Demand Letter For Release Of Earnest Money

Description

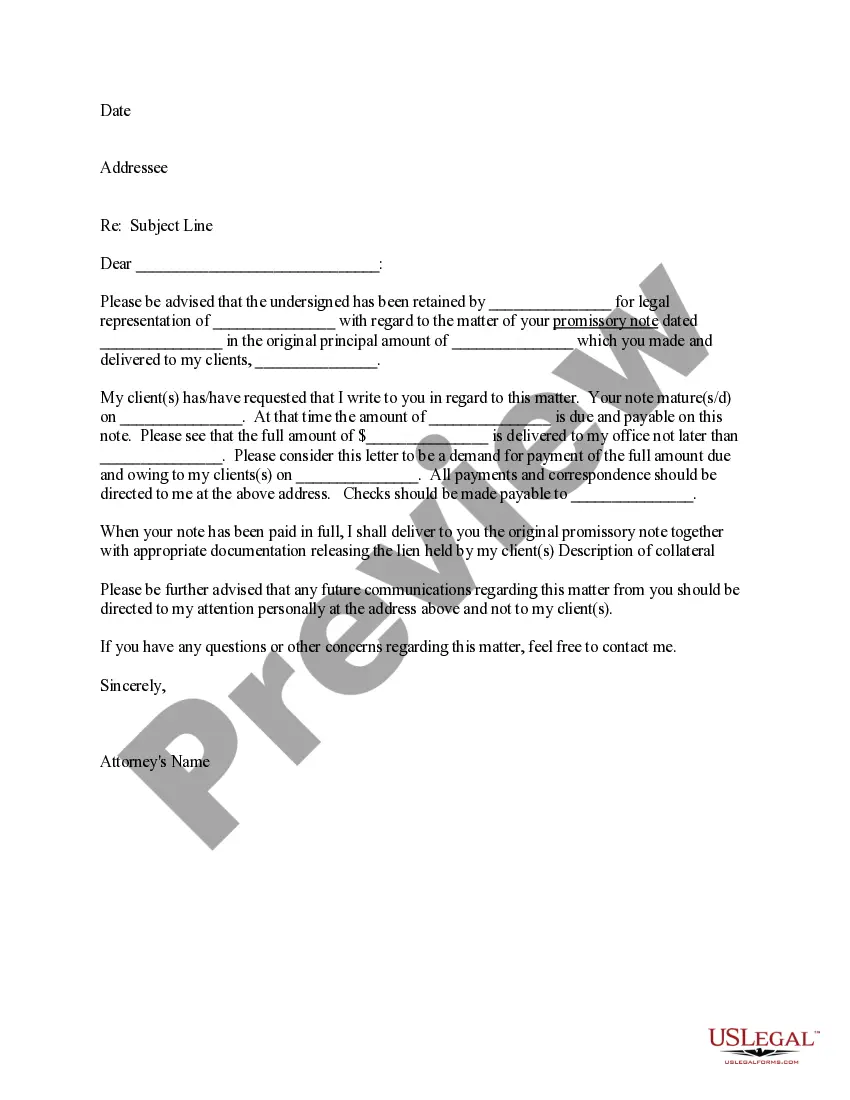

How to fill out Minnesota Demand Letter - Repayment Of Promissory Note?

Navigating through the red tape of official documents and formats can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate format for obtaining a Demand Letter For Release Of Earnest Money will be laborious, as it must be authoritative and accurate to the very last figure.

Nonetheless, you will invest considerably less time selecting an appropriate format if it originates from a source you can depend on.

Obtain the correct document in a few uncomplicated steps: Enter the title of the document in the search box. Locate the suitable Demand Letter For Release Of Earnest Money from the search outcomes. Review the summary of the template or view its preview. When the format meets your requirements, click Buy Now. Continue to select your subscription plan. Utilize your email and create a password to set up an account with US Legal Forms. Choose a credit card or PayPal method for payment. Download the template file onto your device in the desired format. US Legal Forms will save you considerable time verifying whether the template you discovered online is appropriate for your requirements. Establish an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of sourcing the right documents on the internet.

- US Legal Forms serves as a singular location where you can acquire the latest templates of documents, seek guidance on their use, and download these templates for completion.

- This is a repository containing over 85,000 documents applicable in various professional fields.

- When seeking a Demand Letter For Release Of Earnest Money, you will not have to doubt its legitimacy since all of the templates are authenticated.

- An account with US Legal Forms guarantees you have access to all the requisite templates at your fingertips.

- You can save them in your history or add them to the My documents catalog.

- Accessing your saved templates from any device is simple by clicking Log In on the library's website.

- If you still lack an account, you can always search again for the template you require.

Form popularity

FAQ

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete.

Frequently Asked Questions (FAQ)Type your letter.Concisely review the main facts.Be polite.Write with your goal in mind.Ask for exactly what you want.Set a deadline.End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand.Make and keep copies.More items...

There are several ways to get your buyer's earnest money deposit back in Texas, including mediation, suing for the money, and including a liquidated damages clause.

Q: When does an EMD have to be deposited? Within five days the deposit must occur within five business banking days following ratification unless otherwise agreed to in writing by the parties.

The earnest money can be held in escrow during the contract period by a title company, lawyer, bank, or brokerwhatever is specified in the contract. Most U.S. jurisdictions require that when a buyer timely and properly drops out of a contract, the money be returned within a brief period of time, say, 48 hours.