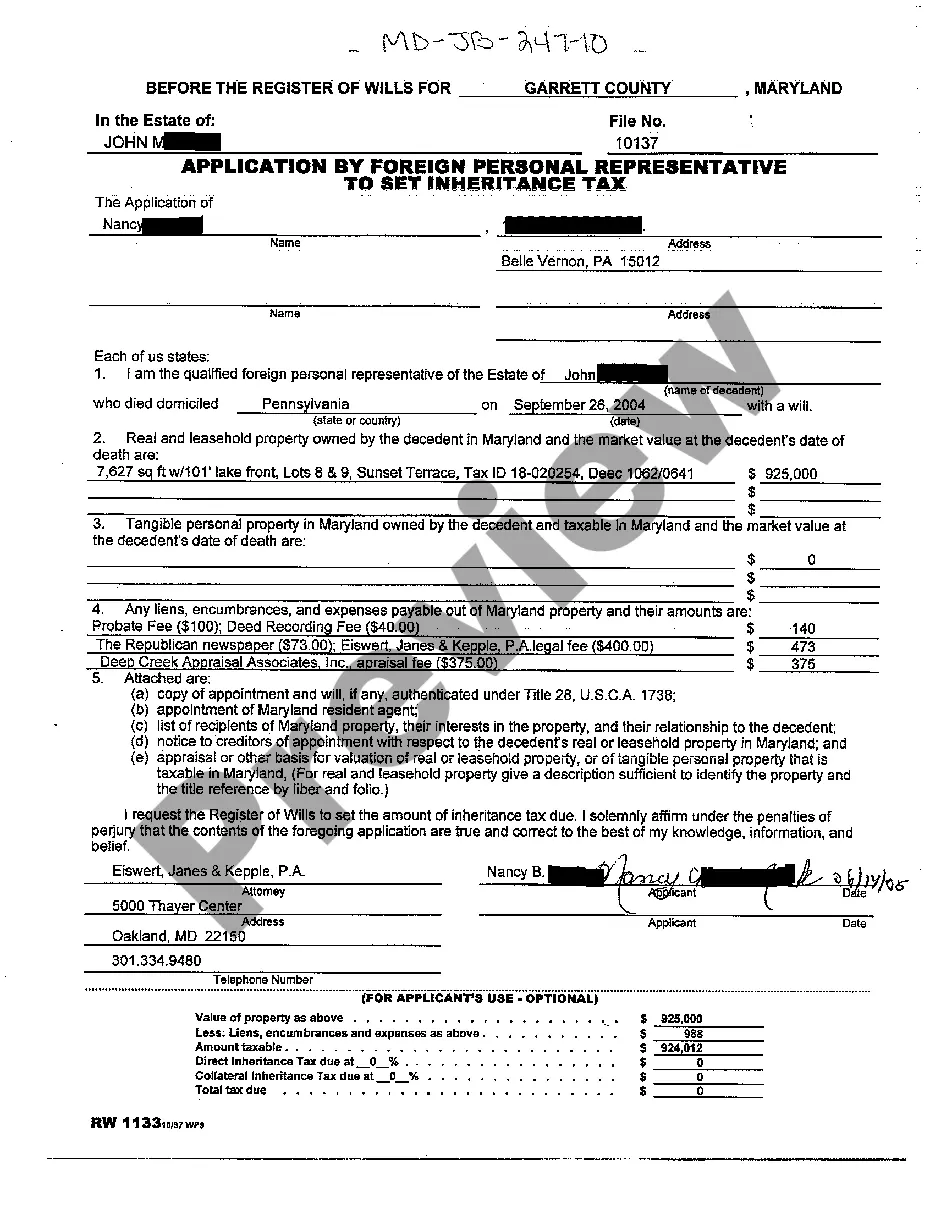

Maryland Inheritance Tax Waiver Form With Pa

Description

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

The Maryland Inheritance Tax Waiver Document With Pa you see on this page is a reusable legal template crafted by professional attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has furnished individuals, businesses, and lawyers with more than 85,000 verified, state-specific forms for any business or personal circumstance. It’s the quickest, easiest, and most reliable way to obtain the documentation you require, as the service ensures bank-level data protection and anti-malware measures.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances readily available.

