Limited Companies

Description

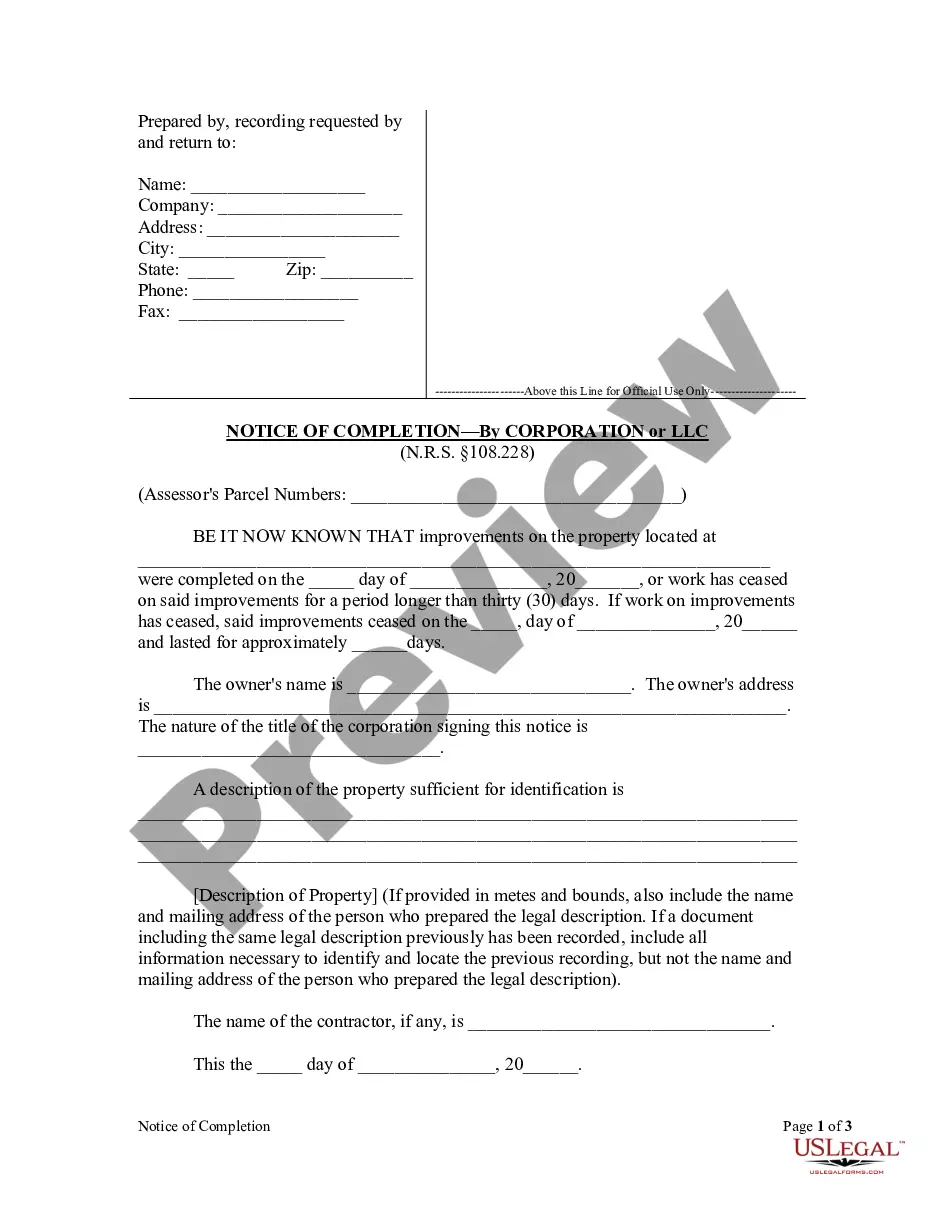

How to fill out Nevada Notice Of Completion - Corporation?

- Log into your account if you have used US Legal Forms before. Confirm that your subscription is active; if it isn't, renew according to your payment plan.

