Dissolution Dissolve Company With Llc

Description

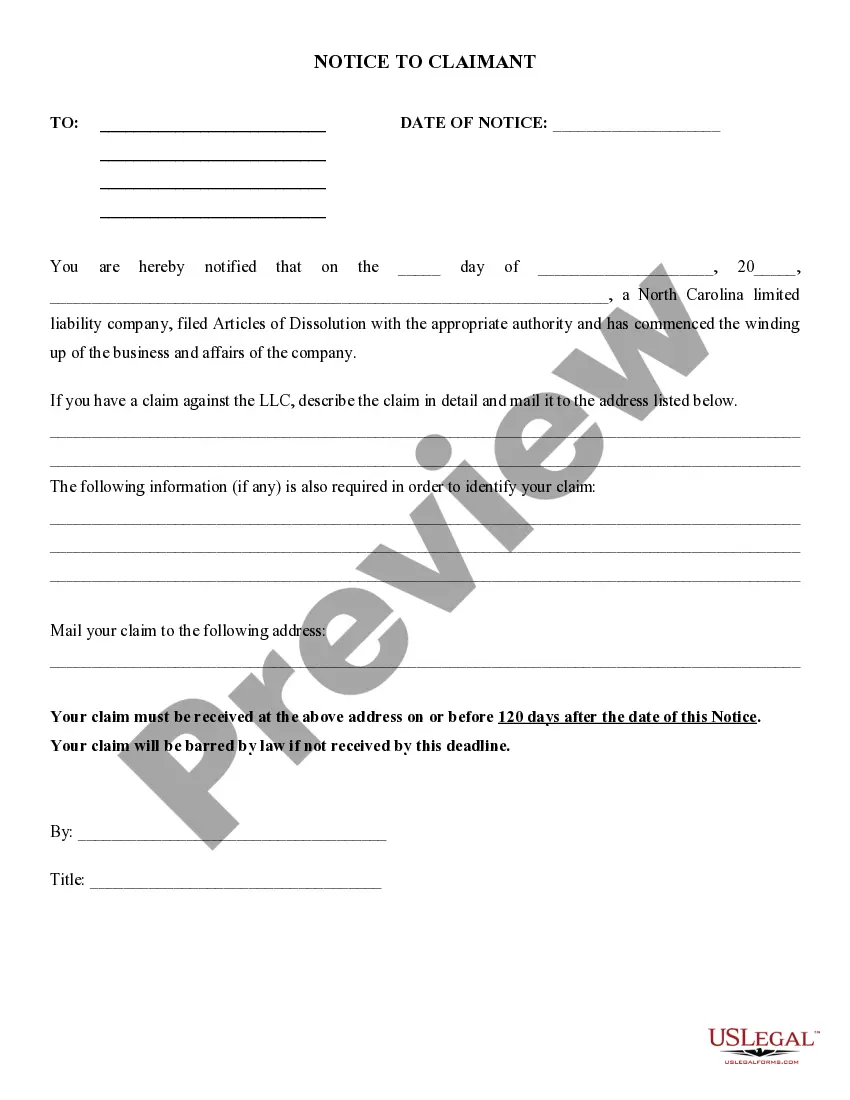

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

It’s well known that you cannot instantly become a legal expert, nor can you swiftly discover how to efficiently prepare a Dissolution to Dissolve Company with an LLC without possessing a specialized education.

Drafting legal documents is a lengthy undertaking that necessitates specific training and expertise.

So why not entrust the preparation of the Dissolution to Dissolve Company with an LLC to professionals.

You can regain access to your documents from the My documents section at any time.

If you’re an existing client, you can simply Log In and find and download the template from the same section.

