Missouri House With Jail Cells Zillow

Description

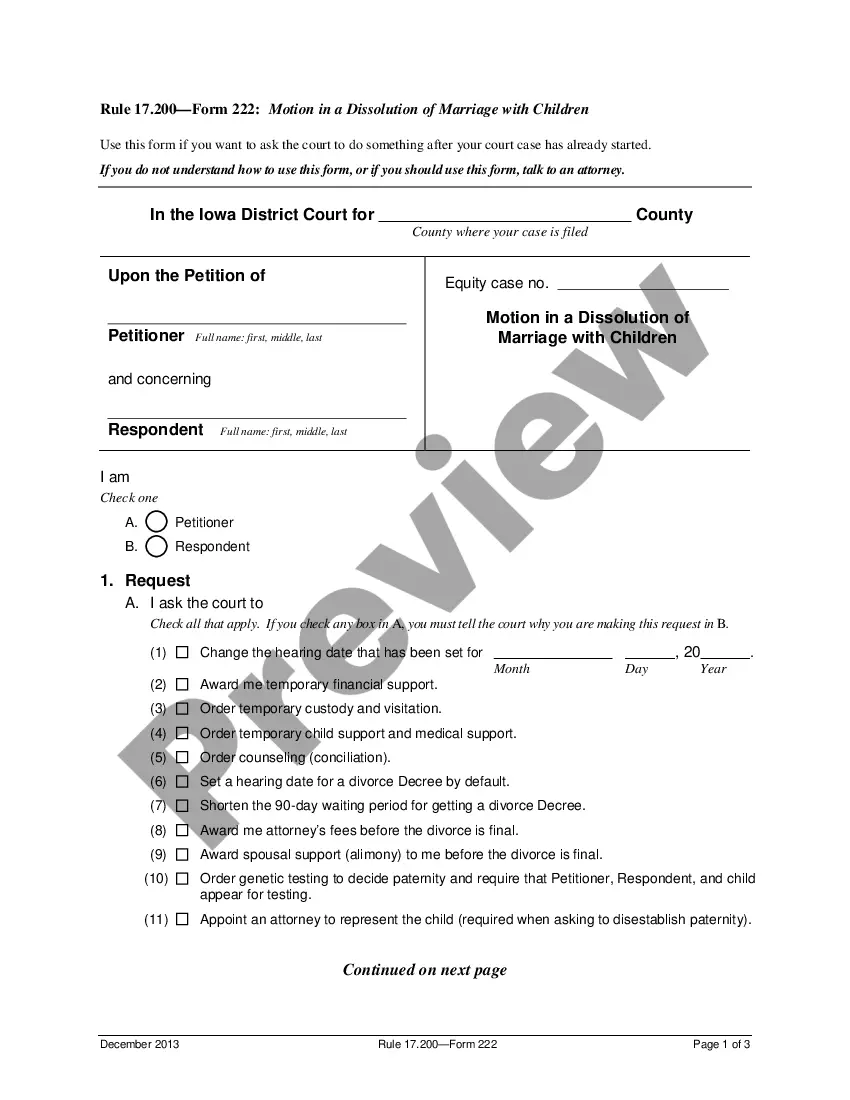

