Oregon Transfer On Death Deed Form With Notary

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

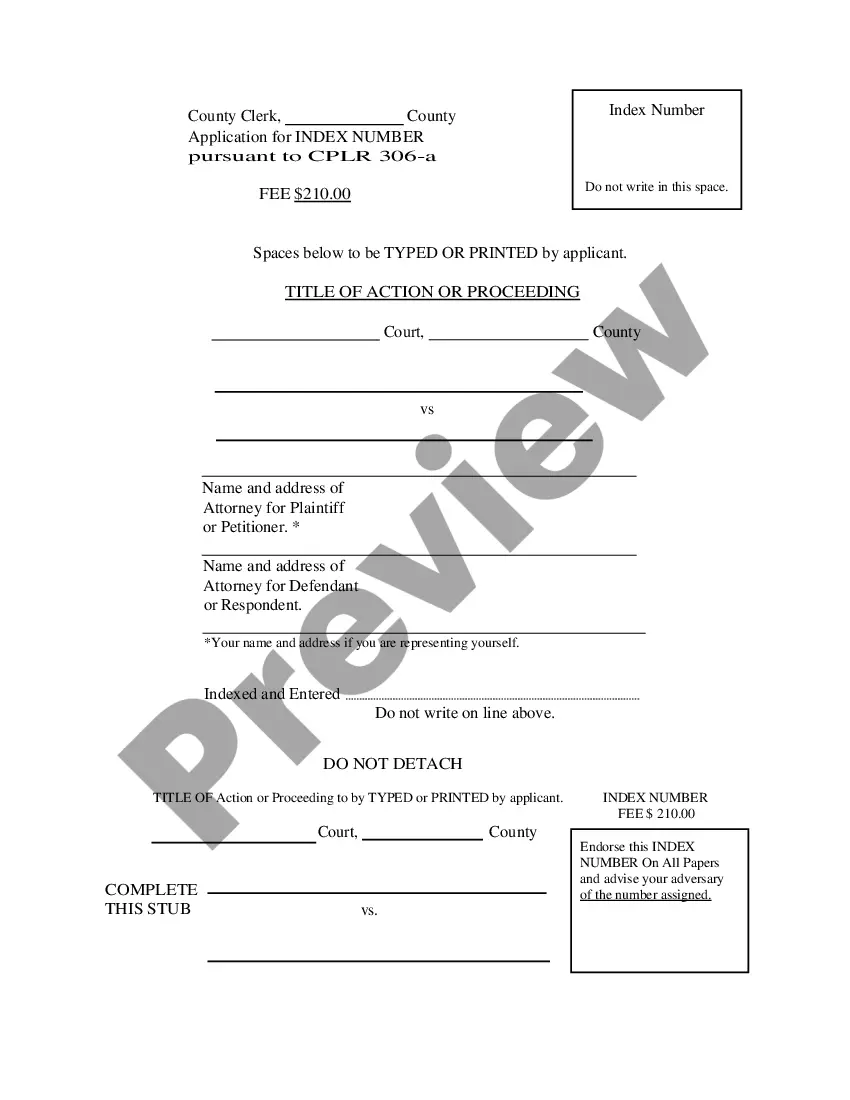

Whether for business purposes or for personal affairs, everyone has to manage legal situations sooner or later in their life. Filling out legal paperwork needs careful attention, beginning from choosing the right form sample. For example, if you pick a wrong version of a Oregon Transfer On Death Deed Form With Notary, it will be turned down when you submit it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

If you have to obtain a Oregon Transfer On Death Deed Form With Notary sample, follow these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it suits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, get back to the search function to find the Oregon Transfer On Death Deed Form With Notary sample you require.

- Get the template when it meets your requirements.

- If you have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Select the file format you want and download the Oregon Transfer On Death Deed Form With Notary.

- After it is downloaded, you can fill out the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time searching for the appropriate sample across the internet. Make use of the library’s easy navigation to get the proper template for any situation.