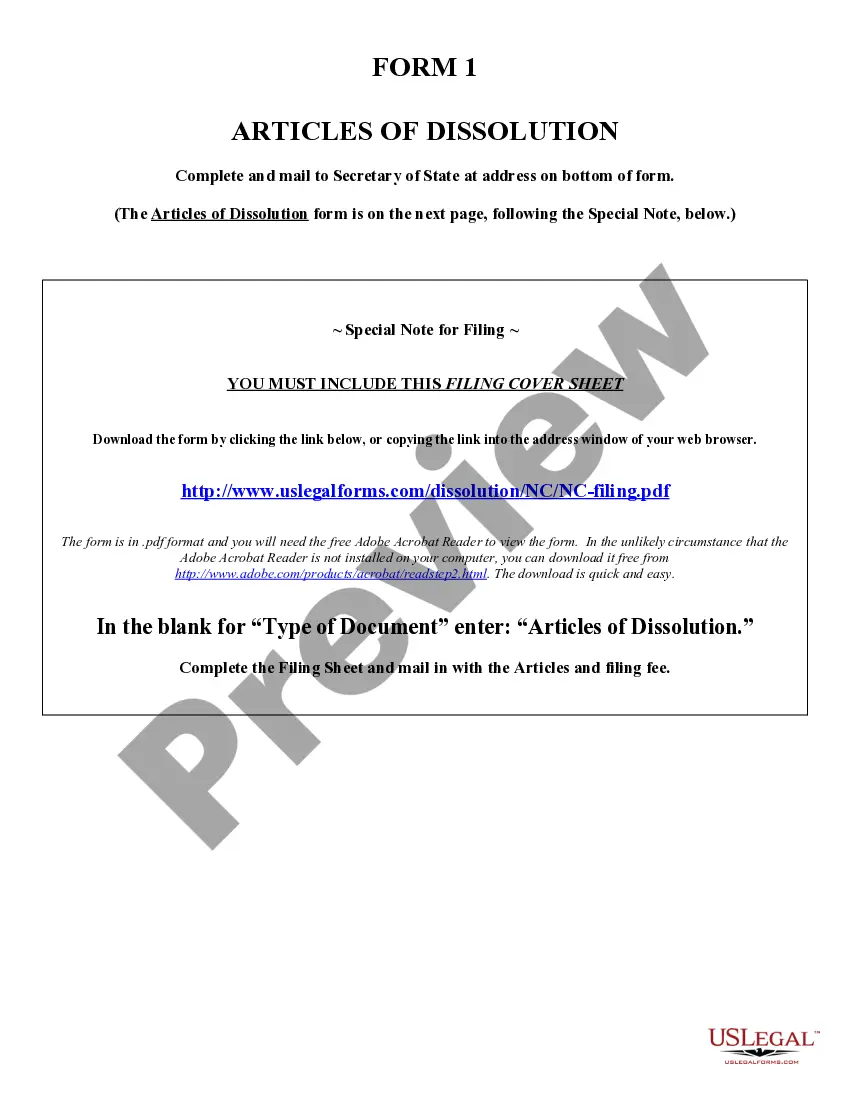

- Access the document you need using the search bar positioned at the top of the page.

- Preview it (if this option is available) and review the accompanying description to confirm whether the Dissolution to Dissolve Company with an LLC is what you’re looking for.

- Restart your search if you require any additional forms.

- Create a free account and select a subscription plan to acquire the template.

- Select Buy now. Once the payment is completed, you can download the Dissolution to Dissolve Company with an LLC, complete it, print it, and send or mail it to the designated parties or entities.

