Affidavit Of Heirship Form Oregon

Description

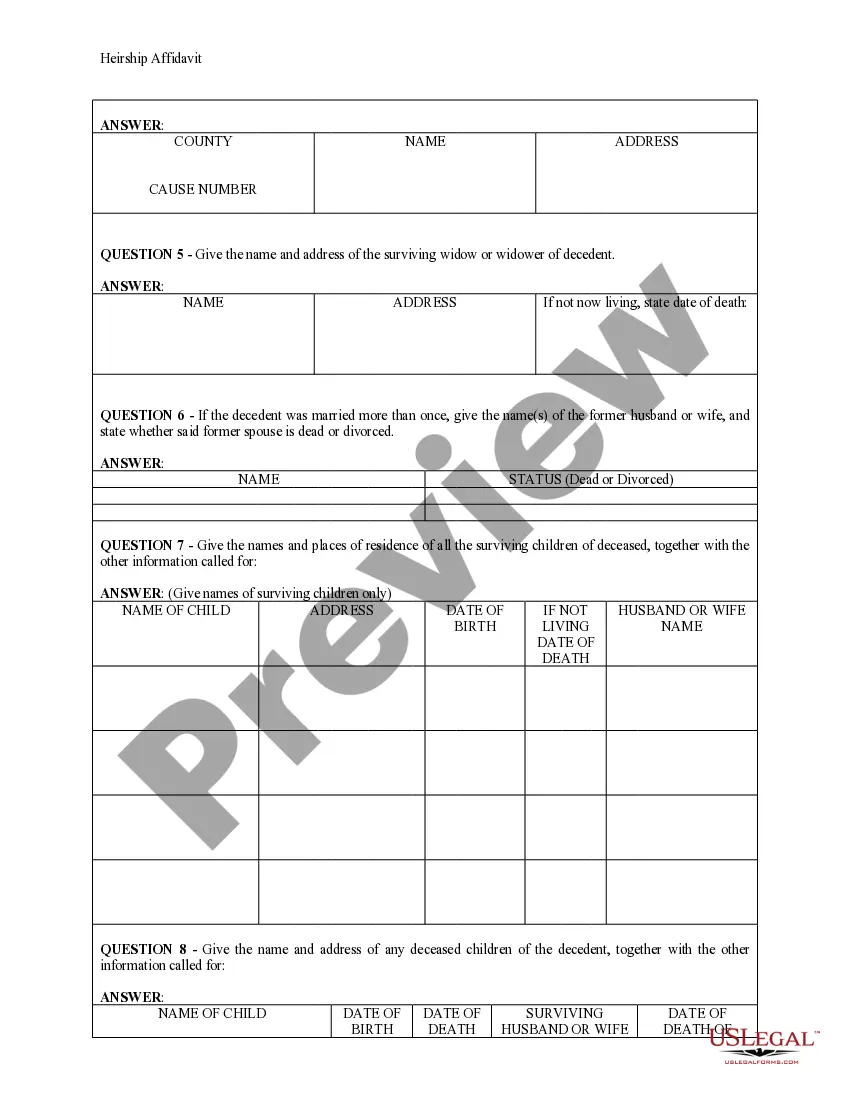

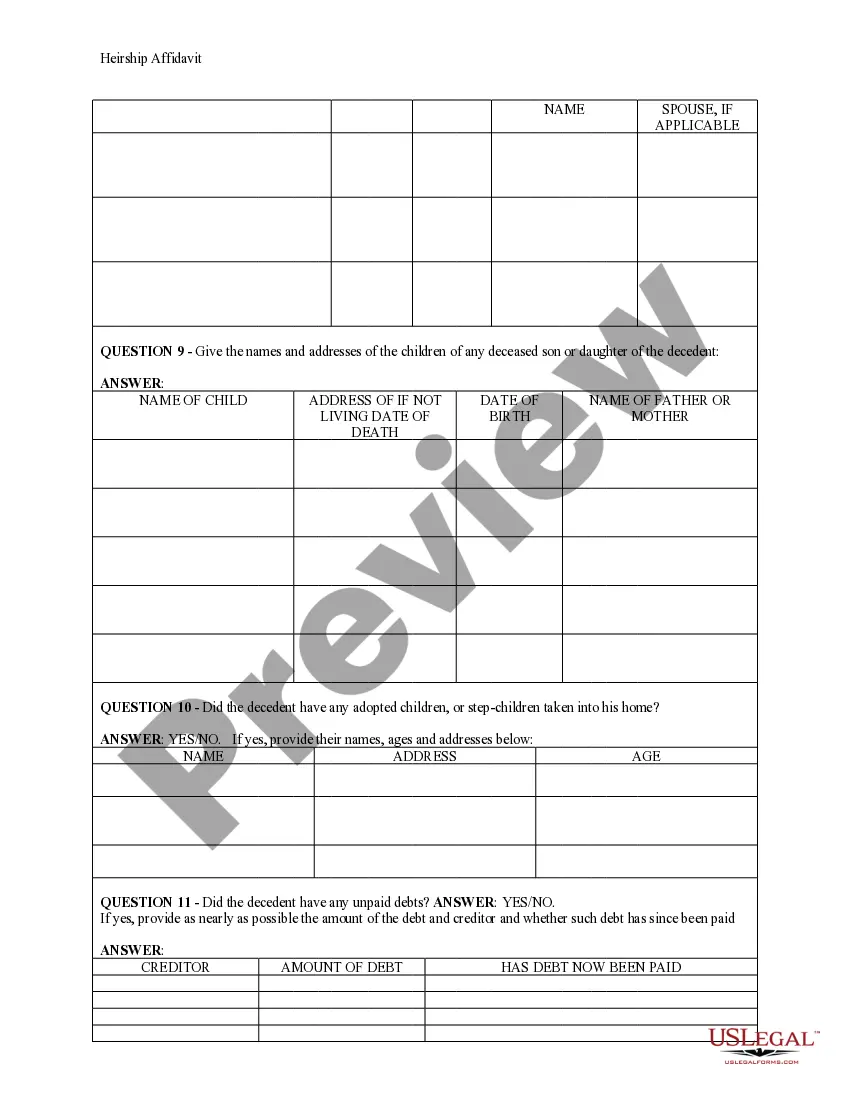

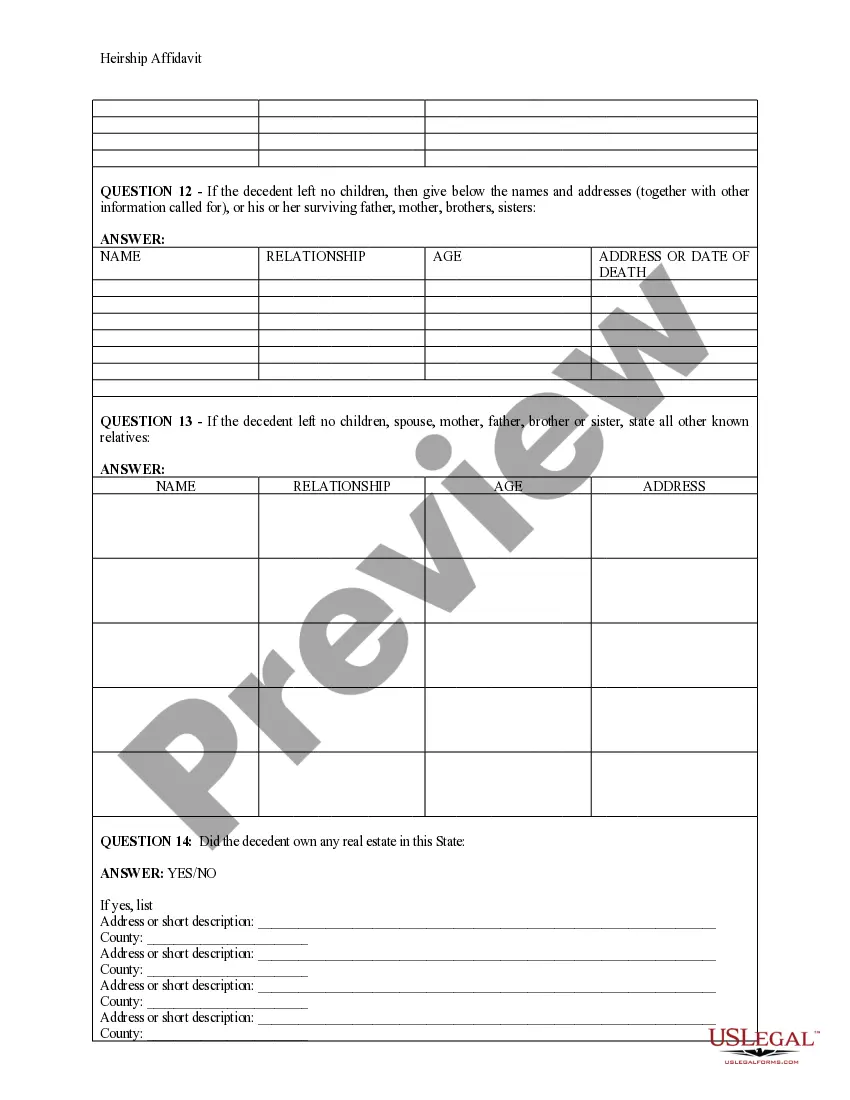

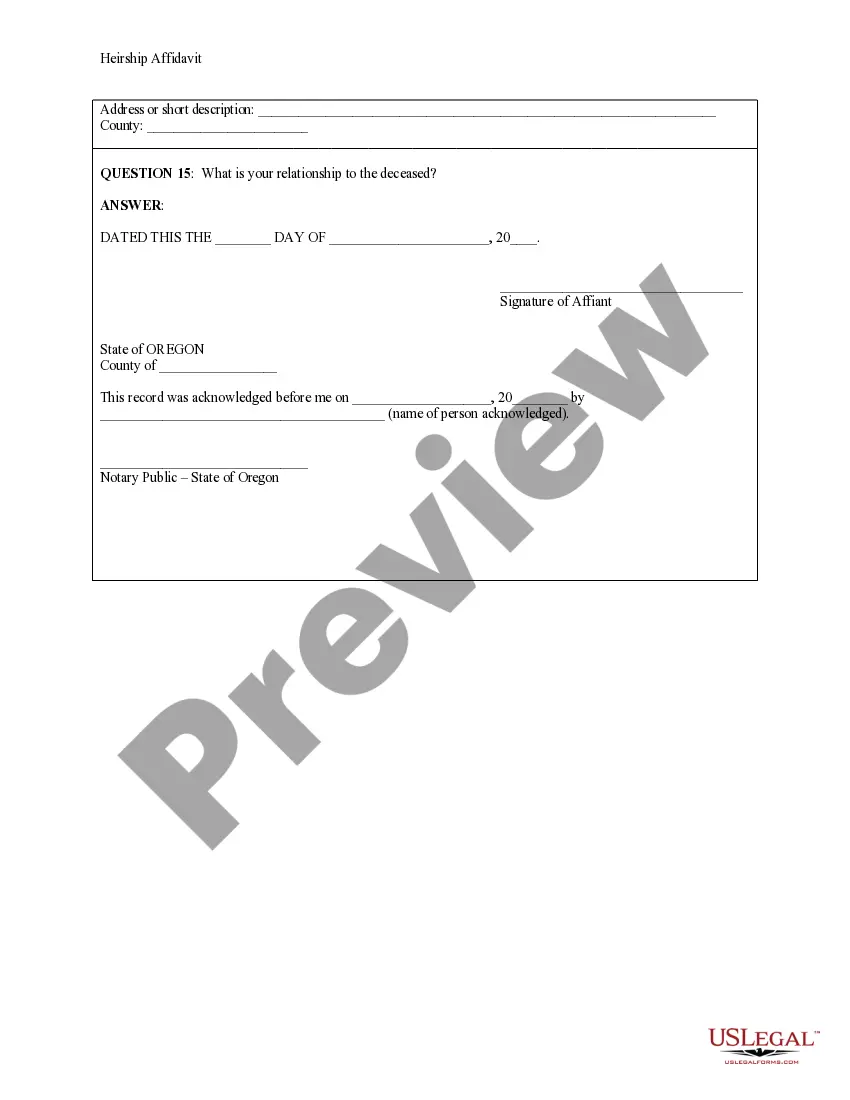

How to fill out Oregon Heirship Affidavit - Descent?

Bureaucracy requires exactness and correctness.

If you do not manage the completion of documents like the Affidavit Of Heirship Form Oregon regularly, it may lead to some confusions.

Choosing the right example from the outset will guarantee that your document submission proceeds without issues and avert any troubles of resubmitting a file or repeating the same task entirely from the beginning.

Finding the correct and current samples for your documentation takes just a few moments with an account at US Legal Forms. Eliminate the bureaucracy worries and enhance your efficiency in handling documents.

- Locate the template using the search bar.

- Verify that the Affidavit Of Heirship Form Oregon you’ve found is suitable for your state or region.

- Examine the preview or review the description that includes the specifics on how to use the template.

- When the result corresponds with your search, click the Buy Now button.

- Select the appropriate option from the offered subscription plans.

- Log In to your account or sign up for a new one.

- Complete the purchase using a credit card or PayPal account.

- Receive the document in the file format of your preference.

Form popularity

FAQ

While many people assume surviving spouses automatically inherit everything, this is not the case in California. If your deceased spouse dies with a will, their share of community property and their separate property will be distributed according to the terms of that will, with some exceptions.

Step 1 Wait Thirty (30) Days. The small estate affidavit can only be filed after thirty (30) days have passed since the decedent's death.Step 2 No Personal Representative.Step 3 Complete Forms.Step 4 File With Court.Step 5 Send to Estate Recipients.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...

The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.