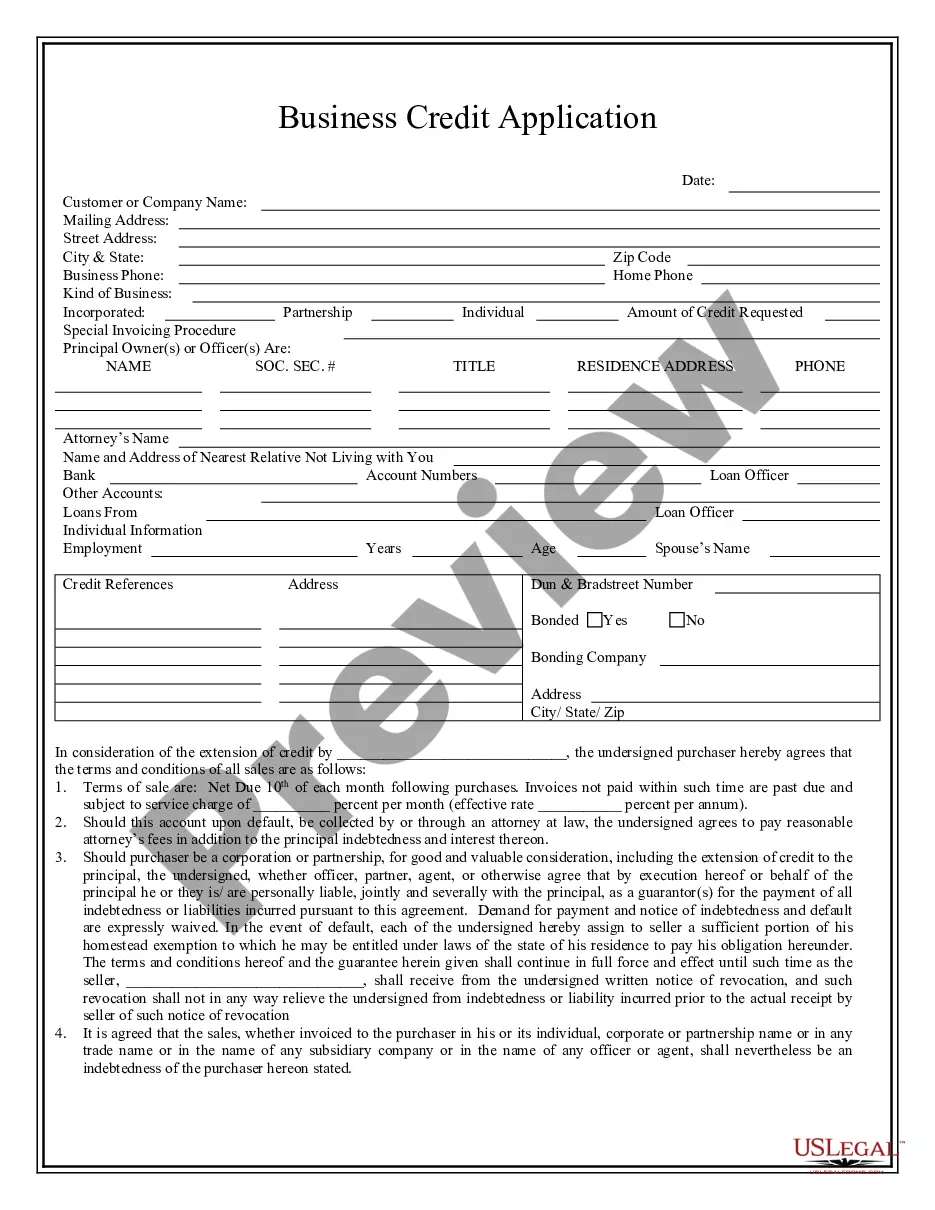

Minnesota Transfer Death Form With Two Points

Description

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Regardless of whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their lives. Filling out legal documents requires meticulous care, starting from selecting the appropriate form template. For example, if you choose an incorrect version of a Minnesota Transfer Death Form With Two Points, it will be denied upon submission. Therefore, it is crucial to have a trustworthy source of legal paperwork like US Legal Forms.

If you need to acquire a Minnesota Transfer Death Form With Two Points template, follow these straightforward steps: Obtain the form you require by utilizing the search bar or catalog browsing. Review the form's details to ensure it corresponds with your circumstances, jurisdiction, and county. Click on the form's preview to examine it. If it is the incorrect document, return to the search function to find the Minnesota Transfer Death Form With Two Points template you need. Download the file when it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to retrieve previously stored documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate payment option.

- Fill out the account registration form.

- Decide on your payment method: use a credit card or PayPal account.

- Choose the document format you prefer and download the Minnesota Transfer Death Form With Two Points.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

- With a vast US Legal Forms catalog available, you do not need to waste time searching for the right template online.

- Utilize the library’s user-friendly navigation to locate the correct form for any circumstance.

Form popularity

FAQ

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

A motor vehicle is registered in transfer-on-death form by designating on the certificate of title the name of the owner and the names of joint owners with identification of rights of survivorship, followed by the words ?transfer-on-death to (name of beneficiary or beneficiaries).? The designation ?TOD? may be used ...

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

Gifting assets is one way to avoid probate, but it must be done before a person passes away. If a person gives all of their assets away to beneficiaries before they pass away, then there will be no need to go through probate court.

A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.