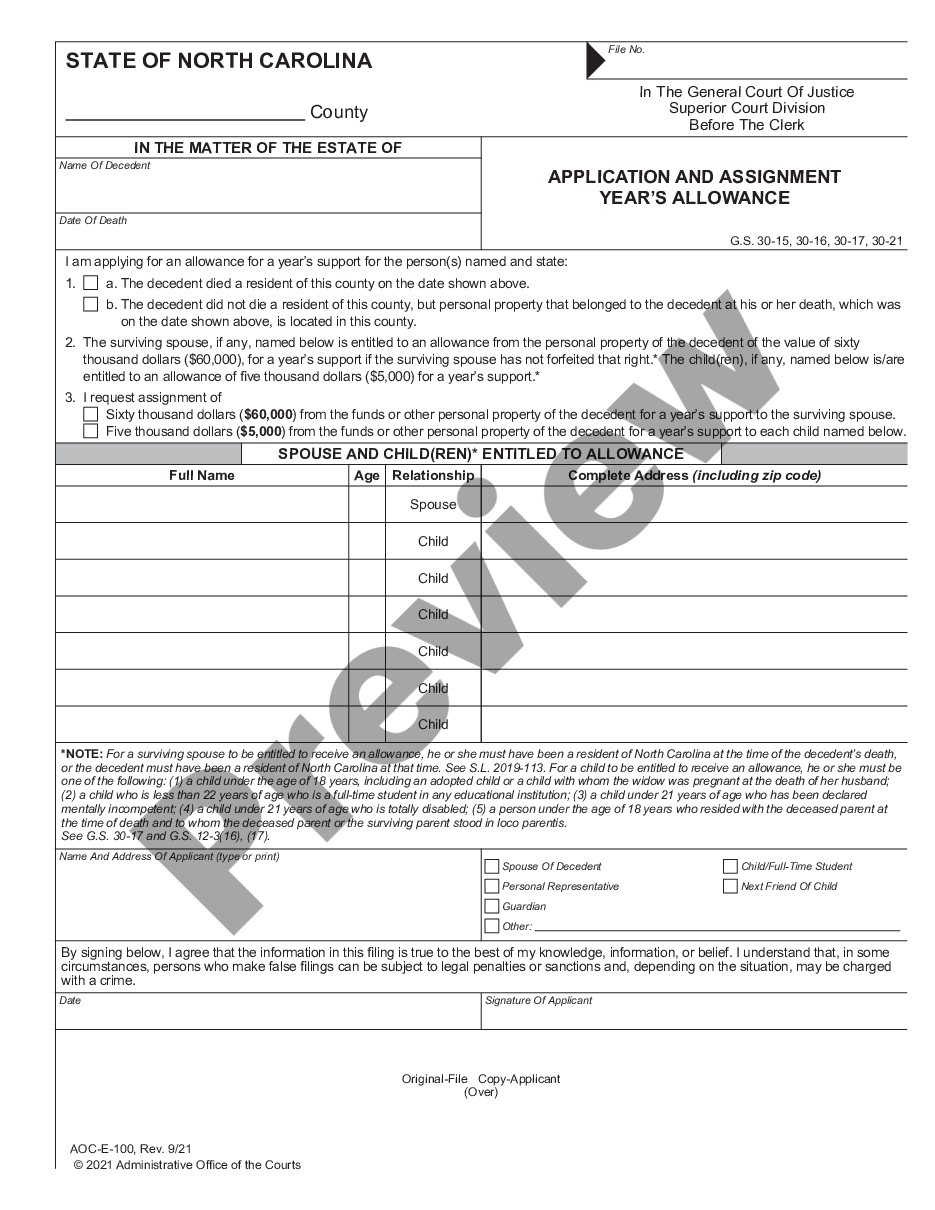

Spousal Allowance Nc Form With Estate

Description

How to fill out North Carolina Application And Assignment Year's Allowance?

