Form Real Estate With Llc

Description

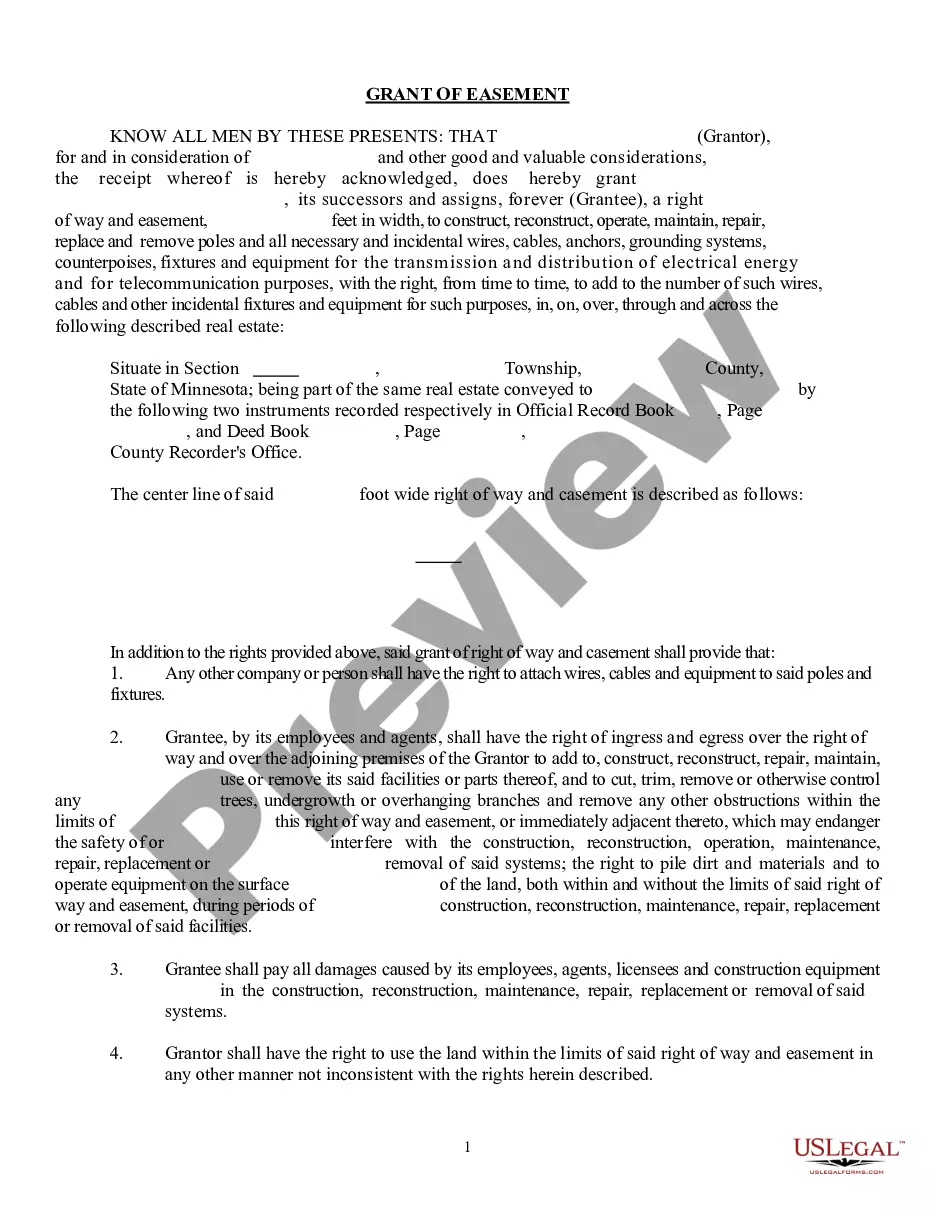

How to fill out Minnesota Grant Of Easement For The Transmission Of Electrical Energy?

- If you're a returning user, log in to your account to download the required document directly onto your device. Confirm that your subscription is active and renew if necessary.

