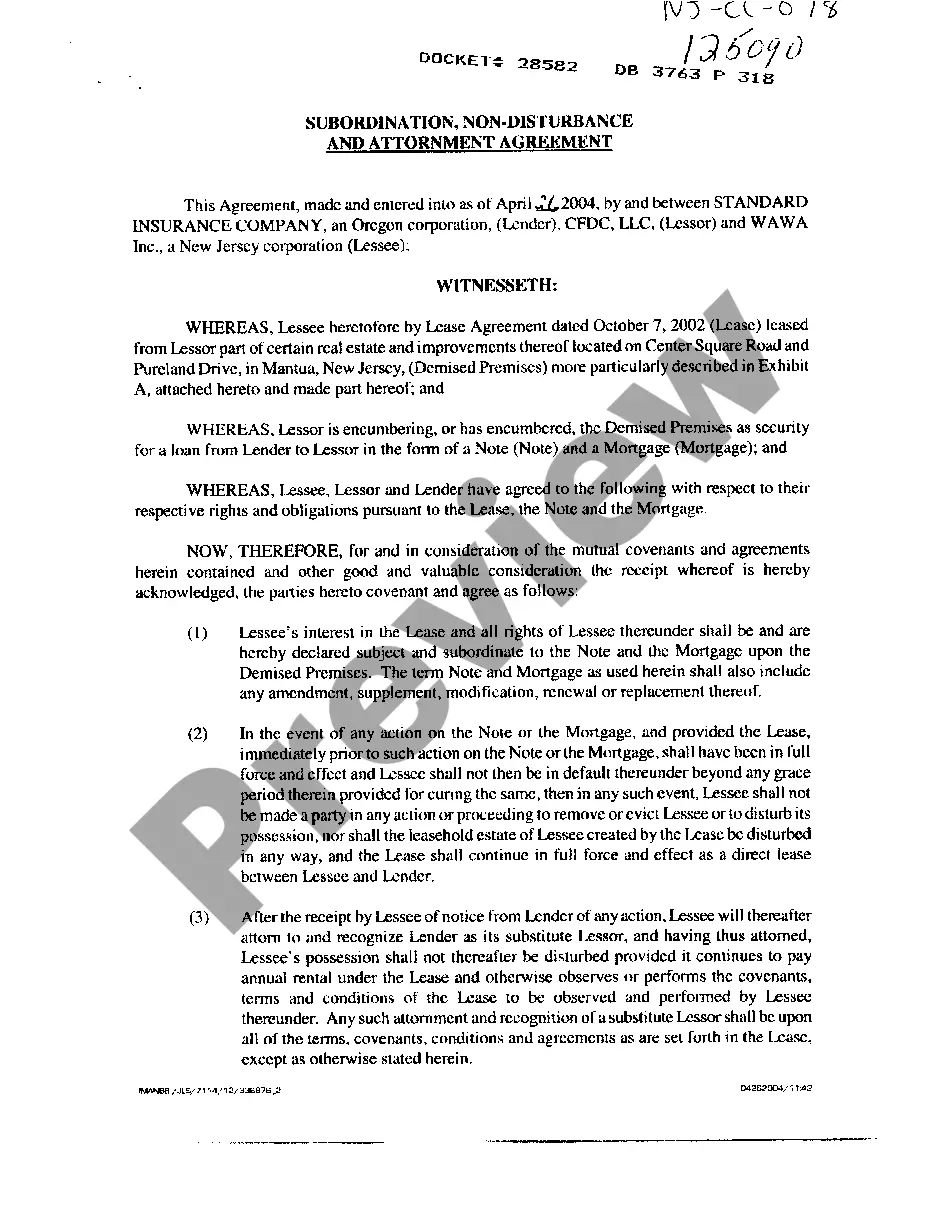

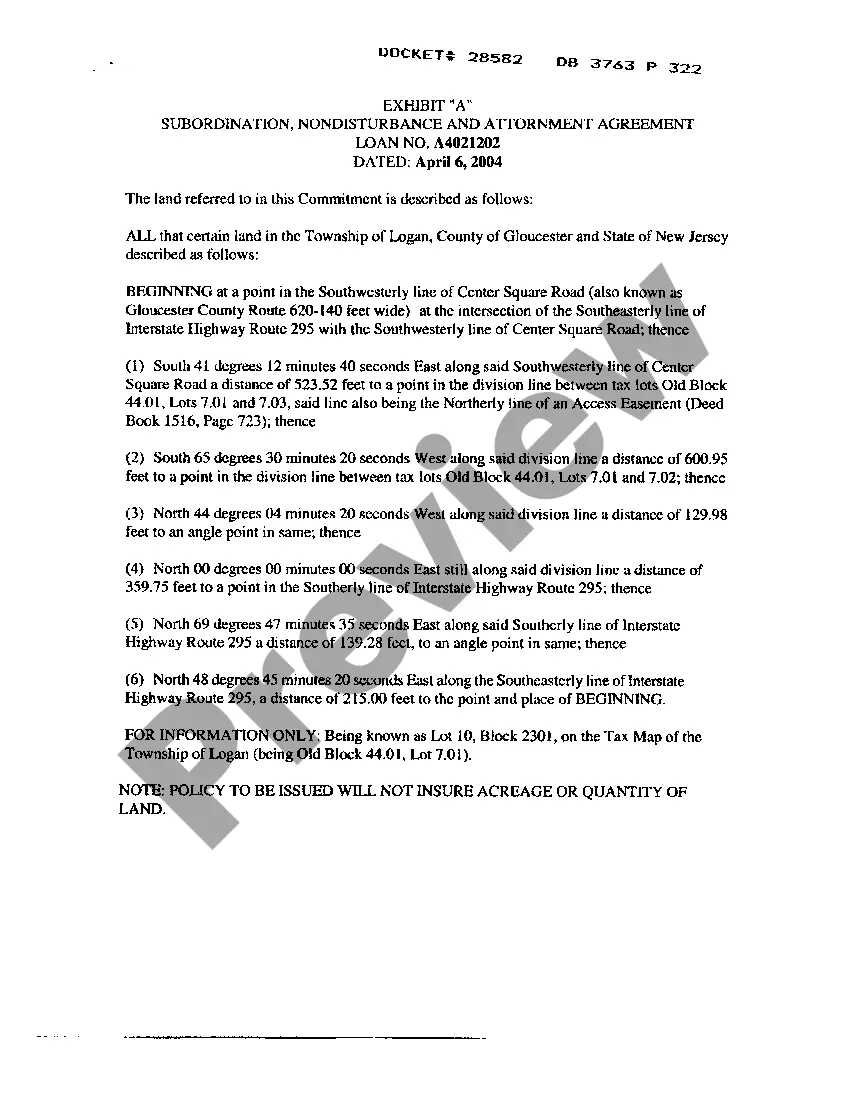

Letter Of Attornment Nj Withholding

Description

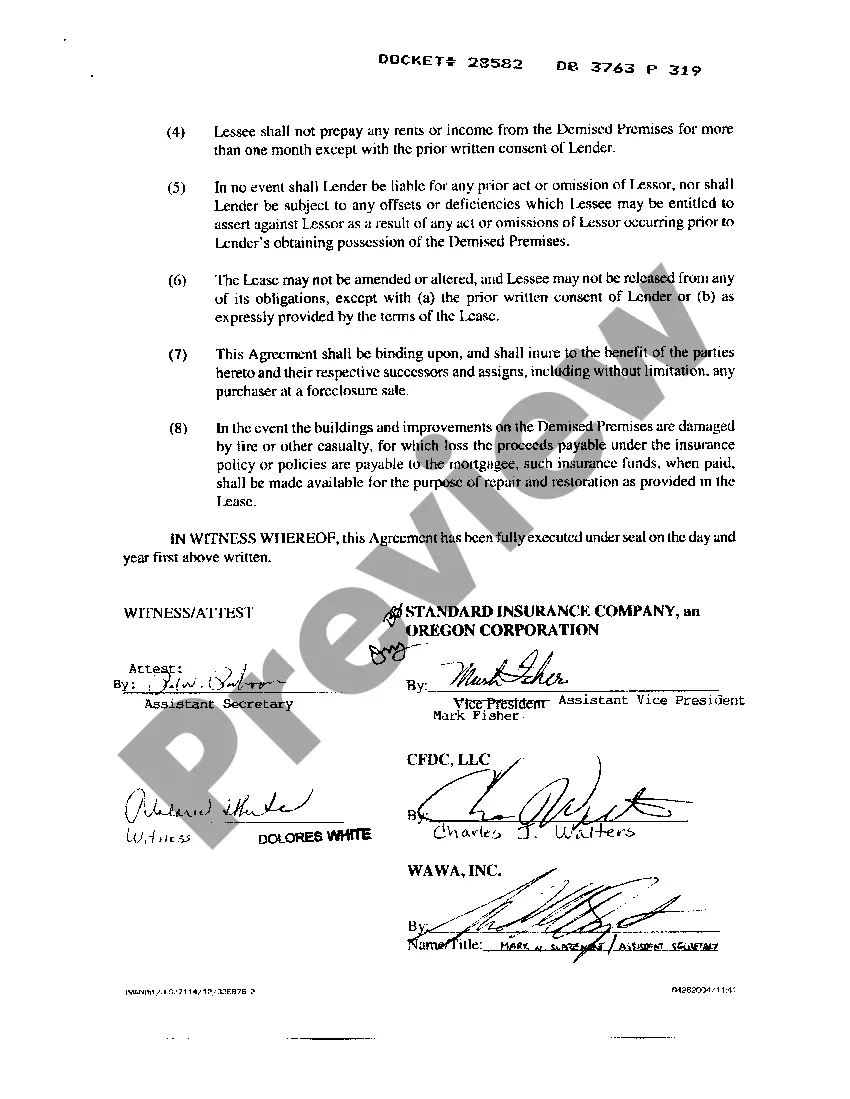

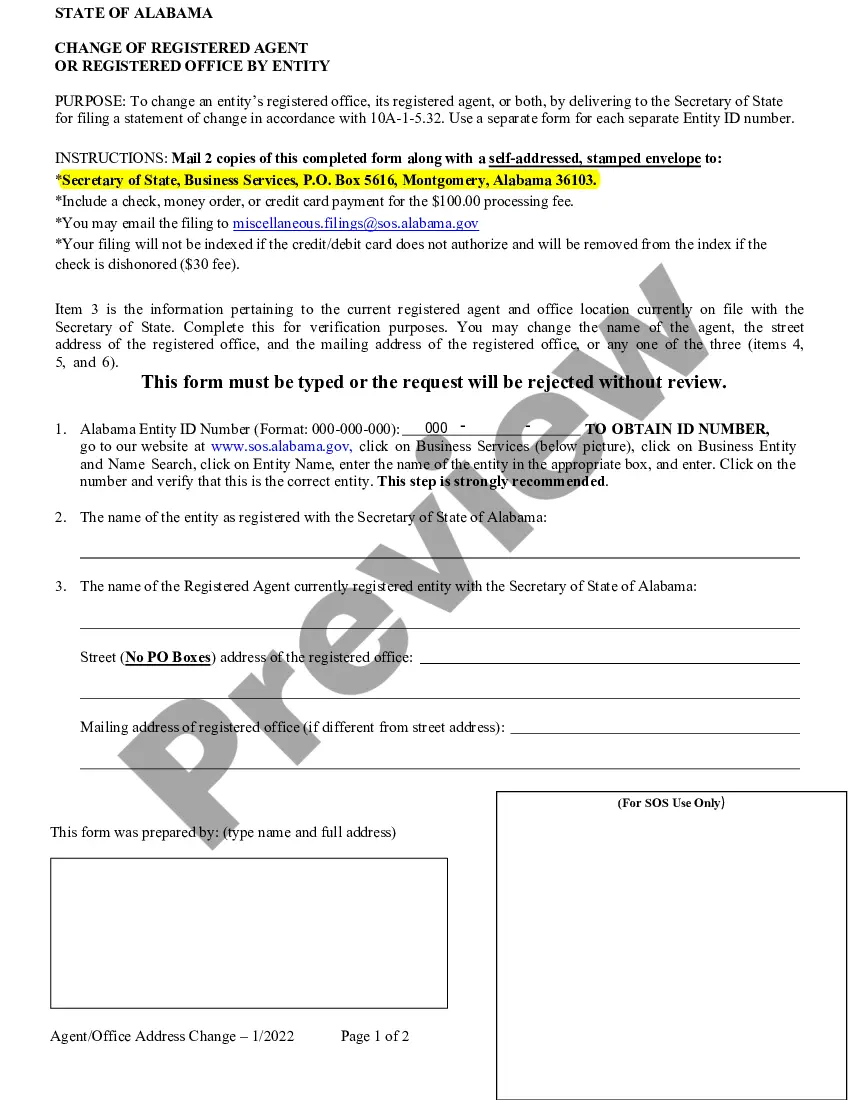

How to fill out New Jersey Subordination, Nondisturbance And Attornment Agreement?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations may require extensive research and significant expenses.

If you’re seeking a more straightforward and economical method for generating the Letter Of Attornment Nj Withholding or any other documents without complications, US Legal Forms is consistently at your service.

Our digital repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal concerns.

However, before proceeding to download the Letter Of Attornment Nj Withholding, keep the following advice in mind: Assess the document preview and descriptions to verify that you have located the form you need. Ensure that the form you choose complies