Pennsylvania Correction Pa Form Pa-40es

Description

How to fill out Pennsylvania Correction Deed -?

Obtaining legal templates that comply with federal and regional laws is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the appropriate Pennsylvania Correction Pa Form Pa-40es sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are simple to browse with all documents collected by state and purpose of use. Our professionals stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Pennsylvania Correction Pa Form Pa-40es from our website.

Getting a Pennsylvania Correction Pa Form Pa-40es is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the instructions below:

- Take a look at the template utilizing the Preview option or via the text outline to make certain it meets your requirements.

- Locate another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Pennsylvania Correction Pa Form Pa-40es and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Description:Step 1: Select the Form PA-40 by Tax Year below. Step 2: Fill in the space next to to "Amended Return" on the upper right-hand corner to indicate that it's an amended return. Step 3: Download, Complete Schedule PA-40X as an explanation of your amended return. Attach it to your Form PA-40.

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows ?

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

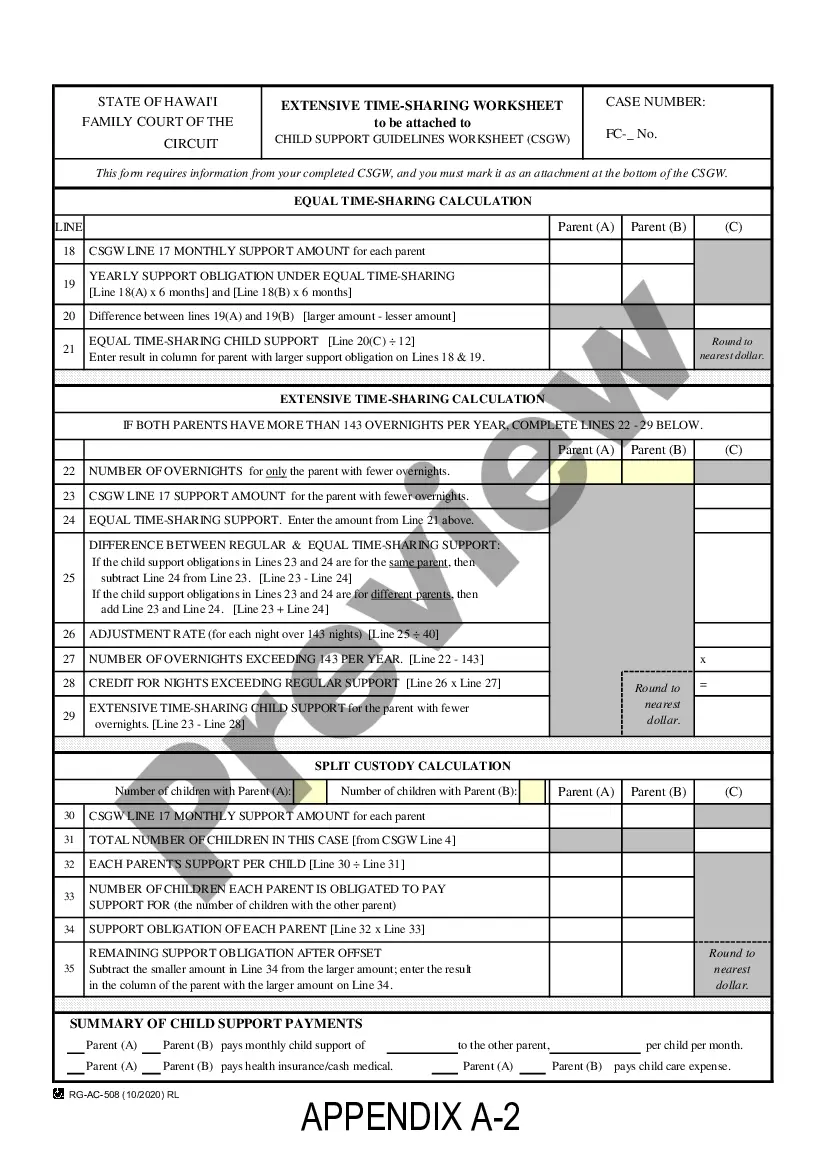

PERSONAL INCOME TAX (PA-40 ES) Use the 2023 Form PA-40 ES-I to make your quarterly estimated payment of tax owed.

Use PA-40 Schedule E to report the amount of net income (loss) from rents royalties, patents and copyrights for indi- vidual or fiduciary (estate or trust) taxpayers. Refer to the PA Personal Income Tax Guide ? Net Income (Loss) from Rents, Royalties, Copyrights and Patents sec- tion for additional information.