Minnesota Transfer Death Form With Notary Signature

Description

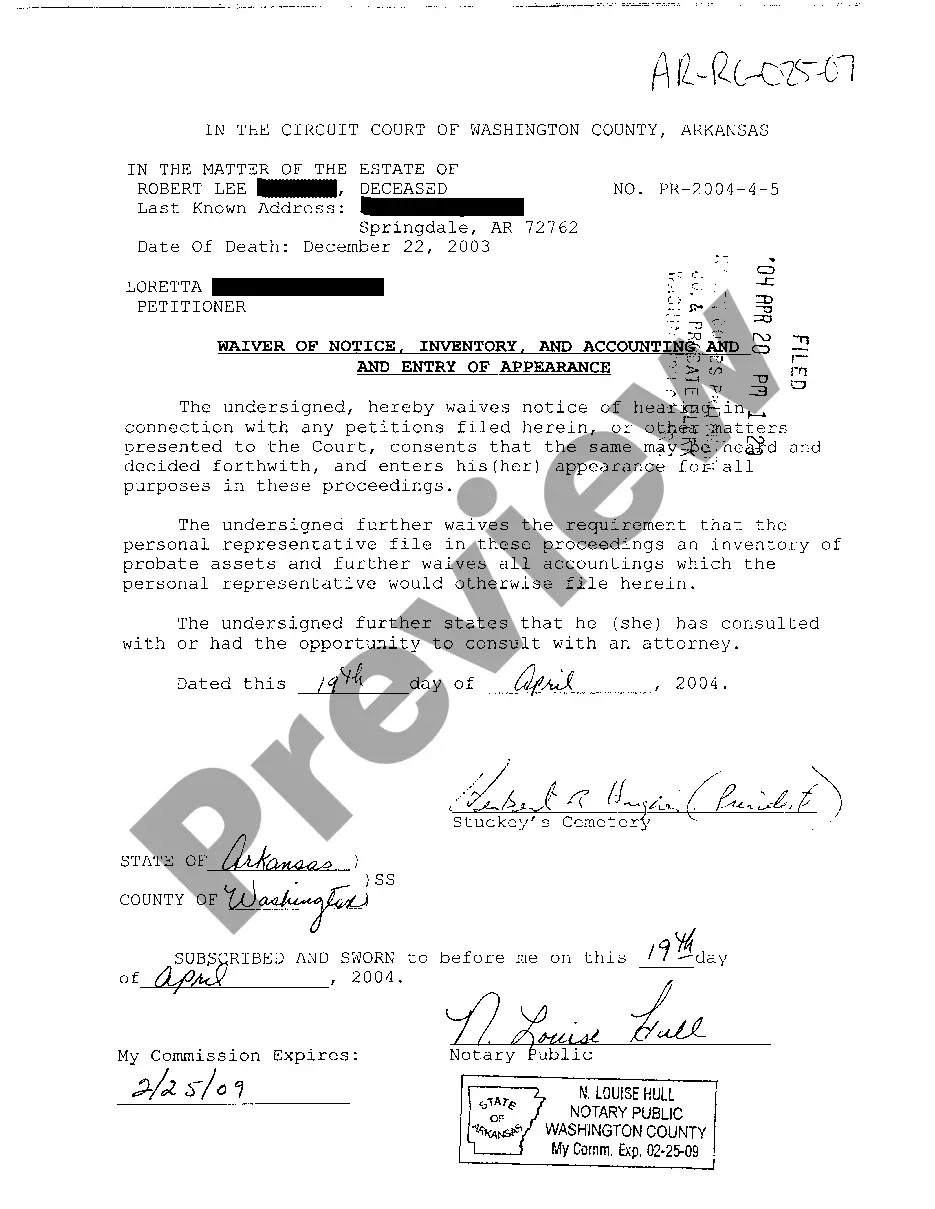

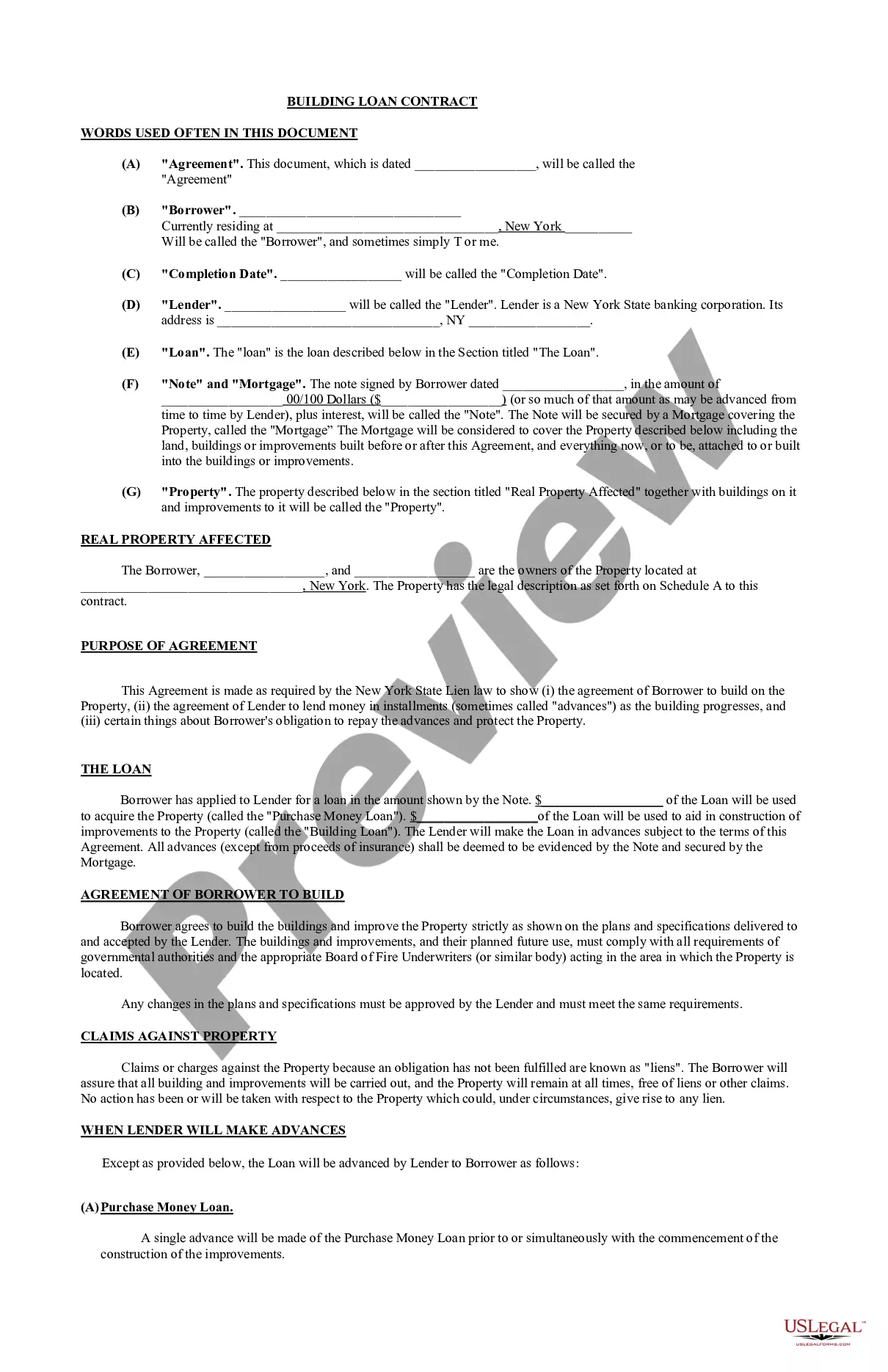

How to fill out Minnesota Transfer On Death Deed - Individual To Individual?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Discovering the right legal papers demands accuracy and attention to detail, which is why it is important to take samples of Minnesota Transfer Death Form With Notary Signature only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the information regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Minnesota Transfer Death Form With Notary Signature:

- Use the catalog navigation or search field to locate your template.