Form popularity

FAQ

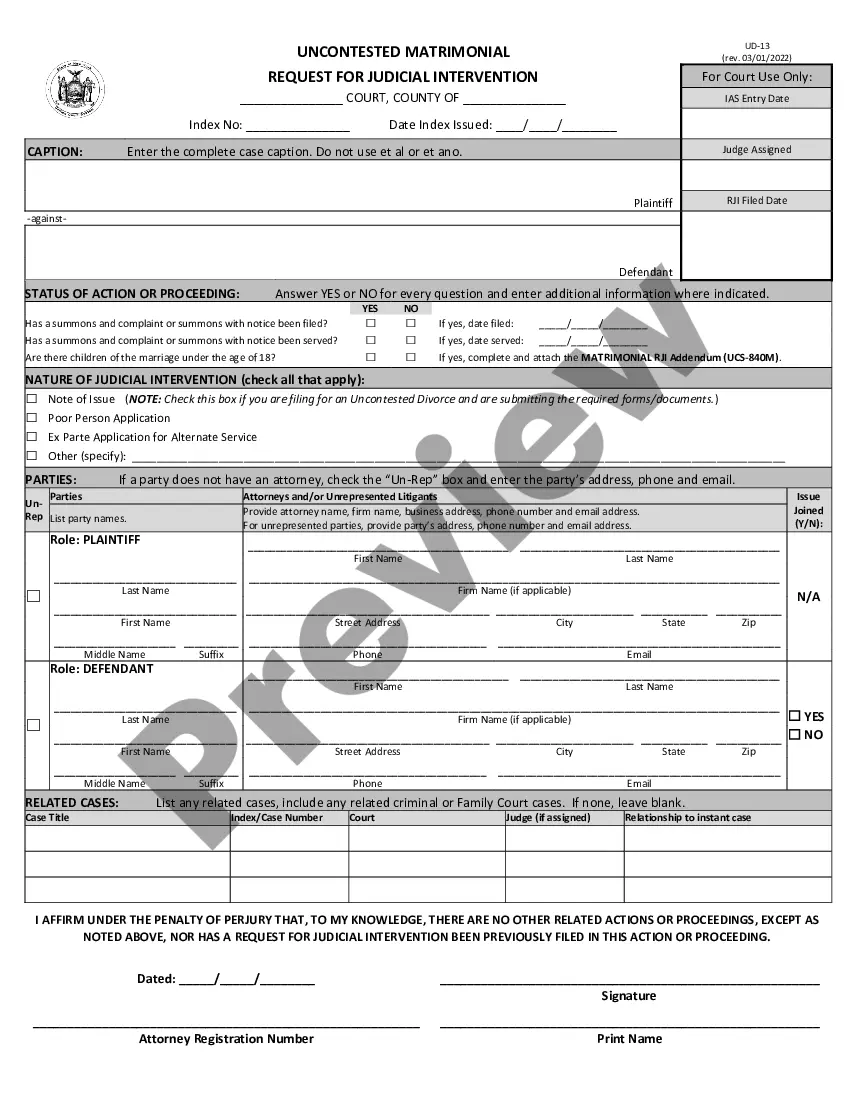

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.

Hear this out loud PauseTransfer on Death Deeds are used in Estate Planning to avoid probate and simplify the passing of real estate to your loved ones or Beneficiaries. It's also known as a ?Beneficiary Deed? because in essence, you're naming a Beneficiary who will receive the deed to your property after you pass away.

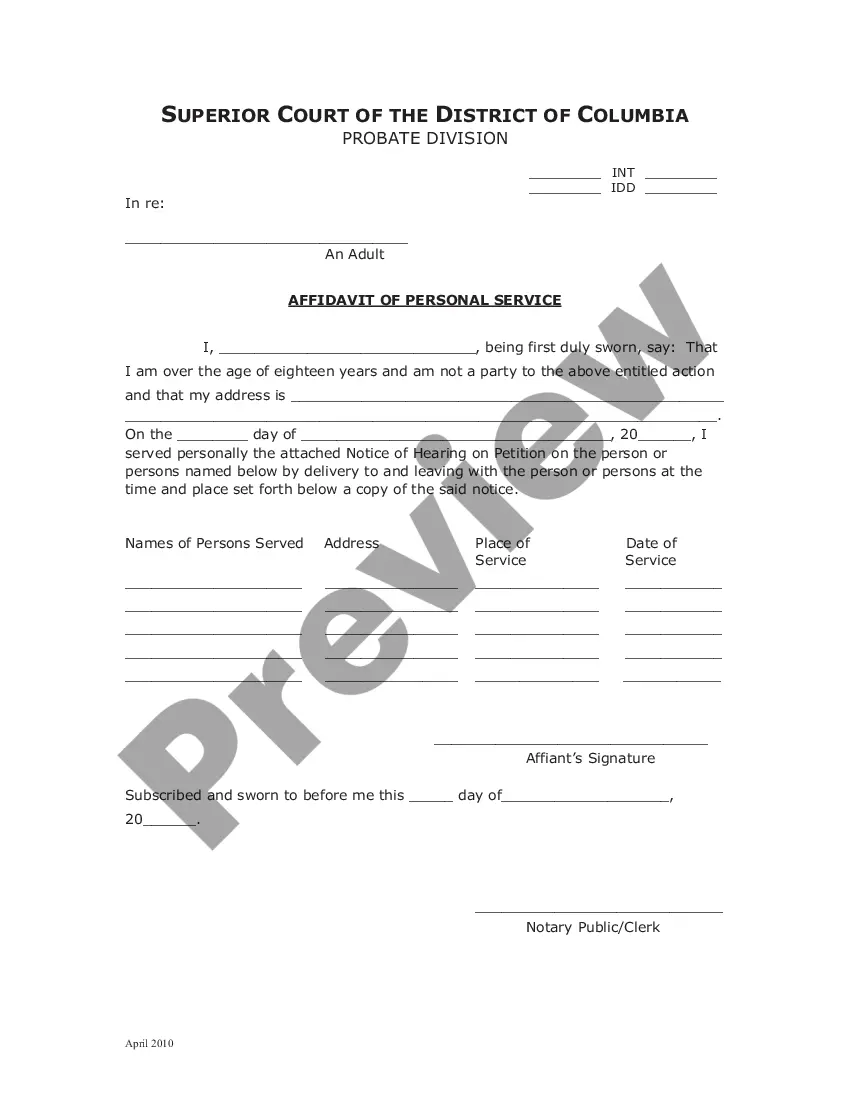

Hear this out loud PauseYou must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk before your death. Otherwise, it won't be valid. You can make an Oregon transfer on death deed with WillMaker.

Hear this out loud PauseAn Oregon deed must be signed by the current owner transferring real estate?the grantor?or a lawful agent or attorney signing for the grantor. Notarization. The current owner's signature must be acknowledged before a notary or other authorized officer.

Hear this out loud PauseDisadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.