Michigan Limited Liability Company With Multiple Owners

Description

How to fill out Michigan LLC Notices, Resolutions And Other Operations Forms Package?

Managing legal documents can be daunting, even for seasoned professionals.

If you're interested in a Michigan Limited Liability Company with multiple proprietors and cannot find the time to search for the correct and up-to-date version, the process can be challenging.

Tap into a resource library of articles, tutorials, and guides related to your circumstances and needs.

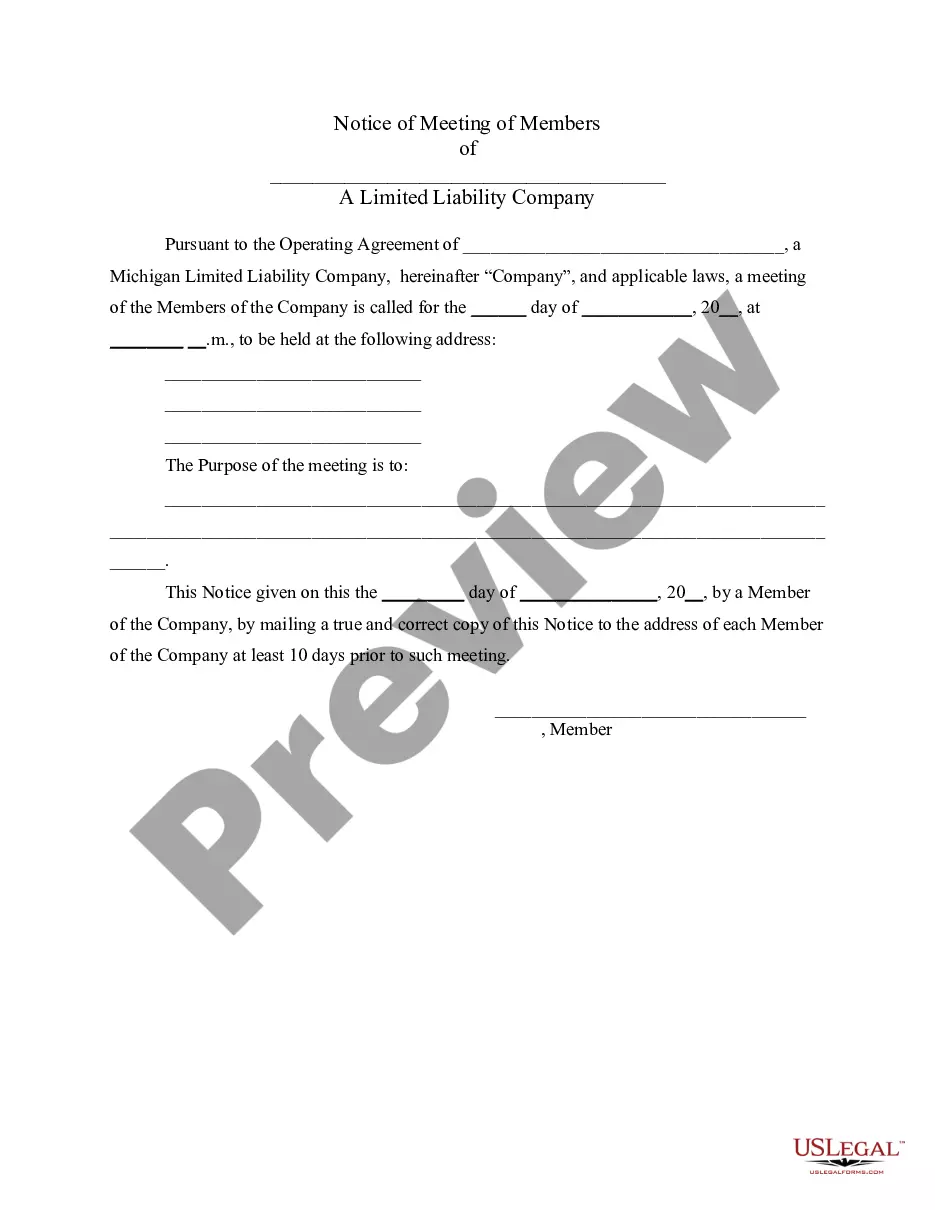

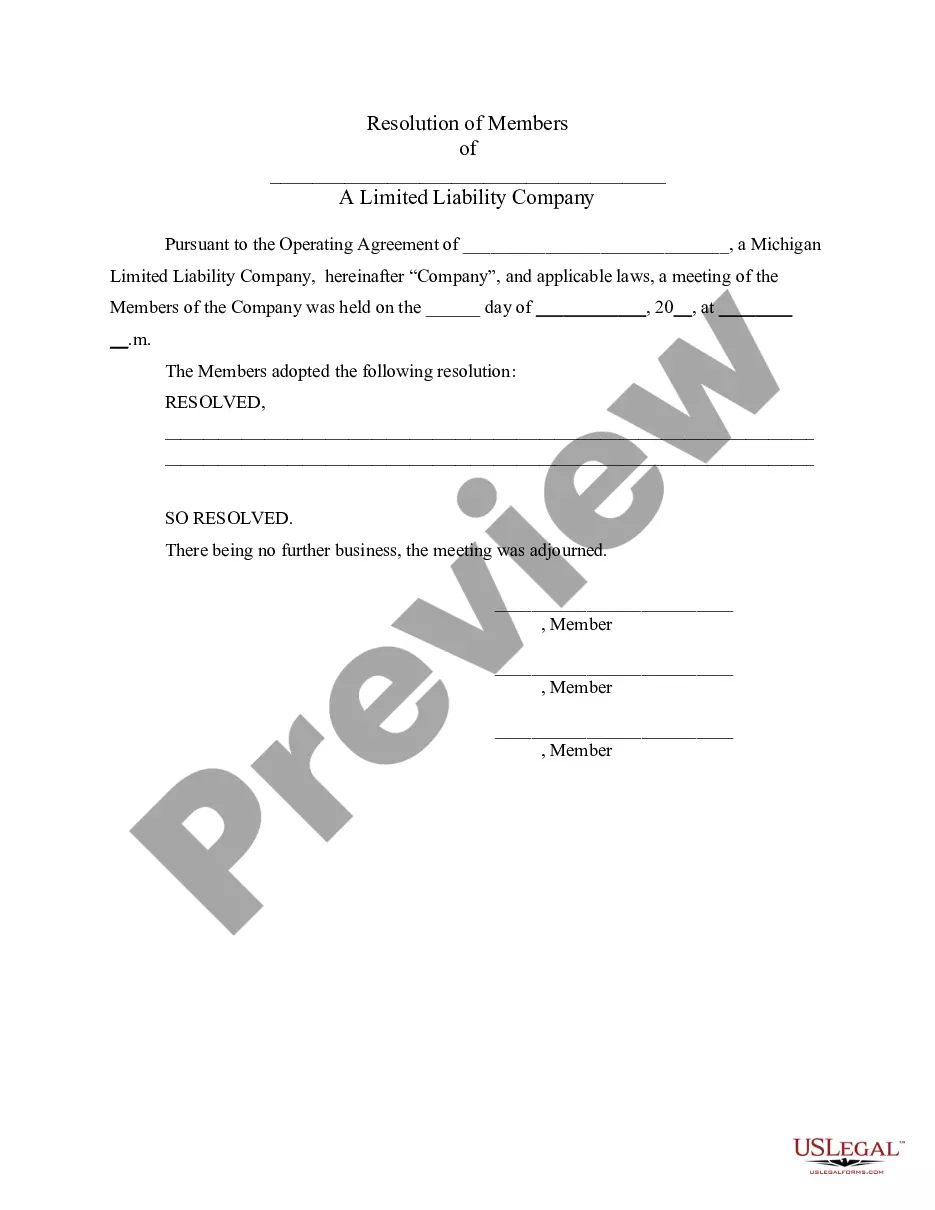

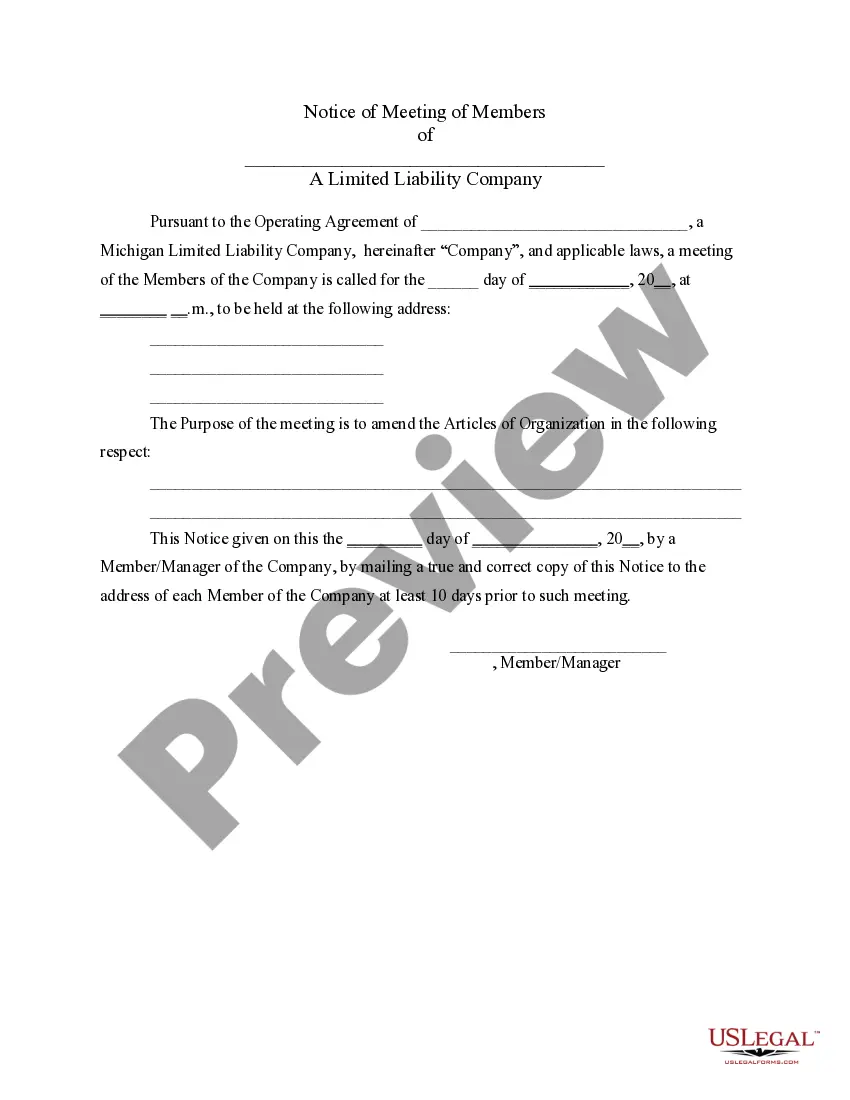

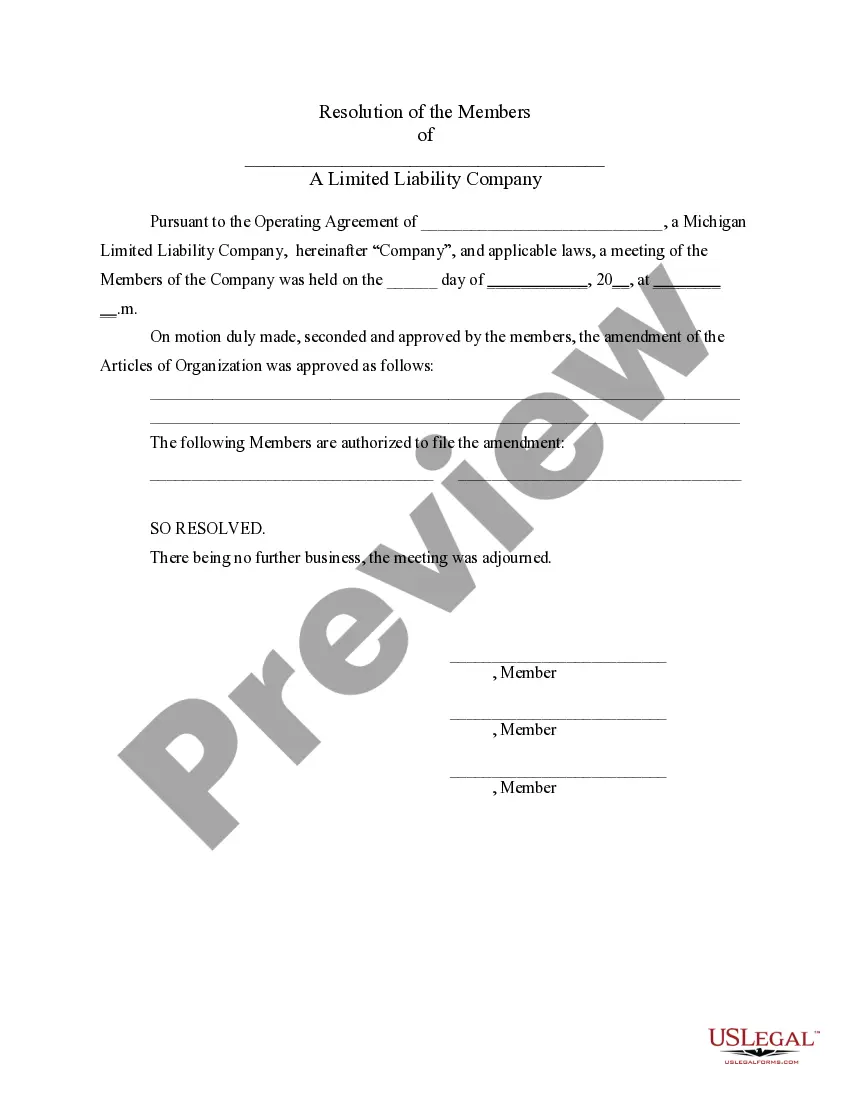

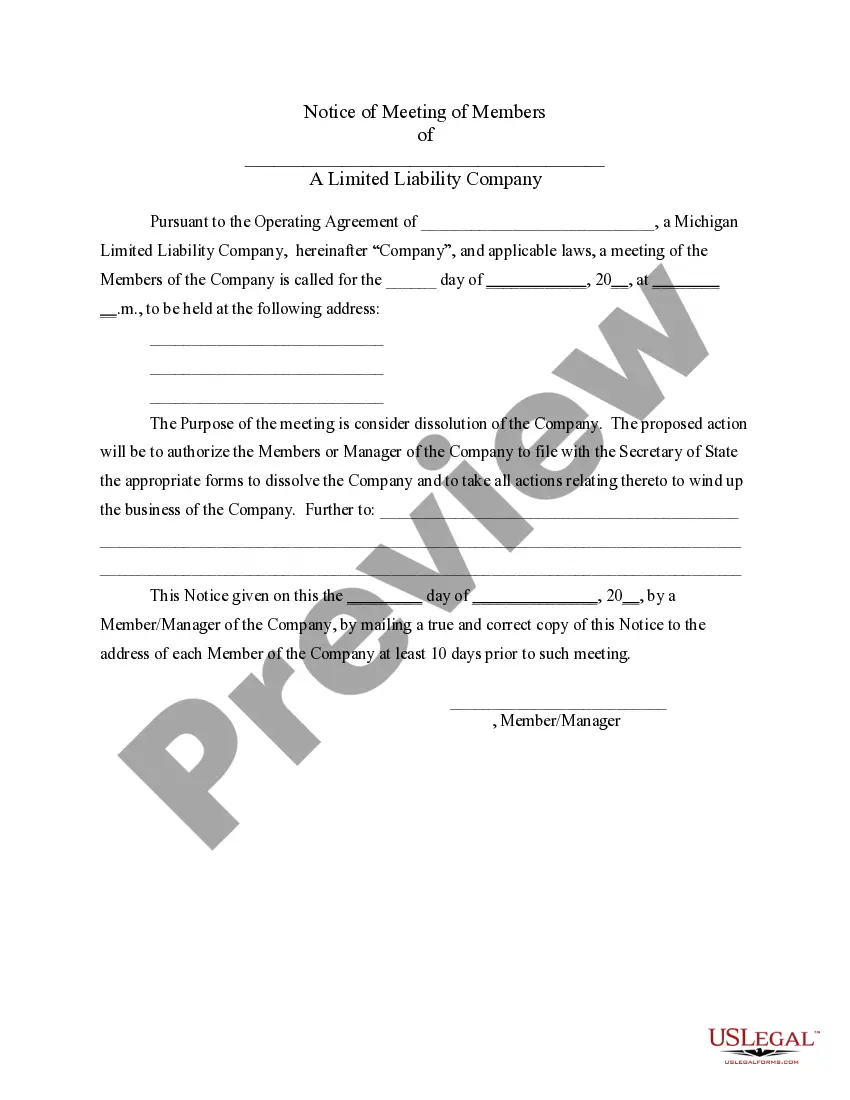

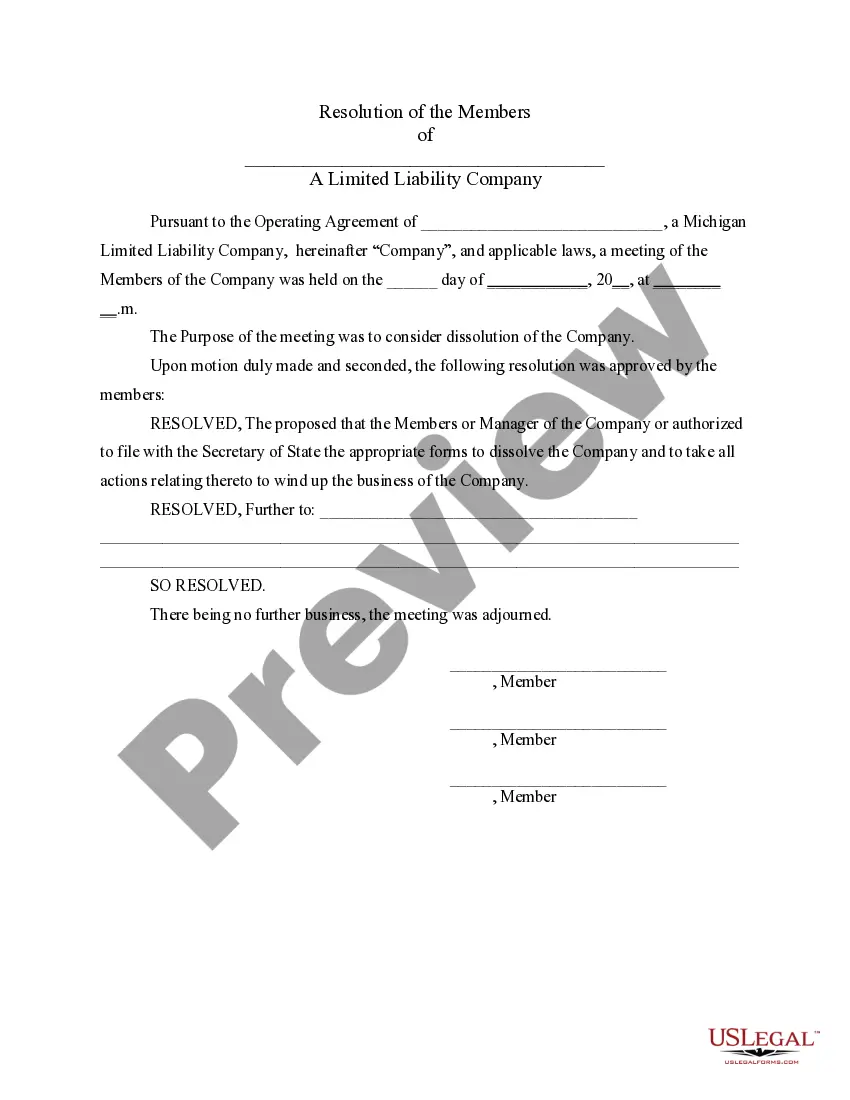

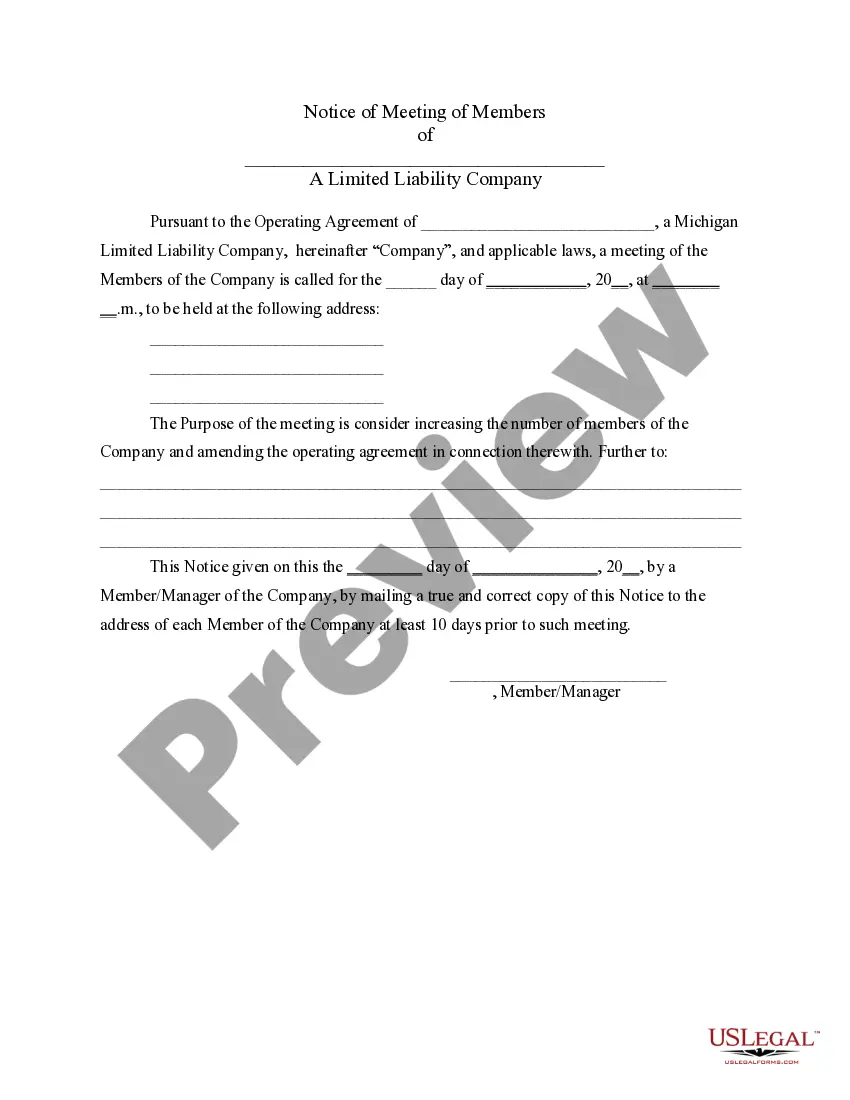

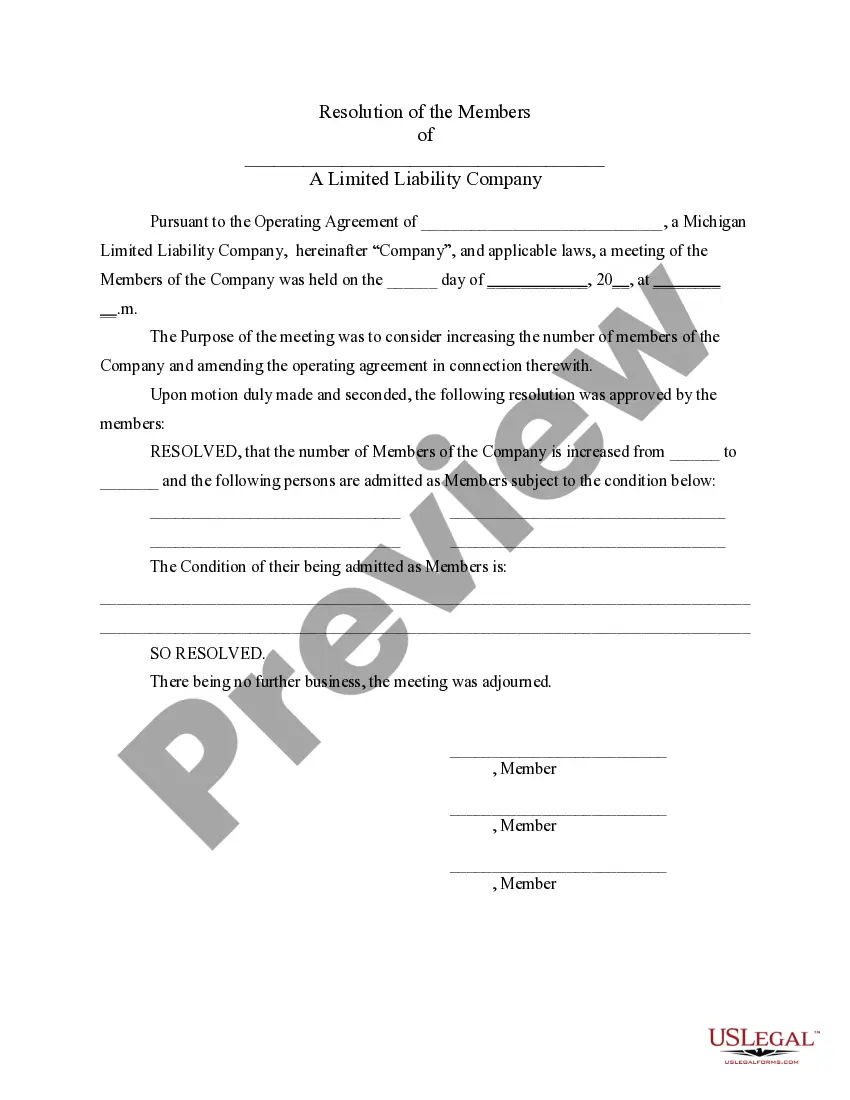