- Open the form’s description to ascertain if it fits the requirements of your state and area.

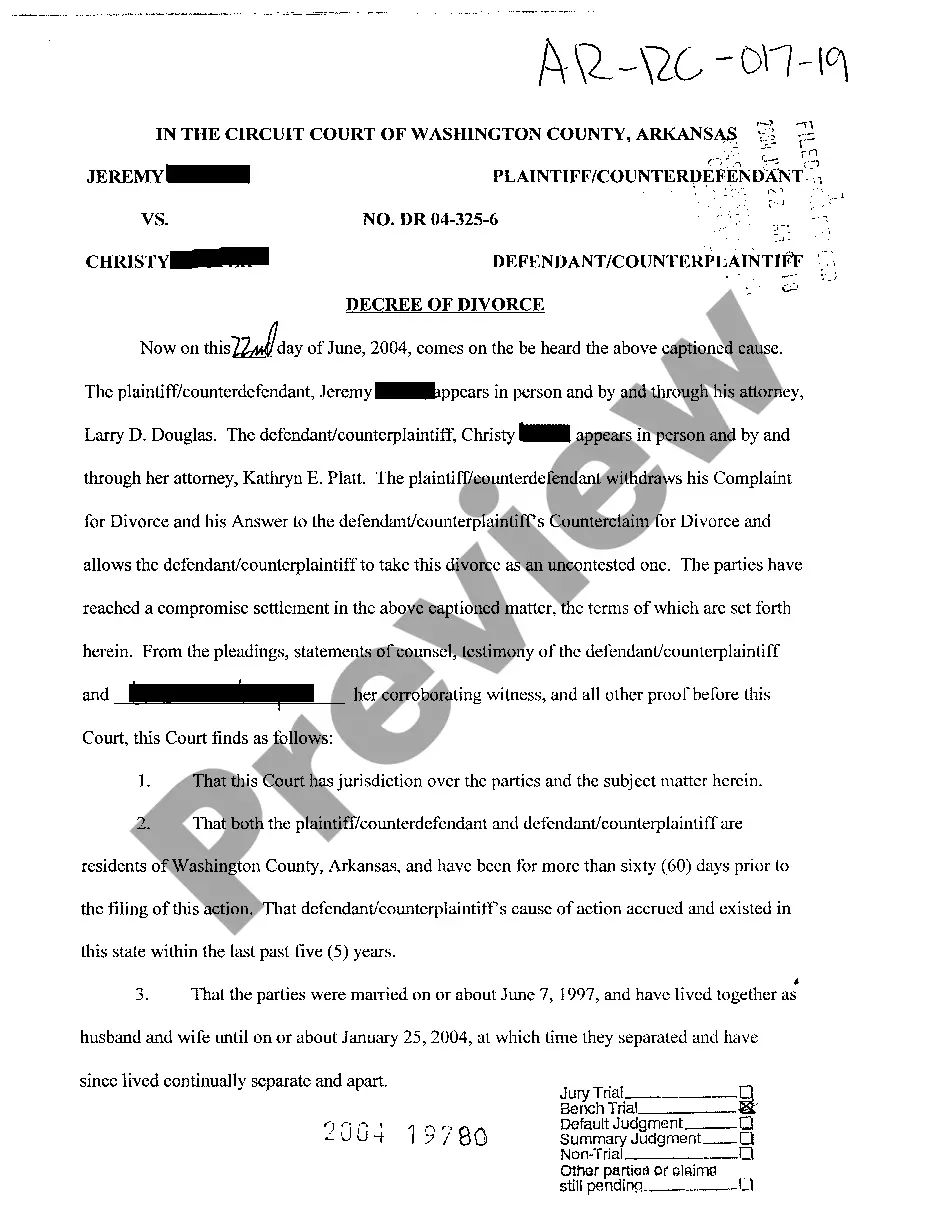

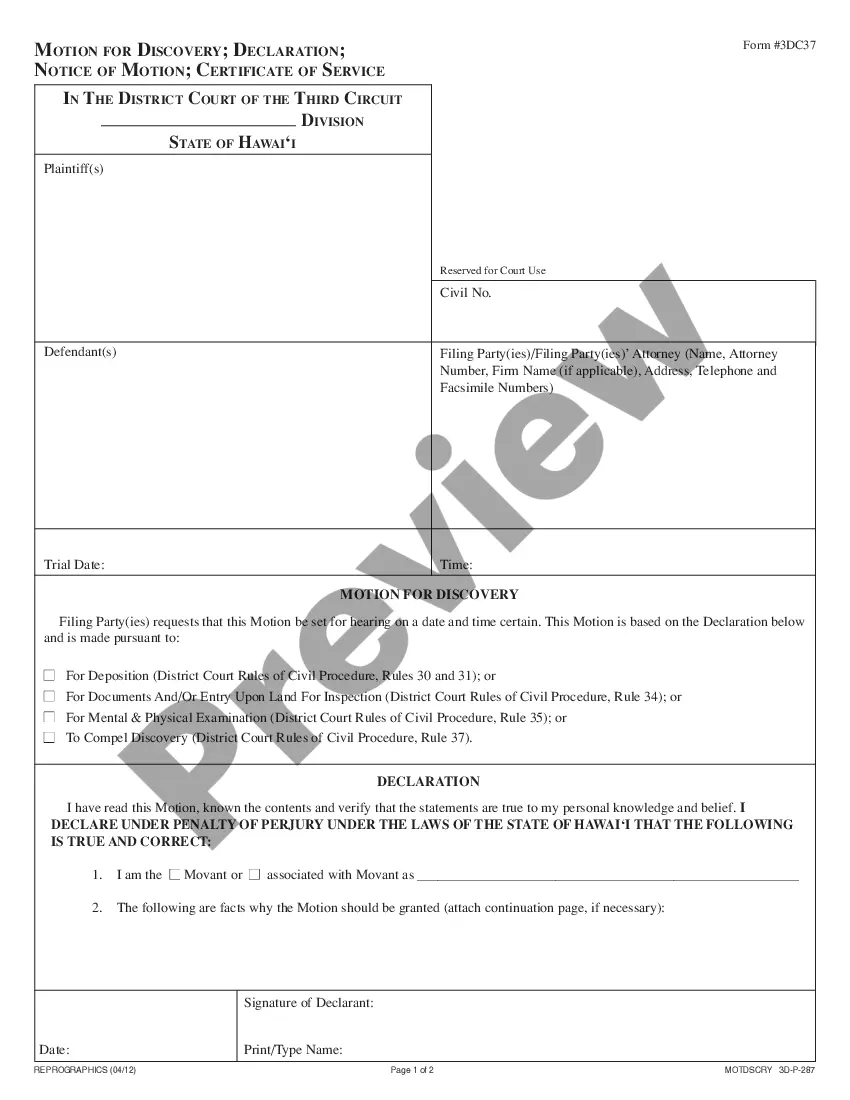

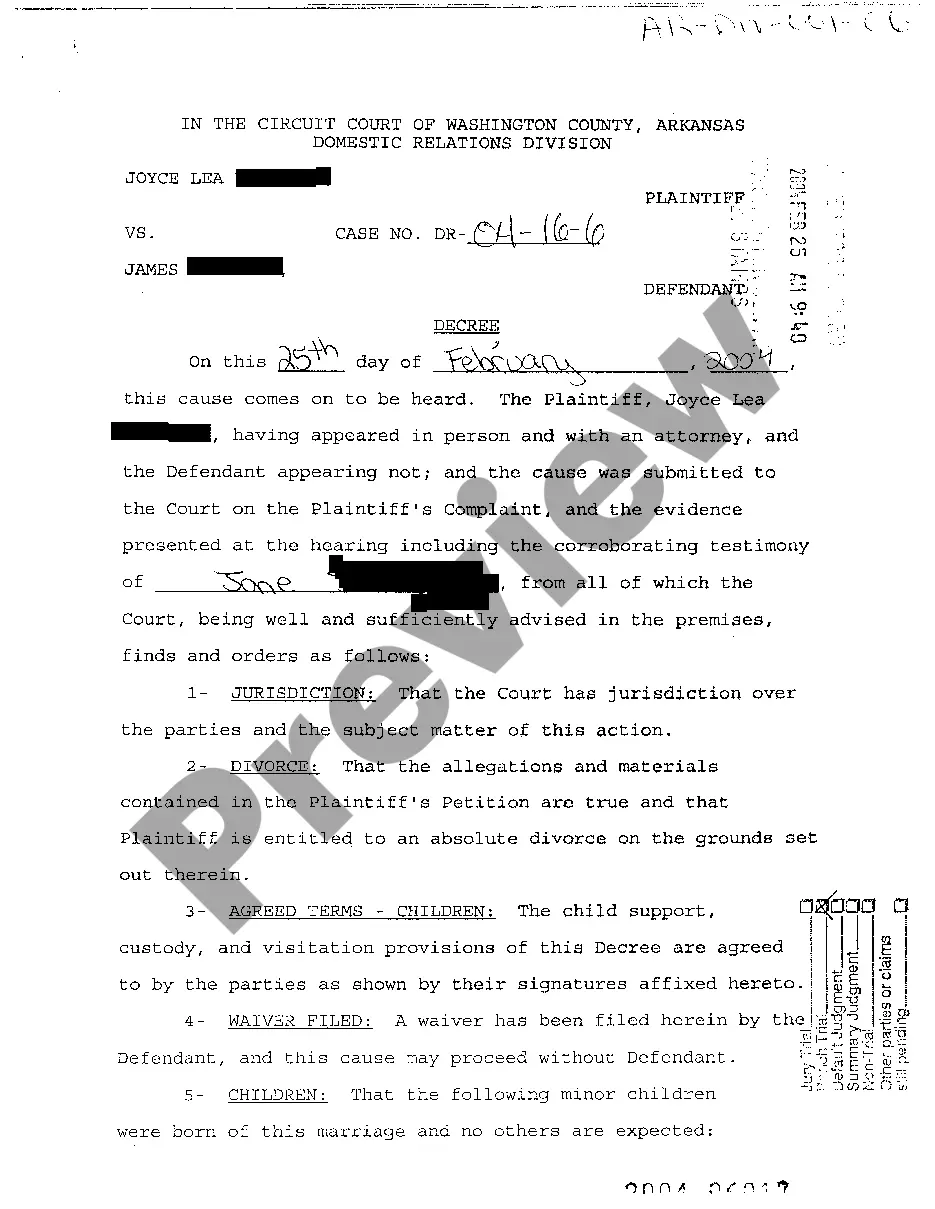

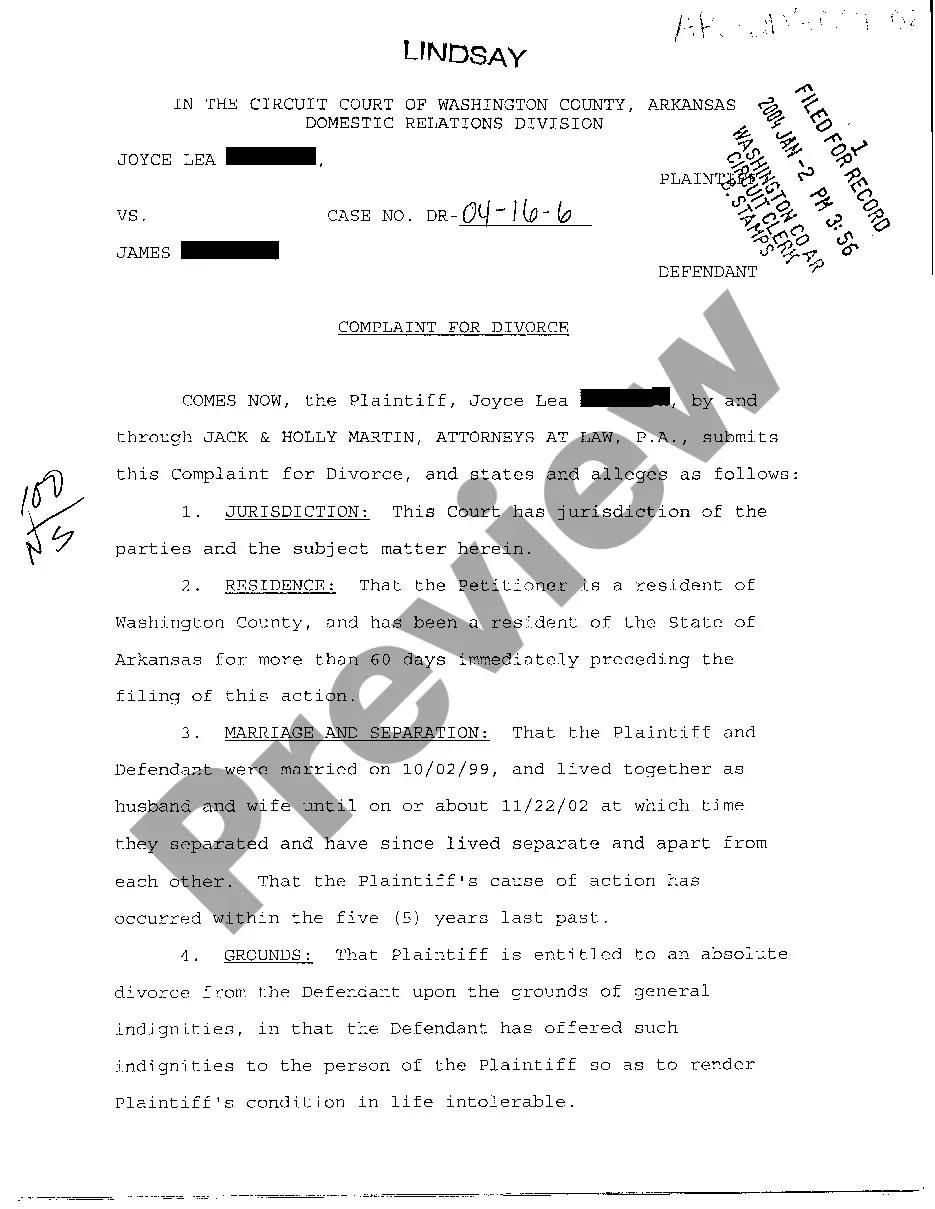

- Open the form preview, if available, to ensure the template is definitely the one you are looking for.

- Return to the search and locate the right document if the Minnesota Transfer Death Form With Notary Signature does not match your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that fits your requirements.

- Go on to the registration to complete your purchase.