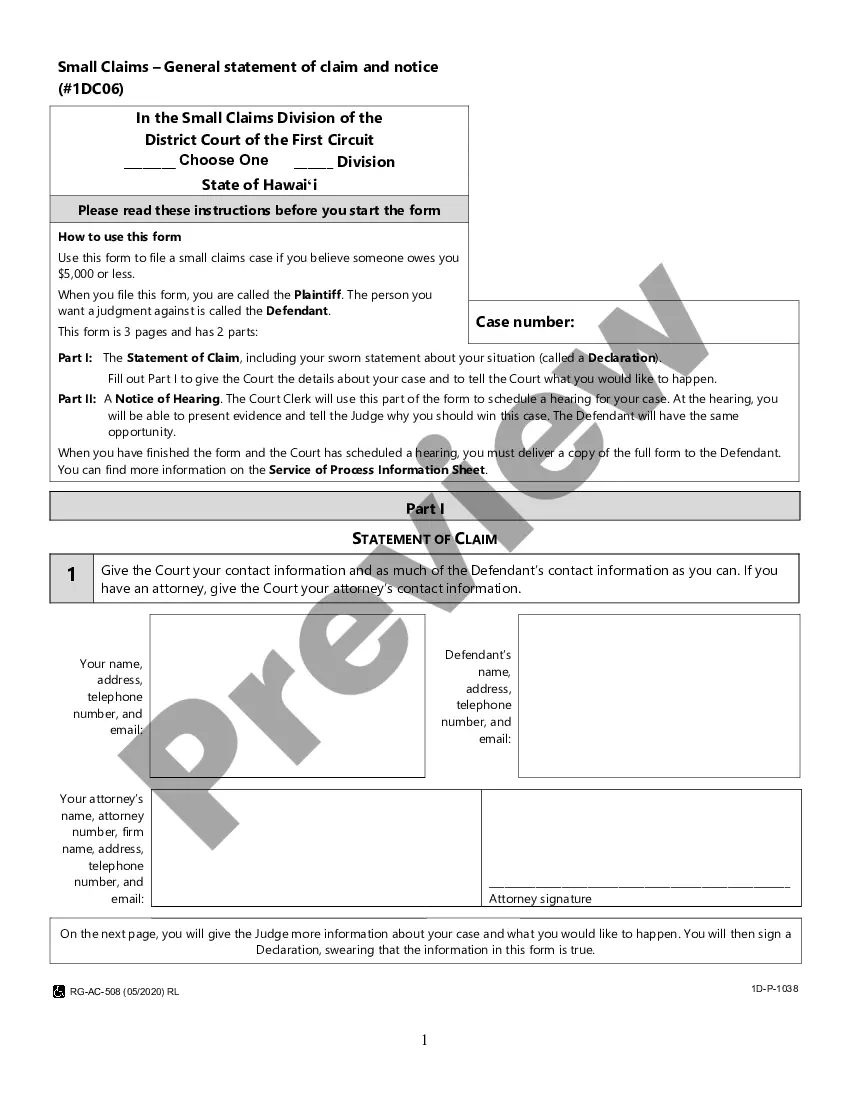

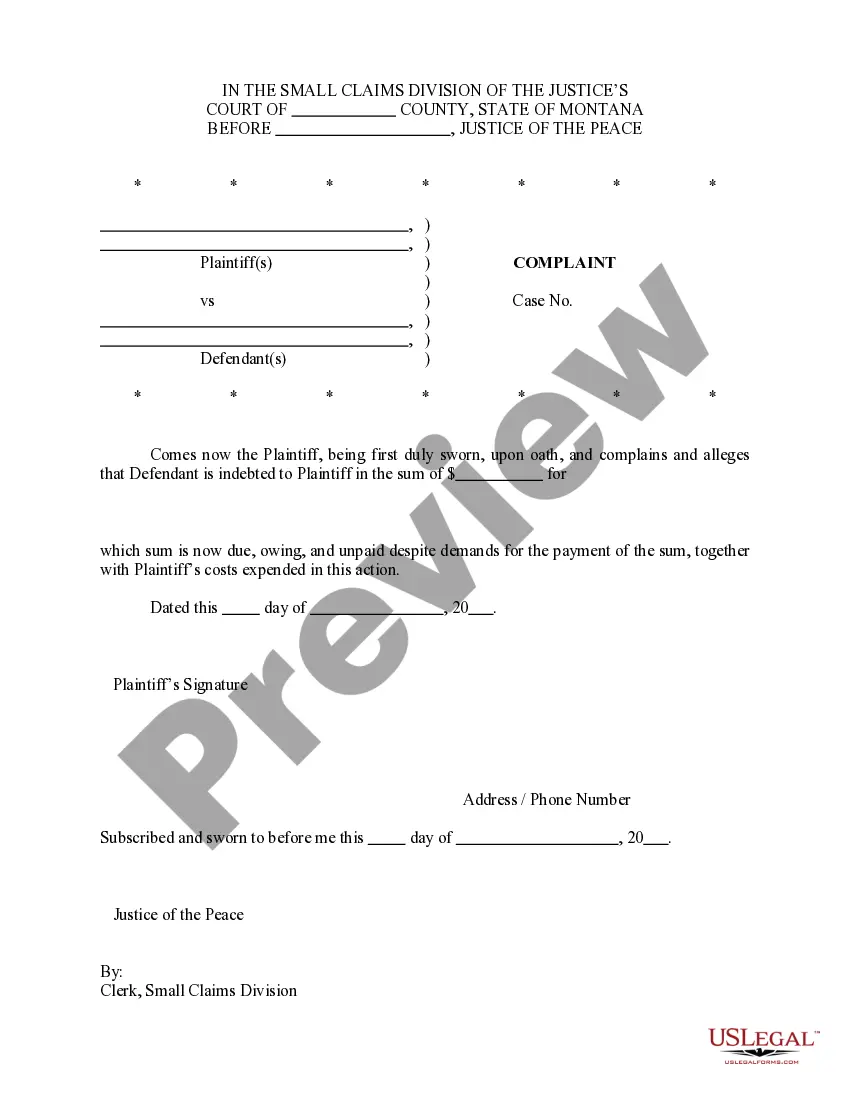

