South Carolina Separation Agreement Template For House

Description

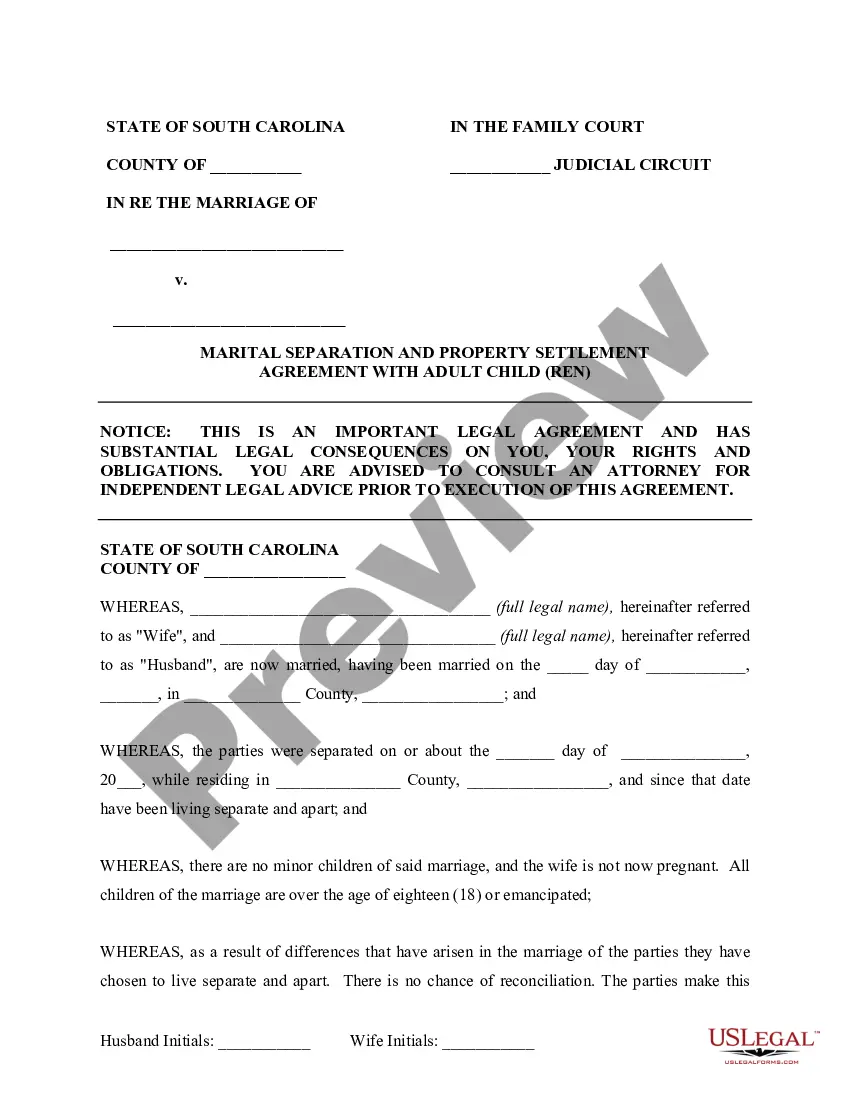

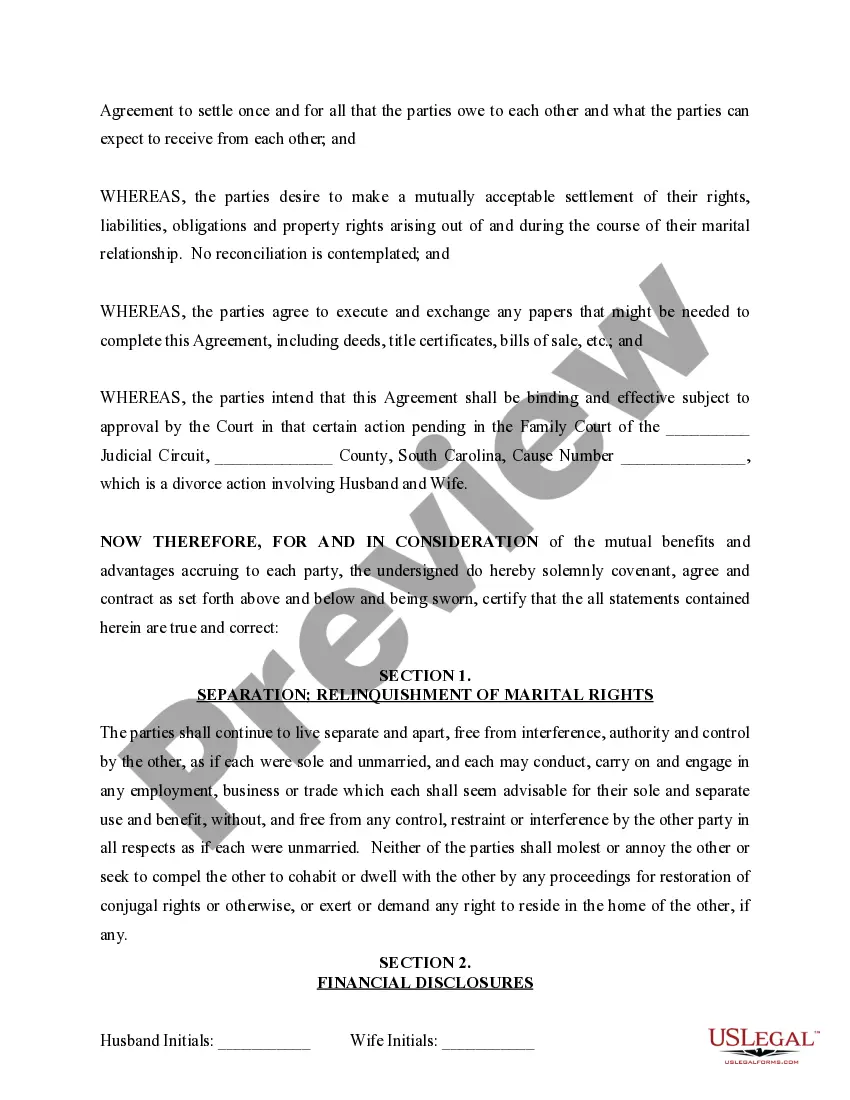

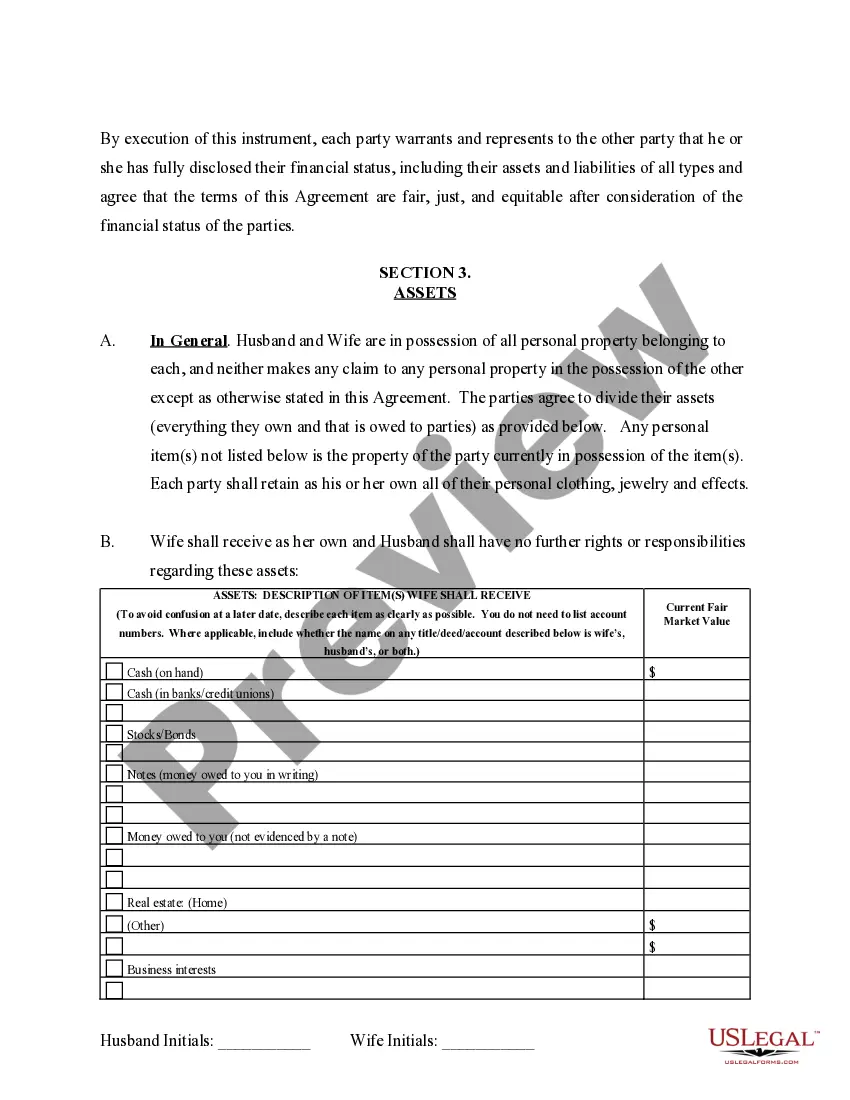

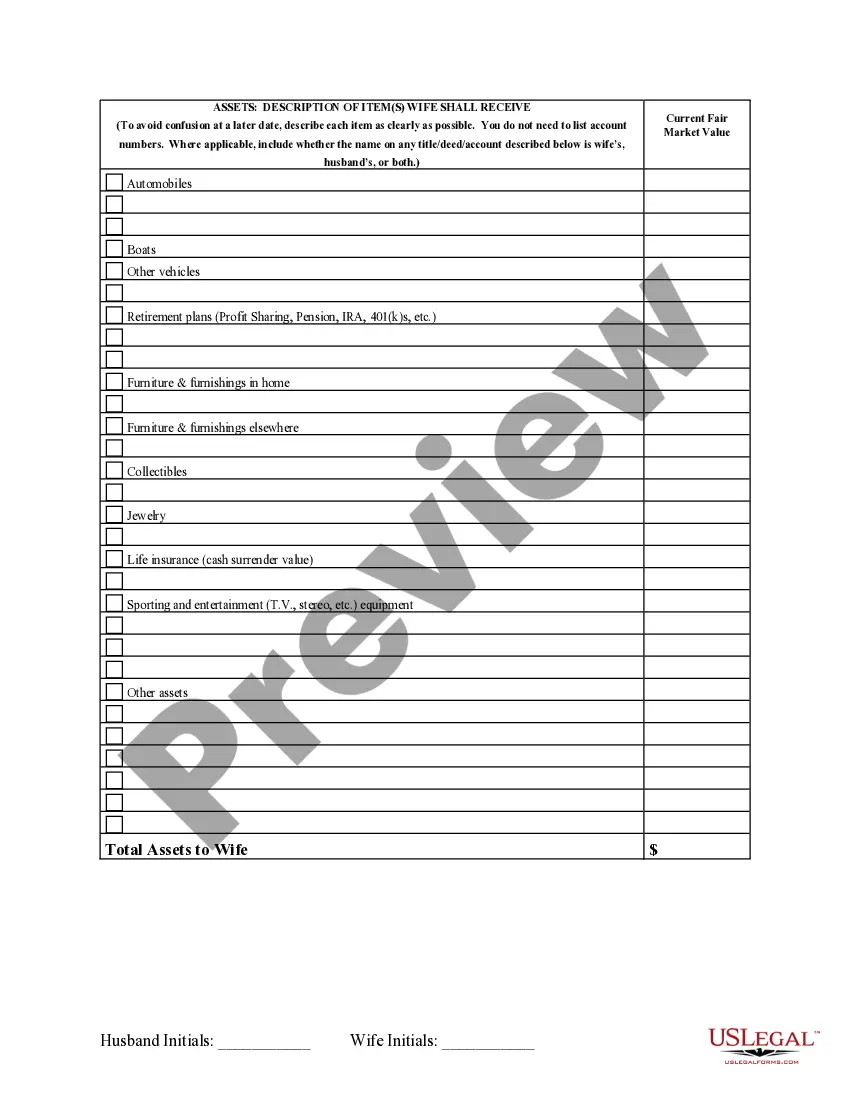

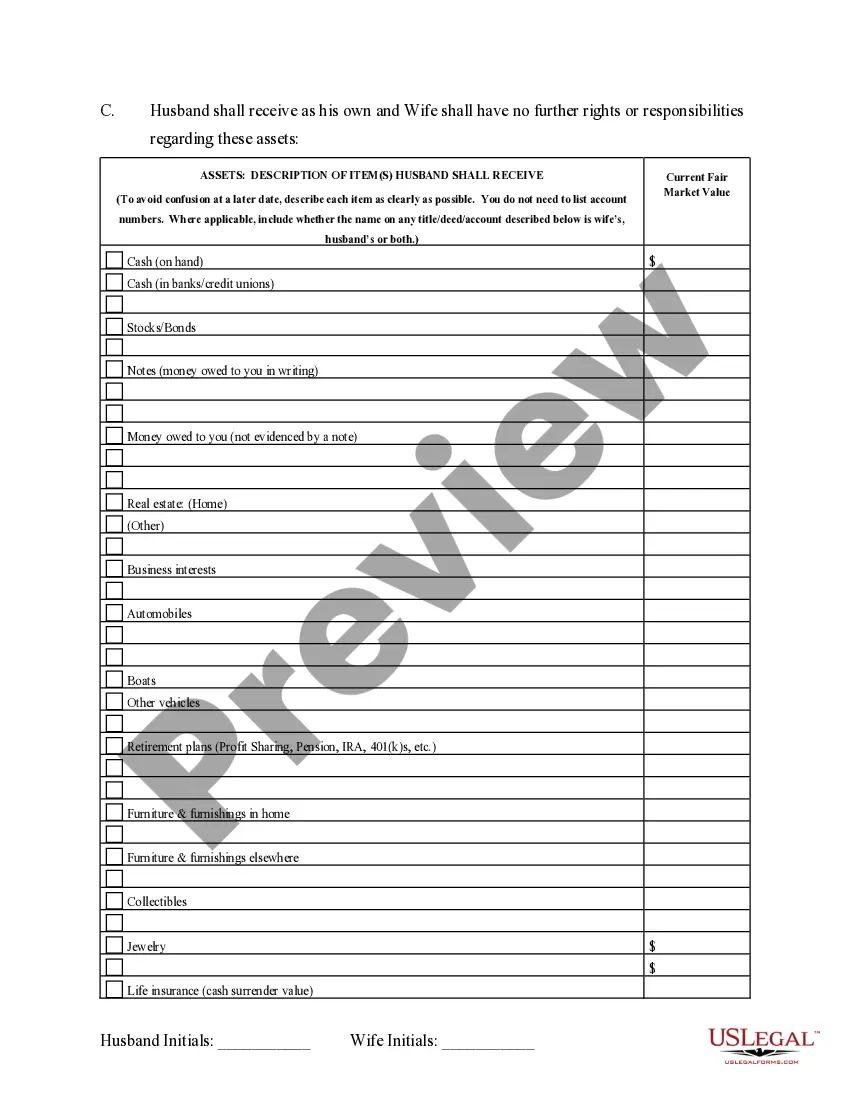