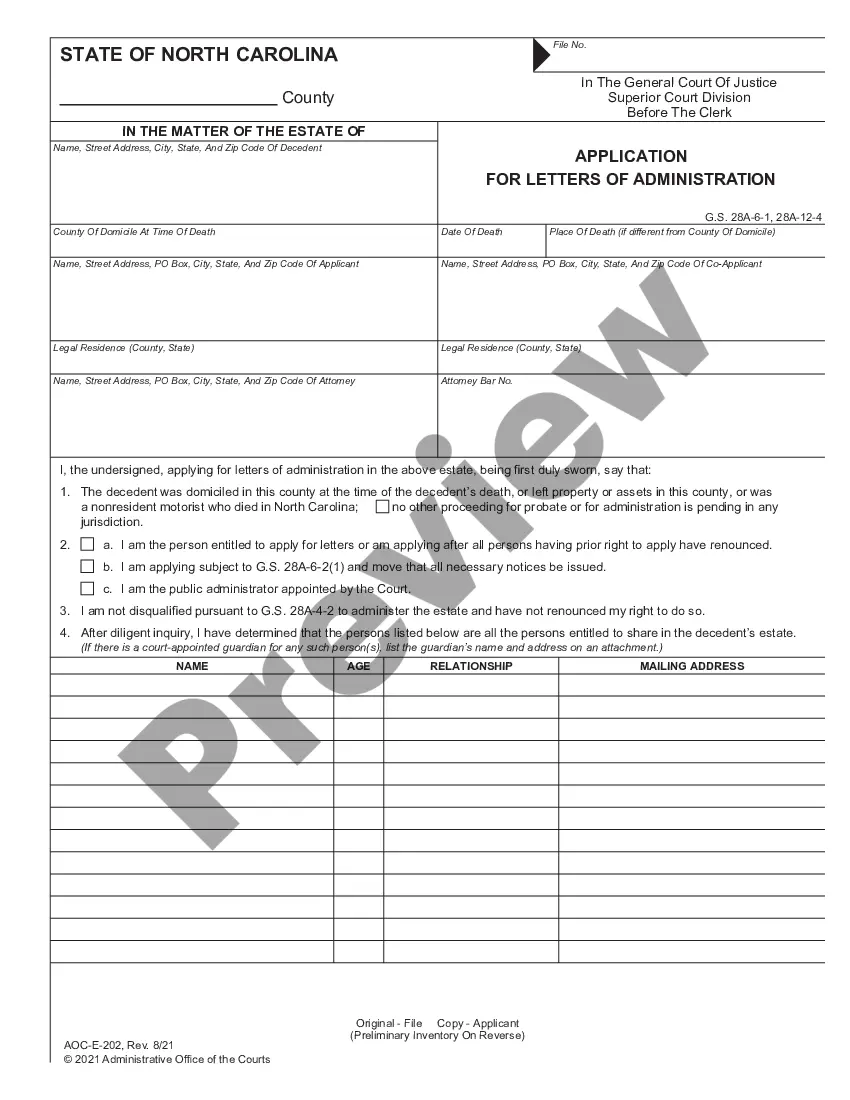

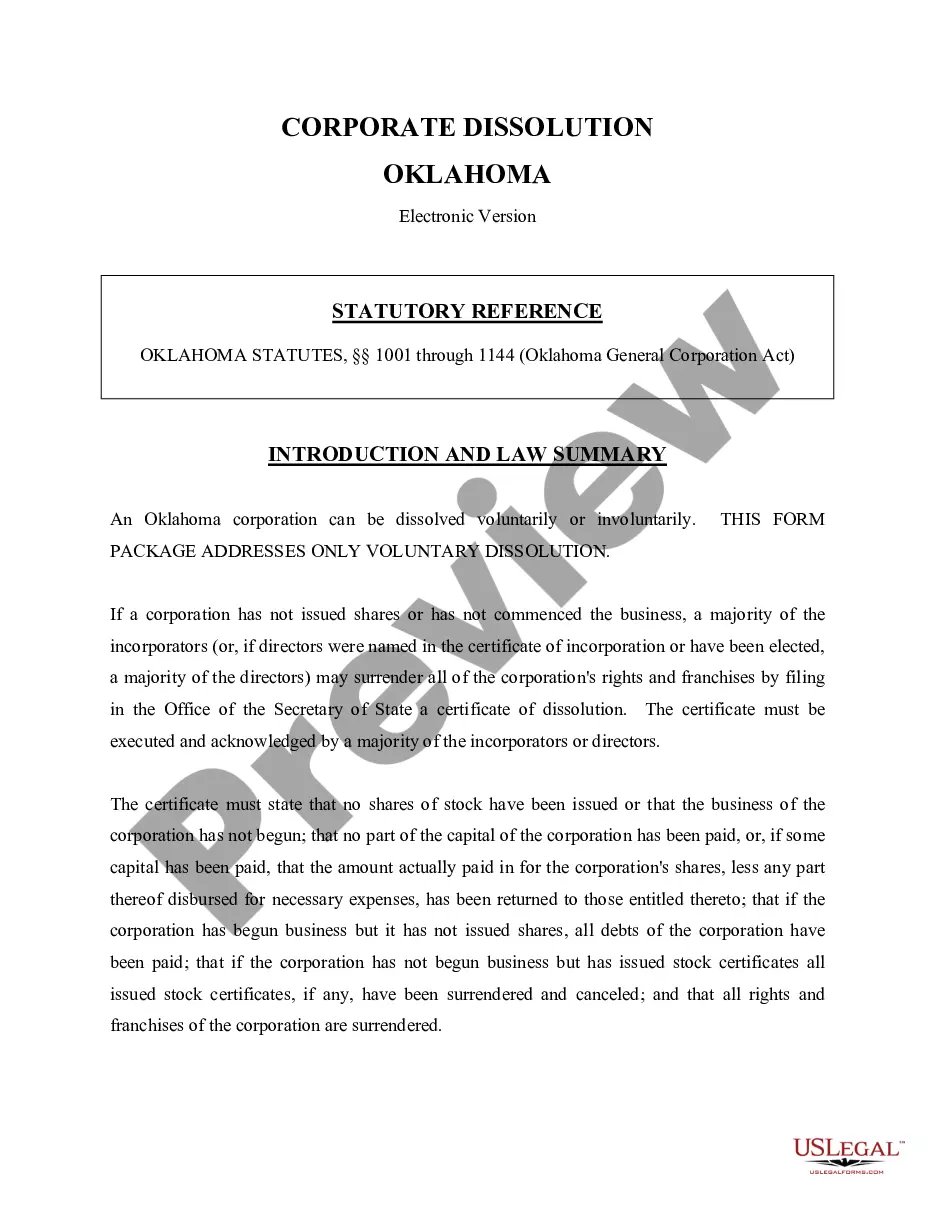

Legal document managing can be mind-boggling, even for experienced professionals. When you are interested in a Spousal Allowance Nc Form With Estate and don’t get the a chance to commit searching for the right and updated version, the processes can be stressful. A robust online form library might be a gamechanger for everyone who wants to take care of these situations effectively. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from personal to business documents, all-in-one location.

- Make use of advanced resources to complete and handle your Spousal Allowance Nc Form With Estate

- Gain access to a resource base of articles, instructions and handbooks and materials highly relevant to your situation and requirements

Help save effort and time searching for the documents you will need, and use US Legal Forms’ advanced search and Review tool to get Spousal Allowance Nc Form With Estate and acquire it. If you have a subscription, log in for your US Legal Forms profile, search for the form, and acquire it. Review your My Forms tab to find out the documents you previously downloaded and to handle your folders as you see fit.

Should it be the first time with US Legal Forms, create an account and acquire unrestricted use of all benefits of the library. Here are the steps for taking after downloading the form you want:

- Verify it is the correct form by previewing it and reading through its description.

- Ensure that the sample is approved in your state or county.

- Choose Buy Now once you are all set.

- Choose a subscription plan.