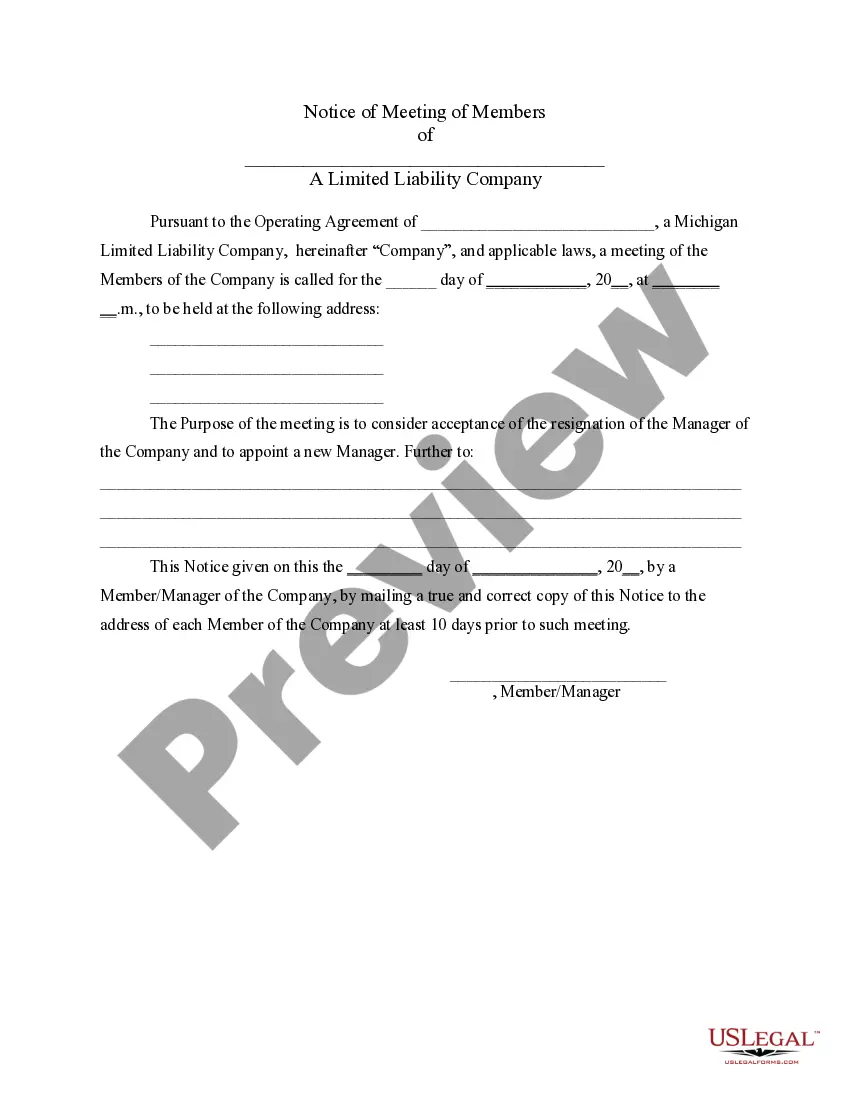

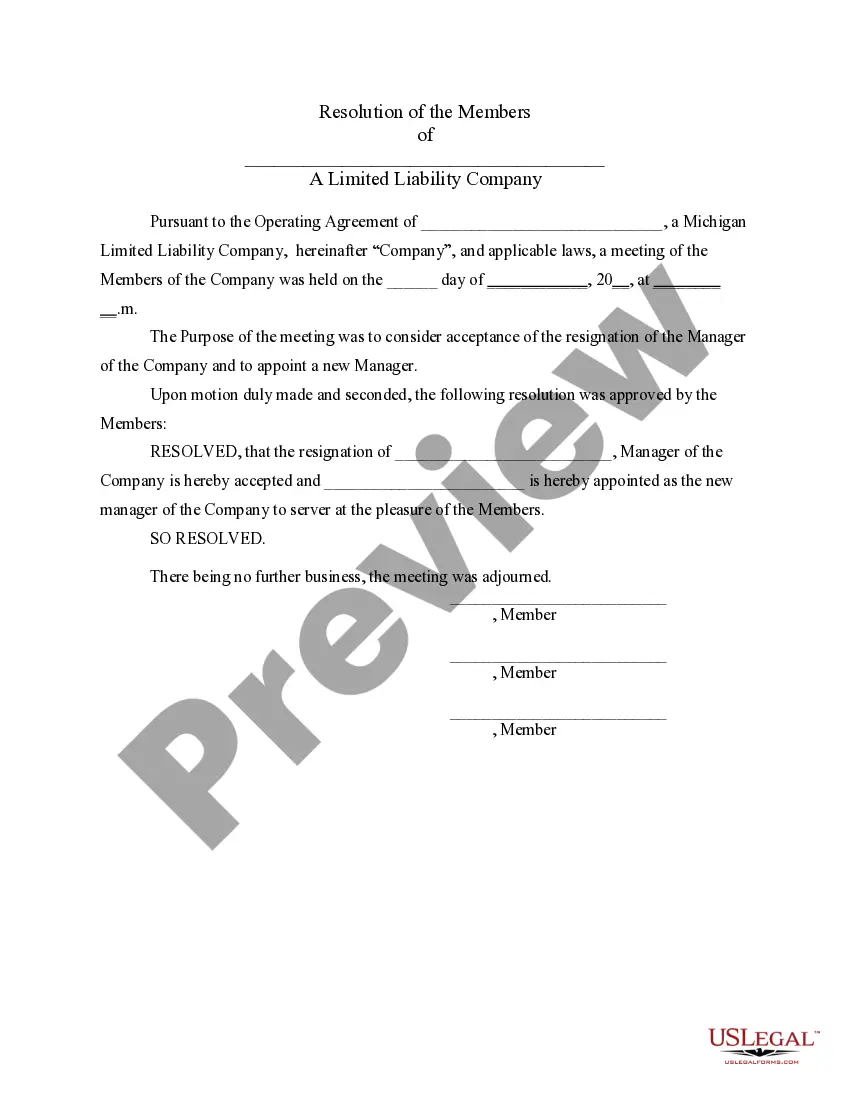

Save time and effort searching for the documents you require, and leverage US Legal Forms’ advanced search and Preview feature to obtain the Michigan Limited Liability Company with multiple owners and download it.

Take advantage of the US Legal Forms online catalog, supported by 25 years of expertise and credibility. Transform