Quitclaim Deed To Add Spouse To Title Without Spouse

Description

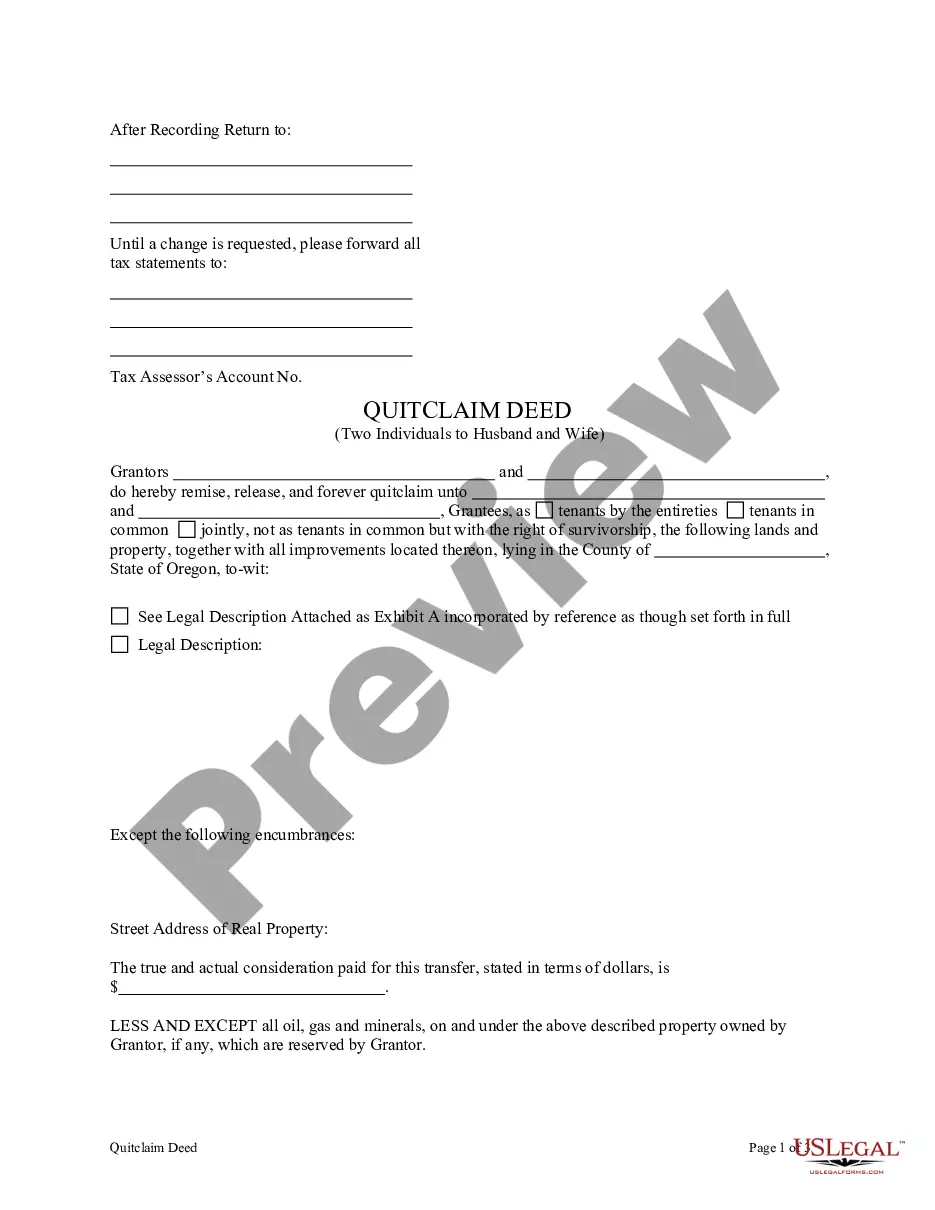

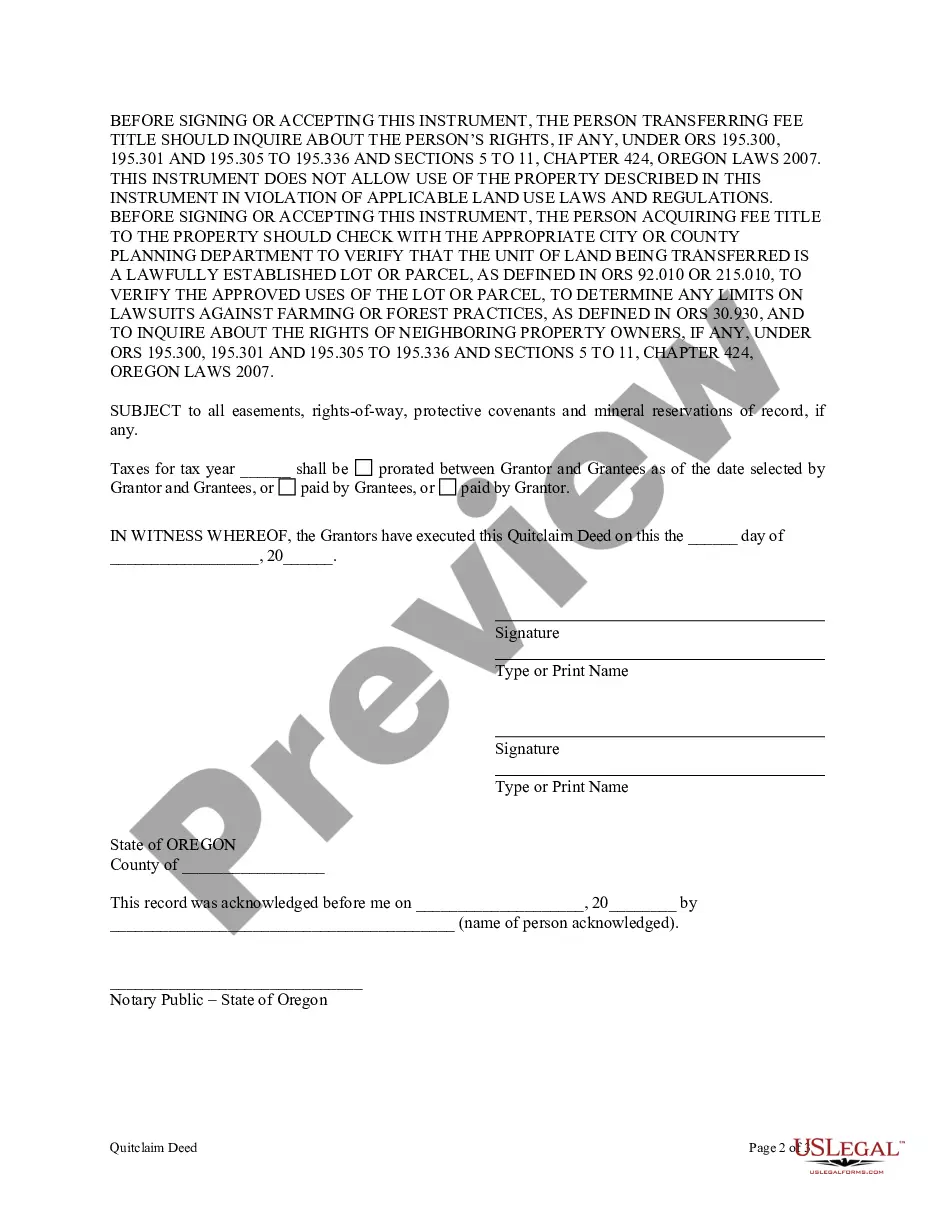