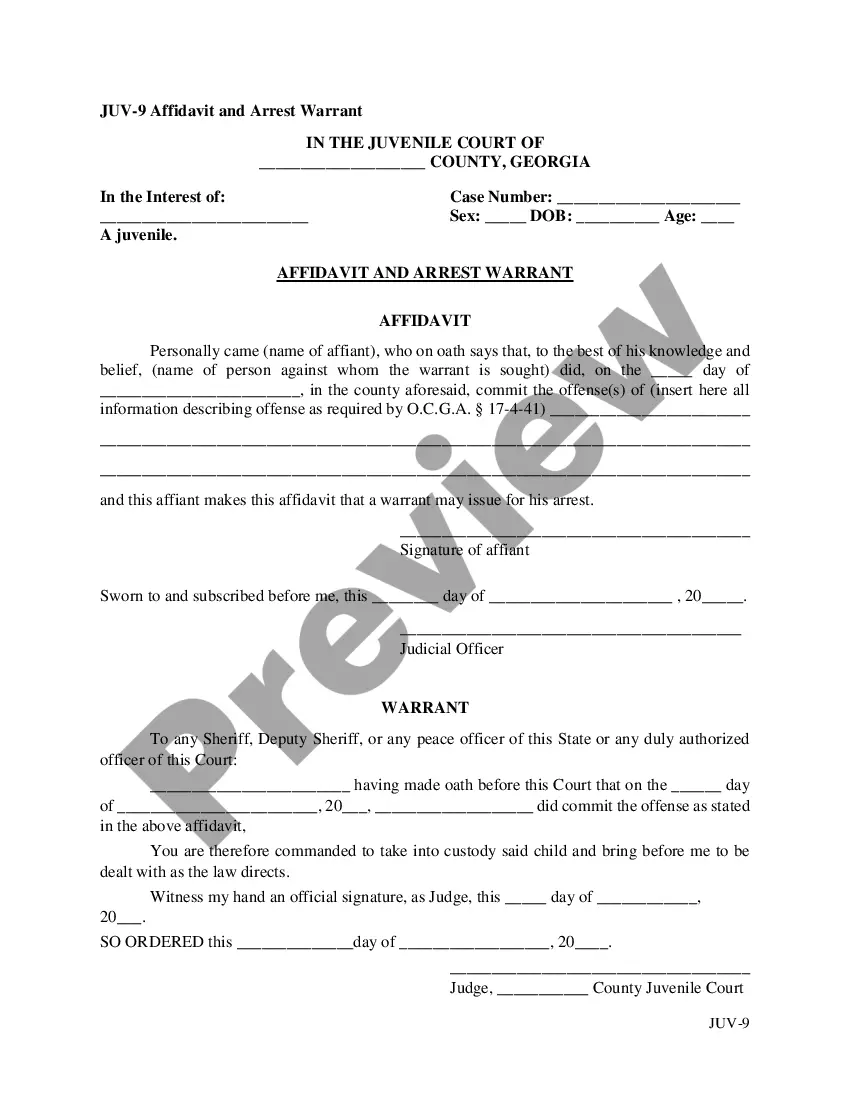

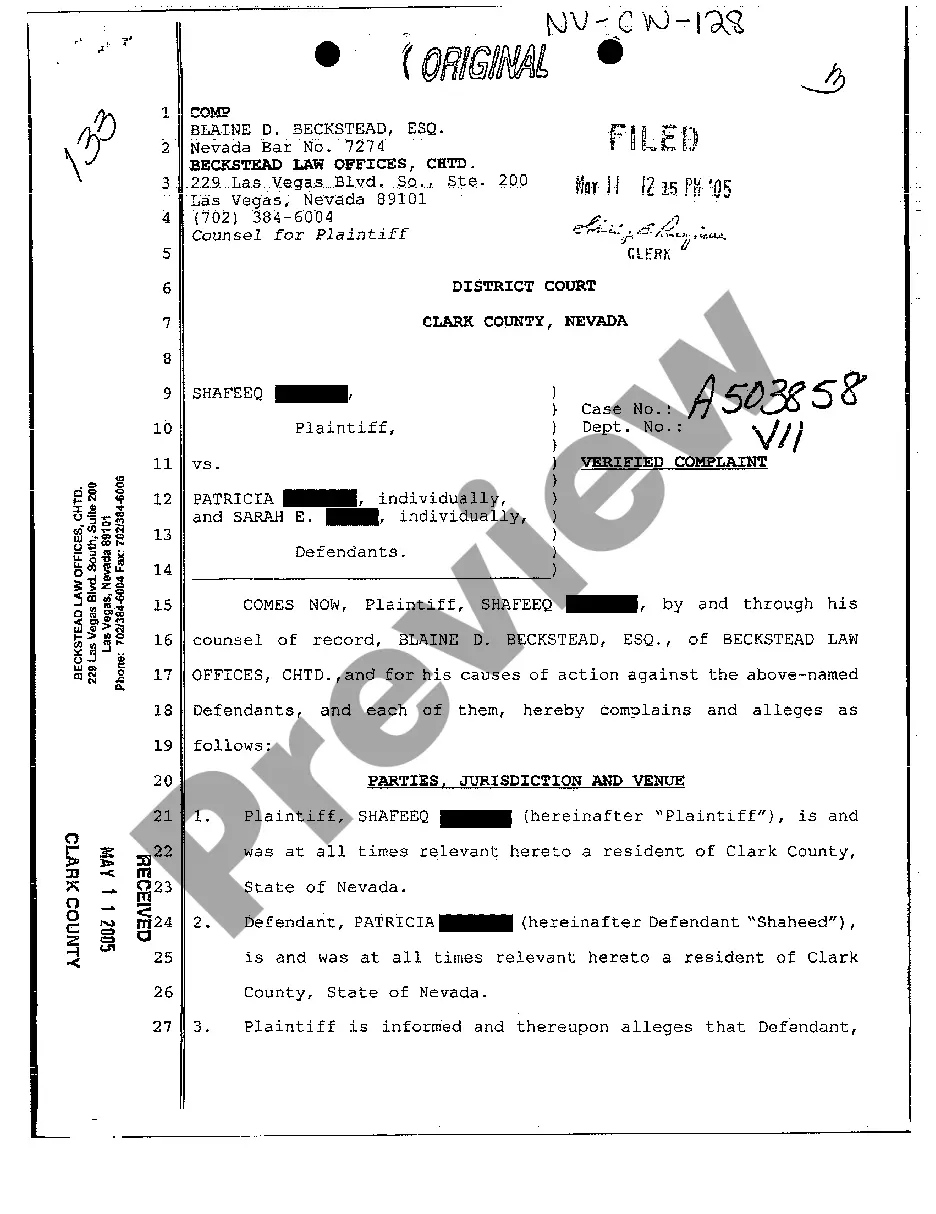

How to fill out Missouri Commercial Property Sales Package?

