Missouri Lake Property For Sale

Description

How to fill out Missouri Commercial Property Sales Package?

The Missouri Lake Estate Available for Purchase showcased on this page is a versatile legal framework crafted by experienced attorneys in line with federal and state statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, enterprises, and legal experts access to more than 85,000 verified, state-specific documents for various business and personal events. It’s the fastest, easiest, and most reliable method to acquire the papers you require, as the service ensures the utmost level of data security and anti-malware safeguarding.

Redownload your document whenever necessary. Access the 'My documents' section in your profile to retrieve any previously downloaded documents.

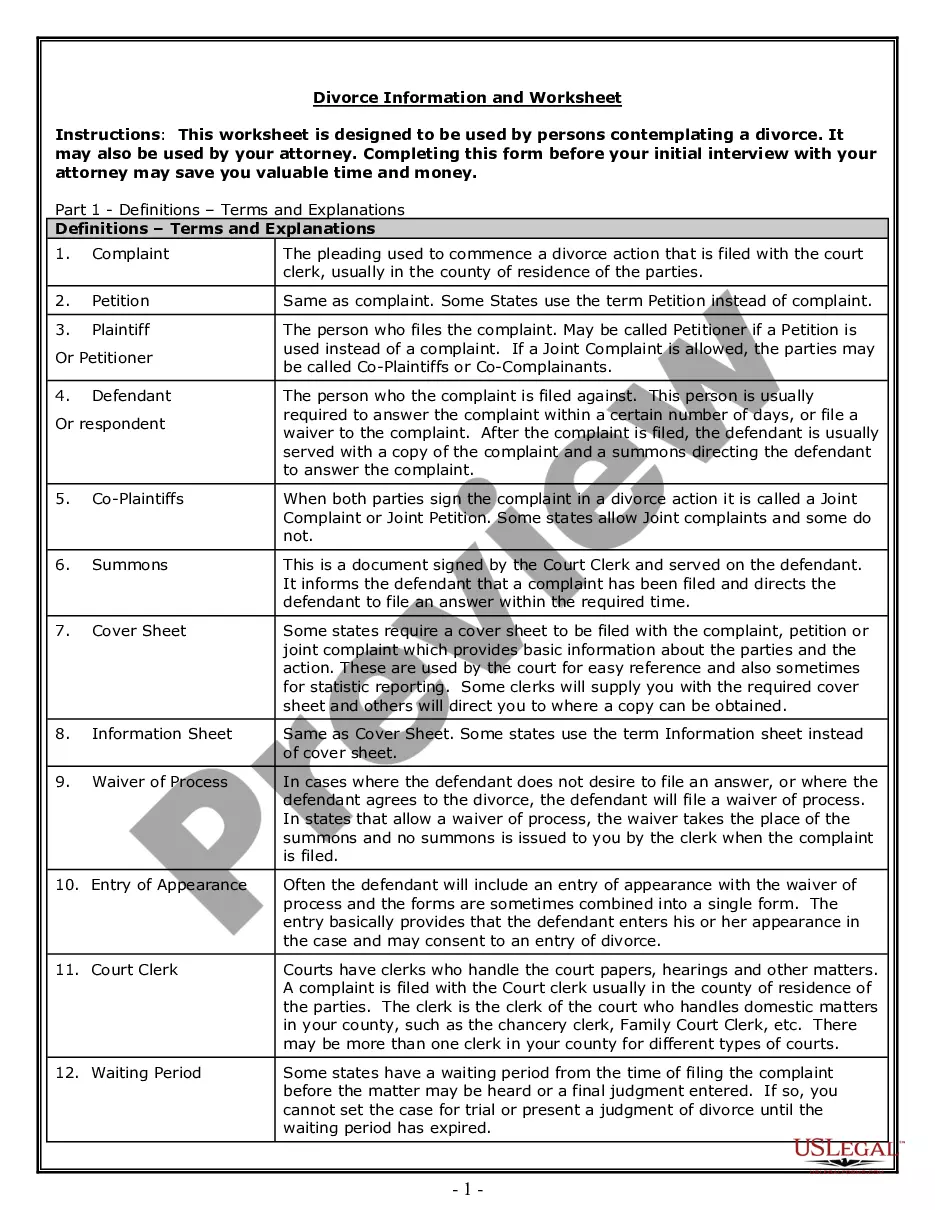

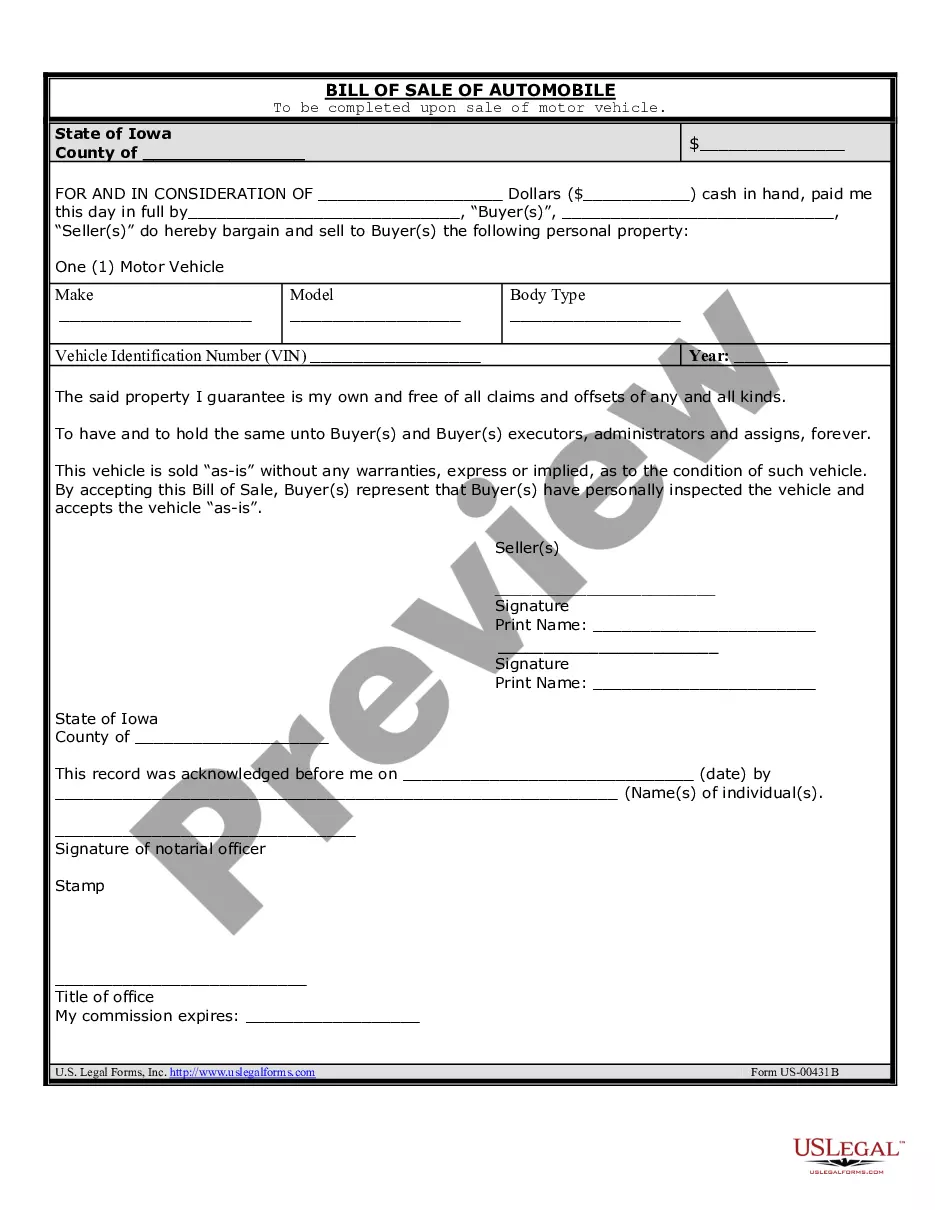

- Conduct a search for the document you need and verify it.

- Browse the sample you found and preview it or examine the form description to ensure it meets your requirements. If it does not, utilize the search feature to discover the right one. Click on 'Buy Now' once you have identified the template you want.

- Choose a subscription plan and create an account. Make a swift payment using PayPal or a credit card. If you already possess an account, Log In and check your subscription to continue.

- Choose the desired format for your Missouri Lake Estate Available for Purchase (PDF, DOCX, RTF) and save the template on your device.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your document with an electronic signature.

