Release Lien Property With Tax

Description

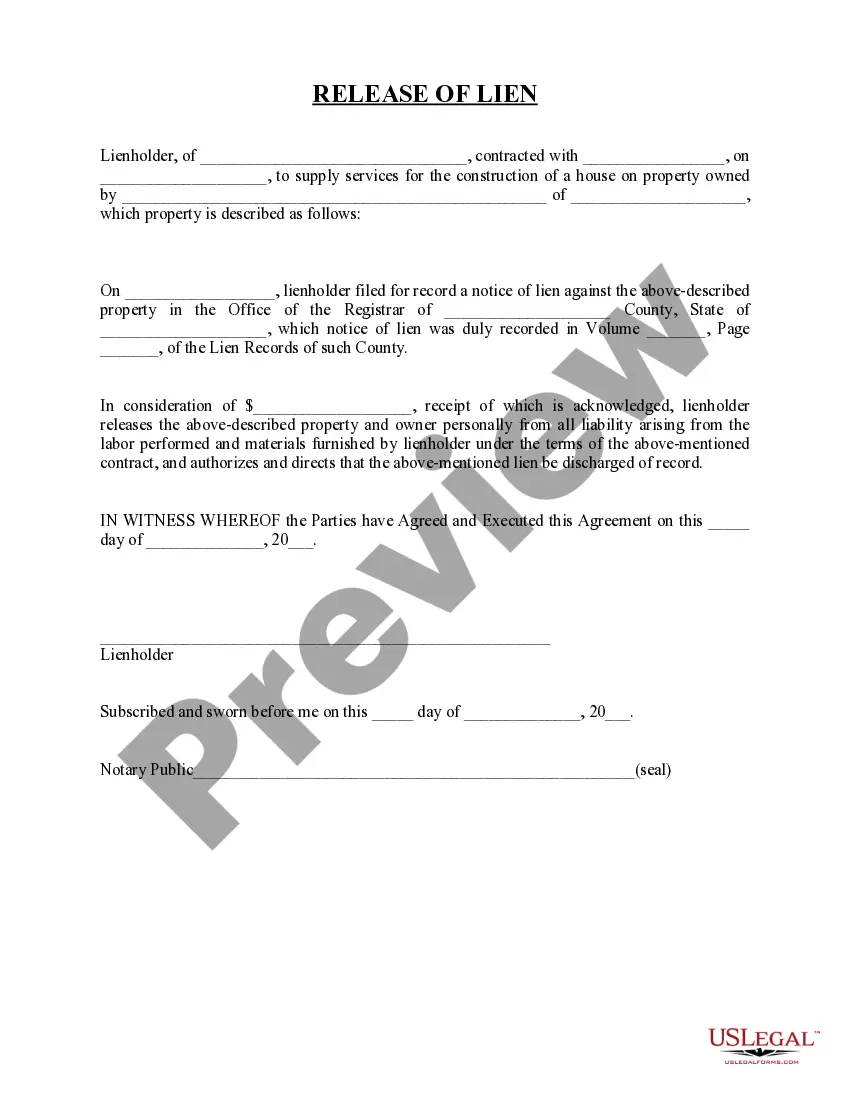

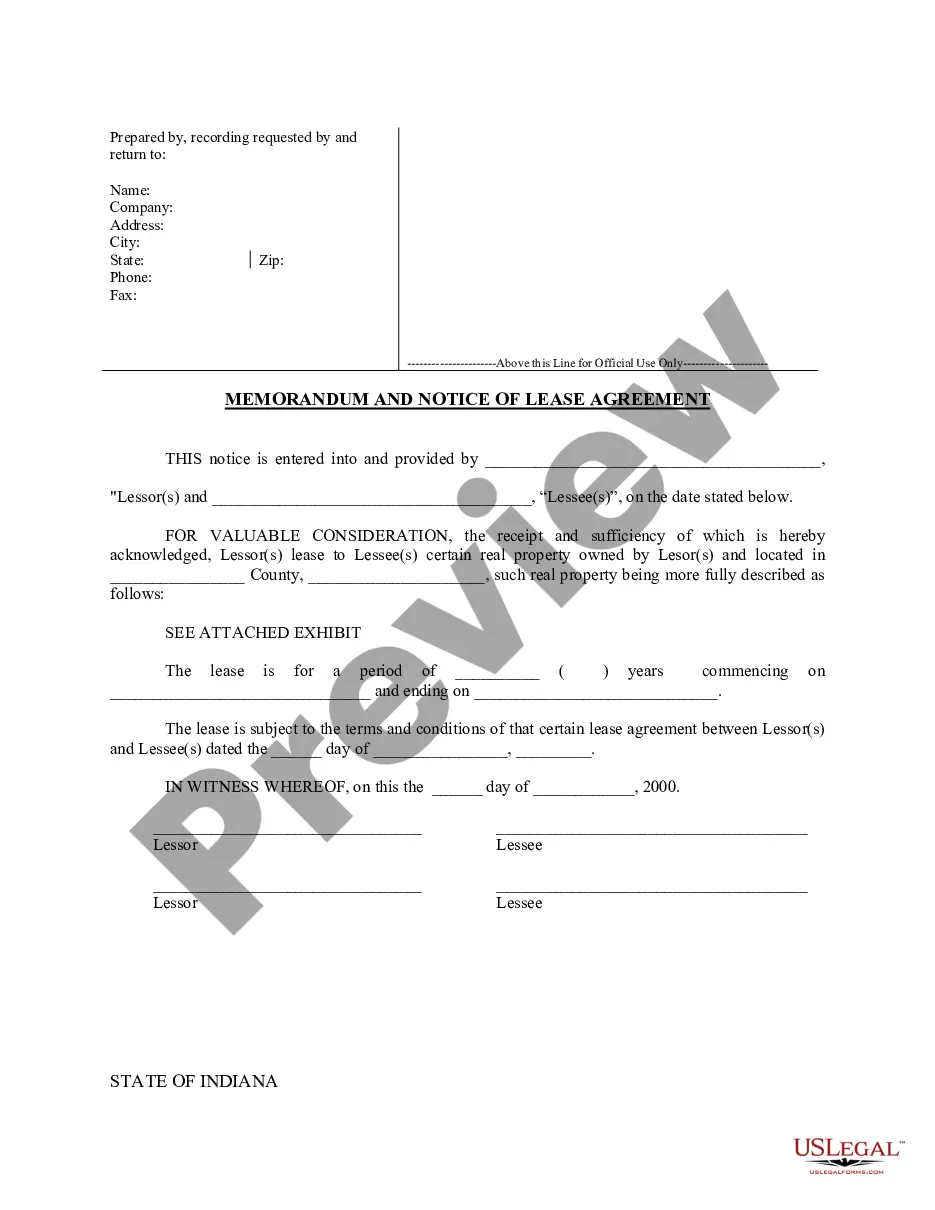

How to fill out Release Of Lien For Property?

Individuals often link legal documents with something complex that only an expert can manage.

In a certain sense, this is valid, as preparing Release Lien Property With Tax necessitates a considerable comprehension of subject matter specifications, including state and county statutes.

However, with US Legal Forms, the process has become more straightforward: pre-prepared legal templates for various life and business situations specific to state regulations are gathered in a single online repository and are now accessible to everyone.

Choose the format for your document and click Download. You can print your document or use an online editor for quicker completion. All templates in our collection are reusable: once acquired, they remain stored in your profile. You can access them whenever needed through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85k current documents categorized by state and use case, so searching for Release Lien Property With Tax or any specific template requires just minutes.

- Users who have previously registered with a valid subscription must Log In to their account and select Download to retrieve the form.

- New users to the service will need to create an account and subscribe before they can save any documents.

- Here is a detailed guide on how to obtain the Release Lien Property With Tax.

- Carefully review the page content to make sure it meets your requirements.

- Read the form description or check it using the Preview option.

- If the previous option does not meet your needs, search for another sample using the Search field above.

- When you locate the correct Release Lien Property With Tax, click Buy Now.

- Select a subscription plan that aligns with your needs and financial plan.

- Create an account or Log In to continue to the payment page.

- Complete your payment for the subscription via PayPal or using your credit card.

Form popularity

FAQ

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

How to Complete a Satisfaction of MortgageStep 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage.Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued.Step 3 File and Record the Form.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

Certificate of Release of Federal Tax Lien IRS. Section 6325(a) of the Internal Revenue Code directs us to release a Federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the IRS accepts a bond for payment of the liability.