Operating Agreement For Nonprofit

Description

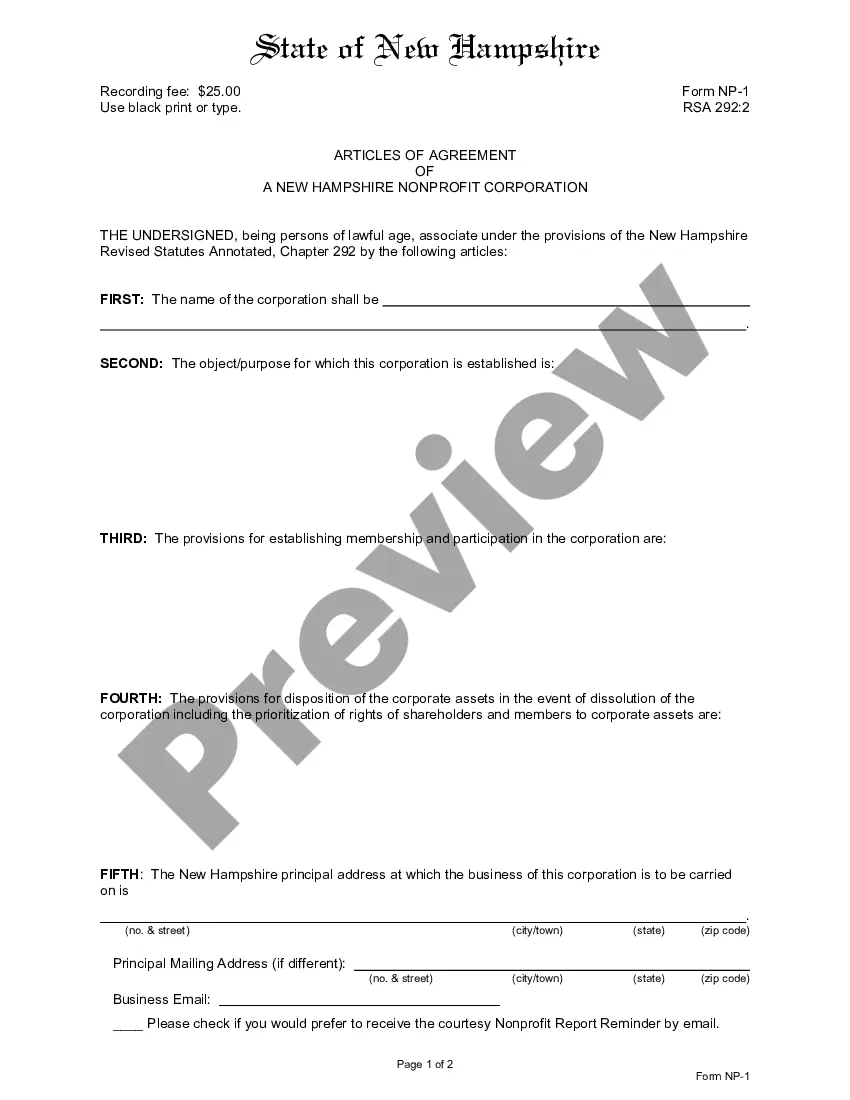

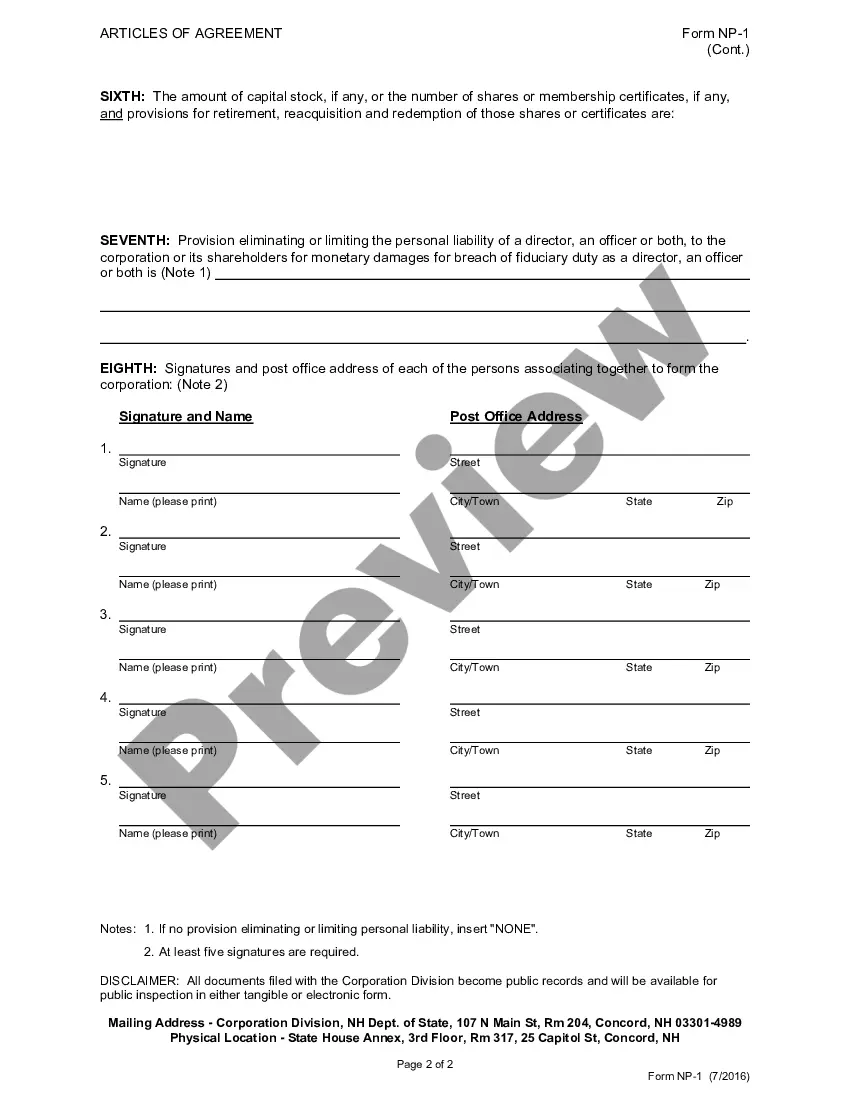

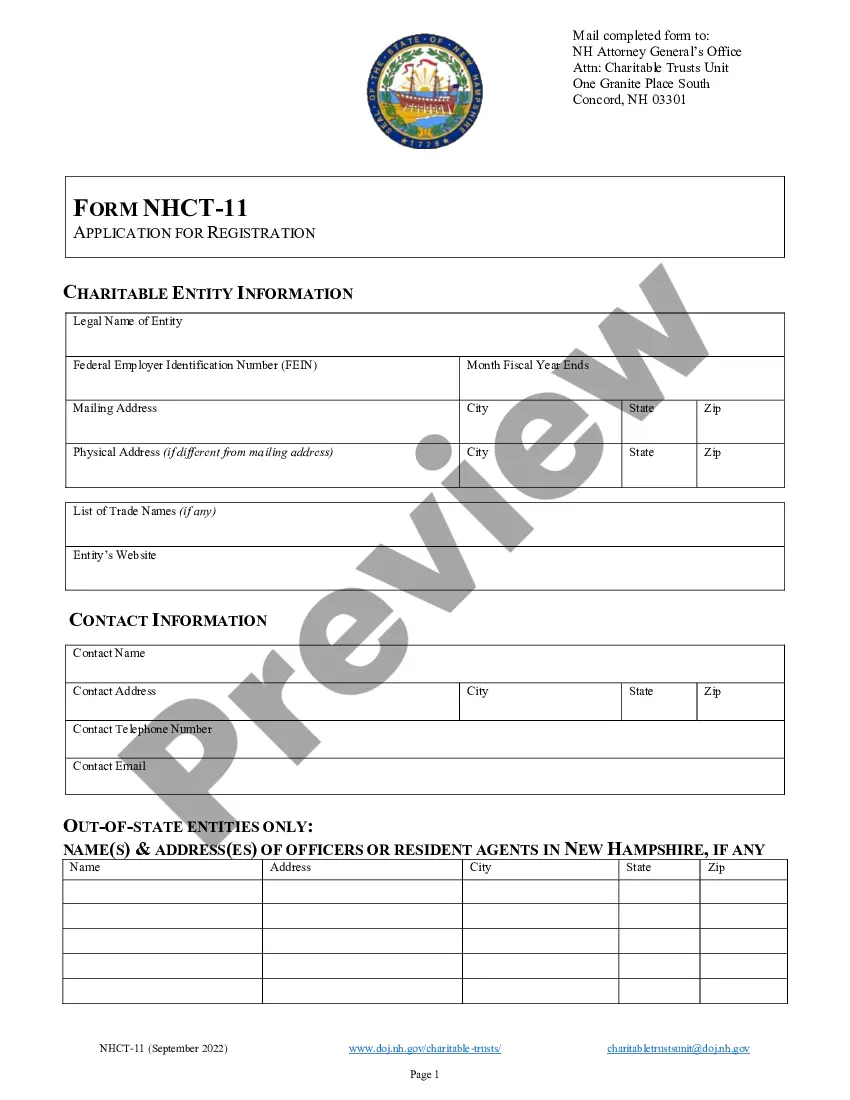

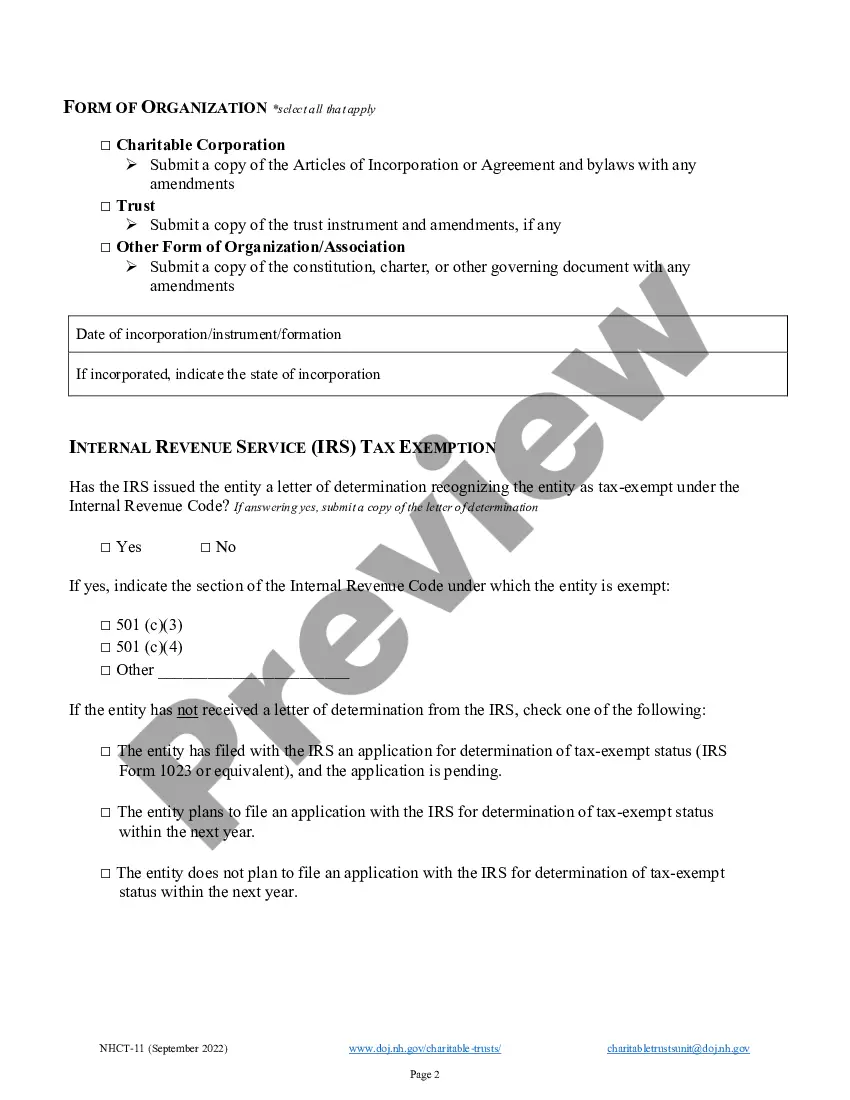

How to fill out New Hampshire Articles Of Agreement For Domestic Nonprofit Corporation?

There's no further justification to squander time searching for legal documents to comply with your local state laws. US Legal Forms has gathered all of them in one location and streamlined their availability.

Our platform offers over 85k templates for any business and personal legal situations categorized by state and purpose. All forms are professionally crafted and verified for accuracy, allowing you to feel confident in acquiring a current Operating Agreement For Nonprofit.

If you are acquainted with our service and currently possess an account, you must ensure your subscription is active before obtaining any templates. Log In to your account, choose the document, and click Download. You can also revisit all obtained documents whenever needed by accessing the My documents tab in your profile.

