Pennsylvania Name Change Cost

Description

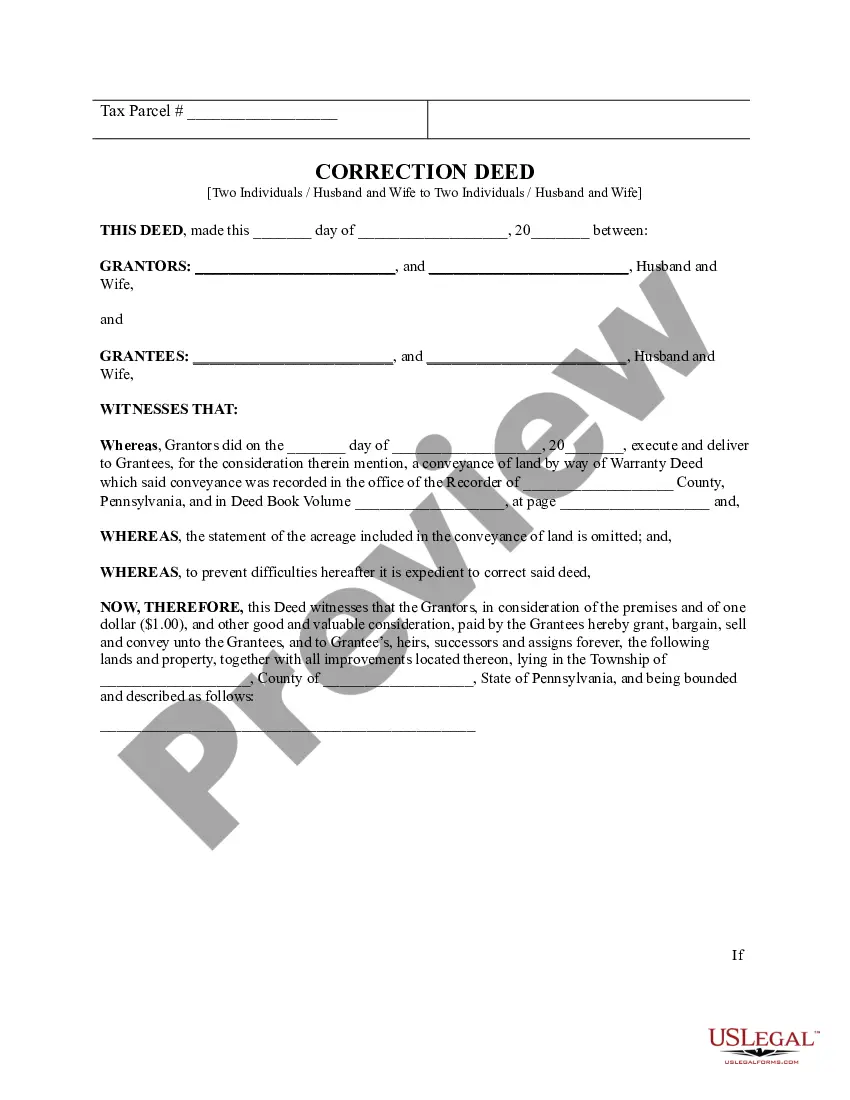

How to fill out Pennsylvania Correction Deed -?

The Pennsylvania Name Change Fee displayed on this page is a reusable legal document created by skilled attorneys in accordance with federal and state statutes and guidelines.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 validated, state-specific forms for any professional and personal situation. It’s the quickest, easiest, and most reliable method to obtain the documents you require, as the service ensures bank-level data protection and anti-malware safeguards.

Register for US Legal Forms to access verified legal templates for all of life’s situations available at your convenience.

- Search for the document you need and examine it.

- Browse the example you searched for and view it or read the form description to confirm it meets your needs. If it does not, use the search feature to find the suitable one. Click Buy Now when you have found the template you need.

- Register and sign in.

- Choose the pricing plan that fits you best and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and check your subscription status to proceed.

