Approved Transfer On Death Deed Form For Oregon Form 40 2017

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

Identifying a reliable source for obtaining the latest and pertinent legal samples constitutes a significant portion of dealing with bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why sourcing samples of the Approved Transfer On Death Deed Form For Oregon Form 40 2017 from trustworthy providers like US Legal Forms is crucial. An incorrect template may squander your time and delay your situation.

Once you have the form on your device, you may edit it using the editor or print it out and fill it out manually. Eliminate the complications associated with your legal documentation. Explore the comprehensive US Legal Forms catalog to discover legal samples, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search function to find your template.

- Check the form’s description to verify its suitability for your state and county.

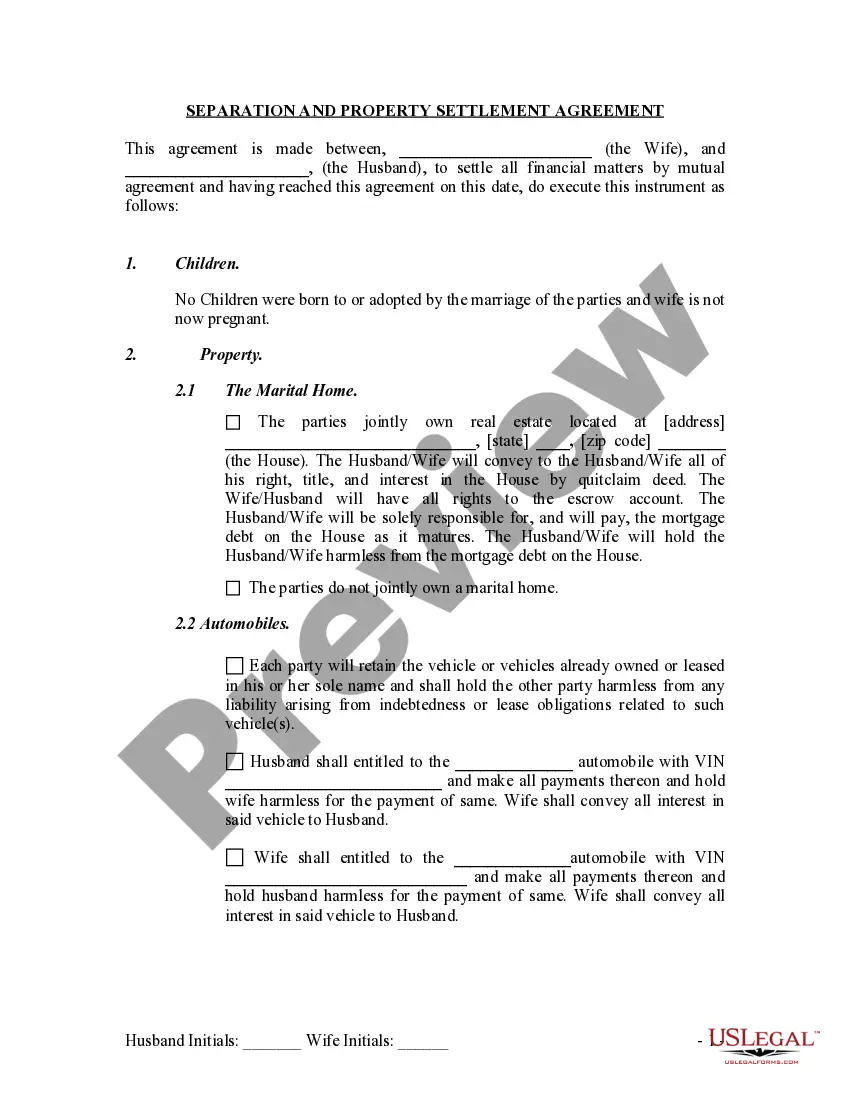

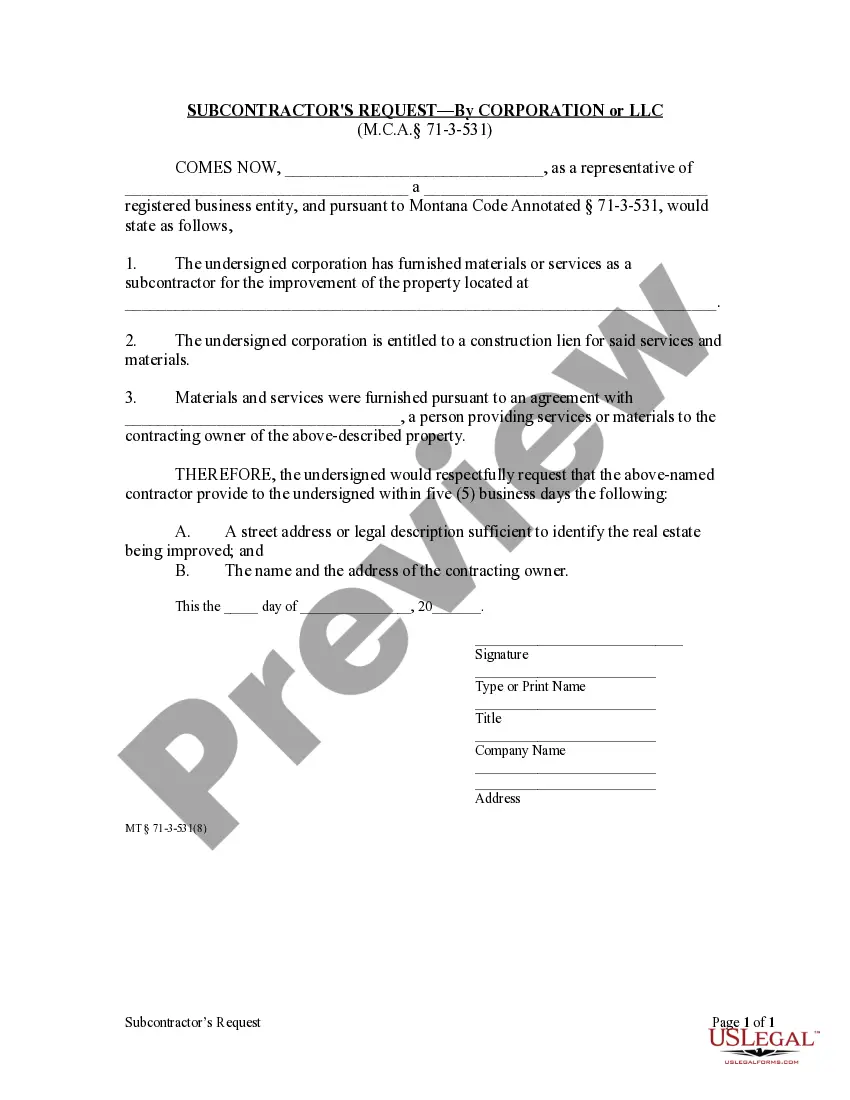

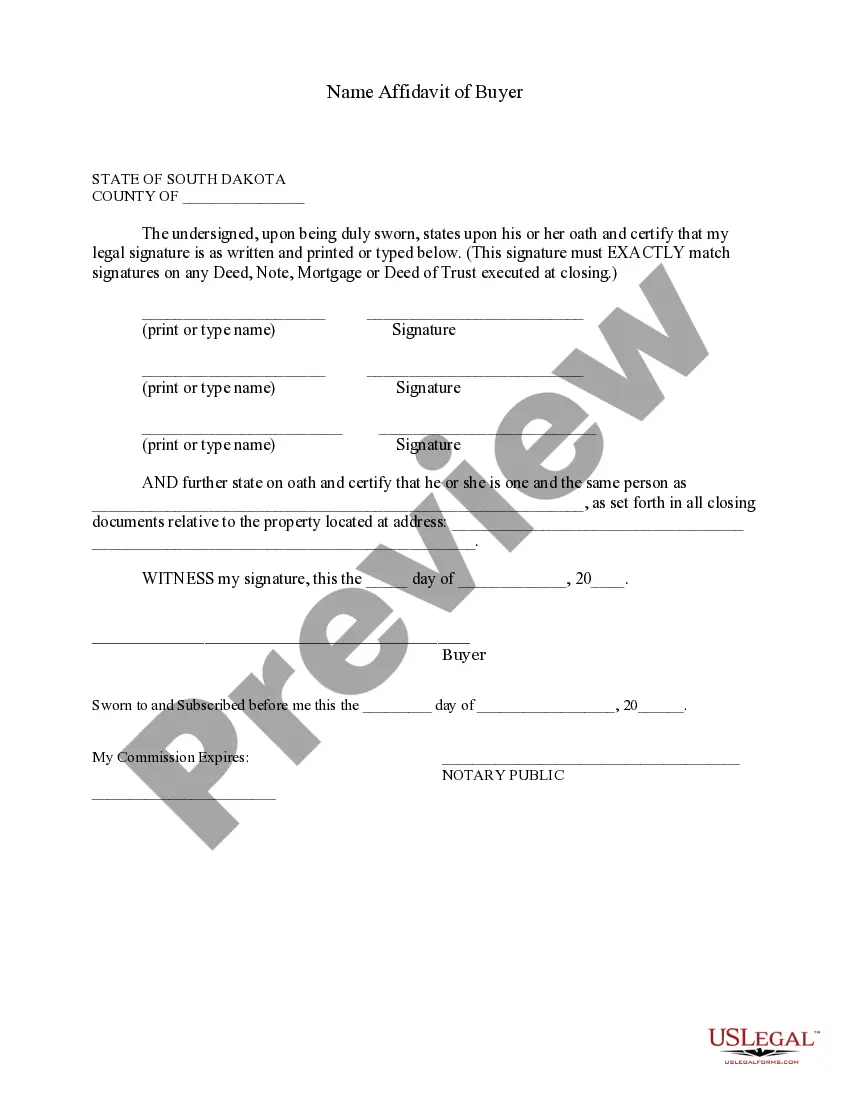

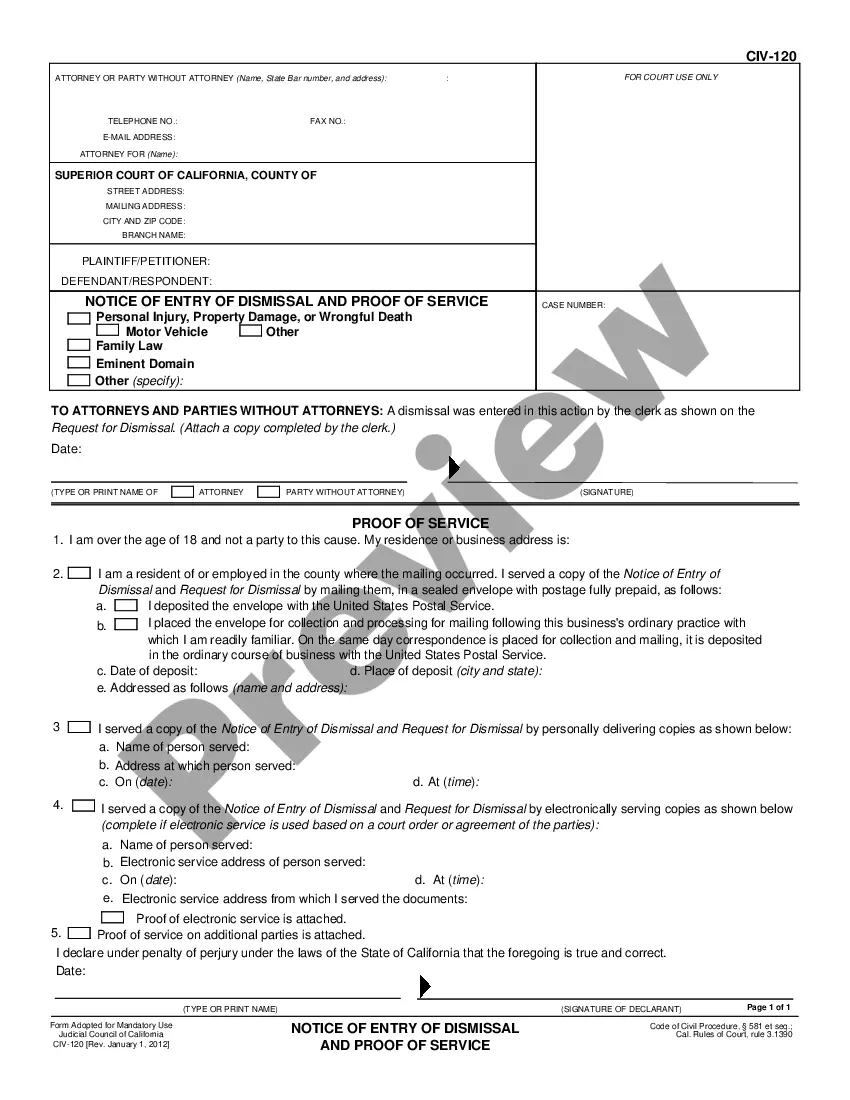

- Examine the form preview, if available, to confirm it is the document you want.

- Return to the search and seek the correct document if the Approved Transfer On Death Deed Form For Oregon Form 40 2017 does not meet your needs.