- Search for the document you require and review it.

- Browse the example you searched and either preview it or examine the form description to confirm it meets your needs. If it does not, utilize the search feature to find the appropriate one. Click Buy Now once you have found the template you need.

- Register and sign in.

- Choose the pricing option that suits you and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the editable template.

- Choose the format you desire for your Maryland Inheritance Tax Waiver Document With Pa (PDF, Word, RTF) and download the sample onto your device.

- Fill out and sign the documentation.

- Print the template to complete it manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature.

- Re-download your documents as needed.

- Access the same document anytime required. Open the My documents tab in your account to redownload any previously purchased forms.

Form popularity

FAQ

Yes, there are strategies to potentially reduce or avoid Pennsylvania inheritance tax. One effective method is to utilize a Maryland inheritance tax waiver form with PA, which can provide clarity on tax exemptions for beneficiaries. Proper estate planning, including gifts made before death and establishing trusts, can also minimize tax liabilities. It is advisable to consult a tax professional to explore your specific situation and ensure compliance with both Maryland and Pennsylvania tax laws.

The PA inheritance tax waiver is a document that helps clarify the tax obligations related to inherited property. It allows heirs to assert their rights and potentially prevent future tax complications. When filed properly, it can facilitate smoother transactions of inherited assets. Utilizing platforms like uslegalforms can simplify the process of obtaining a Maryland inheritance tax waiver form with PA.

While you cannot completely avoid inheritance tax in Pennsylvania, you may reduce your burden through careful planning. Gifting assets during your lifetime or positioning your estate appropriately can lessen your tax impact. Consider using a Maryland inheritance tax waiver form with PA to streamline this process and potentially offer relief. It is wise to consult with an estate planner to explore your options.

Yes, Pennsylvania taxes out-of-state inheritances. If you receive property or assets from an estate outside Pennsylvania, the state still requires you to report it for tax purposes. Therefore, you might need to file a Maryland inheritance tax waiver form with PA to clarify your obligations. It’s important to keep this in mind when planning your estate or inheritance.

Maryland does not offer an outright waiver for inheritance tax; however, the state does provide certain exemptions and deductions that can significantly reduce tax liabilities. To navigate these exemptions effectively, you may want to obtain the Maryland inheritance tax waiver form with PA. This form can offer guidance on achieving the most favorable outcomes for your estate.

Yes, Pennsylvania does provide a form of waiver associated with inheritance tax. This waiver can be essential for heirs to avoid tax liabilities on certain assets. Utilizing the Maryland inheritance tax waiver form with PA can further assist you in understanding the process and documentation required for a smooth transition.

In Pennsylvania, several asset types are exempt from inheritance tax, including real estate transferred to a spouse and certain small business interests. Additionally, life insurance proceeds and retirement accounts that name a beneficiary are generally exempt. For detailed information, you may refer to the Maryland inheritance tax waiver form with PA to ensure you are fully informed about what assets you can protect.

Yes, Pennsylvania offers several exemptions for inheritance tax, especially for spousal inheritances and transfers to certain charitable organizations. Understanding these exemptions can help beneficiaries reduce their tax liabilities. Using tools like the Maryland inheritance tax waiver form with PA, inhabitants can identify applicable exemptions that might be beneficial to their financial planning.

You can avoid Maryland inheritance tax on certain properties by considering the structure of your estate and beneficiary designations. Establishing a living trust or making gifts during your lifetime are common strategies. Using the Maryland inheritance tax waiver form with PA can help you better understand the available exemptions and ensure that your estate planning is optimized.

Yes, Pennsylvania may impose inheritance tax on out of state property if the deceased had a connection to Pennsylvania. If the deceased was a resident of PA, all assets, including out of state property, can be subject to the state's inheritance tax. To navigate this complex situation, obtaining the Maryland inheritance tax waiver form with PA can clarify tax obligations.