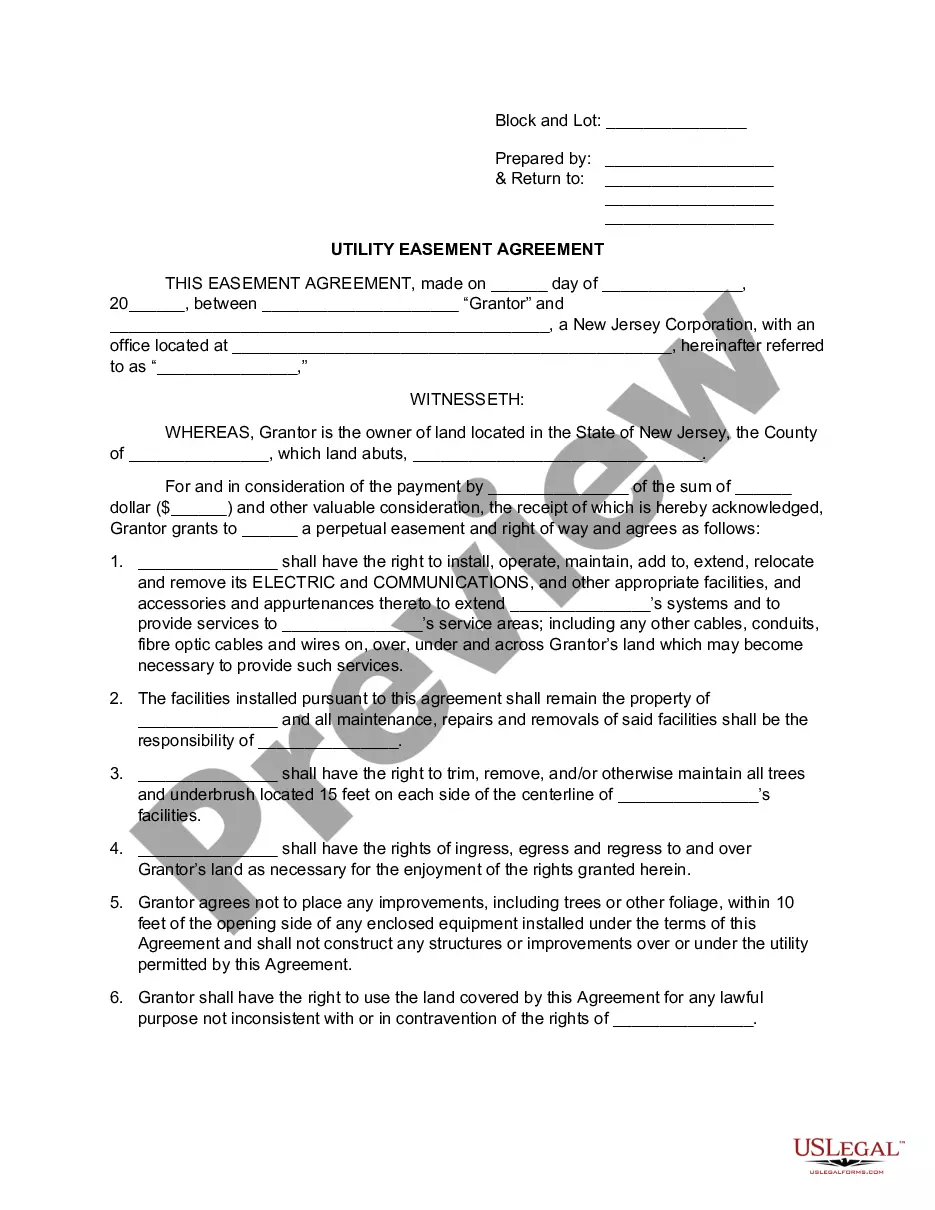

The Missouri Residence With Jail Cells Zillow visible on this page is a versatile official template crafted by experienced attorneys in compliance with national and local laws.

For over 25 years, US Legal Forms has offered individuals, entities, and legal experts access to more than 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most reliable method to acquire the forms you require, as the service provides bank-grade data security and antivirus protection.

Register with US Legal Forms to access verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or review the template details to confirm it meets your needs. If it doesn’t, use the search feature to find the correct one. Click Buy Now once you have found the form you need.

- Register and Log In.

- Select the payment plan that works for you and establish an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Choose the format you desire for your Missouri Residence With Jail Cells Zillow (PDF, Word, RTF) and save the document to your device.

- Fill out and sign the documents.

- Print the template to complete it manually. Alternatively, employ an online multifunctional PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Re-download your documents.

- Access the same document again whenever necessary. Open the My documents section in your profile to retrieve any previously saved forms.

Form popularity

FAQ

Org/node/508) protects consumers from unfair and deceptive acts and practices, whether they occur online or offline. This law generally prevents companies from hiding important facts or falsely representing the facts related to consumer goods, services, property, or credit in Maryland.

The Maryland Consumer Protection Act, 12 enacted in 1973,' 3 provides a private cause of action for consumers harmed by several specified unfair or deceptive trade practices, which consist of various types of false and misleading statements made in consumer transactions.

Although subjective, four basic consumer rights that are widely accepted are 1) the right to be informed, 2) the right to safety, 3) the right to choose, and 4), the right to voice your opinion.

The Personal Information Protection Act (PIPA), Md. Code Ann. Com?m. Law 14-3504?, was enacted to make sure that Maryland consumers' personal identifying information is reasonably protected, and if it is compromised, they are notified so that they can take steps to protect themselves.

Deceptive trade practices in Maryland are dealt under Maryland Commercial Law Code, Title 13 (Consumer Protection Act), Subtitle 3 (Unfair or Deceptive Trade Practices) Section 13-301 et seq. Any advertisement of consumer goods or services without intent to sell, lease or rent are prohibited under Section 13-301.

You may request a complaint form be emailed to you by emailing us at mediator@oag.state.md.us? for general consumer complaints against businesses or heau@oag.state.md.us? for health billing and health insurance complaints. You may also download general consumer complaint forms here.

Consistent with applicable law, we securely share complaints with other state and federal agencies to, among other things, facilitate: supervision activities, enforcement activities, and. monitor the market for consumer financial products and services.

To get a judgment, a creditor must bring the claim to court within 3 years after the debt comes due. If someone claims in court that you owe them money and you believe that the money became due more than 3 years ago, you may be able to raise the 3-year statute of limitation as a defense.