Quitclaim Deed For Trust

Description

How to fill out Oklahoma Quitclaim Deed From Husband And Wife To Five Individuals As Joint Tenants With Right Of Survivorship?

- Log in to your US Legal Forms account if you're a returning user and ensure your subscription is active. If necessary, renew your plan.

- For first-time users, start by exploring the Preview mode and checking the form description to confirm it fits your local jurisdiction requirements.

- If needed, search for alternative templates using the Search tab to find the correct quitclaim deed that meets your specific needs.

- Purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to create an account to access the entire library.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Download the completed form to your device. You can easily access it later in the My Forms section of your profile.

Utilizing US Legal Forms empowers both individuals and attorneys, providing access to a comprehensive library of over 85,000 editable legal forms. Their extensive offerings ensure that users can swiftly secure the necessary documents for their legal needs.

In conclusion, obtaining your quitclaim deed for trust is a straightforward process with US Legal Forms. Start your journey today to ensure you’re equipped with the right legal tools. Visit US Legal Forms now!

Form popularity

FAQ

Choosing between gifting a house or placing it in a trust depends on your personal goals. Gifting the house can provide immediate benefits but may complicate future tax considerations. On the other hand, using a Quitclaim deed for trust helps avoid probate and can be more manageable for your heirs. Assess your family's needs and consider guidance from uslegalforms to determine the best option for your situation.

While putting your house in trust can offer benefits, it also comes with some disadvantages. For instance, it can lead to initial costs, including legal fees and potential taxes, that you should be aware of. Additionally, if you use a Quitclaim deed for trust, you may lose direct control over the property. It's vital to evaluate these factors and consult professionals for tailored advice before making a decision.

One effective method to leave your house to your child is through a Quitclaim deed for trust. This approach allows you to transfer your property swiftly and efficiently, reducing potential complications in the future. It ensures your child receives the property without the lengthy probate process, providing peace of mind. To get started, consider consulting uslegalforms for guidance on your specific situation.

Choosing between a quitclaim deed for trust and a trust itself depends on your specific needs. A quitclaim deed transfers interests in property quickly and simply, while a trust offers broader management and protection options. If you seek to avoid probate and manage assets over time, a trust may be the better choice. For immediate transfers, a quitclaim deed could serve you well.

