Assumption Letter For House And Lot

Description

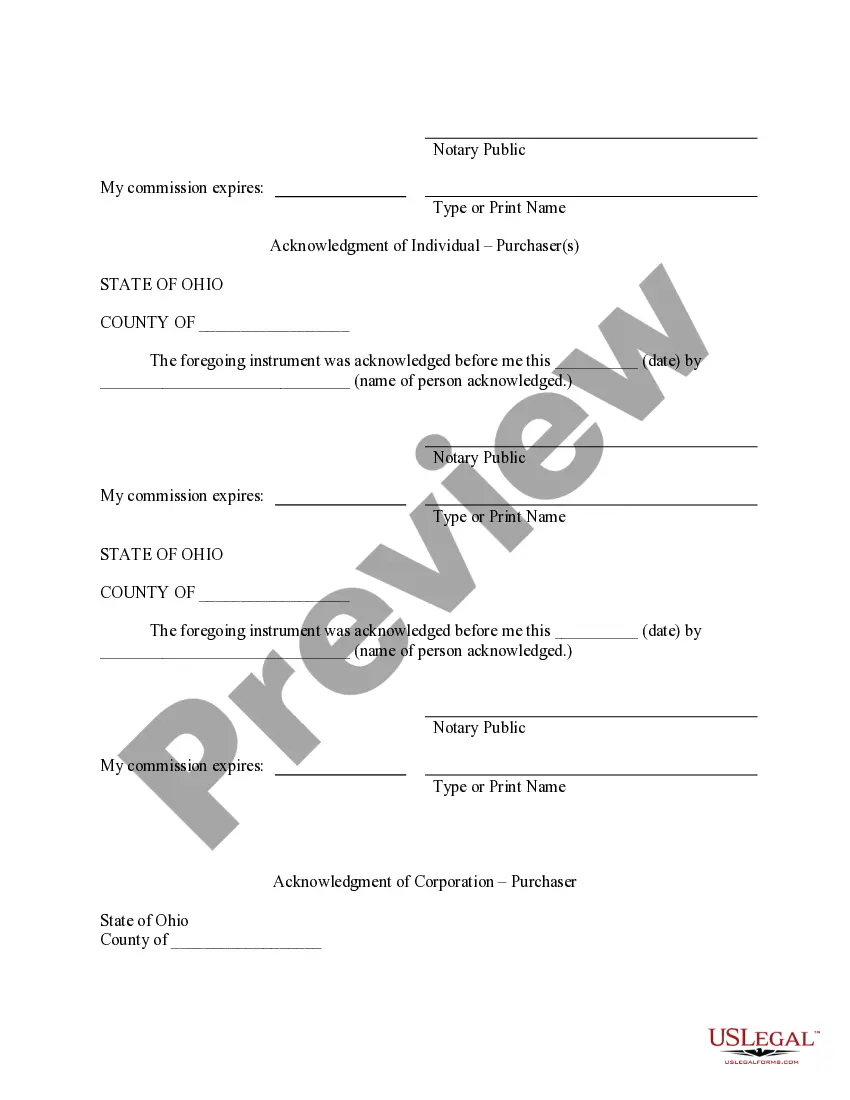

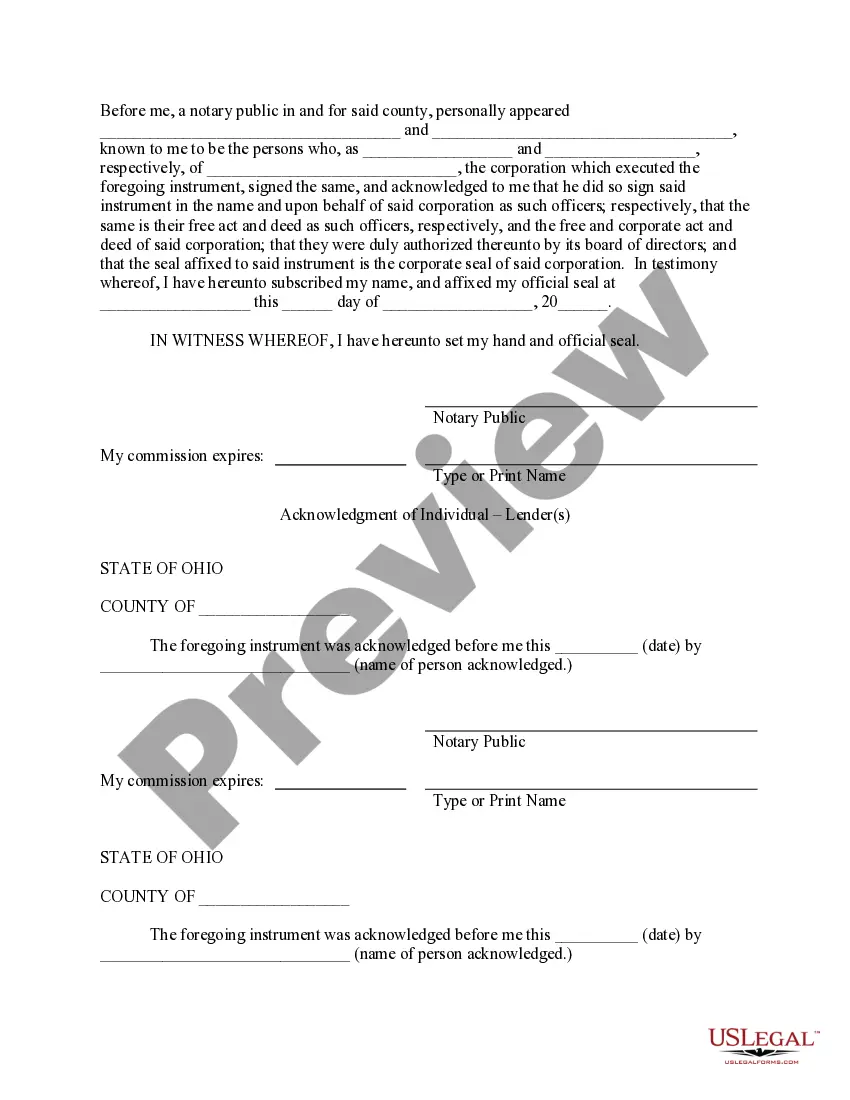

How to fill out Ohio Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

What is the most trustworthy service to obtain the Assumption Letter For House And Lot and other current versions of legal documents? US Legal Forms provides the solution! It boasts the largest compilation of legal paperwork for any situation.

Every template is skillfully drafted and verified for adherence to federal and local standards. They are categorized by region and state of application, making it easy to find exactly what you require.

US Legal Forms is an excellent resource for anyone dealing with legal paperwork. Premium users benefit further by electronically completing and approving previously saved documents at any time using the built-in PDF editing tool. Try it out today!

- Experienced users of the platform just need to Log In to their account, confirm if their subscription is active, and click the Download button next to the Assumption Letter for House And Lot to retrieve it.

- Once downloaded, the template will be accessible for future use within the My documents section of your profile.

- If you don’t have an account yet, follow these steps to create one.

- Form compliance examination. Before acquiring any template, ensure it meets your usage requirements and complies with your state or county regulations. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