Form popularity

FAQ

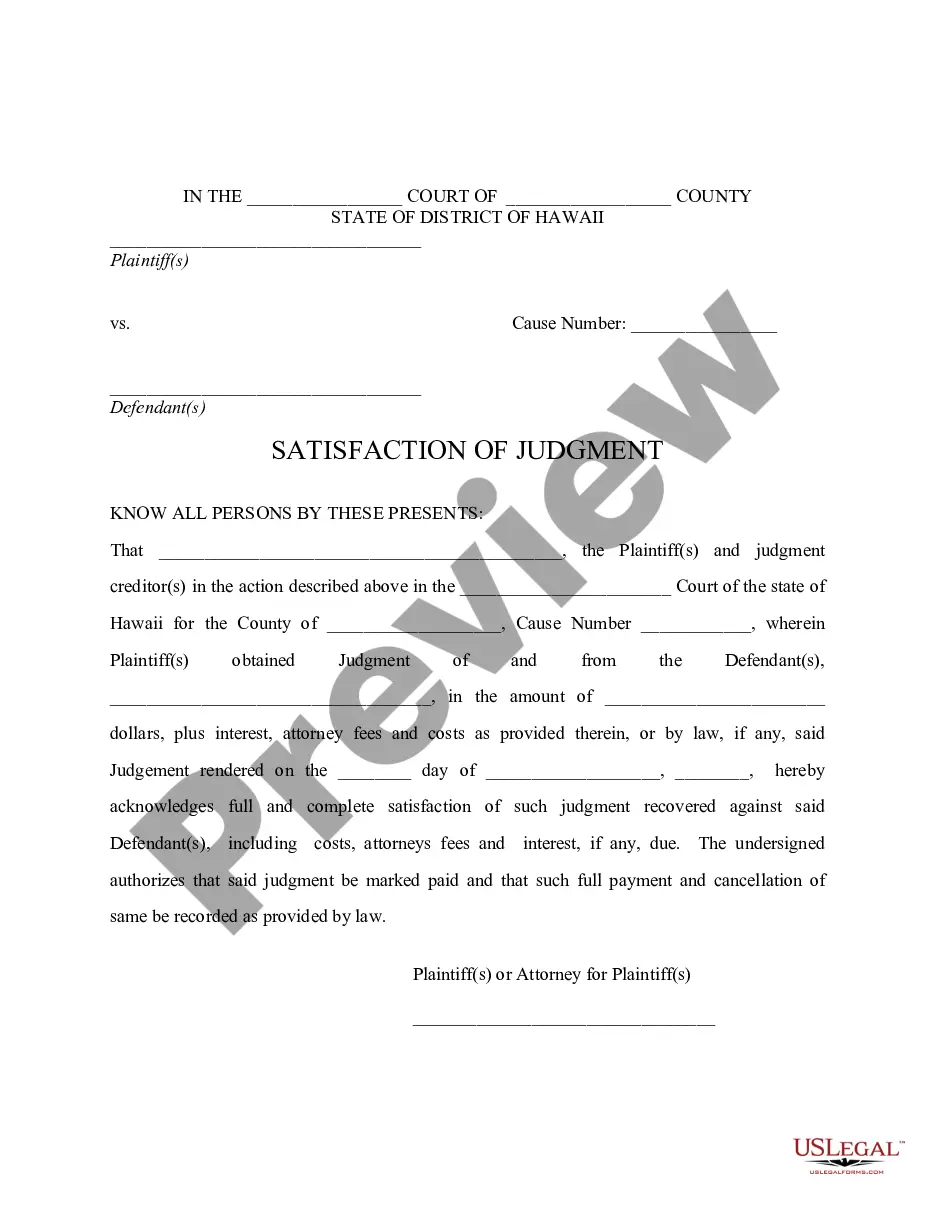

Maryland is a consumer-friendly state. The statute of limitations allows a creditor three years to collect on debts. That's a shorter timeframe than many states. There also are limits on how long a debt collector has to collect on a debt.

How long does a judgment lien last in Maryland? A judgment lien in Maryland will remain attached to the debtor's property (even if the property changes hands) for 12 years.

(2) If the property is subject to a special valuation under § 7-211 of this article, a lien: (i) arises on the date on which the interest in the property vests in possession; and (ii) continues for 20 years.

A creditor who obtains a judgment against you is the "judgment creditor." You are the "judgment debtor" in the case. A judgment lasts for 12 years and the plaintiff can renew the judgment for another 12 years.

To establish a lien, a contractor or subcontractor must file a petition in the circuit court for the county where the property is located within 180 days after completing work on the property or providing materials. It can be difficult to determine the work completion date. Notice For Subcontractors.

An artisan's lien is a type of lien that gives workers a security interest in personal property until they have been paid for their work on that property.

However, in 2019, Maryland Governor Larry Hogan signed a law that created a statute of limitations for certain tax liens. So, Maryland state tax liens can eventually expire, but the statute of limitations is very long: 20 years. Even if two decades seems a long time, the new statute of limitations has a bright spot.

In Maryland, any project participant providing labor or materials for a construction project can file a mechanics lien.