Mt Lien 3 Complete Formula

Description

How to fill out Montana Construction Lien Notice - Individual?

Utilizing legal document examples that adhere to national and local regulations is essential, and the web provides a multitude of choices to select from.

However, what's the use of squandering time looking for the suitable Mt Lien 3 Complete Formula template online if the US Legal Forms digital library already compiles such formats in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable templates prepared by attorneys for any business and personal situation. They are easy to navigate with all documents categorized by region and intended purpose.

Search for an alternative sample using the search bar at the top of the page if needed.

- Our experts stay informed on legislative updates, ensuring you can always trust that your document is current and compliant when acquiring a Mt Lien 3 Complete Formula from our site.

- Obtaining a Mt Lien 3 Complete Formula is quick and easy for both existing and new clients.

- If you already possess an account with an active subscription, sign in and retrieve the document template you require in the correct format.

- If you are unfamiliar with our website, please follow the steps outlined below.

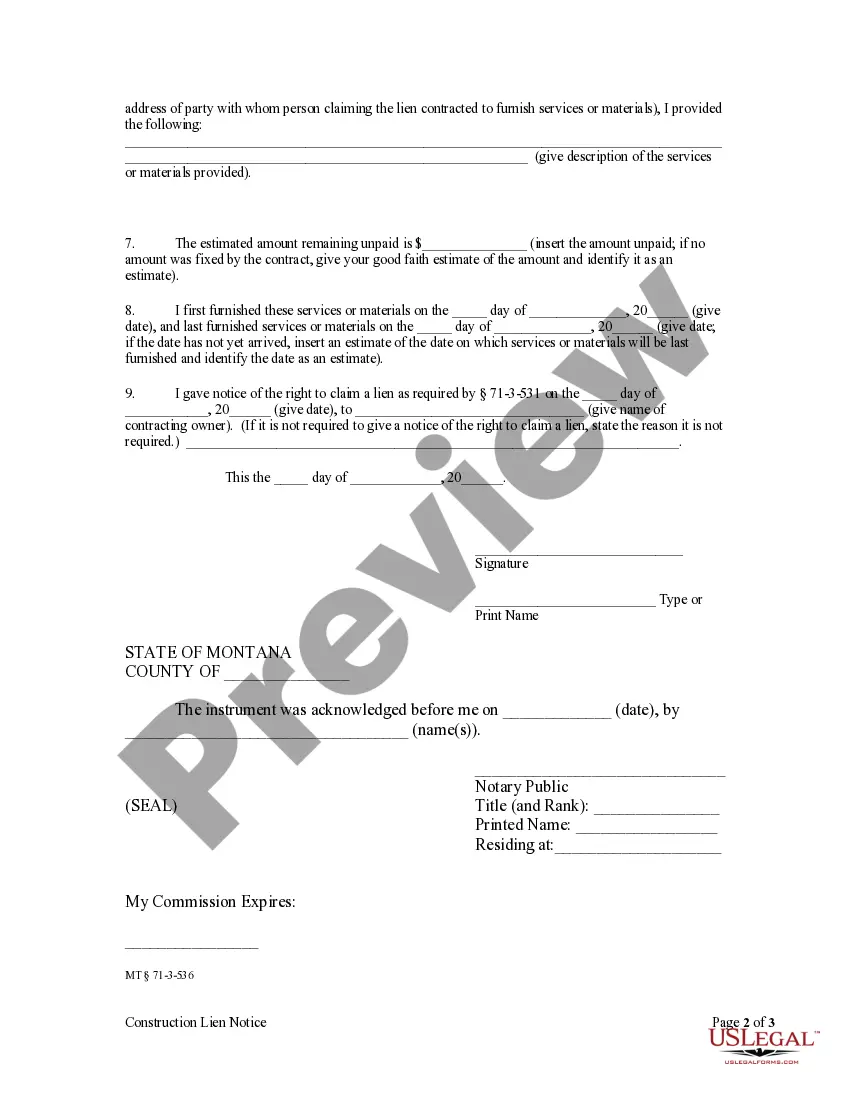

- Review the template using the Preview option or via the text outline to confirm it satisfies your needs.

Form popularity

FAQ

A lien is perfected by following specific steps to ensure that it has priority over other claims. You typically file necessary paperwork with your local authorities, notifying them of your claim. By implementing the Mt lien 3 complete formula, you can enhance your chances of proper perfection, thereby securing your interests. After filing, confirm that the lien is public and check for any additional requirements in your state.

To negotiate a lien on a house, start by gathering all relevant documents related to the lien. Review the terms and assess whether adjustments may benefit both parties. Utilize the Mt lien 3 complete formula to structure your negotiation strategy effectively, and consider proposing a payment plan or settlement amount that reflects your financial situation. Approach the lien holder respectfully and maintain open communication throughout the negotiation process.

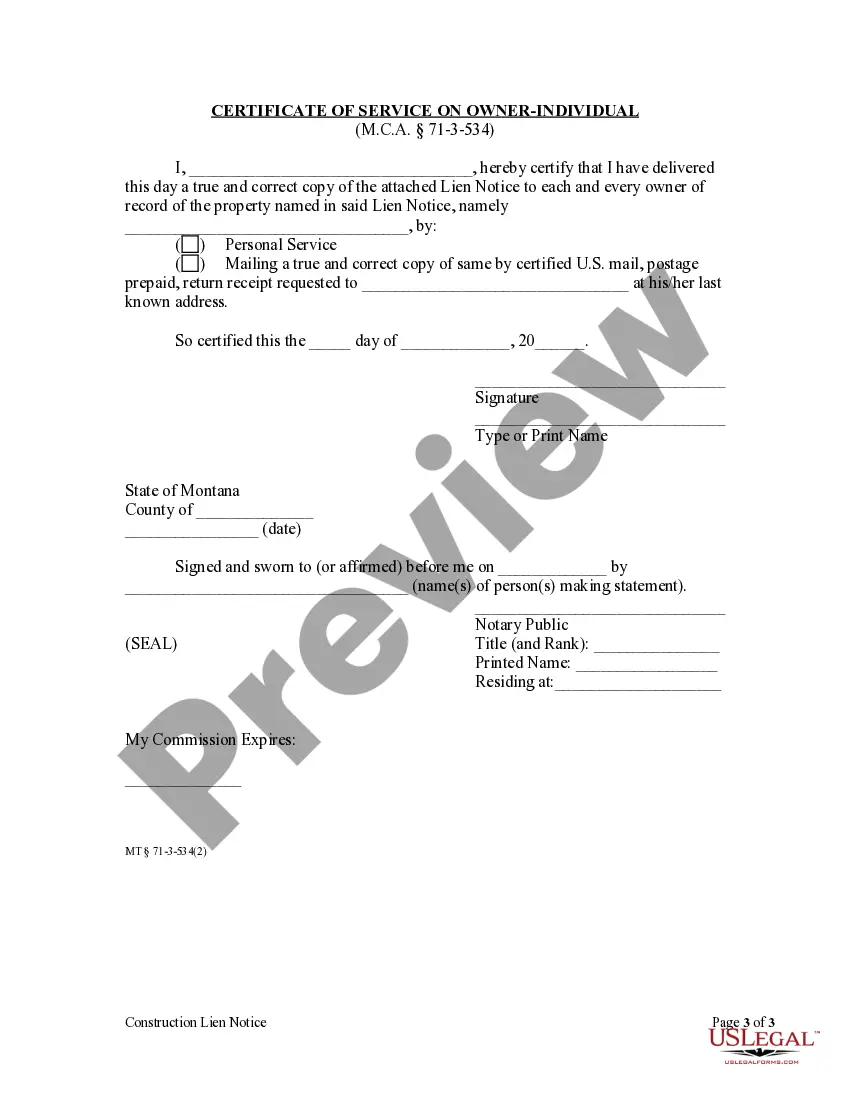

To effectively file a lien, several conditions must be met. First, the claim must be legitimate and connected to an unpaid debt or obligation. Furthermore, the Mt lien 3 complete formula requires proper documentation, including the filing within the appropriate time frame and jurisdiction. By using the US Legal Forms platform, you can access resources and templates that help ensure you meet all the conditions for a valid lien.

In Montana, you generally have 90 days from the last day of service to file a lien. This timeframe is critical to protect your rights and ensure your claim is valid. Remember to follow the Mt lien 3 complete formula during this period to avoid missing deadlines. For comprehensive guidance, uslegalforms can assist you in understanding these timelines effectively.

To file a mechanic's lien in Montana, you first need to gather essential documents, including the completed lien form and the property owner's details. Next, submit these documents to the appropriate county clerk's office. Following the Mt lien 3 complete formula ensures you complete this process smoothly and correctly. Consider uslegalforms for helpful templates and guidance.

Filling out a waiver and release of lien requires attention to detail. You need to provide accurate information regarding the parties involved and the property in question. The Mt lien 3 complete formula can guide you through the necessary steps to ensure completeness and accuracy. Using a reliable platform like uslegalforms can make this process easier.

You do not necessarily need a lawyer to file a mechanic's lien in Montana. However, having legal assistance can simplify the process and help avoid mistakes. With the Mt lien 3 complete formula, you can confidently handle the filing on your own. However, consult a lawyer if you're unsure about any specific requirements.