Print your form to complete it manually or upload the template if you prefer to use an online editor. Preparing official documents under federal and state laws and regulations is quick and straightforward with our collection. Try out US Legal Forms today to maintain your documentation in order!

- If you haven't previously utilized our service, the procedure will require more steps to finalize.

- Here's how new users can find the Operating Agreement For Nonprofit in our collection.

- Examine the page content thoroughly to ensure it includes the sample you require.

- To do this, use the form description and preview options if available.

- Employ the search field above to look for another sample if the current one was not suitable.

- Click Buy Now next to the template title when you discover the correct one.

- Select the most appropriate pricing plan and create an account or Log In.

- Make a payment for your subscription with a credit card or via PayPal to proceed.

- Choose the file format for your Operating Agreement For Nonprofit and download it to your device.

Form popularity

FAQ

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

An operating agreement is the basic written agreement between the members (i.e., owners) of the LLC, or between the members and the managers of the company, if there are managers.

An operating agreement is ONLY required in the five (5) States of California, Delaware, Maine, Missouri, and New York. In all other States, an operating agreement is not required but is recommended to be written and signed by all members of the LLC.

An LLC operating agreement contains clear provisions about each owner's contributions to the business, their share of profits and their responsibilities to the company and other members. That means the agreement is a good dispute resolution tool.