Form popularity

FAQ

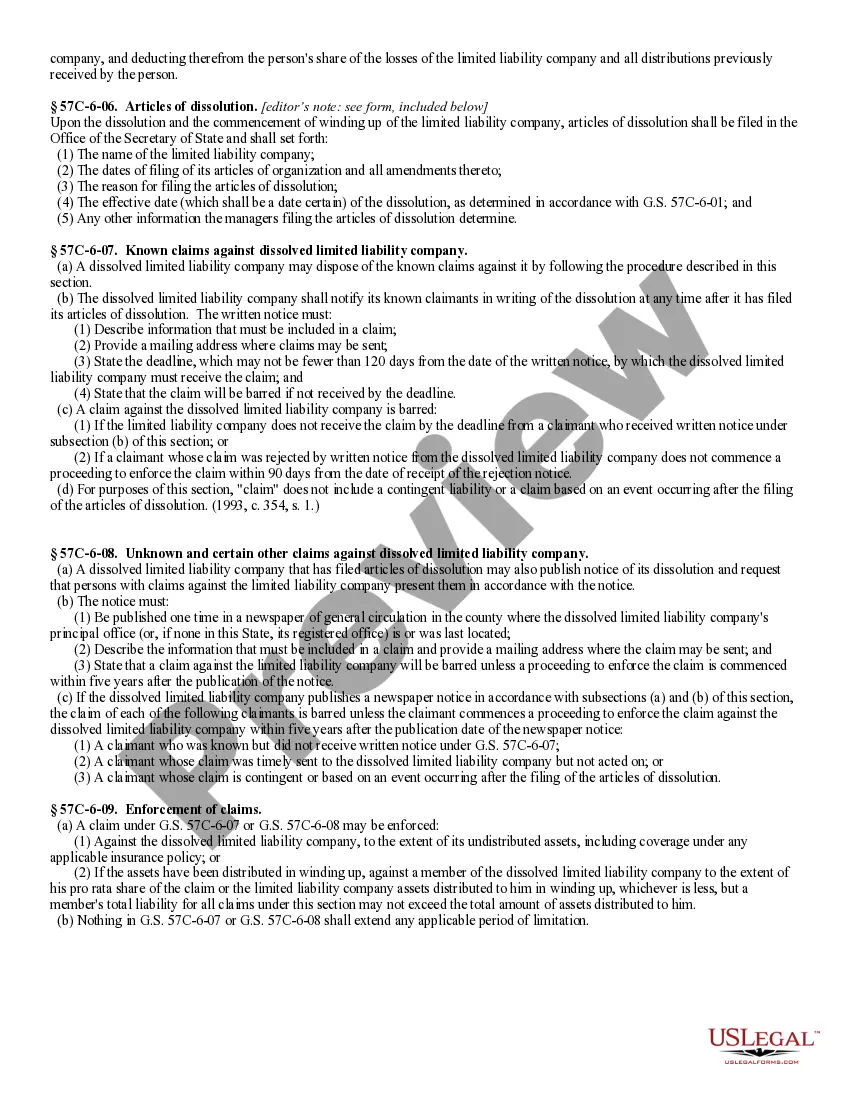

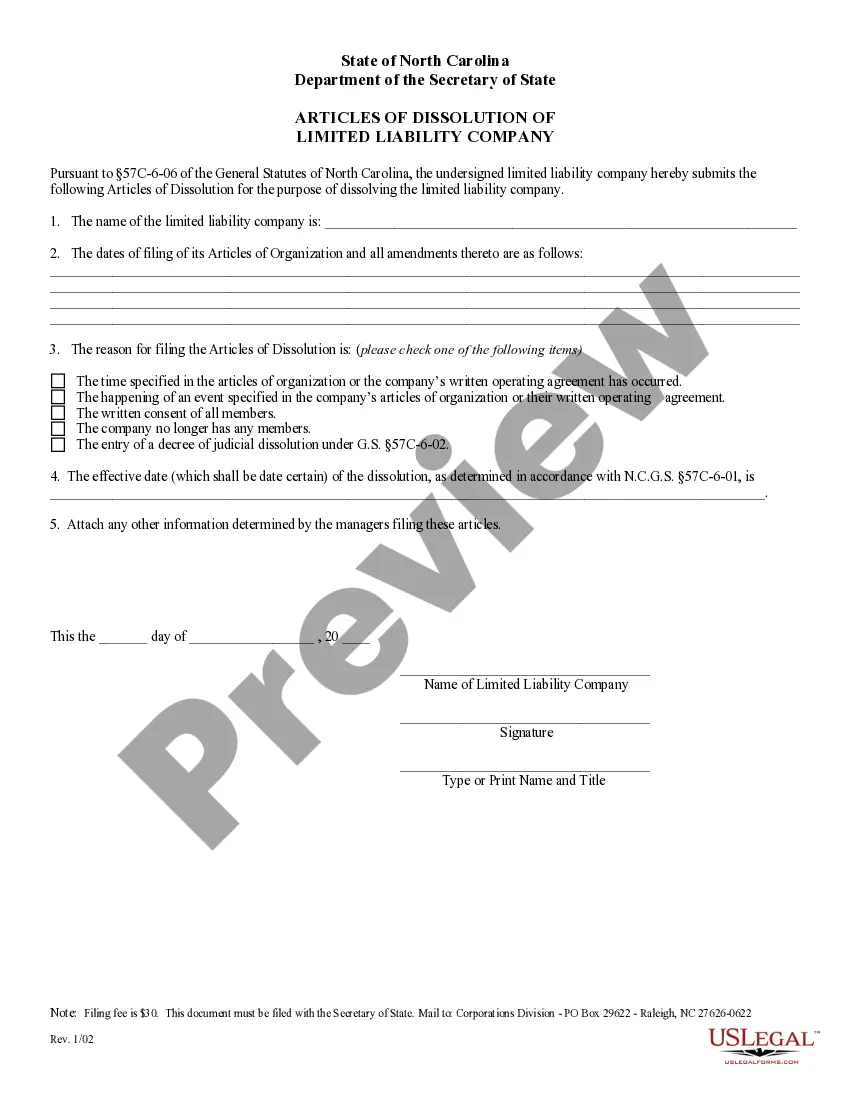

To file a dissolution for your LLC, begin by reviewing your state's specific requirements for dissolution. Generally, you will need to complete a dissolution form and submit it along with any required fees. Utilizing platforms like US Legal Forms can simplify this process, providing you with the necessary documents and guidance. Completing this step correctly is essential to officially dissolve your company.

Yes, you must notify the IRS when you close your LLC. This process involves filing your final tax return and marking it as such. Additionally, you should check if there are any outstanding tax obligations or filings required for your LLC. Proper notification ensures you correctly manage your tax responsibilities during the dissolution process.

To dissolve your LLC company, you must follow specific procedures outlined by your state. Typically, this involves filing a formal dissolution document with the Secretary of State and notifying any creditors and stakeholders. Additionally, you need to settle any outstanding debts and complete final tax filings. For assistance, US Legal Forms provides comprehensive templates and support to help you effectively navigate the dissolution process.