- For first-time users, begin by reviewing the Preview mode and form description. Make certain the selected template fits your specific requirements and adheres to local regulations.

- If necessary, utilize the Search tab to find alternate forms that may better suit your needs, ensuring you have the correct paperwork before proceeding.

- Purchase your document by clicking the 'Buy Now' button and selecting your preferred subscription plan. You'll need to create an account for access to the form library.

- Complete the purchase by submitting your payment through a credit card or PayPal, securing your access to the document.

- Finally, download the form to your device. You'll also find this document available in the My Forms section of your account for easy retrieval later.

By using US Legal Forms, you leverage a robust collection of over 85,000 customizable legal forms, allowing you to create accurate, legally sound documents without hassle. Enjoy the benefits of premium support for additional assistance during form completion, making your real estate journey more efficient.

Don't wait any longer! Start forming your real estate LLC today with the help of US Legal Forms and secure your financial future.

Form popularity

FAQ

Opening an LLC is a wise decision for real estate agents. It not only protects your personal assets but also enhances your professional image in the market. Moreover, forming real estate with LLC allows for easier management of your business expenses and potential tax breaks. Platforms like US Legal Forms can help simplify the process of setting up your LLC efficiently and affordably.

For a real estate agent, forming an LLC is often the best business structure. It provides crucial personal liability protection while allowing for flexible management options. Additionally, LLCs offer potential tax benefits that sole proprietorships do not. Choosing to form real estate with LLC simplifies your financial responsibilities and enhances your professional credibility.

While you can be your own registered agent when you form real estate with LLC, it's often more advantageous to hire a professional service. A registered agent is responsible for receiving legal documents on your behalf, ensuring you don't miss crucial notifications. By utilizing a registered agent service, you can focus on growing your real estate business while ensuring compliance with state regulations.

When you form real estate with LLC, you enjoy several advantages, such as personal asset protection and flexibility in taxation. An LLC separates your personal finances from your business dealings, shielding your home and savings from any claims made against the business. Additionally, an LLC can simplify joint ownership between partners, making it easier to manage properties collectively.

Yes, realtors should consider forming an LLC for their business. An LLC offers personal liability protection, which means your personal assets are safeguarded from business-related debts and lawsuits. Forming real estate with LLC also provides potential tax benefits that can help you manage your earnings more effectively. Overall, it's a smart choice for those serious about their real estate career.

Many people place their houses under an LLC to protect their personal assets and reduce liability risks. By doing this, they can separate their property from personal finances, creating a buffer against potential lawsuits or claims. Additionally, placing a house in an LLC can offer benefits related to estate planning. If you are looking to simplify this process, considering USLegalForms might make it easier to form real estate with an LLC.

An LLC offers several advantages for real estate investment. It provides liability protection, meaning your personal assets remain safe in case of legal issues or debts related to the property. Furthermore, an LLC can help with tax flexibility, allowing you to choose how you want to be taxed. When you form real estate with an LLC, you create a solid foundation for your investments.

Yes, you can transfer property from your LLC to yourself. This process usually involves drafting a transfer document, which effectively changes the ownership of the property. It is essential to document this transaction properly to maintain clear records. Additionally, consider consulting legal assistance or platforms like USLegalForms for streamlined processes when you form real estate with an LLC.

When you form real estate with an LLC, filing taxes for your rental property involves a few key steps. First, you'll need to report the rental income on your personal tax return, typically using Schedule E. Additionally, your LLC can deduct certain expenses related to property management, maintenance, and depreciation. Consider using the resources available on the US Legal Forms platform to help you navigate this process and ensure compliance with all tax regulations.

People typically form real estate with LLC to safeguard their personal assets from potential lawsuits or claims related to the property. Additionally, LLCs provide flexible management options and can help simplify the transfer of ownership. Many investors also appreciate the tax advantages that LLCs can offer. Overall, an LLC can be a smart strategy for effective asset management and protection.