- Finalize your purchase by picking a payment method (bank card or PayPal).

- Select the document format for downloading Minnesota Transfer Death Form With Notary Signature.

- When you have the form on your gadget, you may change it using the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Discover the extensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

To get title to the property after your death, the beneficiary must record the following documents in the county where the property is located: (1) an affidavit of identity and survivorship, (2) a certified death certificate, and (3) a clearance certificate (showing that the county will not seek reimbursement for ...

Disadvantages of a Transfer on Death Deed For example, your property will be subject to probate court if your beneficiary predeceases you and you lack an alternate estate plan. Another disadvantage is if you co-own property under a joint tenancy.

Ownership of the vehicle will transfer to the beneficiary upon the death of the owner or the last survivor of joint ownership with rights to survivorship, subject to the rights of secured creditors. To remove a beneficiary, you must apply for a new title.

A motor vehicle is registered in transfer-on-death form by designating on the certificate of title the name of the owner and the names of joint owners with identification of rights of survivorship, followed by the words ?transfer-on-death to (name of beneficiary or beneficiaries).? The designation ?TOD? may be used ...

A transfer on death deed can be a useful addition to your estate plan, but it may not address other concerns, like minimizing estate tax or creditor protection, for which you need a trust. In addition to a will or trust, you can also transfer property by making someone else a joint owner, or using a life estate deed.