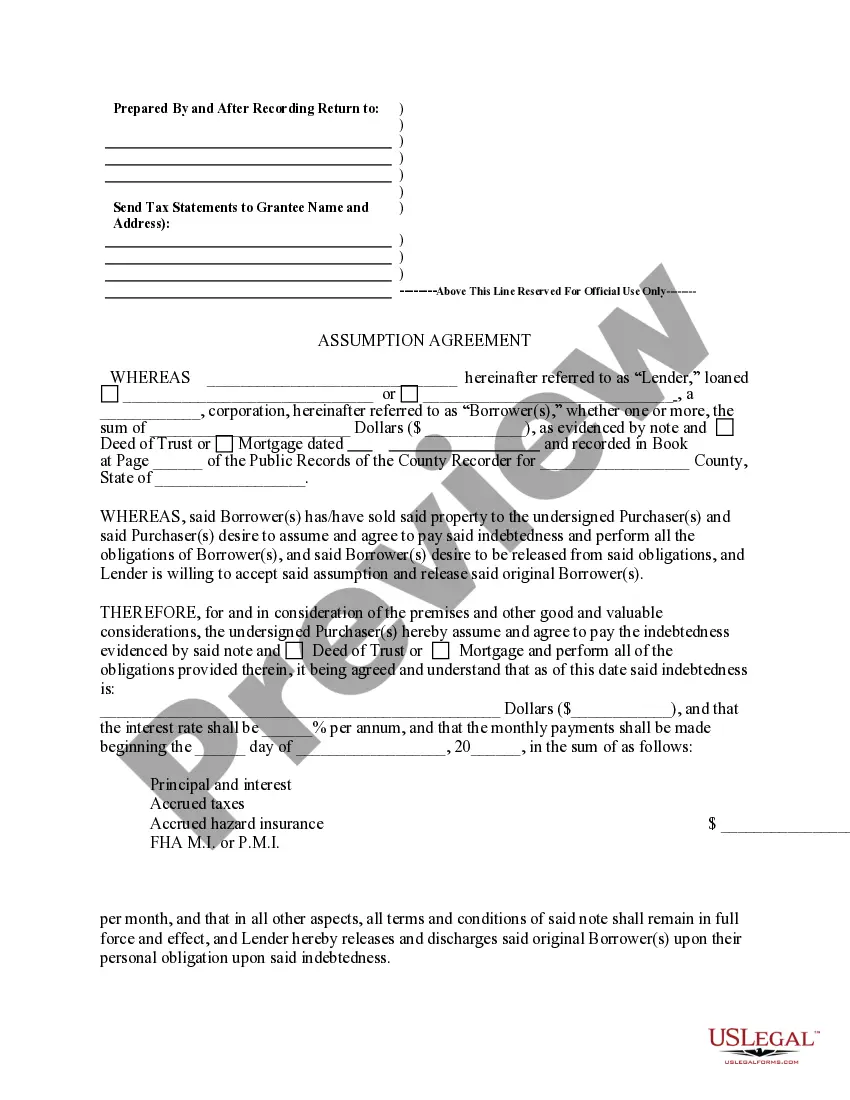

An assumption letter is a document that confirms a buyer's acceptance of a mortgage obligation from the seller. This letter clearly outlines the terms under which the buyer assumes responsibility for the mortgage. It is an essential part of the process as it provides legal protections for both parties involved in the transaction. Obtaining an assumption letter for house and lot ensures that all agreements are documented correctly.

While assumable mortgages can appear attractive, it’s important to be aware of potential catches. The original lender may have restrictions or additional fees associated with the transfer. You should also check whether the mortgage includes a due-on-sale clause, which could hinder your plans. An assumption letter for house and lot can help you navigate these complexities.

To fill out an assumption agreement, first gather necessary information such as borrower details and property specifics. Clearly define the obligations being assumed and include any relevant terms. Ensure all involved parties sign the document to validate it. Utilizing resources like uslegalforms can guide you through creating an effective assumption letter for house and lot.

