One Other Corporation With A

Description

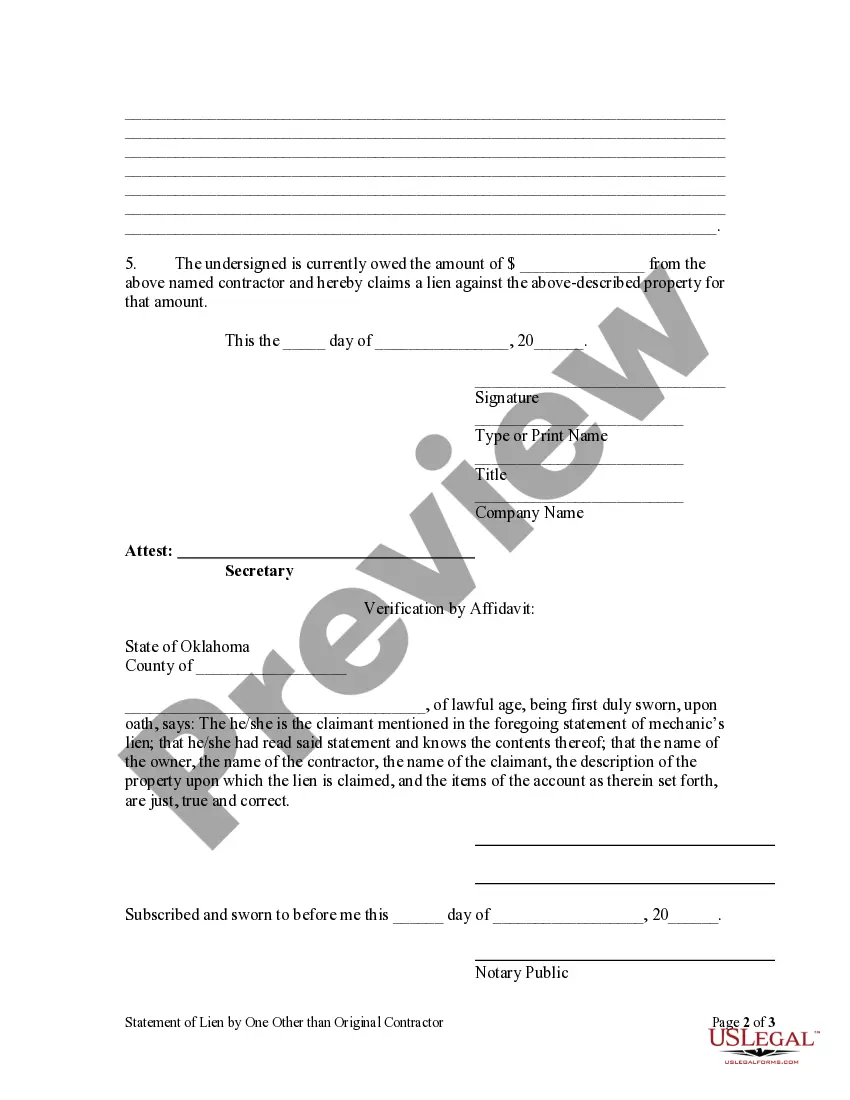

How to fill out Oklahoma Statement Of Lien - Subcontractor And Other By Corporation?

- Log in to your account if you are a returning user, ensuring your subscription is active. If it requires renewal, do so according to your payment plan.

- For first-time users, start by checking the Preview mode and description of the legal form to confirm it meets your needs.

- If you need a different template, utilize the Search tab to find the appropriate document that aligns with your local jurisdiction's requirements.

- Click on the 'Buy Now' button and select your preferred subscription plan. You must create an account to access the comprehensive library.

- Proceed to payment by entering your credit card information or using your PayPal account to finalize your subscription.

- Once the transaction is complete, download your form and save it to your device. You can access it anytime from the 'My Forms' section in your profile.

In conclusion, US Legal Forms not only simplifies the process of acquiring legal documents but also provides valuable resources to ensure they are filled out correctly. Whether you are returning or a new user, the platform offers a user-friendly experience catered to your legal needs.

Start your journey with US Legal Forms today and empower yourself with the legal tools you need!

Form popularity

FAQ

Yes, you must file a separate Schedule C for each business you operate. Each Schedule C should detail business income and expenses, ensuring compliance with tax regulations. Keeping thorough records for each entity simplifies this process significantly. One other corporation with multiple business structures can share insights into managing these filings effectively.

You typically do not file your personal and LLC taxes together. If your LLC is a single-member entity, its income may be reported on your personal tax return using Schedule C. For multi-member LLCs, a separate return is required. Understanding how One other corporation approaches these filings can give you clarity on the best path.

Yes, you can file taxes separately for two different companies. Each company must report its own income and expenses, which may impact your overall tax liability. It's essential to be diligent about maintaining separate accounts to avoid confusion. One other corporation with a similar tax structure can demonstrate effective methods for filing between entities.

To file taxes with multiple businesses, keep distinct records for each entity. You need to complete separate tax forms for each business, including income and expenses. This organization helps ensure compliance and maximizes potential deductions. Aligning with One other corporation with expertise in multi-business tax filing can provide targeted support.

When filing taxes with multiple businesses, each business must have its own records and tax filings. Make sure to track income and expenses separately to simplify the filing process. You can file individual returns for each business or consolidate income on a single tax return, depending on your structure. One other corporation with similar operations can offer valuable advice on effective filing strategies.

Your LLC can choose to be taxed as either an S corporation or a C corporation based on your financial strategy. These options can provide different tax benefits, such as avoiding double taxation or allowing more deductions. To determine the best choice for your business structure, consider consulting a tax professional. One other corporation with a similar structure can give insights into the advantages of each designation.

Filing taxes with two companies means you must report income and expenses for each entity separately. The tax structures of the corporations may differ, affecting overall liability. Additionally, you'll be responsible for complying with tax regulations for both businesses, which can get complicated. Utilizing One other corporation with a clear strategy can simplify your tax reporting.

Yes, you can run multiple businesses under one corporation by creating separate divisions or departments. This structure allows you to streamline operations and consolidate management while enjoying shared resources. Keep in mind that maintaining clear records and finances for each business is crucial for legal and tax purposes. One other corporation with a similar setup can maximize efficiencies.

To find out if your LLC is classified as an S Corp or C Corp, review the IRS forms submitted by your business. If your LLC has filed Form 2553, it is treated as an S Corporation. If you have not made this election, your LLC remains a default tax entity, and discussing your options with an expert can provide clarity on operating similarly to one other corporation with a.

To identify whether a company is classified as an S Corp or C Corp, you should look at its tax filings and status with the IRS. An S Corporation has filed Form 2553 with the IRS, while a C Corporation typically has not made this election. Understanding this distinction helps you evaluate the benefits associated with one other corporation with a for your business goals.