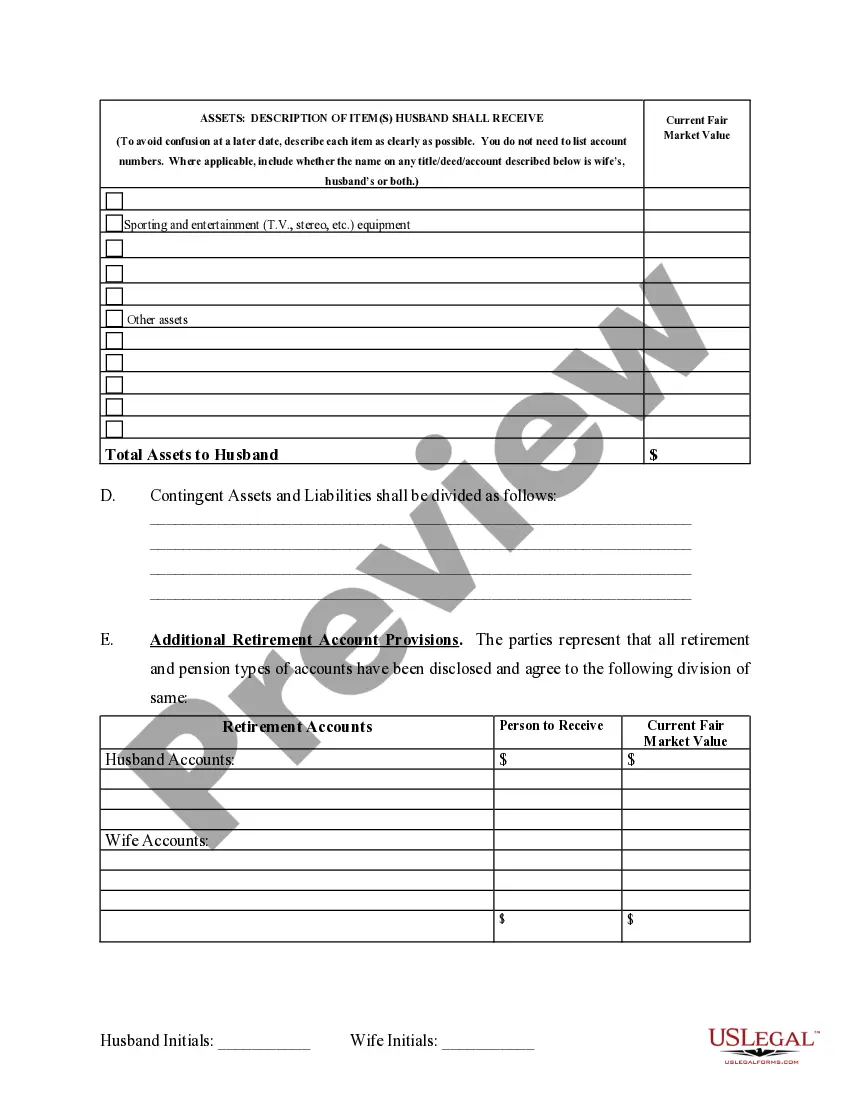

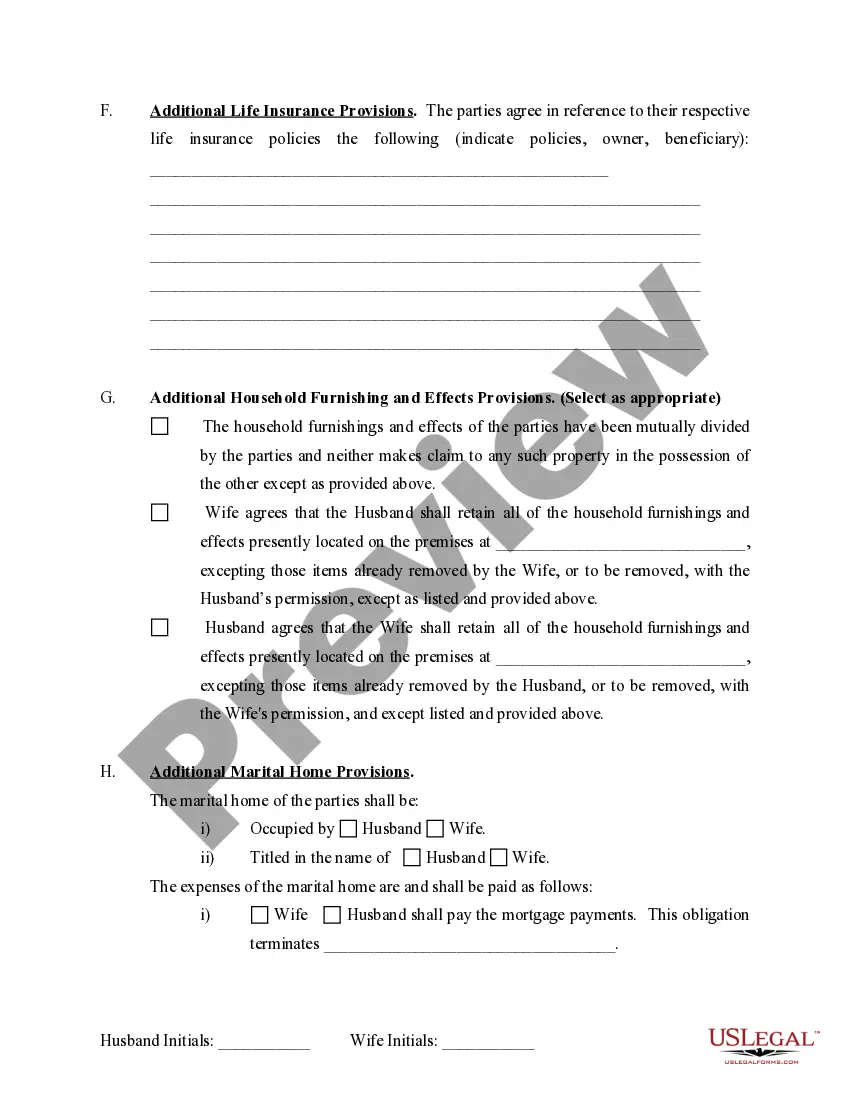

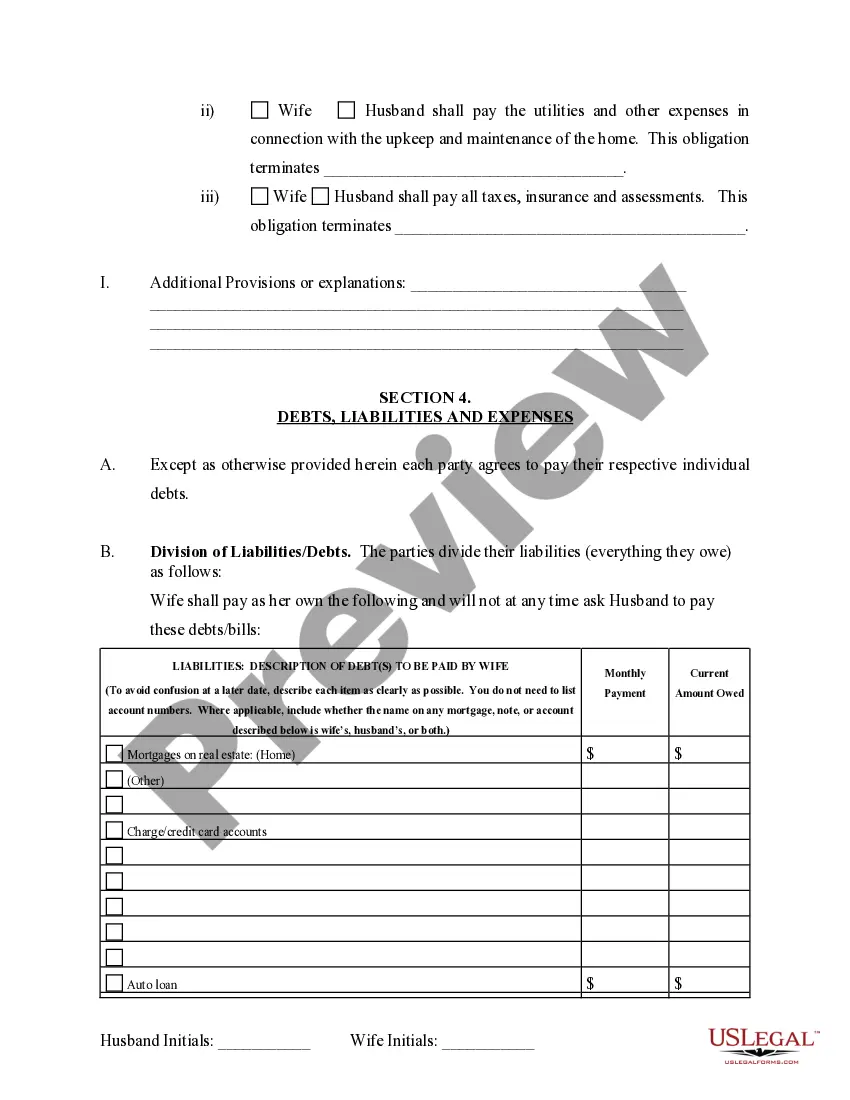

How to fill out South Carolina Marital Domestic Separation And Property Settlement Agreement Adult Children?

Identifying a reliable location to procure the most up-to-date and applicable legal templates is a significant part of navigating bureaucracy.

Selecting the proper legal documents requires accuracy and meticulousness, which is why it is essential to obtain samples of the South Carolina Separation Agreement Template For House solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and hinder the ongoing process.

Once you possess the document on your device, you can edit it using the editor or print it out to complete it manually. Eliminate the stress associated with your legal paperwork. Browse through the extensive US Legal Forms catalog, where you can discover legal samples, verify their relevance to your case, and download them immediately.

- Utilize the catalog navigation or search feature to find your template.

- Examine the form's description to determine if it satisfies the requirements of your state and county.

