Pennsylvania Correction Pa Form Pa-65 Instructions 2022

Description

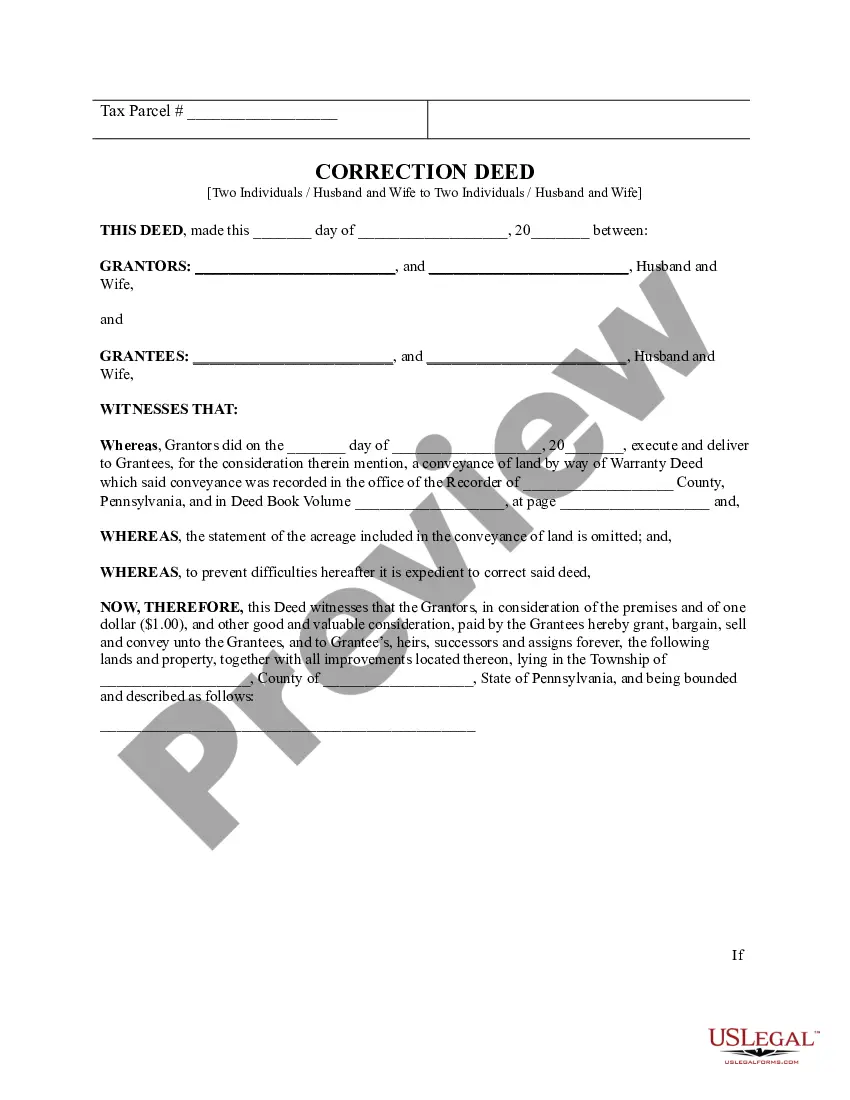

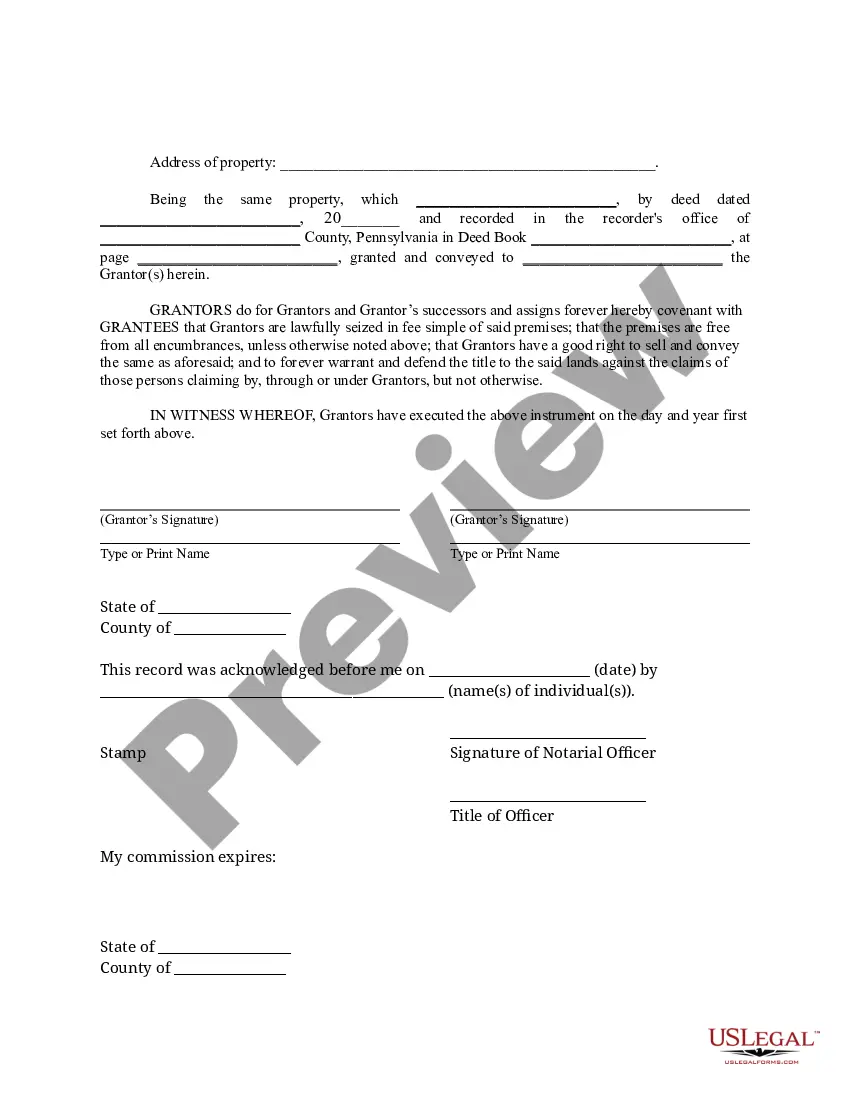

How to fill out Pennsylvania Correction Deed -?

Getting a go-to place to access the most current and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers requirements precision and attention to detail, which is why it is very important to take samples of Pennsylvania Correction Pa Form Pa-65 Instructions 2022 only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the information regarding the document’s use and relevance for your circumstances and in your state or region.

Take the following steps to complete your Pennsylvania Correction Pa Form Pa-65 Instructions 2022:

- Make use of the catalog navigation or search field to locate your sample.

- Open the form’s information to see if it suits the requirements of your state and region.

- Open the form preview, if available, to make sure the form is definitely the one you are looking for.

- Resume the search and look for the appropriate template if the Pennsylvania Correction Pa Form Pa-65 Instructions 2022 does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a transaction method (credit card or PayPal).

- Choose the document format for downloading Pennsylvania Correction Pa Form Pa-65 Instructions 2022.

- When you have the form on your device, you can alter it with the editor or print it and finish it manually.

Eliminate the hassle that comes with your legal paperwork. Discover the comprehensive US Legal Forms collection where you can find legal samples, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

PURPOSE OF SCHEDULE A PA S corporation, partnership and limited liability company filing as a partnership or PA S corporation for federal income tax purposes uses PA-20S/PA-65 Schedule OC to enter its share for each tax credit received after applying the tax credit to the entity's corporate liability, if any.

PURPOSE OF SCHEDULE Use PA-20S/PA-65 Schedule A to report interest income of PA S corporations, partnerships and limited liability companies filing as partnerships or PA S corporations for federal income tax purposes.

Who must file the PA-65 Corp, Directory of Corporate Partners (PA-65 Corp)? A partnership wholly owned by C corporations submits a PA-65 Corp and a complete copy of federal Form 1065, including all federal schedules and federal Form 1065 Schedules K-1.

Pennsylvania law requires withholding at a rate of 3.07 percent on non-wage Pennsylvania source income payments made to nonresidents. Withholding of payments that are less than $5,000 during the calendar year are optional and at the discretion of the payor.

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations.