Limited Liability Company For Dummies

Description

How to fill out North Carolina Limited Liability Company LLC Operating Agreement?

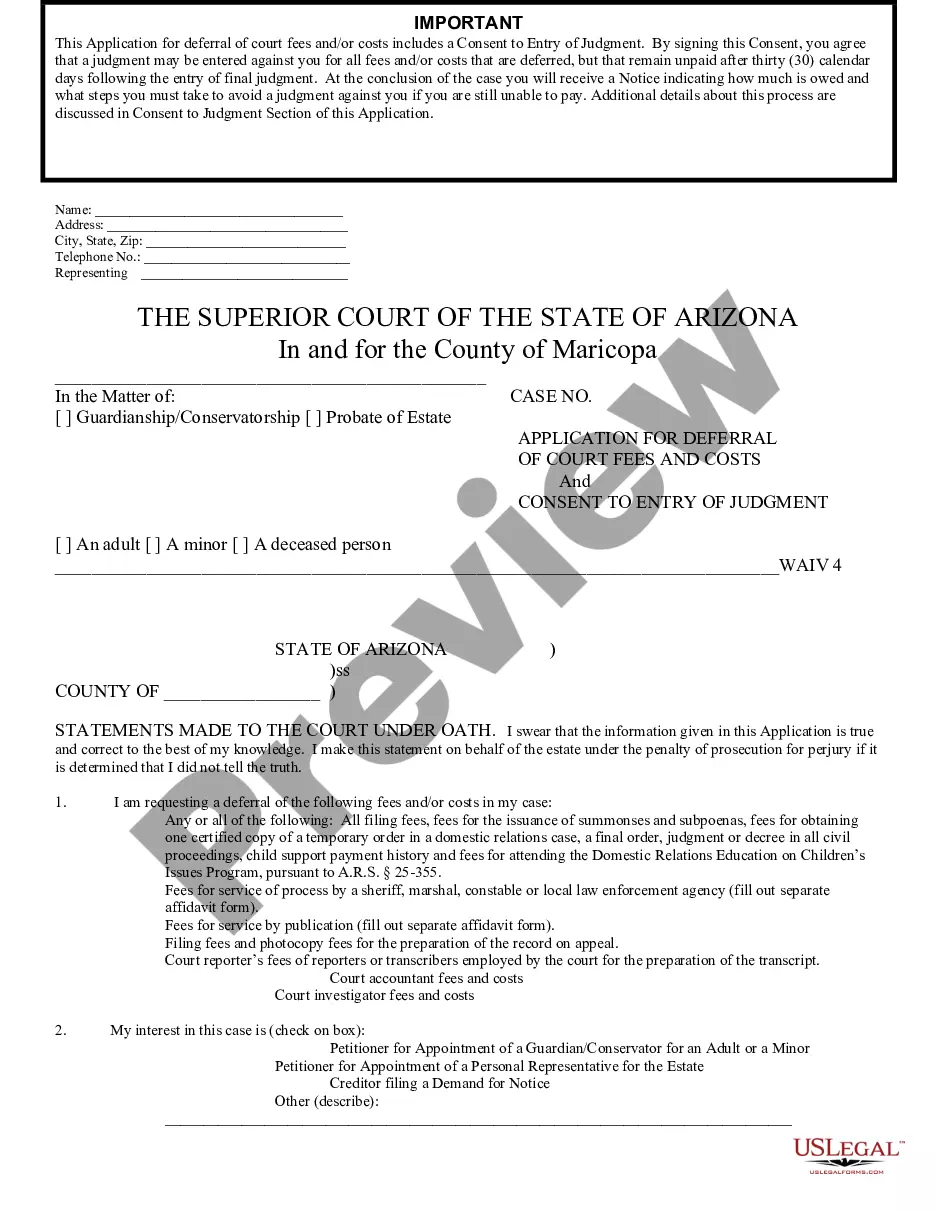

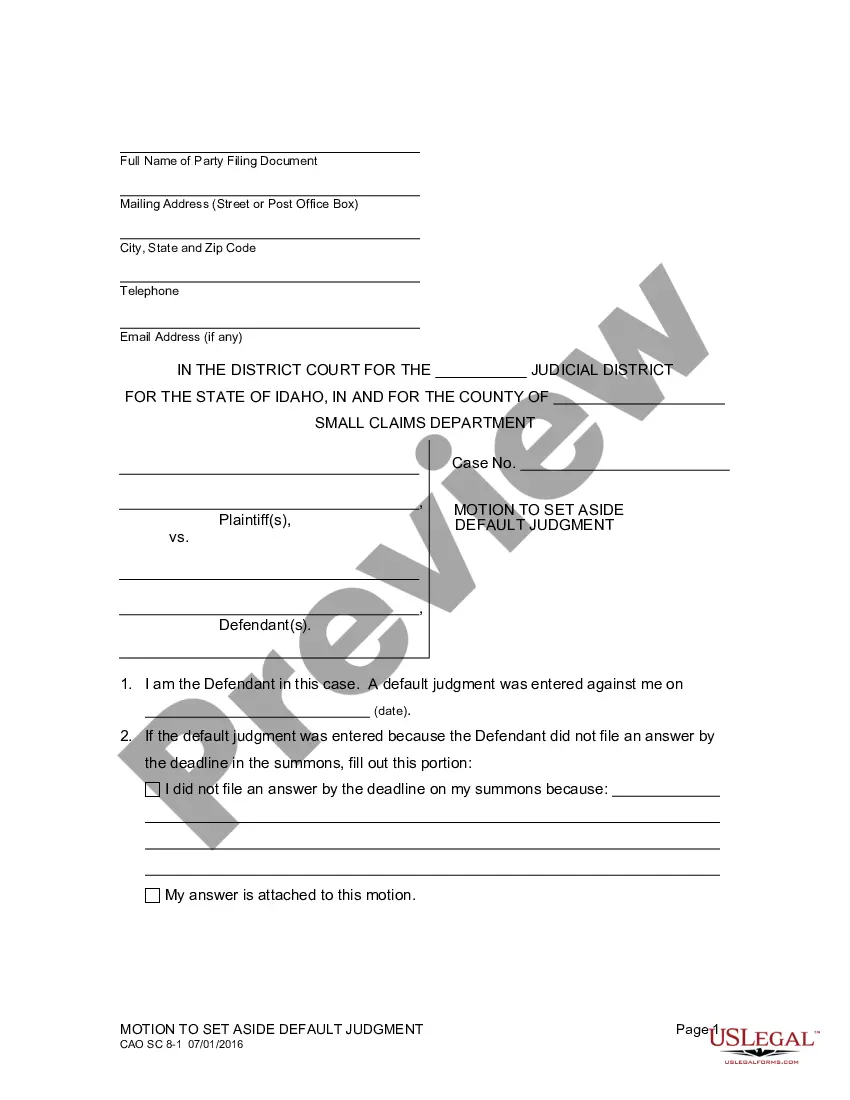

- If you've previously used the US Legal Forms service, first log into your account and ensure your subscription is active. Click the Download button to save the needed form template to your device.

- For first-time users, access the service's main page and utilize the Preview mode to review form descriptions carefully. Confirm you’ve selected the correct legal document that meets local requirements.

- If necessary, utilize the Search tab to explore additional templates until you find the one matching your needs.

- Click the Buy Now button, select your preferred subscription plan, and register for an account to access the library's resources.

- Complete your purchase by entering your payment details, whether that’s a credit card or your PayPal account.

- Once your transaction is confirmed, download the form and save it on your device. You can also find it later under the My Forms section of your profile.

US Legal Forms takes the hassle out of legal documentation by providing a user-friendly platform with a vast selection of forms, outpacing competitors in both quantity and quality.

Don't let paperwork slow you down. Start your LLC journey today with US Legal Forms and navigate your legal needs with ease!

Form popularity

FAQ

The easiest LLC to create is usually one that can be formed online with minimal paperwork and quick processing. Many people find that using services from US Legal Forms simplifies this experience, making it straightforward for anyone to establish an LLC successfully. Choosing the right state can also influence how easy it is to create your LLC.

One common downside to an LLC is the potential for higher formation and maintenance costs compared to sole proprietorships. Additionally, some states impose franchise taxes or fees on LLCs. However, the benefits of limited liability often outweigh these drawbacks, especially when considering asset protection and flexible management options.

The term 'limited liability' is often abbreviated as 'LL' or referred to as 'LLC' when discussing limited liability companies. Understanding these terms is foundational for anyone looking to form a business structure that provides personal asset protection. It simplifies discussions and documentation related to business formation.

Limited liability protects owners from being personally responsible for business debts, meaning they can only lose what they invested. On the other hand, unlimited liability means business owners are personally liable for all debts, leaving their assets at risk. A limited liability company offers the first type, which is crucial for safeguarding your personal finances.

The easiest LLC to start typically involves a straightforward application process and minimal paperwork. States like Wyoming and New Mexico are known for their user-friendly procedures and low fees. You can utilize platforms like US Legal Forms to streamline the entire process and help you get your LLC up and running quickly.

A limited liability company, or LLC, is a type of business structure that combines the benefits of a corporation with those of a partnership. Essentially, you get liability protection while maintaining flexibility in management and taxation. Understanding this concept is straightforward, making it an ideal choice for small business owners or first-time entrepreneurs.

Limited liability means that a business owner's financial responsibility for debts is limited to the amount they invested in the business. In other words, if your business fails, your personal assets such as your home or savings are generally protected. This concept is a key benefit of forming a limited liability company.

An LLC files taxes for dummies by first determining its classification for tax purposes. Most single-member LLCs will file taxes using Schedule C, whereas multi-member LLCs may file Form 1065. Remember to keep accurate records of your income and expenses throughout the year. U.S. Legal Forms can provide the necessary forms and tips to ensure your tax filing is straightforward and compliant.

The best way to file taxes as a limited liability company for dummies depends on your chosen tax structure. If your LLC is a single-member entity, you'll generally report your income and expenses on a Schedule C attached to your personal tax return. If you've opted for corporate taxation, you'll need to file Form 1120. U.S. Legal Forms provides resources to help you understand these filing requirements.

Typically, with a limited liability company for dummies, you do not file LLC and personal taxes together. Most LLCs are considered pass-through entities, meaning the profits and losses are reported on your personal tax return. However, if your LLC elects to be taxed as a corporation, different rules apply. It's wise to consult with a tax professional for personalized advice.