- Obtain the fillable document.

- Select the format you prefer for your Pennsylvania Name Change Fee (PDF, Word, RTF) and download the example to your device.

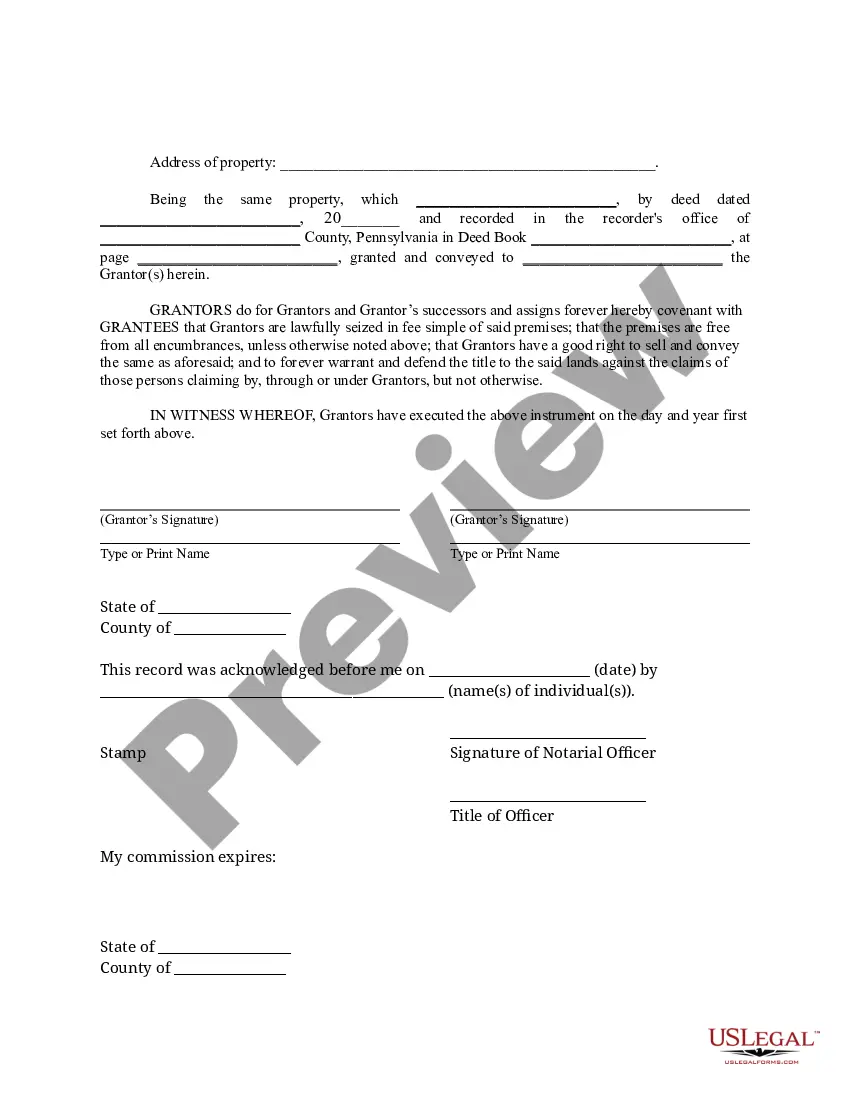

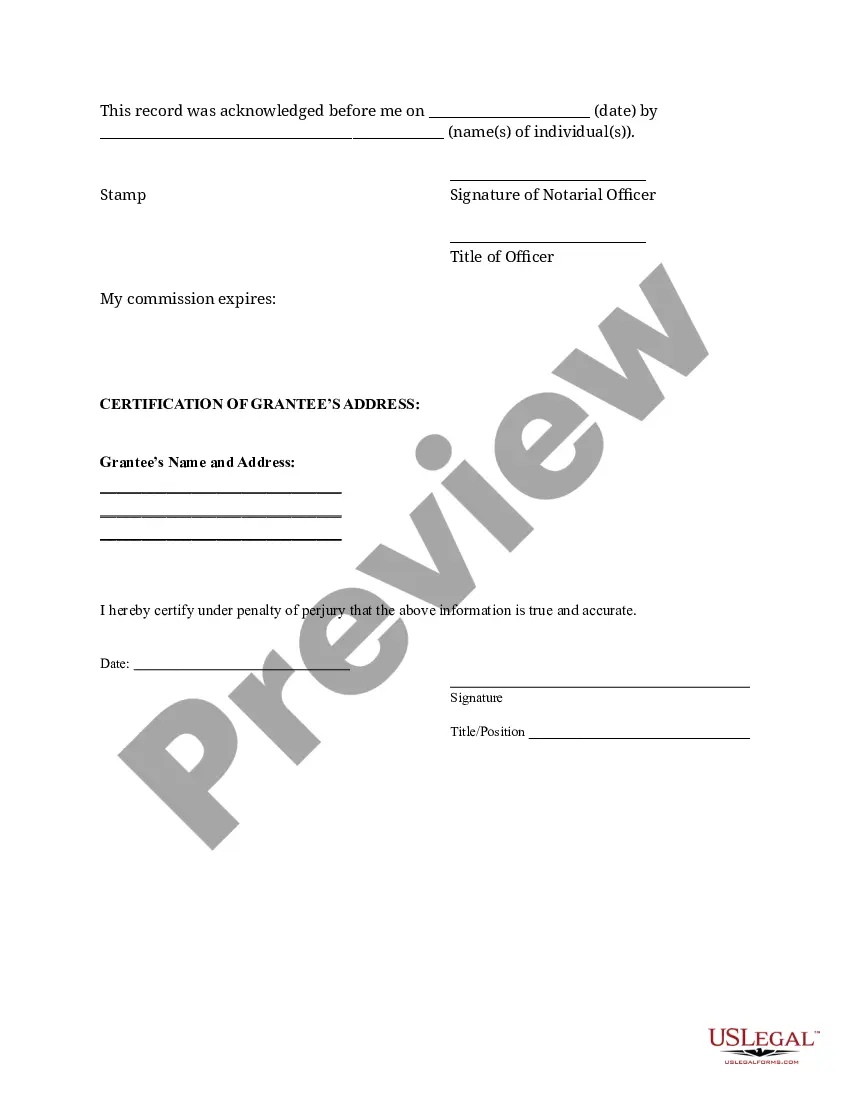

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, utilize an online multi-functional PDF editor to swiftly and accurately complete and sign your form with an eSignature.

- Download your documents again.

- Use the same document whenever needed. Access the My documents tab in your account to redownload any previously purchased forms.

Form popularity

FAQ

To start a corporation in Nebraska, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost a minimum of $65 to file.

Absolutely! You can easily change your Nebraska LLC name. The first step is to file a form called the Amended Certificate of Organization with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Nebraska.

(RULLCA 108) (a) The name of a limited liability company must contain the words limited liability company or limited company or the abbreviation L.L.C., LLC, L.C., or LC. Limited may be abbreviated as Ltd., and company may be abbreviated as Co.

To meet Nebraska's publication requirement, LLCs and corporations must: Publish a Notice of Organization (for LLCs) or Incorporation (for corporations) in a local, legal newspaper. Obtain Proof of Publication from the newspaper. File your Proof of Publication with the Nebraska Secretary of State.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office. It typically takes the state 10 days to process your paperwork after they receive it.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Nebraska LLC net income must be paid just as you would with any self-employment business.

Name your Nebraska LLC. ... Choose your registered agent. ... Prepare and file certificate of organization. ... File an affidavit of publication. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

You can use the Nebraska Corporate & Business Search tool on the Secretary of State website to check if your business name is available. You may also contact the Nebraska Secretary of State via phone at (402) 471-4079 or email at sos.corp@nebraska.gov for assistance on how to perform a Nebraska LLC name search.