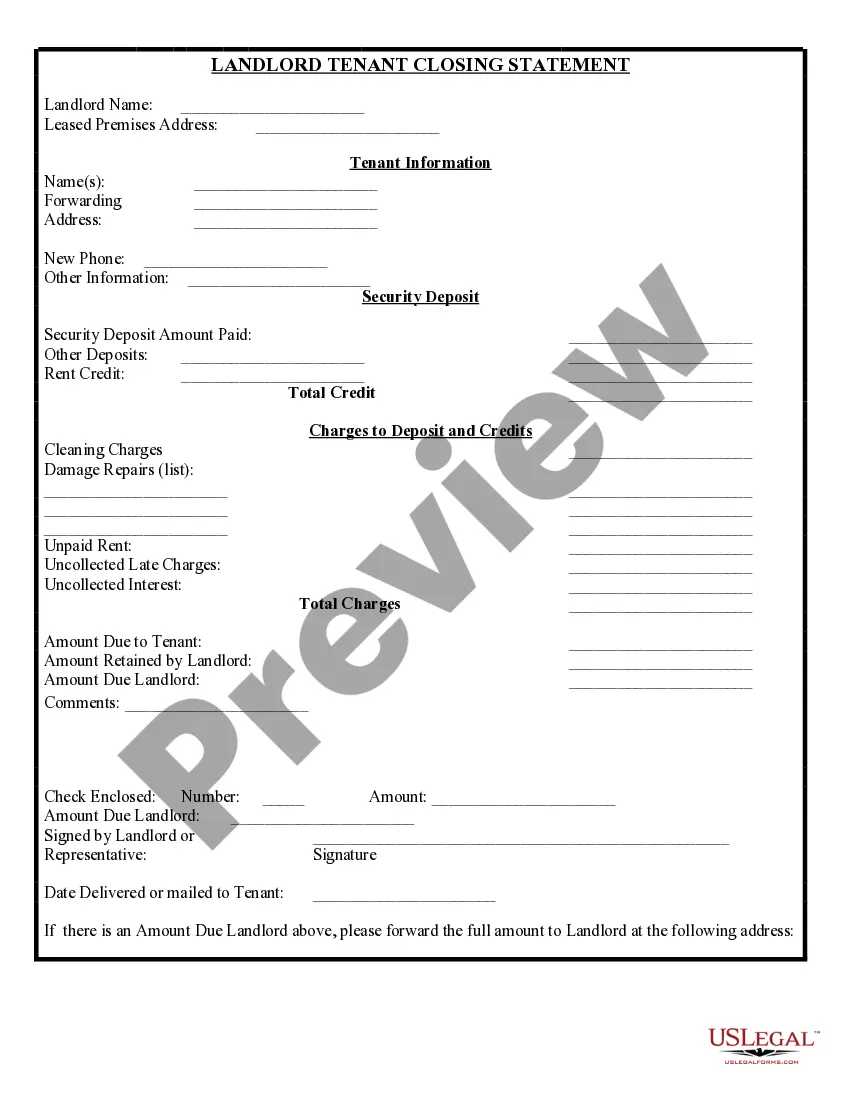

Statement Security Deposit Within 30 Days

Description

How to fill out New York Landlord Tenant Closing Statement To Reconcile Security Deposit?

Accessing legal document samples that comply with federal and local regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Statement Security Deposit Within 30 Days sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life situation. They are simple to browse with all documents organized by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when obtaining a Statement Security Deposit Within 30 Days from our website.

Obtaining a Statement Security Deposit Within 30 Days is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template utilizing the Preview feature or through the text description to ensure it meets your needs.

- Locate another sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Statement Security Deposit Within 30 Days and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Because the security deposit is not considered rental income it does not appear on the income statement or net cash flow reports. Instead, the deposit is shown on the rental property balance sheet in the security deposit category.

A Security Deposit Receipt provides proof that payment of a security deposit was made and received by the landlord, and it documents the amount that was paid, when it was paid, who made the payment, and the method of payment.

On the balance sheet, a tenant's security deposit amount is generally shown as a liability. This is because it's an amount that the landlord may owe back to the tenant at the end of the leasing journey. It's categorized this way to reflect the potential obligation to return the funds.

Because security deposits are generally not considered rental income, they should not appear on your income statement or cash flow statement. Instead, include it as a liability on your balance sheet on the date you received it, since it's an amount you're planning to eventually return.

If your landlord still does not return your deposit after about 30 days, you can file a case against them in small claims court. Think through whether the amount of the security deposit is worth your time in filing the claim and then appearing at a hearing.