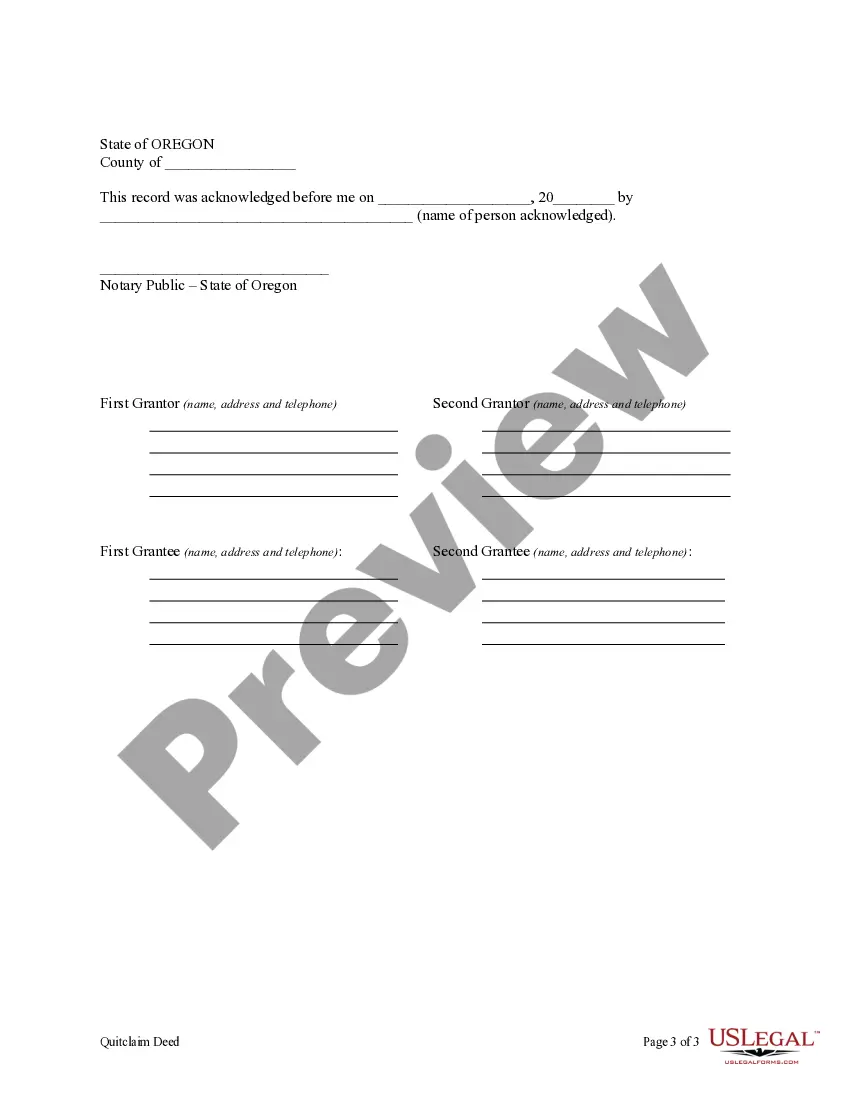

How to fill out Oregon Quitclaim Deed By Two Individuals To Husband And Wife?

