Nevada Lien Waiver Form With Notary

Description

Form popularity

FAQ

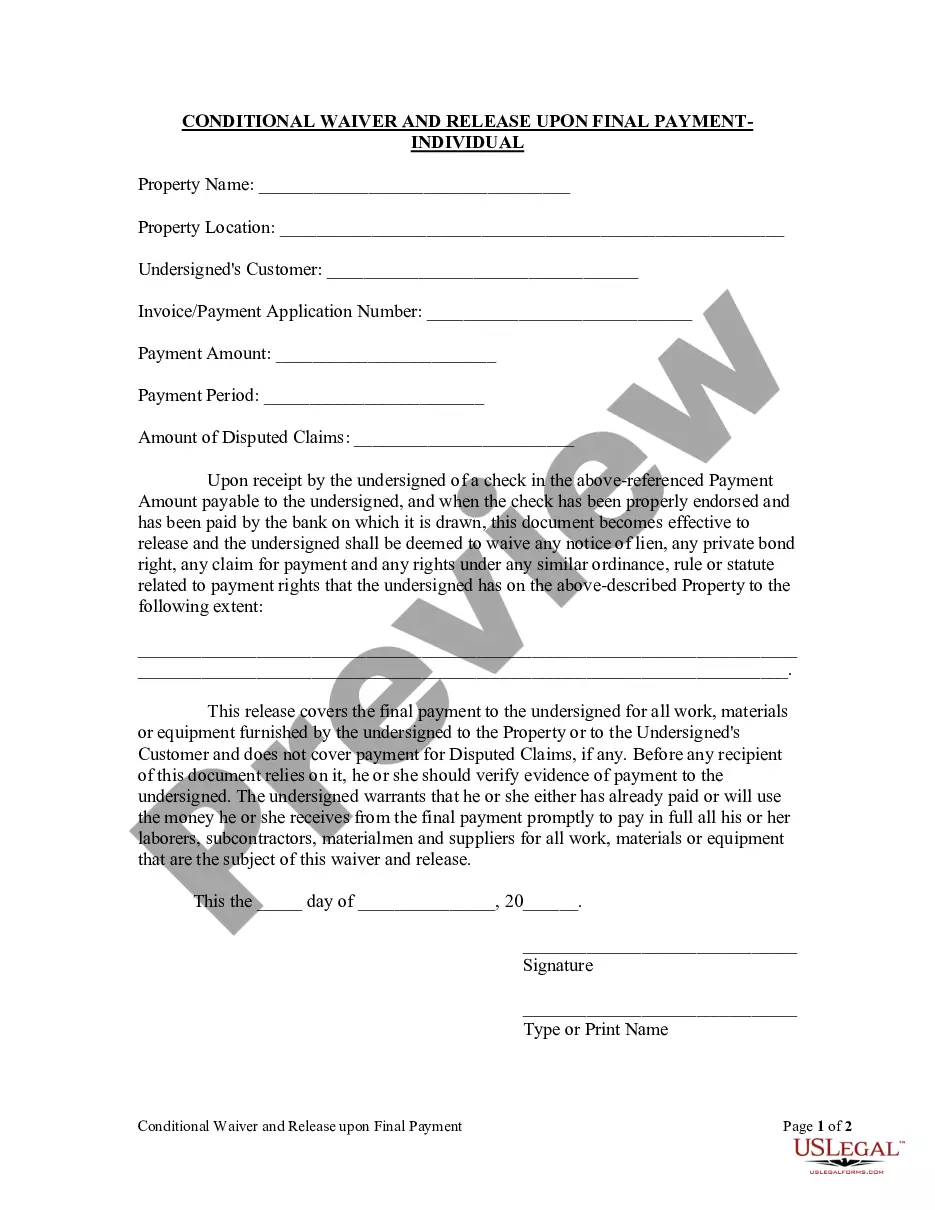

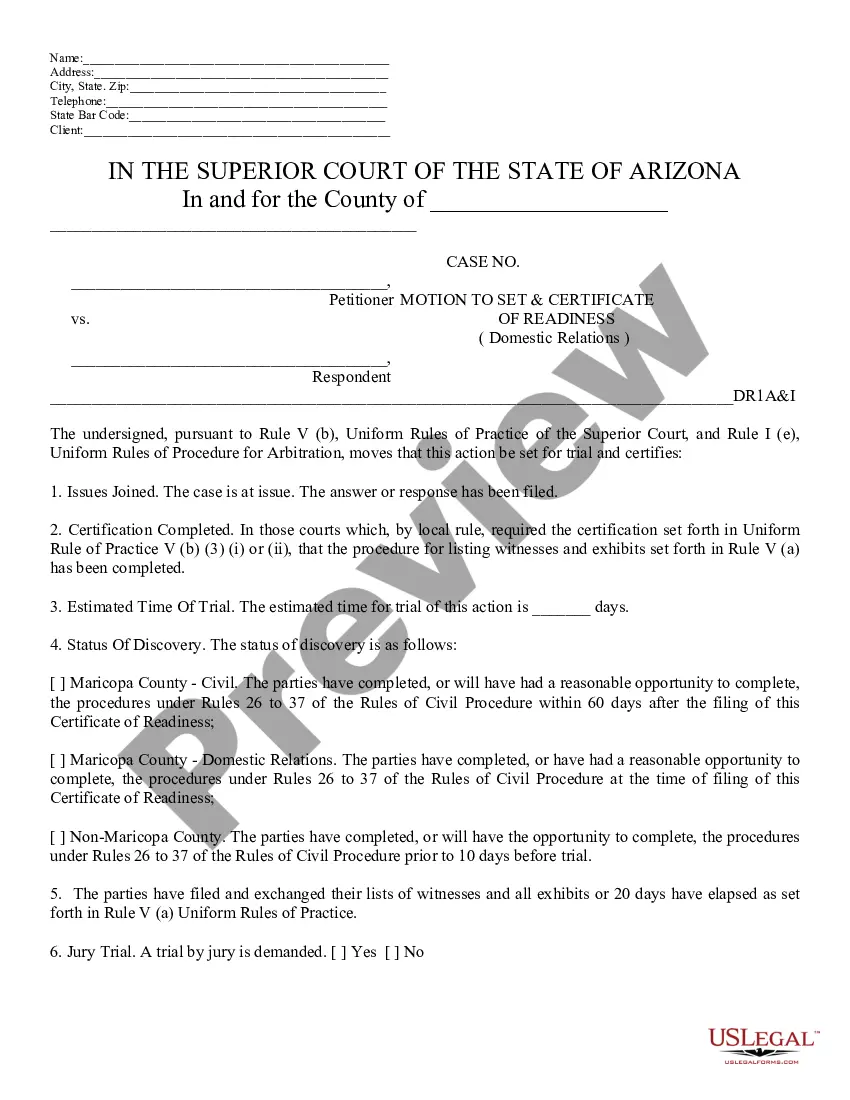

In North Carolina, you will encounter several types of lien waivers, including conditional, unconditional, and partial waivers. Each type serves its purpose based on the stage of payment and relationship between the parties. When drafting a Nevada lien waiver form with notary, you can adapt these types to fit local requirements while maintaining clarity. Always ensure adherence to state regulations to protect your interests.

An unconditional release is a type of lien waiver that relinquishes the right to file a lien without any conditions after signing. This means the contractor or vendor cannot claim any unpaid amounts once the waiver is executed. When using a Nevada lien waiver form with notary, this release gives you confidence that your transaction remains secure. It's a powerful tool for property owners looking to mitigate risk.

Filling out a waiver form involves providing essential project details, including the parties involved and the payment amounts. Make sure you accurately state the terms to avoid confusion later. Utilizing a Nevada lien waiver form with notary can add an extra layer of legitimacy to your document. Just follow the prompts carefully, and you'll have a complete form ready for signing.

Conditional lien waivers are valid only after certain conditions are met, such as the receipt of payment. In contrast, unconditional lien waivers become effective immediately upon signing, regardless of payment. When using a Nevada lien waiver form with notary, it's crucial to understand which type suits your situation better. Choose wisely to protect your rights.

To lien a property in Nevada, you must start by obtaining the necessary Nevada lien waiver form with notary. Ensure that you fill out the form correctly with details about the property, the debtor, and the amount owed. After completing the form, submit it to the appropriate county recorder's office to officially place the lien on the property.