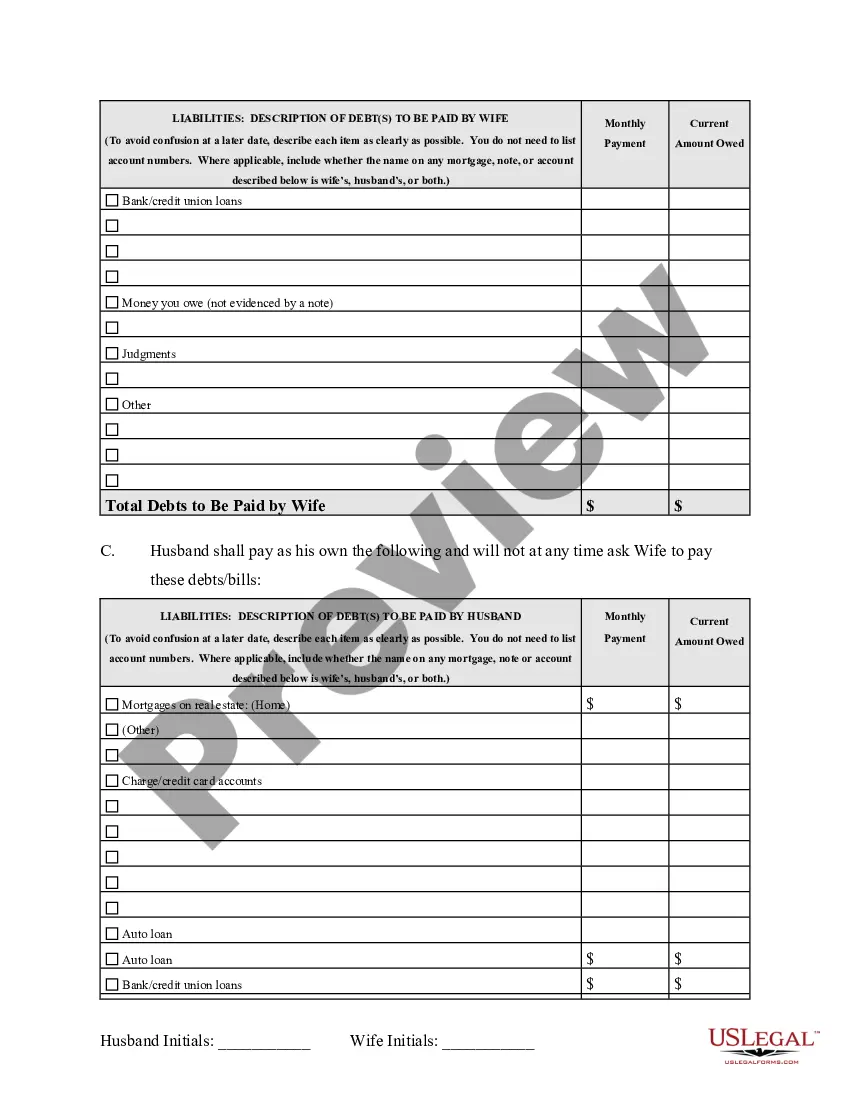

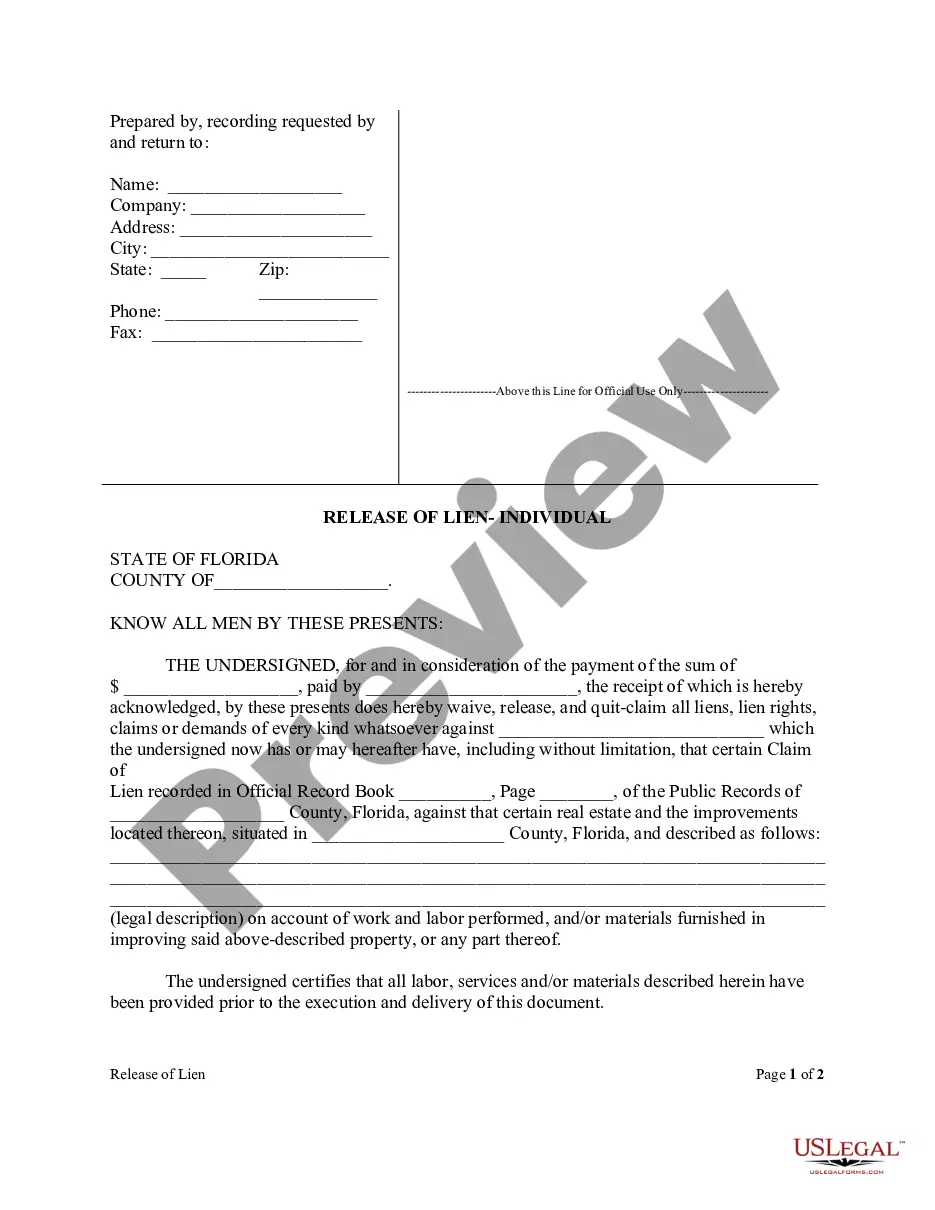

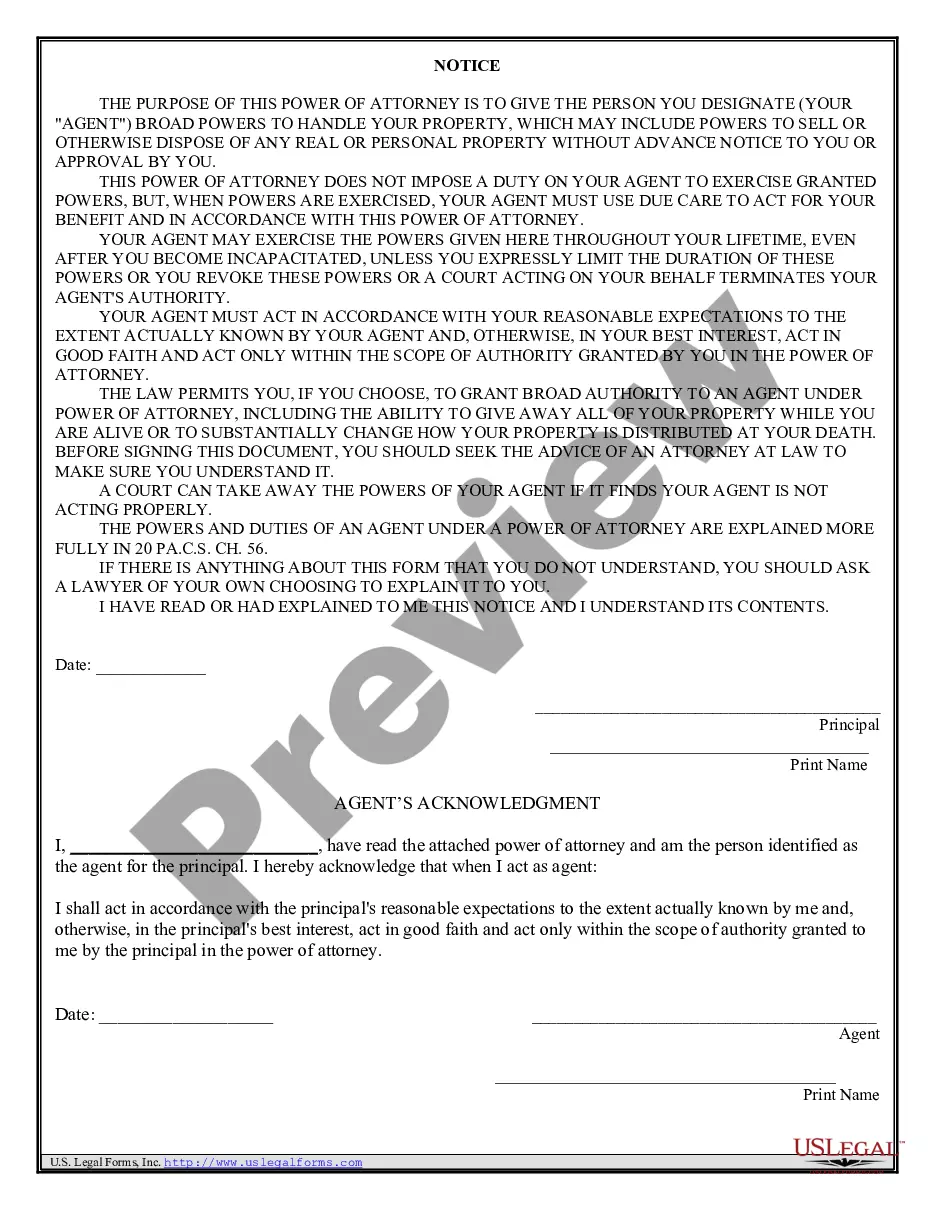

- Check the form preview, if available, to confirm it is indeed the template you need.

- If the South Carolina Separation Agreement Template For House does not meet your criteria, return to the search to find the appropriate template.

- Once you are certain about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you have yet to create an account, click Buy now to obtain the form.

- Select the pricing plan that aligns with your needs.

- Proceed to registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading the South Carolina Separation Agreement Template For House.

Form popularity

FAQ

Find Your Utah Tax ID Numbers and Rates You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

