Pennsylvania Correction Pa Form Pa-65 Instructions 2021

Description

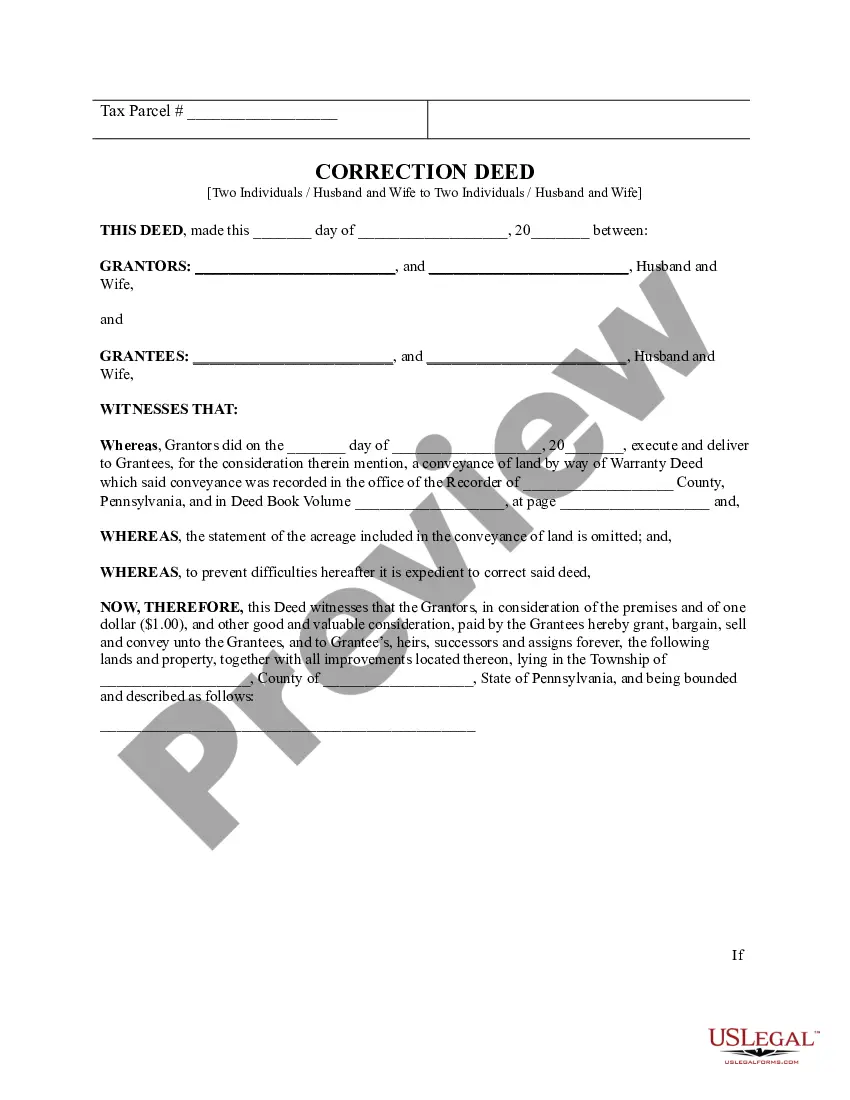

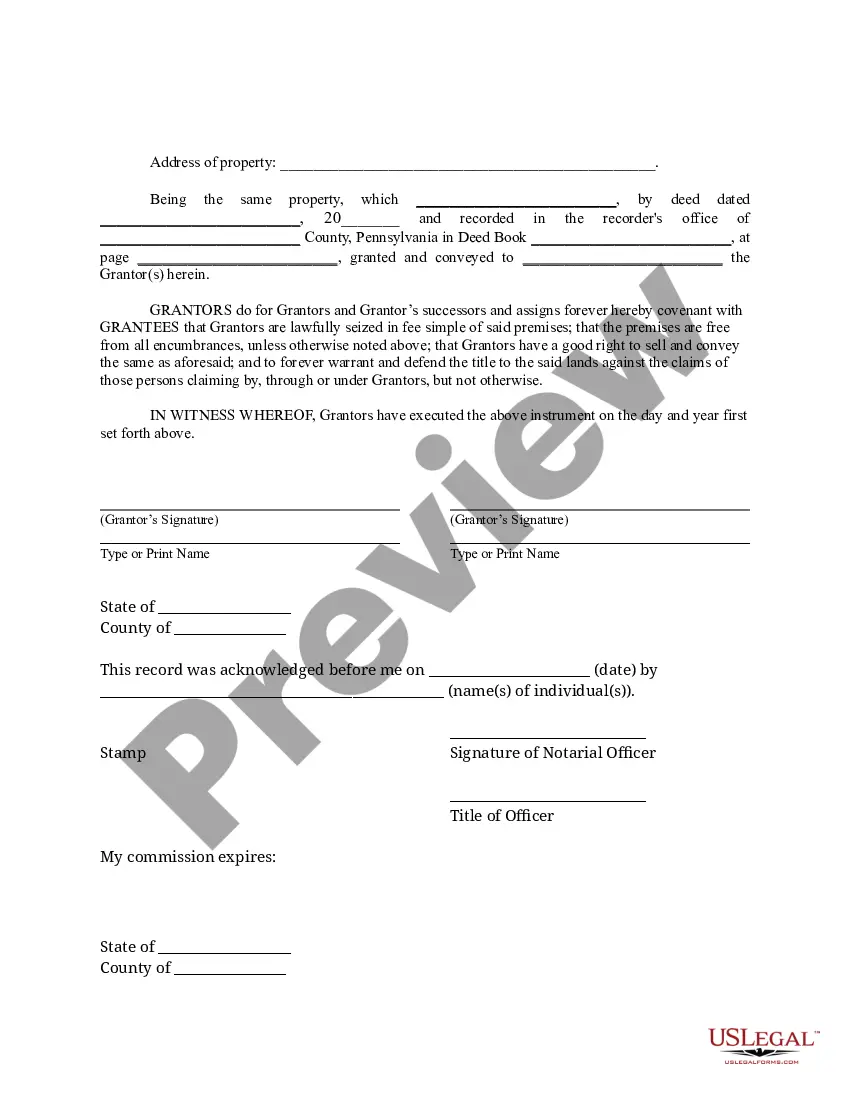

How to fill out Pennsylvania Correction Deed -?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of preparing Pennsylvania Correction Pa Form Pa-65 Instructions 2021 or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of over 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-compliant templates carefully prepared for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Pennsylvania Correction Pa Form Pa-65 Instructions 2021. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and navigate the library. But before jumping straight to downloading Pennsylvania Correction Pa Form Pa-65 Instructions 2021, follow these tips:

- Check the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the template you choose conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Pennsylvania Correction Pa Form Pa-65 Instructions 2021.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

PURPOSE OF SCHEDULE A PA S corporation, partnership and limited liability company filing as a partnership or PA S corporation for federal income tax purposes uses PA-20S/PA-65 Schedule OC to enter its share for each tax credit received after applying the tax credit to the entity's corporate liability, if any.

Description:Step 1: Select the Form PA-40 by Tax Year below. Step 2: Fill in the space next to to "Amended Return" on the upper right-hand corner to indicate that it's an amended return. Step 3: Download, Complete Schedule PA-40X as an explanation of your amended return. Attach it to your Form PA-40.

PURPOSE OF SCHEDULE Use PA-20S/PA-65 Schedule A to report interest income of PA S corporations, partnerships and limited liability companies filing as partnerships or PA S corporations for federal income tax purposes.

PURPOSE OF SCHEDULE Use PA-20S/PA-65 Schedule A to report interest income of PA S corporations, partnerships and limited liability companies filing as partnerships or PA S corporations for federal income tax purposes.

A partnership must file a PA-20S/PA-65 Information Return to report the income, deductions, gains, losses etc. from their operations.