- Find the formatting you want, and Download, complete, sign, print and send your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of expertise and reliability. Transform your everyday papers administration in a easy and intuitive process right now.

Form popularity

FAQ

The theory behind this law is that spouses of either gender come to depend on one another throughout a marriage, and in the tragic event that one of them loses their partner, the surviving member should be entitled to a monetary allowance from their partner's estate regardless of what debts the deceased owed.

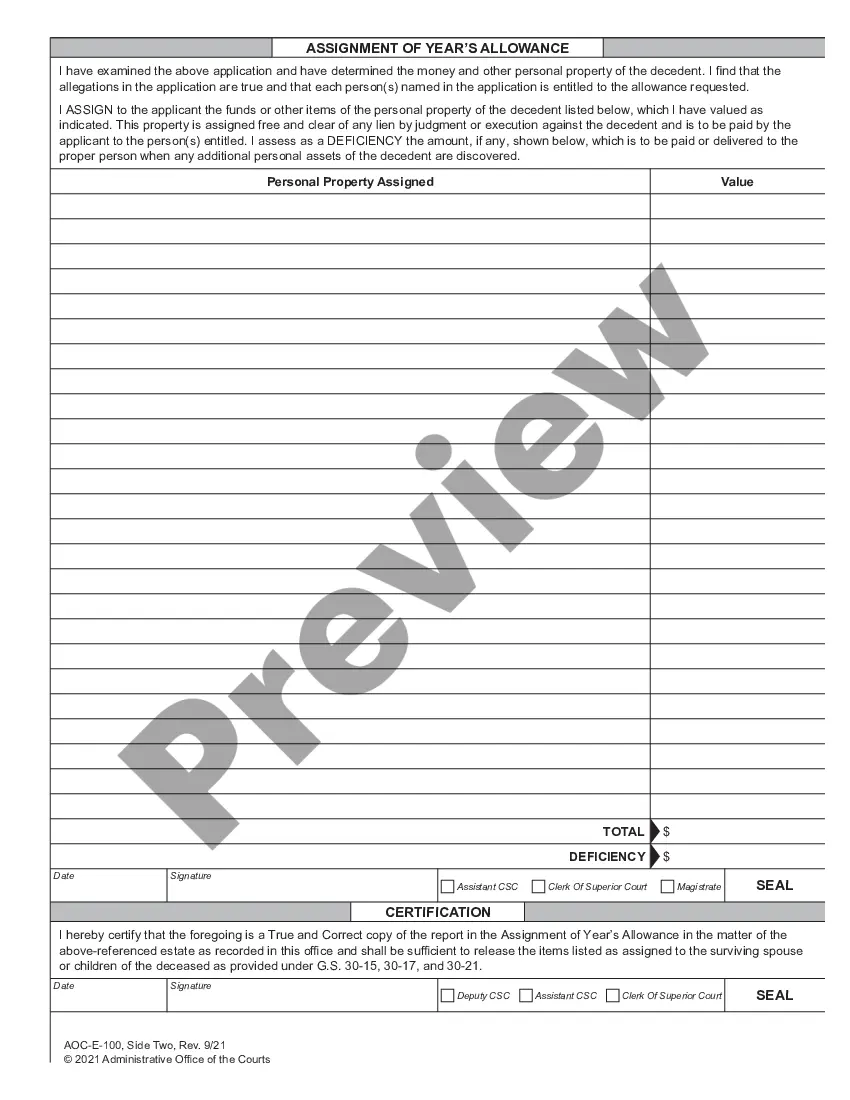

The Year's Allowance allows for the assignment of up to $30,000.00 in personal property (vehicles, money, etc.) from the deceased spouse to their surviving spouse, without having to go through probate.

California and federal tax laws about spousal support are the same. If you pay support, you can deduct the payments on your federal or state income tax forms. If you receive support, you must report the payments as income on your federal and state tax forms.

NCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.

California and federal tax laws about spousal support are the same. If you pay support, you can deduct the payments on your federal or state income tax forms. If you receive support, you must report the payments as income on your federal and state tax forms.