New York State Non Resident Withholding Tax

Description

How to fill out New York New State Resident Package?

It’s clear that you cannot transform into a law expert instantly, nor can you comprehend how to swiftly create New York State Non Resident Withholding Tax without possessing a specific set of talents.

Drafting legal documents is a prolonged process necessitating a distinctive education and expertise. So why not entrust the preparation of the New York State Non Resident Withholding Tax to the experts.

With US Legal Forms, one of the most extensive libraries of legal documents, you can access anything from court filings to office communication templates. We understand the importance of compliance and adherence to federal and state laws and regulations.

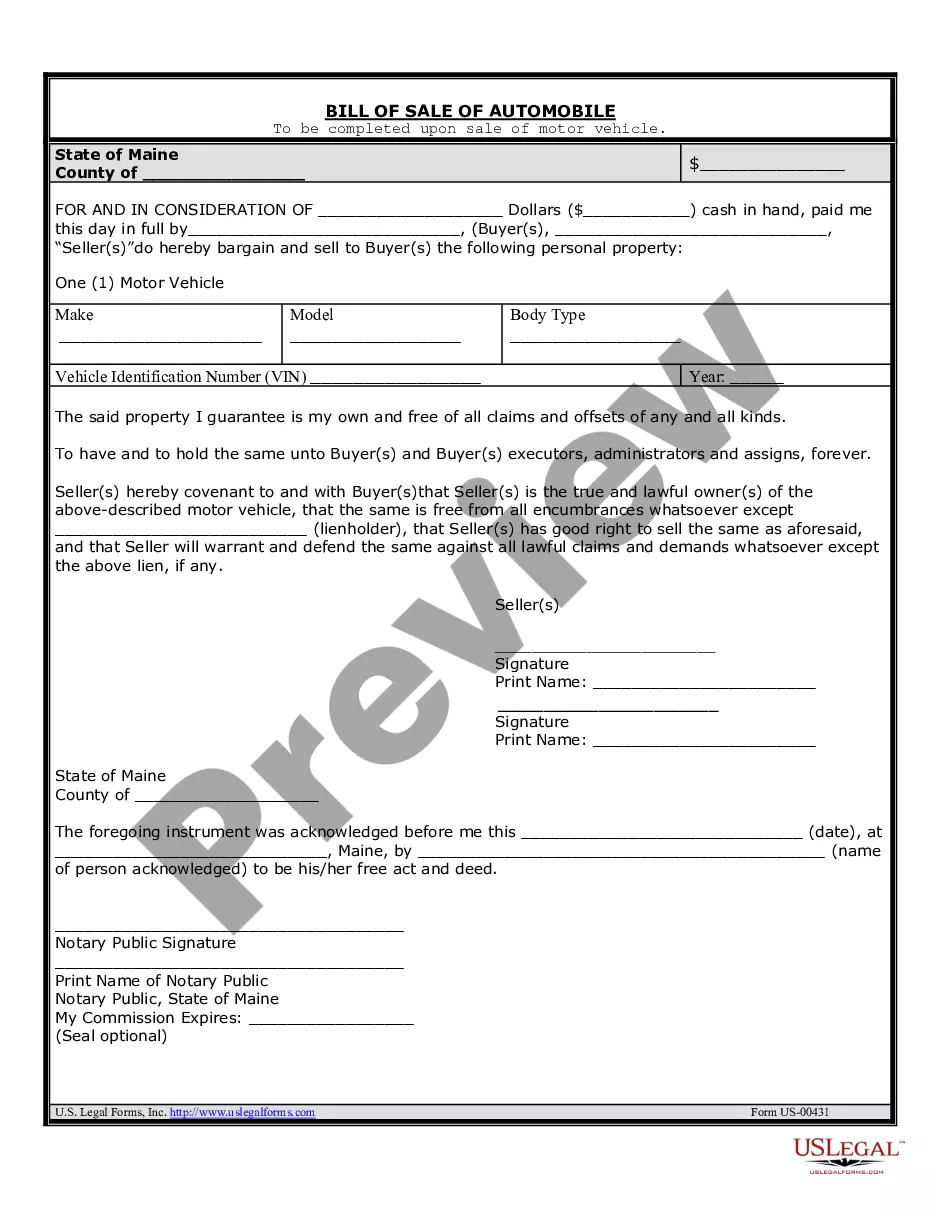

Click Buy now. Once the purchase is finalized, you can download the New York State Non Resident Withholding Tax, complete it, print it, and send or mail it to the relevant individuals or organizations.

You can revisit your forms from the My documents tab anytime. If you’re a current client, you can simply Log In and locate and download the template from the same tab. Regardless of your document's purpose—be it financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Start with our website and acquire the document you need in just a few minutes.

- Locate the form you need using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to see if New York State Non Resident Withholding Tax is what you are looking for.

- If you require a different template, begin your search again.

- Register for a complimentary account and select a subscription plan to purchase the template.

Form popularity

FAQ

The withholding tax in Brazil for non-residents typically applies to income earned within the country. This tax rate can vary based on the nature of the income and the type of transaction. It's important to understand these rates to ensure compliance and avoid unexpected liabilities, especially when dealing with international income. If you are considering investments, consulting with experts on New York state non resident withholding tax may also be beneficial.

Nonresident Alien Tax Withholding If a nonresident receives US source income, a mandatory withholding of 30% on most types of income will apply. However, there are exceptions.

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if an Internal Revenue Code Section provides for a lower rate, or there is a tax treaty between the foreign person's country of residence and the United States.

Register your business for income withholding and unemployment tax on the New York Department of Labor website. (Registering with the New York Department of Labor will automatically register you for the New York Department of Taxation and Finance as well.)

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.