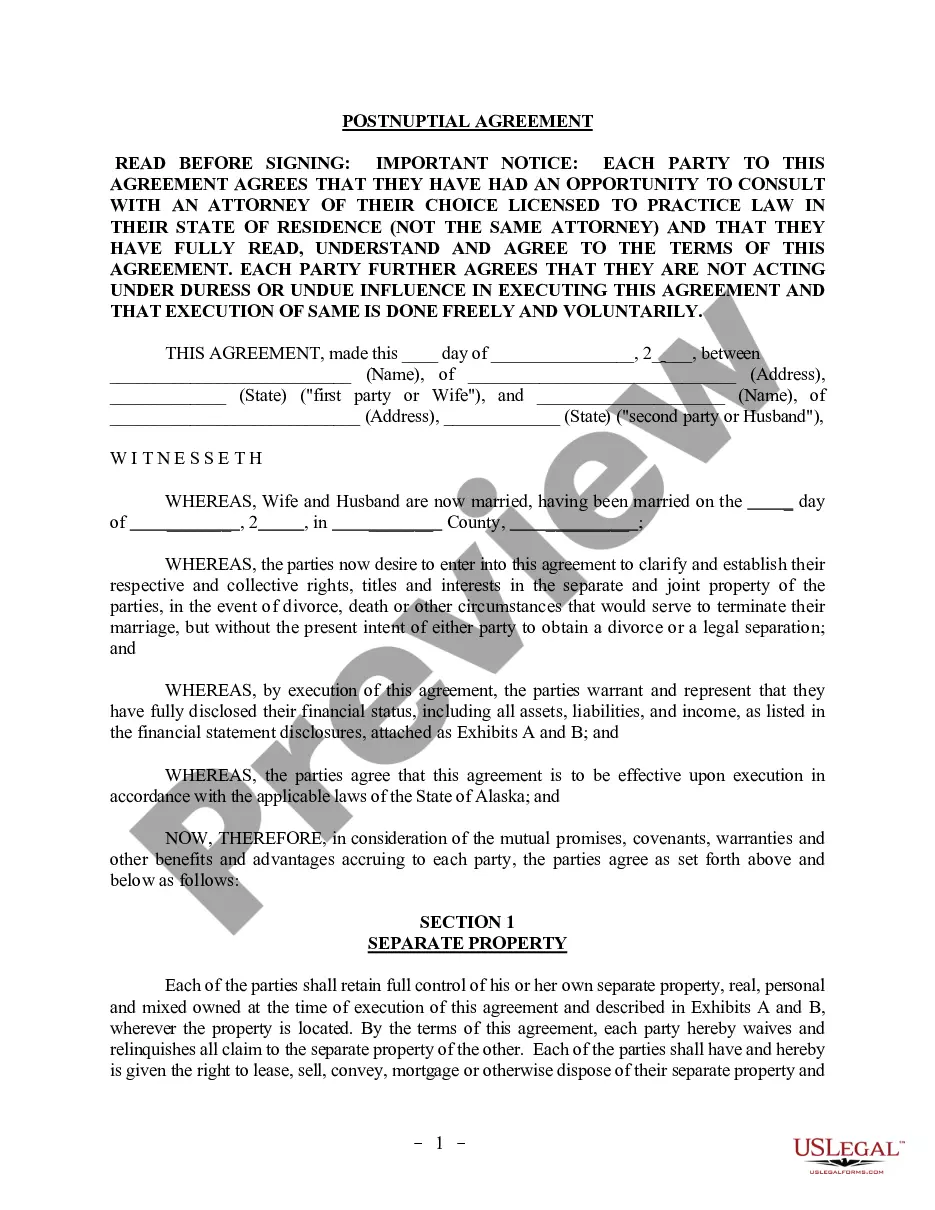

It’s no secret that you can’t become a legal expert overnight, nor can you learn how to quickly prepare Quitclaim Deed To Add Spouse To Title Without Spouse without the need of a specialized set of skills. Creating legal documents is a long venture requiring