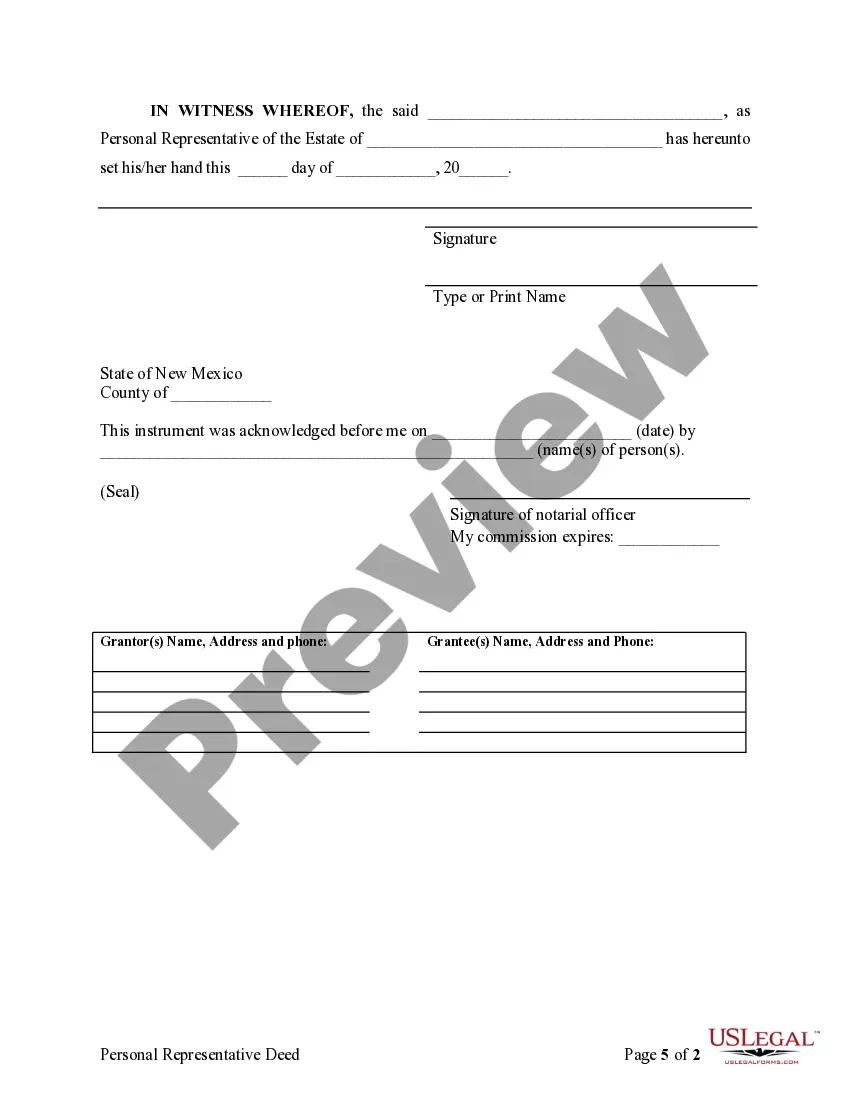

Personal Representative Deed Example With Trustee

Description

How to fill out New Mexico Quitclaim Deed For Personal Representative's Deed?

Creating legal documents from the ground up can frequently be intimidating. Specific situations may require extensive research and significant financial investment.

If you seek a more straightforward and cost-effective method for generating a Personal Representative Deed Example With Trustee or other documents without facing obstacles, US Legal Forms is always available to assist.

Our online collection of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific forms carefully prepared for you by our legal experts.

Utilize our website whenever you require dependable and trustworthy services to quickly locate and download the Personal Representative Deed Example With Trustee. If you are already familiar with our services and have set up an account, simply Log In, find the template, and download it or re-download it anytime from the My documents section.

Verify that the template you select complies with your state and county regulations. Choose the appropriate subscription plan to obtain the Personal Representative Deed Example With Trustee. Download the document, then complete, sign, and print it. US Legal Forms is well-regarded and has over 25 years of expertise. Join us today and make document processing easy and efficient!

- Don’t have an account? No worries.

- It takes minimal time to register and browse the catalog.

- Before downloading the Personal Representative Deed Example With Trustee, consider these suggestions.

- Examine the form preview and descriptions to ensure you are selecting the correct form.

Form popularity

FAQ

To obtain a personal representative deed, you typically need to file the appropriate documentation with your local probate court. This process usually includes submitting a petition and proving your appointment as the personal representative. Once approved, you can draft the deed to transfer property accordingly. Utilizing a platform like uslegalforms can simplify this process by providing templates and guidance, including personal representative deed example with trustee.

The two main types of trust deeds are the revocable trust deed and the irrevocable trust deed. A revocable trust deed allows the grantor to retain control over the assets during their lifetime, while an irrevocable trust deed transfers ownership permanently. Each type serves different purposes in estate planning and asset management. For real-world applications, a personal representative deed example with trustee can illustrate how these deeds are used.

A trustee holds legal title to property on behalf of the trust's beneficiaries, but does not have personal ownership rights. This means the trustee must act in the best interests of the beneficiaries, following the specific guidelines set forth in the trust agreement. Understanding the role of a trustee can be crucial when navigating estate planning. A personal representative deed example with trustee can further clarify this ownership structure.

A trustee's deed is a legal document that transfers property from a trust to a beneficiary or another party. This deed is executed by the trustee, who has the authority to manage the trust’s assets according to the trust agreement. It provides clear evidence of ownership and helps facilitate the distribution of assets. A personal representative deed example with trustee can provide insight into how this deed functions in practice.

A trustee typically utilizes a trustee's deed for transferring property. This deed serves to legally transfer real estate from the trust to a beneficiary or another entity. It is important that the trustee adheres to the trust's instructions while executing this deed. You might find a personal representative deed example with trustee helpful in understanding the specifics of this process.

Yes, a trustee and personal representative can indeed be the same person. This arrangement may simplify the management of your estate, allowing for a cohesive approach to handling assets. However, it is crucial to ensure that the individual can fulfill both roles responsibly and ethically. A personal representative deed example with trustee can clarify how one person can effectively manage these responsibilities.

A trustee typically uses a trustee's deed to transfer property on behalf of a trust. This deed provides legal authority to the trustee to convey property according to the trust's terms. It's essential for the trustee to follow the guidelines established in the trust document to ensure compliance. A personal representative deed example with trustee can illustrate how this process works effectively.

The best deed to avoid probate is often a revocable living trust deed. This type of deed allows you to transfer assets into a trust while maintaining control during your lifetime. Upon your passing, the assets can be distributed to your beneficiaries without the need for probate. By utilizing a personal representative deed example with trustee, you can ensure a smooth transition of your estate.