Get a Certificate of Existence Or Certificate of Good Standing is an official document issued by Utah validating that a business is authorized to transact business in Utah and that the company is in compliance with all state requirements.

A state tax identification number (also known as a state EIN, a state employer ID, or a state tax registration) is a unique number assigned to a business or organization by the state where the business operates, and is used for filing taxes and hiring employees.

How to Apply? Method 1: Apply Online. Online is preferred as it is the fastest method to receive your EIN. ... Method 2: Apply by Fax. Taxpayers can also complete Form SS-4 and send it to the IRS fax number listed below for Utah businesses. ... Method 3: Apply by Mail. ... Method 4: Apply by telephone- International Applicants.

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are ?WTH.? Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

If you need a Utah state tax ID number, your first step should be getting a federal tax ID number. Once you have that, make use of our Utah state tax ID number obtainment services. You can fill out the application online, and get your state tax ID number in 4 to 6 weeks.

You need an EIN if you operate a business and pay employees in Utah. Are EINs issued by the Utah Secretary of State? All EINs are issued by the IRS as of 2023, including those issued for businesses and individuals in Utah.

The filing fee for both in-state and out-of-state entities forming LLCs is $70. Remittance should be made payable to the state of Utah. It costs $75 to expedite the process. You may submit documents online, directly to the Division of Corporations and Commercial Code, or mail them to P.O. Box 146705.