Dissolution of your LLC means that your company will legally cease to exist. This action can affect your business's ability to make contracts, sue or be sued, and handle any remaining debts or obligations. Keep in mind that the process may involve final tax filings and settling any outstanding liabilities. To ensure a smooth transition, consider using the US Legal Forms platform, which offers resources to guide you through the dissolution process.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

How to Dissolve an LLC in 5 Steps Step 1: Members Vote to Dissolve the Business. ... Step 2: Notify Relevant Parties of Dissolution. ... Step 3: File Your Final Tax Forms. ... Step 4: File Your Dissolution Papers. ... Step 5: Distribute Remaining Assets. ... Step 6: Complete Other Potential Tasks for Dissolution.

You cannot end your company without paying off your creditors. You have the responsibility as a business owner to dissolve your LLC in the right way and to pay off all debts related to the business. The creditors of the company are to be paid first from the assets of the business.

How to Dissolve an LLC Vote to Dissolve the LLC. ... File Final Tax Returns and Obtain Tax Clearance. ... File Articles or Certificate of Dissolution. ... Notify Creditors About Your LLC's Dissolution. ... Settle Debts and Distribute Remaining Assets. ... Close All Accounts and Cancel Licenses and Permits. ... Cancel Registrations in Other States.

File Form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended or supplemented after Form 966 is filed, file another Form 966 within 30 days after the amendment or supplement is adopted.