Chapter 13 Bankruptcy Oregon With Solutions

Description

How to fill out Oregon Chapter 13 Plan?

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Completing legal paperwork needs careful attention, starting with picking the correct form template. For instance, if you choose a wrong edition of the Chapter 13 Bankruptcy Oregon With Solutions, it will be turned down once you send it. It is therefore essential to have a dependable source of legal documents like US Legal Forms.

If you have to obtain a Chapter 13 Bankruptcy Oregon With Solutions template, stick to these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Look through the form’s description to make sure it fits your situation, state, and county.

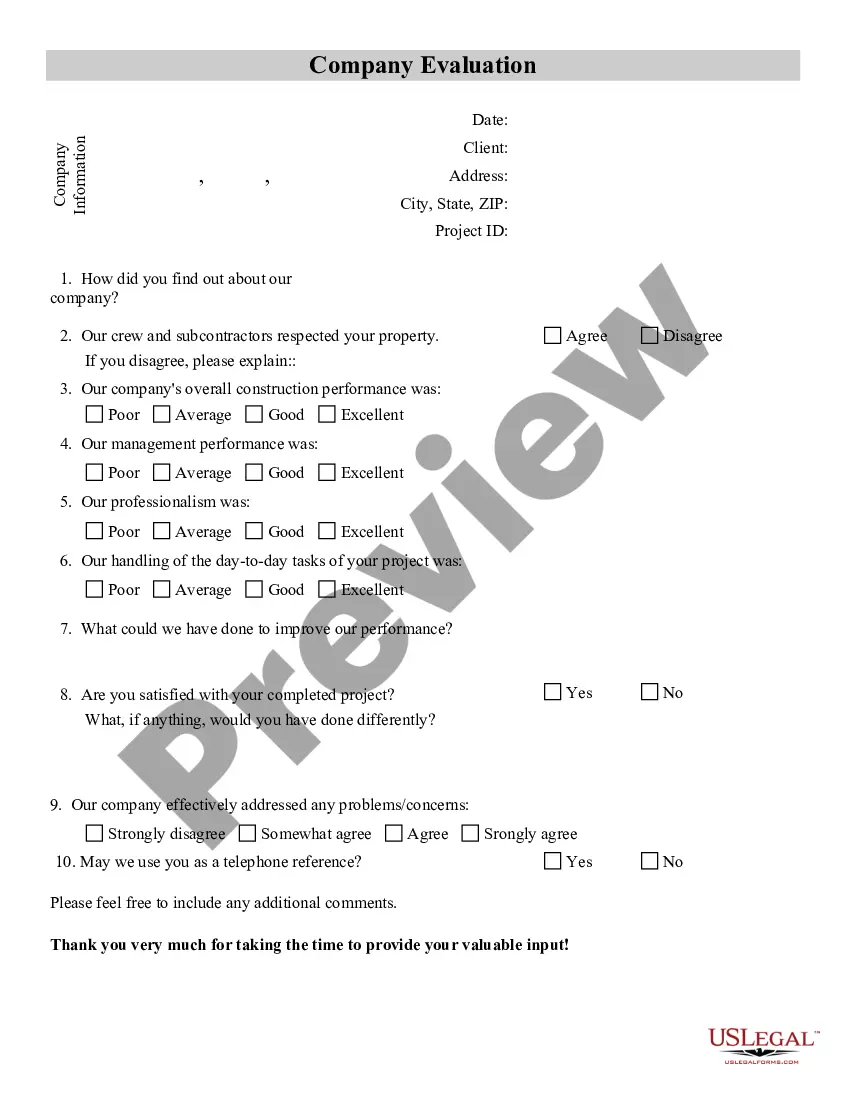

- Click on the form’s preview to examine it.

- If it is the wrong document, get back to the search function to find the Chapter 13 Bankruptcy Oregon With Solutions sample you need.

- Download the template if it meets your needs.

- If you already have a US Legal Forms profile, just click Log in to access previously saved templates in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Chapter 13 Bankruptcy Oregon With Solutions.

- When it is saved, you can fill out the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time searching for the right sample across the web. Take advantage of the library’s simple navigation to get the appropriate template for any occasion.

Form popularity

FAQ

The law does not require you to have an attorney. However, completing all the required documents can be difficult. Also, the filing of a bankruptcy petition is only part of a program to regain financial health.

What Are The Steps to Filing A Chapter 13 Bankruptcy? Step 1: Collect your documents. ... Step 2: Analyze your debt. ... Step 3: Take inventory of the property you have. ... Step 4: Create a budget and figure out the status of your income. ... Step 5: Take the first credit counseling course.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

Also do not not incur debt, use credit, credit cards, or enter into leases while in Chapter 13 without Bankruptcy Court approval, except in the case of an emergency for the protection and preservation of life, health or property. Contact your attorney if you need to sell property or incur debt.

Chapter 13 is a special part of the bankruptcy law. It lets you file a payment plan and gives you a way to repay all or part of your debts while protecting you or your co-signer from claims by creditors. The plan essentially sets out your debts and says how you intend to pay them.