your daily document management into a straightforward and user-friendly process today.

- If you already have a subscription, Log In to your US Legal Forms account, seek out the form, and download it.

- Check the My documents tab to review the documents you have previously saved and manage your folders as needed.

- For first-time users of US Legal Forms, create a complimentary account for unlimited access to all platform features.

- After obtaining the form you require, verify that it is the correct document by previewing it and reviewing its details.

- Ensure that the template is recognized in your state or county.

- Click Buy Now when you are prepared.

- Select a subscription plan.

- Choose the format you prefer, and Download, fill out, sign, print, and submit your document.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your needs, from personal to business forms, in one place.

- Utilize state-of-the-art tools to establish and oversee your Michigan Limited Liability Company with multiple owners.

Form popularity

FAQ

Most states do not restrict LLC ownership, and there is generally no maximum number of members. An LLC with one owner is known as a single-member LLC, while an LLC with multiple owners is known as a multi-member LLC.

Here are the steps to starting an LLC in Michigan: Choose an LLC name and make sure it's available. Choose who will be your Michigan Registered Agent. File the Michigan LLC Articles of Organization. Complete and sign an LLC Operating Agreement. Get a Tax ID Number (EIN) from the IRS. Research business license requirements.

Since the default rule for multi-members LLCs is that the LLC is treated as a partnership, an LLC composed solely of a husband and wife will be a partnership for tax purposes unless the members choose to have it elect to be treated as a corporation.

Divide ownership of the LLC by calculating total cash investment by the members. Give each member an ownership stake equal to his cash investment. Four members contributing $25,000 apiece would each receive a 25 percent stake in the company.

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes.