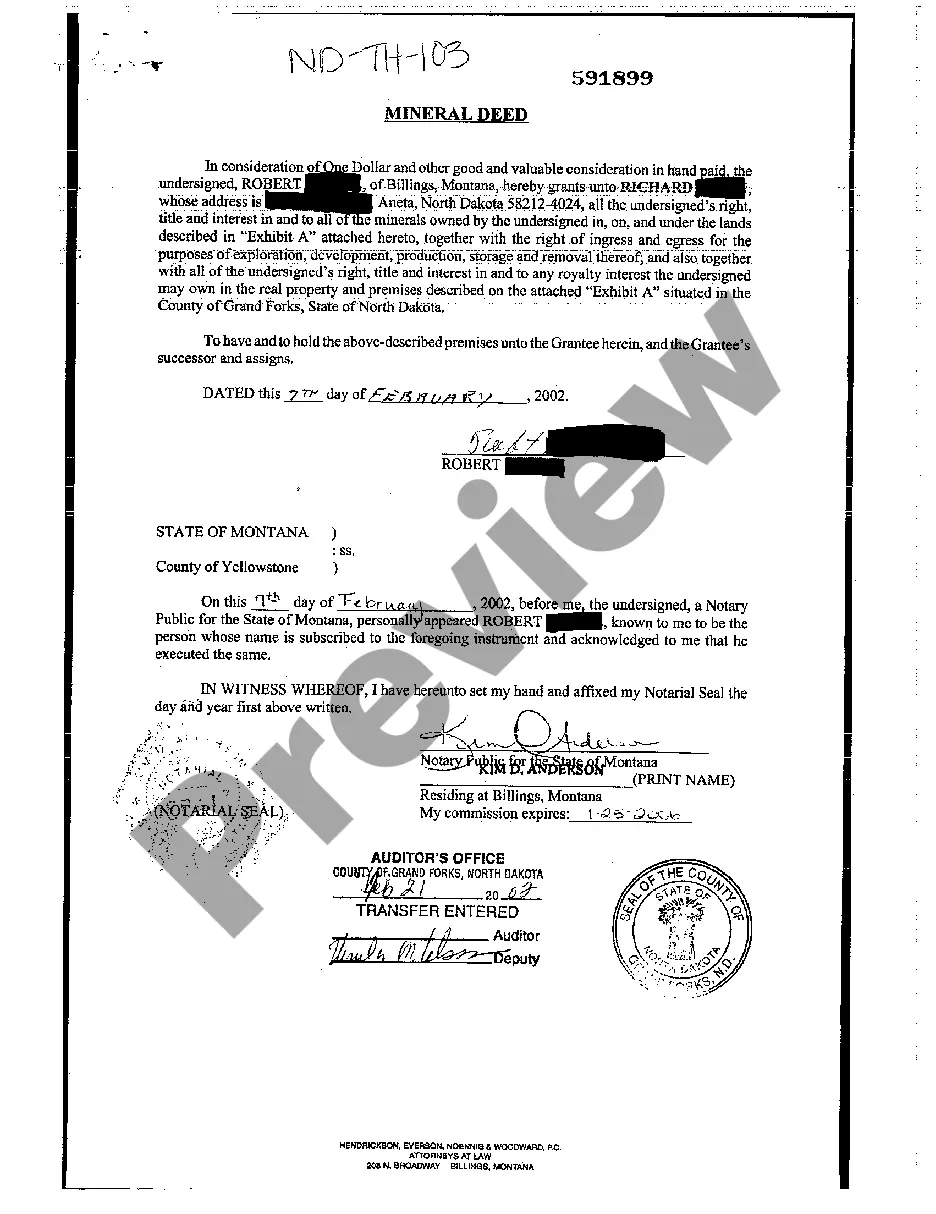

What documents you may need alongside this one

When submitting the South Carolina Affidavit Form Withholding Tax, you may need to present several supporting documents, including:

- Copies of previous withholding tax filings.

- Evidence of withholding, such as payroll records.

- Any corresponding documentation from the South Carolina Department of Revenue.

Gather these documents to streamline the filing process.

What to expect during notarization or witnessing

Notarization or witnessing of the South Carolina Affidavit Form Withholding Tax typically involves:

- Presenting a valid ID to the notary or witness.

- Signing the form in the presence of the notary or witness.

- The notary or witness confirming the identity and observing the signing process.

This step is crucial as it lends credibility and legal weight to the affidavit.

How to fill out South Carolina Name Affidavit Of Seller?

There's no further justification for wasting time searching for legal documents to satisfy your local state mandates.

US Legal Forms has compiled all of them in a single location and simplified their availability.

Our website presents over 85,000 templates for various business and personal legal scenarios organized by state and usage area.

Prepare the official documents under federal and state laws quickly and easily with our platform. Give US Legal Forms a try now to keep your records organized!

- All forms are properly prepared and checked for legitimacy, allowing you to trust in accessing an up-to-date South Carolina Affidavit Form Withholding Tax.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all retrieved documentation whenever necessary by accessing the My documents tab in your profile.

- If you are encountering our platform for the first time, the procedure will require a few additional steps to finish.

- Here's how newcomers can find the South Carolina Affidavit Form Withholding Tax in our catalog.

- Carefully read the page content to confirm it includes the sample you require.

- To achieve this, utilize the form description and preview options if available.

Form popularity

FAQ

Employee instructions Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

You set up your account and obtain a state withholding tax ID number by registering your business with the DOR. You can register online or on paper. To register online, go to the South Carolina Department of Revenue MyDORWAY website. To register on paper, use the SCDOR-111 form, Business Tax Registration.

The IRS has released an updated Tax Withholding Estimator and a FAQ page to assist in filling out the Form W-4. You may also visit the SC Department of Revenue website for information regarding the SC W-4. The university cannot offer tax advice but we may be able to assist with general questions on the form.

How to File:Securely file and pay South Carolina Withholding Tax online using our free tax portal, MyDORWAY.To file by paper, download the correct form below, print, and mail the completed return to the address listed on the return.More items...

You must withhold South Carolina state taxes at the same time wages are earned by employees working in South Carolina. An employee who works in another state but is a resident of South Carolina will have taxes withheld for the other state.