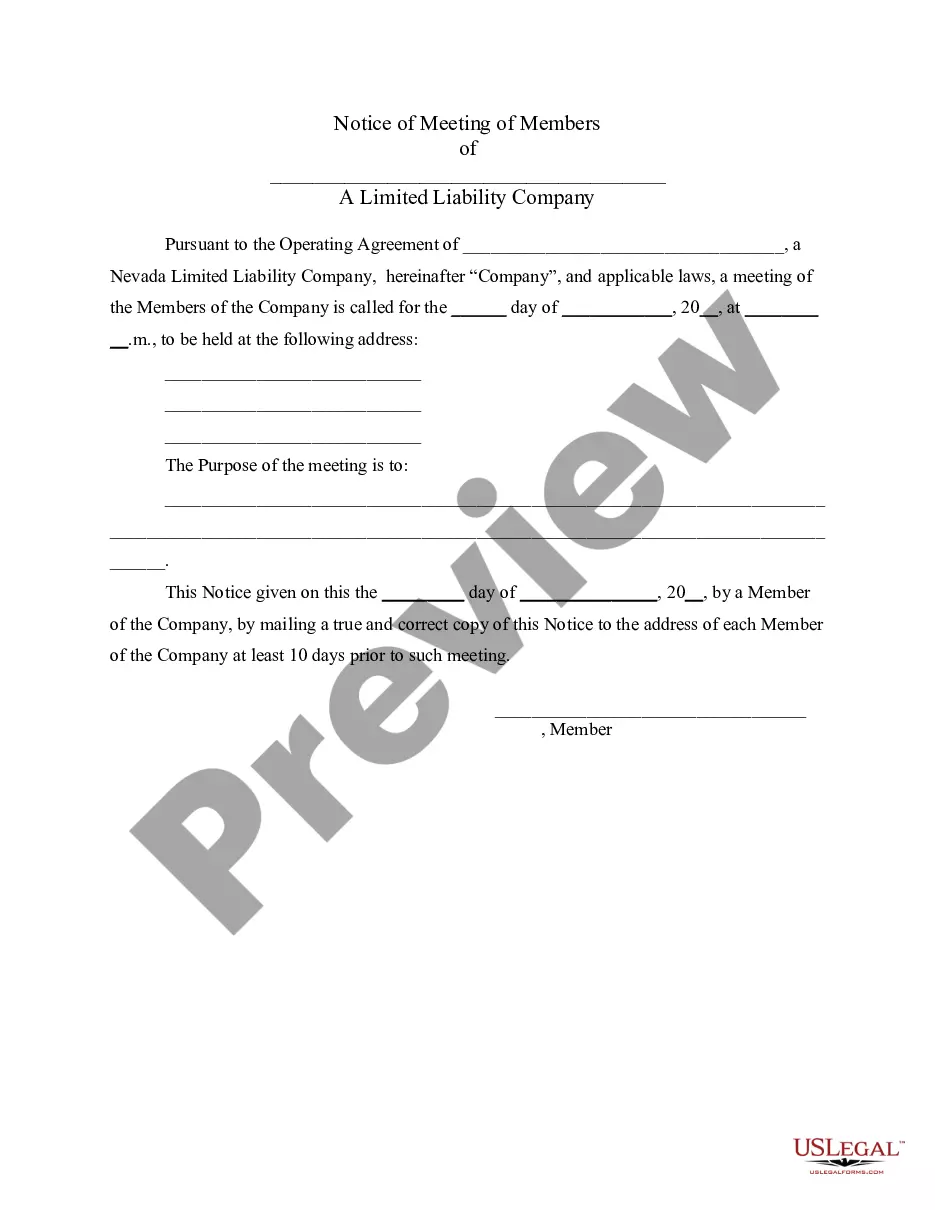

An assumption in real estate occurs when a buyer takes over the seller's mortgage, effectively assuming their payment responsibilities. For instance, if a family member inherits a property, they might assume the existing mortgage through an assumption letter for house and lot. This transaction can ease financial transitions while maintaining the property's ownership.

To fill out an agreement, start by clearly stating the parties involved and the purpose of the document. Include relevant dates, property details, and specify the terms of the assumption. Ensure you sign and date the document to make it legally binding. Using a template for an assumption letter for house and lot can simplify this process.

To assume a mortgage from a family member, you will need a clear assumption letter for house and lot. This letter should state your intention to take over the mortgage and outline the terms. Additionally, ensure to include any details about the existing mortgage agreement. Finally, both parties should sign the letter to formalize the process.

To assume a mortgage, you typically need several documents, including a completed assumption letter for house and lot, proof of income, a credit report, and identification. Lenders may also ask for additional financial disclosures to assess your ability to take over the mortgage. It's essential to gather these documents to streamline the assumption process and ensure a smooth transition. Utilizing US Legal Forms can help you find and create the necessary documents quickly.