a specific education and skills. So why not leave the preparation of the Quitclaim Deed To Add Spouse To Title Without Spouse to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

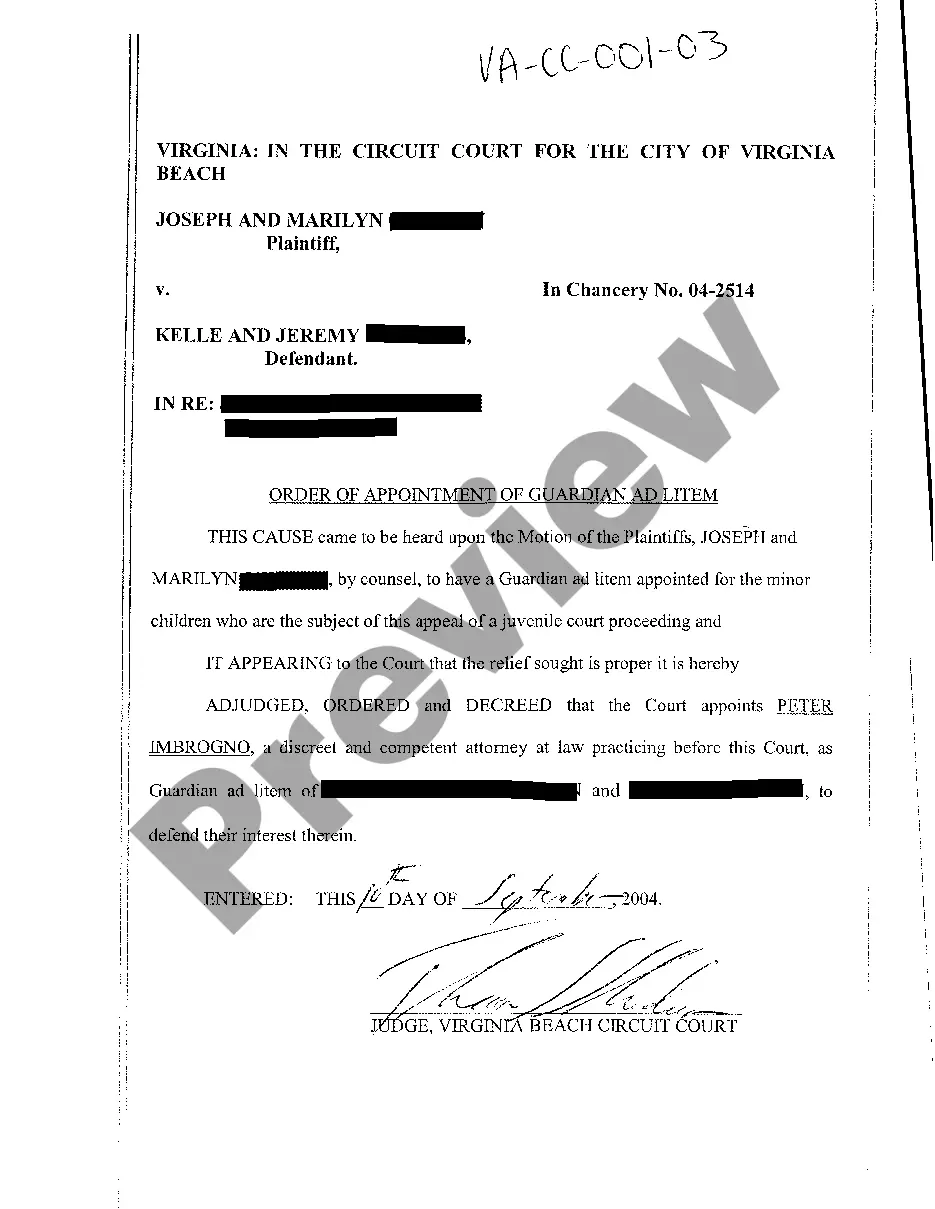

- Discover the document you need with the search bar at the top of the page.