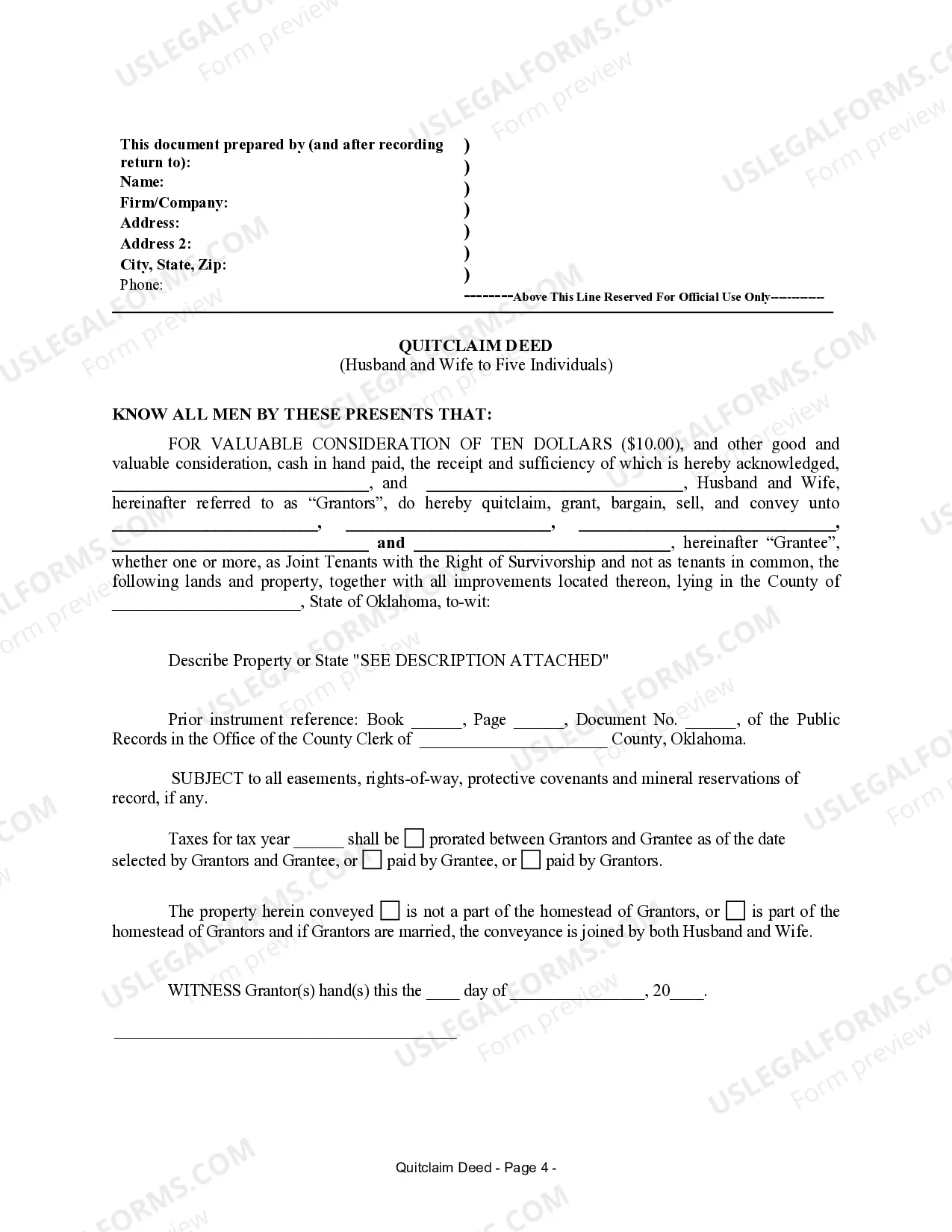

To properly fill out a quitclaim deed for trust, begin by clearly identifying the grantor and grantee. Include their names, addresses, and legal descriptions of the property involved. Make sure both parties sign the document in the presence of a notary public. After completing the form, file it with the appropriate county office to ensure proper public record.

A quitclaim deed in a trust is a legal document that transfers property interest from one party to another without guaranteeing title. This type of deed for trust is often utilized in estate planning or asset protection strategies. It can simplify transferring property held in a trust, ensuring that beneficiaries receive their intended assets efficiently. Using a trusted platform, such as UsLegalForms, makes creating this document straightforward.

Typically, family members or close associates benefit the most from a quitclaim deed for trust. This type of deed facilitates simple and quick transfers of property, suitable for those who trust each other. Therefore, it can be an ideal option during estate planning or when transferring property among family. However, always evaluate the transaction's specifics before proceeding.

Yes, you can prepare a quitclaim deed yourself, but doing so requires careful attention to detail to ensure all legal requirements are met. Using templates from reputable sources like US Legal Forms can help simplify the process and increase accuracy. However, consider consulting an attorney if you're unsure about any specific requirements for your state or property.

Quitclaim deeds are often viewed skeptically because they lack warranties, meaning the grantor does not guarantee the property's title. This can lead to potential risk for the grantee, as they may inherit liens or other claims against the property without any recourse. When considering a quitclaim deed for trust, it is essential to weigh the risks and consult with a legal expert or utilize US Legal Forms for guidance on safer options.

The strongest form of deed is typically considered to be a warranty deed. This deed guarantees that the grantor holds clear title to the property and confirms that there are no claims against it. While a quitclaim deed for trust does not provide such assurances, understanding the different types of deeds can help you choose the most protective option for your real estate transactions.