Transfer On Death Deed Mn Instructions

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Whether for commercial reasons or personal issues, everyone must confront legal circumstances at some point during their lives.

Completing legal documentation requires meticulous care, beginning with choosing the appropriate form example.

With an extensive US Legal Forms catalog available, you don’t have to waste time searching for the right template online. Utilize the library’s easy navigation to find the correct form for any situation.

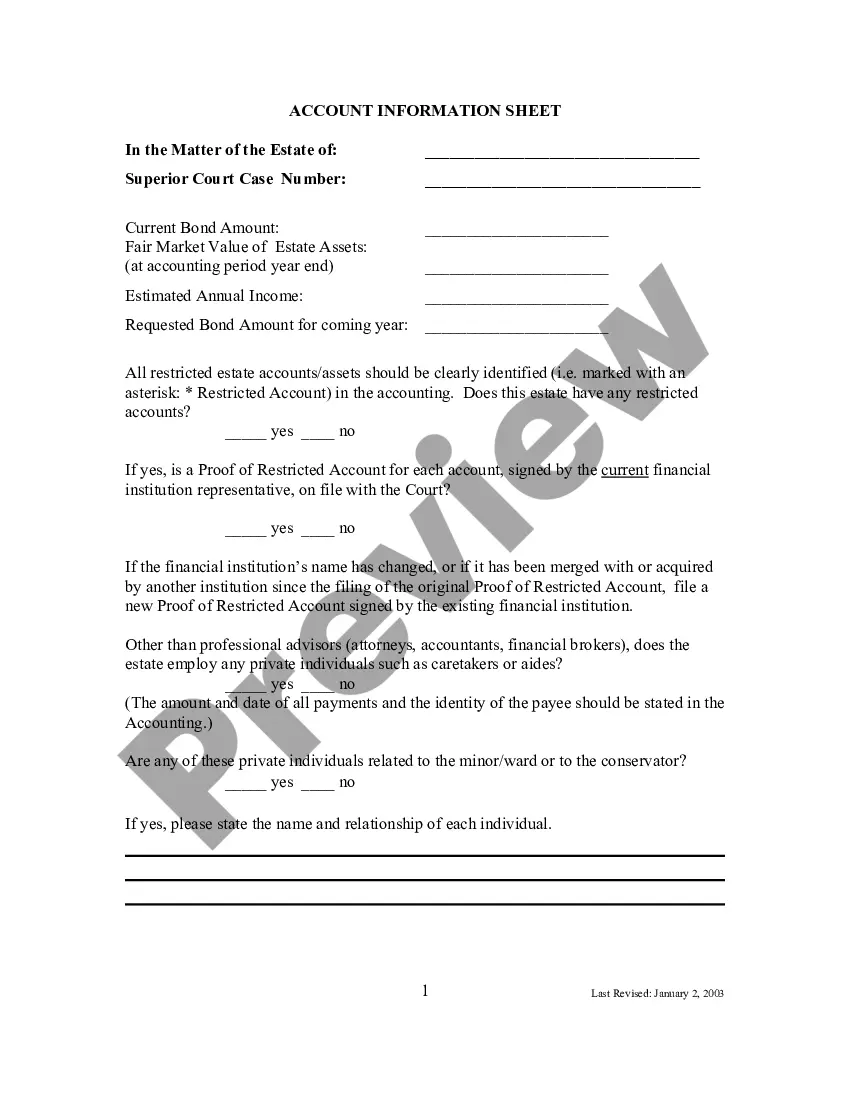

- Obtain the template you require by using the search bar or browsing the catalog.

- Review the document’s details to verify it aligns with your situation, state, and county.

- Select the form’s preview to view it.

- If it is the wrong document, return to the search function to find the Transfer On Death Deed Mn Instructions sample you require.

- Download the file once it meets your needs.

- If you already possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can purchase the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Transfer On Death Deed Mn Instructions.

- Once it is saved, you can complete the form using editing software or print it and finish it by hand.

Form popularity

FAQ

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.

An Affidavit of Survivorship is a legal document used in Minnesota to transfer the ownership of real estate from one party to another when one of the parties has died. It is typically used by the heirs of a deceased party to transfer the deceased's ownership interest in real estate to the surviving owner.

A Minnesota TODD must be either filed, or recorded, in the proper county real estate office before the death of the Grantor Owner(s) in order to achieve the objective of avoiding probate upon the death of the Grantor Owner(s) with respect to any real property interest identified in the Transfer on Death Deed.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office or county registrar of titles (see "Recording Your Deed" below to determine which) before your death. Otherwise, it won't be valid. You can make a Minnesota transfer on death deed with WillMaker.