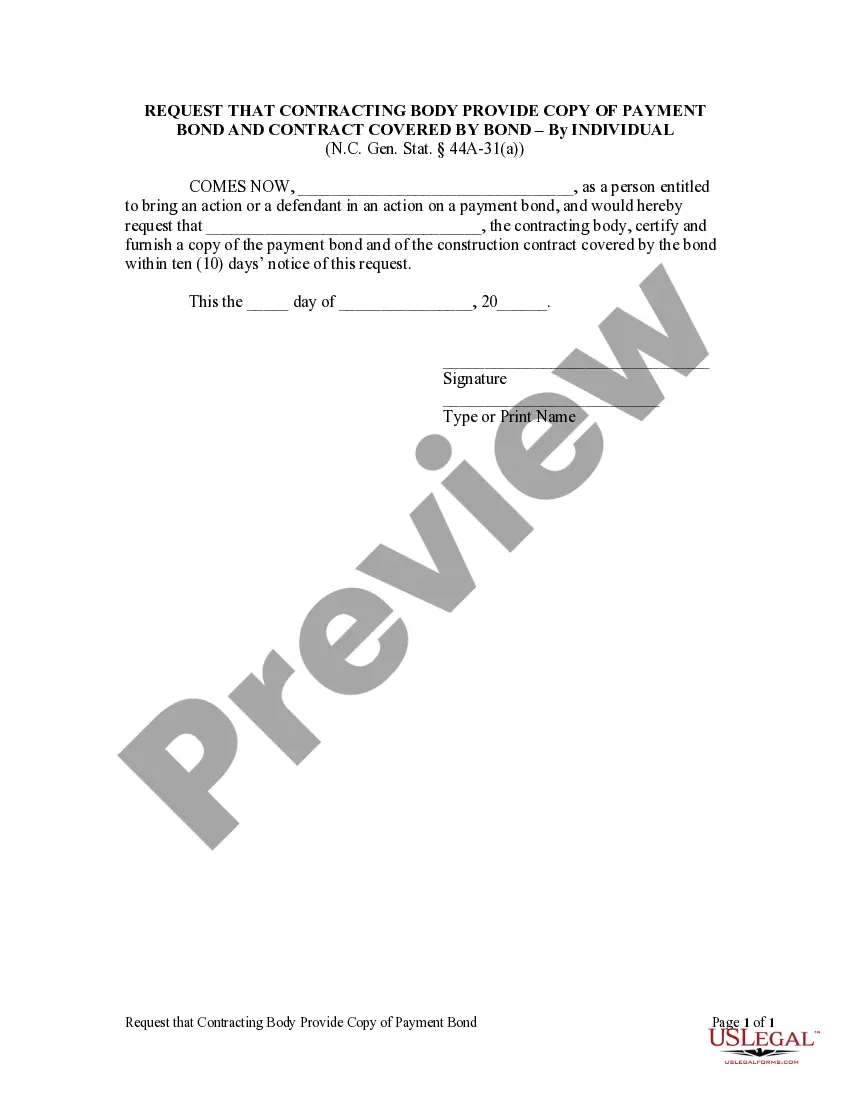

- Preview it (if this option provided) and check the supporting description to determine whether Quitclaim Deed To Add Spouse To Title Without Spouse is what you’re looking for.

- Start your search over if you need any other form.

- Register for a free account and choose a subscription option to buy the template.

- Pick Buy now. As soon as the transaction is through, you can get the Quitclaim Deed To Add Spouse To Title Without Spouse, complete it, print it, and send or send it by post to the designated individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

A quitclaim deed does not make any promises that the seller owns the property or has clear title to it. A quitclaim deed only passes the interest in the property that the seller actually has, without any guarantee. The seller is not responsible to the buyer for a defect in the title.

Quitclaim deed in Michigan as a result of divorce The reason for using a quitclaim deed in this situation is that both spouses know the history of the property and know they have good title to it. A quitclaim deed transfers the entire property to the other spouse while removing the grantor's name from the deed.

How do I add my spouse to my deed in Indiana? You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

Your mortgage loan will most likely need to be fully refinanced. Adding a new person to your mortgage loan changes the loan's terms. You won't be able to change these terms unless a lender creates a new loan for you through a mortgage refinance.

Yes, you can put your spouse on the title without putting them on the mortgage. This would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.