- For first-time users, start by checking the Preview mode and descriptions of available forms. Ensure that the form you choose complies with your local jurisdiction's requirements.

- If the form isn’t quite right, utilize the Search tab to find another template that suits your needs better.

- Once you find the appropriate document, click the Buy Now button and select your preferred subscription plan. You'll need to create an account to gain full access to the library.

- Proceed to checkout by entering your payment details, either through credit card or PayPal, to finalize your subscription.

- Finally, download the form to your device. You can access your purchased template anytime from the My Forms section of your account.

In conclusion, US Legal Forms is an invaluable resource for limited companies seeking legal documentation with ease. With its extensive library and user-friendly interface, it empowers you to create compliant legal documents efficiently. Start your journey today and experience the best in legal form access!

Contact our support for any specific queries you may have.

Form popularity

FAQ

Being a limited company means that the business is a separate legal entity from its owners, protecting their personal assets from business debts. Limited companies offer benefits such as improved credibility, tax advantages, and easier access to funding. This structure is particularly beneficial for entrepreneurs looking to grow their businesses while reducing personal risk. Platforms like uslegalforms help you navigate the formation process, ensuring that you establish your limited company correctly.

Limited companies refer to various business structures, while an LLC, or Limited Liability Company, is a specific type of limited company. The main difference lies in how they are structured and taxed. LLCs provide members with personal liability protection, whereas other limited companies may not offer the same level of safeguard. Understanding these distinctions is crucial for making informed decisions on your business setup.

An LLC is not intrinsically an S or C corp; rather, it can elect to be taxed as either. By default, an LLC is often treated as a pass-through entity, but it can choose S or C corp taxation through elections filed with the IRS. This flexibility can provide significant tax advantages, depending on your business goals and income projections. For more information on classifications and tax implications, USLegalForms can offer valuable assistance.

Your LLC can be classified as either an S corp or C corp based on your tax election choices. If you filed an S corp election using Form 2553, your LLC would be treated as an S corp for tax purposes. Otherwise, it defaults to a C corp or is taxed according to its structure, like a sole proprietorship or partnership. It’s advisable to consult with a tax advisor to confirm your specific classification.

A limited company must file various documents to maintain its status. This typically includes annual reports, tax returns, and any specific filings according to your state’s regulations. Additionally, if your limited company made the S corp election, you will need to file Form 1120S each year. For detailed filing requirements tailored to your situation, consider leveraging USLegalForms for comprehensive resources and guidance.

Your classification as an S corp or LLC can be confusing, especially since an LLC can be taxed as either entity. To clarify, review your formation documents and tax elections filed with the IRS. If you've filed for S corp status, your LLC will follow S corp tax rules. Otherwise, your LLC defaults to being taxed as a sole proprietorship or partnership, depending on your ownership structure.

Choosing between an S corp and a C corp for your limited company depends on your business goals. S corps offer pass-through taxation, which can be beneficial for smaller startups anticipating little revenue. On the other hand, C corps provide flexibility for investment and growth, making them ideal for businesses planning to scale significantly. Reflect on your future plans, and consider seeking advice from a legal expert for tailored guidance.

To determine if your limited company is classified as a C corp or S corp, review your IRS filings. Typically, an S corp election is made by filing Form 2553 with the IRS, while C corps do not require this filing. You can also look at your tax returns; an LLC taxed as an S corp will file Form 1120S, while a C corp files Form 1120. If you're unsure, consulting a tax professional can provide clarity.

Limited companies include both private and public entities that possess limited liability. Examples range from small family-owned businesses to large, publicly traded organizations. The limited company structure provides flexibility and protection, making it a popular choice for various industries seeking to mitigate financial risks while engaging investors.

life example of a limited liability company is Ben & Jerry's Homemade Holdings, Inc. This company operates under the limited company structure, which allows it to manage its assets and liabilities efficiently. By being a limited liability company, it also protects the personal assets of its owners from business debts.