- If you are confident about the form’s relevance, proceed to download it.

- If you are a registered customer, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that fits your requirements.

- Continue to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Approved Transfer On Death Deed Form For Oregon Form 40 2017.

Form popularity

FAQ

You can access a transfer on death deed through various online platforms, including legal document services. For an Approved transfer on death deed form for oregon form 40 2017, consider visiting US Legal Forms, where you can find the correct form and guidance on how to fill it out. This platform streamlines the process, helping you efficiently manage your estate planning needs.

You do not necessarily need an attorney to create a transfer on death deed, but seeking legal advice can be beneficial. An attorney can provide clarity and ensure that you correctly complete the Approved transfer on death deed form for oregon form 40 2017. This way, you can avoid any potential mistakes that could complicate the transfer process in the future.

In Oregon, you can obtain a transfer on death deed by using the Approved transfer on death deed form for oregon form 40 2017, which is available online. You simply need to fill out the form with accurate details about the property and the beneficiaries. Once completed, you must record this deed with your county clerk's office to ensure it is legally binding.

Minnesota does allow a transfer on death deed, which is a useful tool for estate planning. However, it's important to understand the specific requirements and forms necessary for this process. If you are looking for an Approved transfer on death deed form for oregon form 40 2017, you should note that this form is specific to Oregon. For detailed information on Minnesota's regulations, consult local resources or legal assistance.

Filing Form 40 in Oregon is necessary if you are a resident and have taxable income. This form is part of the state’s income tax return process, and you may find the Approved transfer on death deed form for oregon form 40 2017 helpful in your overall tax planning and estate management. Using uslegalforms can provide you with the required guidance to ensure your paperwork is completed correctly and filed on time.

Yes, transfers on death deeds are legal in Oregon. This type of deed allows property owners to transfer their property to beneficiaries upon their death without going through probate. Utilizing the Approved transfer on death deed form for oregon form 40 2017 ensures you comply with all state regulations and finalize your property transfer smoothly.

To order Oregon tax forms, you can visit the Oregon Department of Revenue's website, where you can download various forms, including the Approved transfer on death deed form for oregon form 40 2017. Alternatively, you may also call their service desk to request forms by mail. Using resources like uslegalforms can simplify your process, as they offer access to a range of tax forms and legal documents, making your experience straightforward.

One disadvantage of the approved transfer on death deed form for Oregon form 40 2017 is that it may not address all complexities of your estate plan. Depending on your estate's size or specific circumstances, solely relying on this deed could lead to issues regarding taxes or liabilities. Ensuring your estate plan is comprehensive is vital to achieving your long-term goals.

An approved transfer on death deed form for Oregon form 40 2017 generally overrides a will for the specific property designated in the deed. This means that if you specify the transfer on death in the deed, it takes precedence, and beneficiaries bypass the probate process. It's essential to coordinate your will and deed to avoid confusion among your heirs.

While you can use the approved transfer on death deed form for Oregon form 40 2017 without a lawyer, consulting one can help clarify your situation. A lawyer can ensure that all legal requirements are met and your intentions are accurately represented. This step may save you time and potential legal challenges in the future.