with your state and county regulations. Select the appropriate subscription plan to purchase the Letter Of Attornment Nj Withholding. Finally, download the document and complete, verify, and print it. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and simplify the process of form execution!

- With just a few clicks, you can promptly access localized forms specifically organized for you by our legal experts.

- Utilize our site anytime you require trusted and dependable services to swiftly find and download the Letter Of Attornment Nj Withholding.

- If you're familiar with our offerings and have established an account, simply Log In, pick your form, and download it, or reacquire it anytime later in the My documents section.

- Don’t possess an account? No problem. Setting one up is quick and easy, allowing you to browse through our selection.

Form popularity

FAQ

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form. How to Fill Out a W-4 Form | H&R Block hrblock.com ? tax-center ? irs ? forms ? ho... hrblock.com ? tax-center ? irs ? forms ? ho...

All wages and employee compensation paid to a resident working in New Jersey is subject to withholding. If you employ New Jersey residents working in New Jersey, you must register, file, and pay New Jersey employer withholdings. NJ-WT ? New Jersey Income Tax Withholding Instructions New Jersey (.gov) ? taxation ? pdf ? current New Jersey (.gov) ? taxation ? pdf ? current PDF

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4. How to Fill Out Form W-4 in 2023 - Investopedia investopedia.com ? articles ? personal-finance investopedia.com ? articles ? personal-finance

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances. IRS W4 Form Instructions: How many allowance should you claim on your... marca.com ? personal-finance ? 2023/02/14 marca.com ? personal-finance ? 2023/02/14

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).