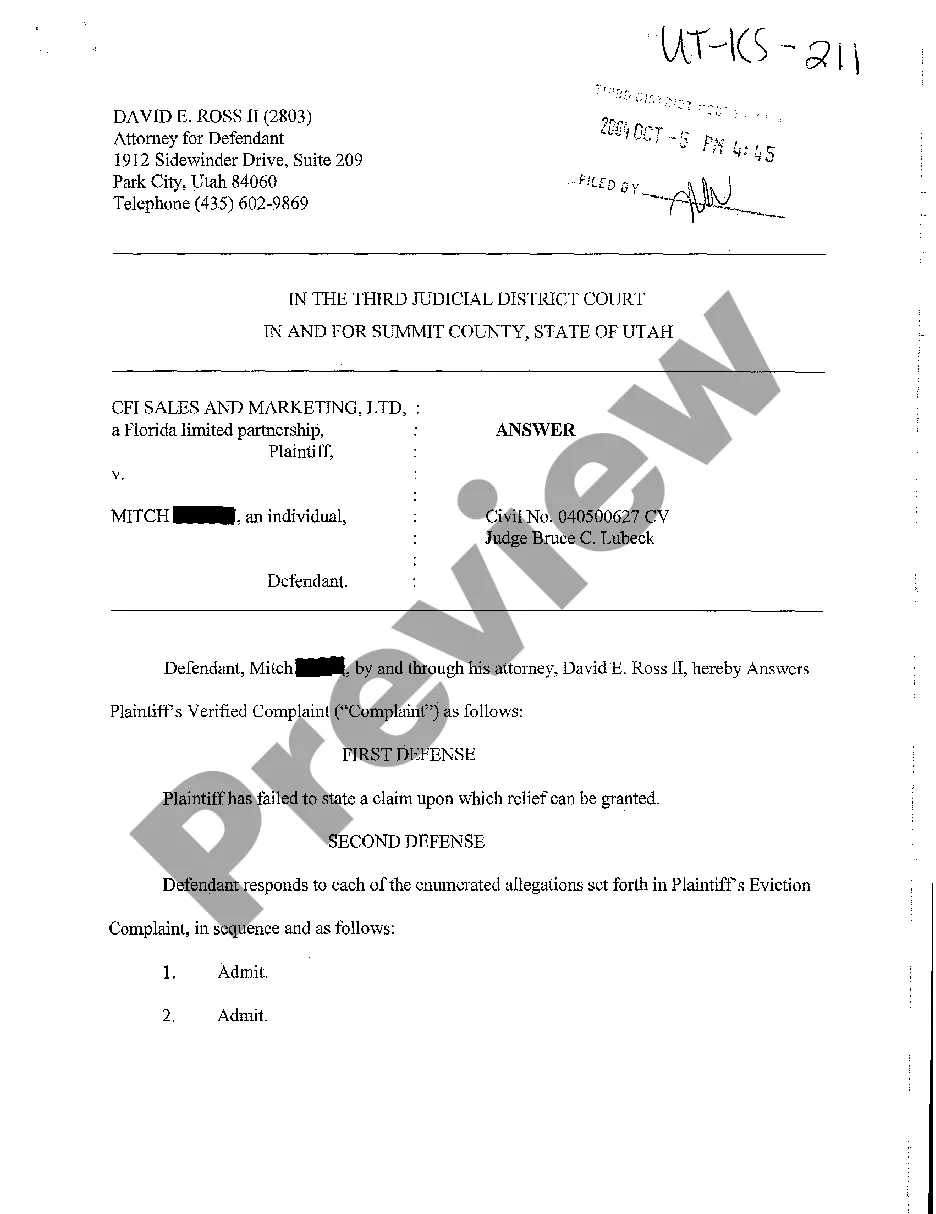

In Nevada, a right to lien grants a creditor the authority to place a claim on a property if a debt remains unpaid. This legal mechanism helps secure the debt, ensuring that creditors have recourse in case of default. Understanding the Nevada lien waiver form with notary is crucial, as it serves to protect both the creditor's rights and the property's ownership in such situations.

To put a lien on a car in Nevada, you must complete the appropriate lien form and file it with the Nevada Department of Motor Vehicles. This form must include details about the vehicle, the lienholder, and the amount owed. Using a Nevada lien waiver form with notary can enhance your documentation process and clarify any agreements. This helps ensure that your rights are protected and simplifies the management of the lien.

In Nevada, a lien is typically valid for six months from the date it is recorded if no action is taken. If you wish to enforce the lien, you generally need to initiate legal proceedings within this timeframe. To maximize your lien's effectiveness, consider preparing a Nevada lien waiver form with notary. This form can assist in clarifying obligations and providing a detailed record of agreements, which may benefit you if further action is required.

A notice of right to lien in Nevada is a document that informs property owners that a contractor or supplier is entitled to file a mechanics lien. This notice is crucial as it preserves the rights of the contractor in the event of non-payment. Including a Nevada lien waiver form with notary can strengthen your position, as it establishes agreement and acknowledgment from the property owner regarding payment obligations. It acts as an important safeguard for both parties.

To file a lien in Nevada, you must prepare a lien document that outlines the debt owed, as well as the property details. You then need to file this document with the county recorder's office where the property is located. Utilizing a Nevada lien waiver form with notary can further streamline this process, providing a clear record of your agreements and protections. This helps ensure that your claim is legally enforceable.