Maryland Tax Lien Foreclosure Process

Description

Form popularity

FAQ

Navigating the Maryland tax lien foreclosure process can be challenging, but there are ways to address a tax lien effectively. First, consider paying off the lien in full to halt any foreclosure actions. If this isn’t feasible, negotiating with the county for a payment plan may help you resolve the issue without losing your property. Additionally, utilizing platforms like US Legal Forms can provide you with essential documents and guidance on how to manage your situation more effectively.

Yes, Maryland does provide a foreclosure redemption period, which lasts for six months after the sale. During this time, you have the opportunity to reclaim your property by paying off the owed amounts. This aspect of the Maryland tax lien foreclosure process gives homeowners a second chance to secure their home. It is advisable to stay informed about this period, and resources from US Legal Forms can guide you through the necessary steps.

To claim surplus funds from a foreclosure in Maryland, you must file a petition in the appropriate court. This usually occurs within a specified timeframe after the property is sold. By understanding the Maryland tax lien foreclosure process, you can ensure you adhere to important deadlines and requirements. Consulting with reliable platforms like US Legal Forms can simplify this procedure for you.

The most effective way to remove a tax lien involves settling the debt with the state or establishing a payment arrangement. Once you fulfill your obligation, you can request a release of the lien. This step is vital for anyone navigating the Maryland tax lien foreclosure process, as a clear title can open doors to new opportunities. Utilizing services like US Legal Forms can assist you in documenting these changes correctly.

In Maryland, state tax liens last for a period of 12 years. This time period starts from the date the lien is recorded. It is crucial to understand this duration as it affects your financial planning, especially in relation to the Maryland tax lien foreclosure process. Keeping track of these timelines can provide peace of mind and help you take proactive measures.

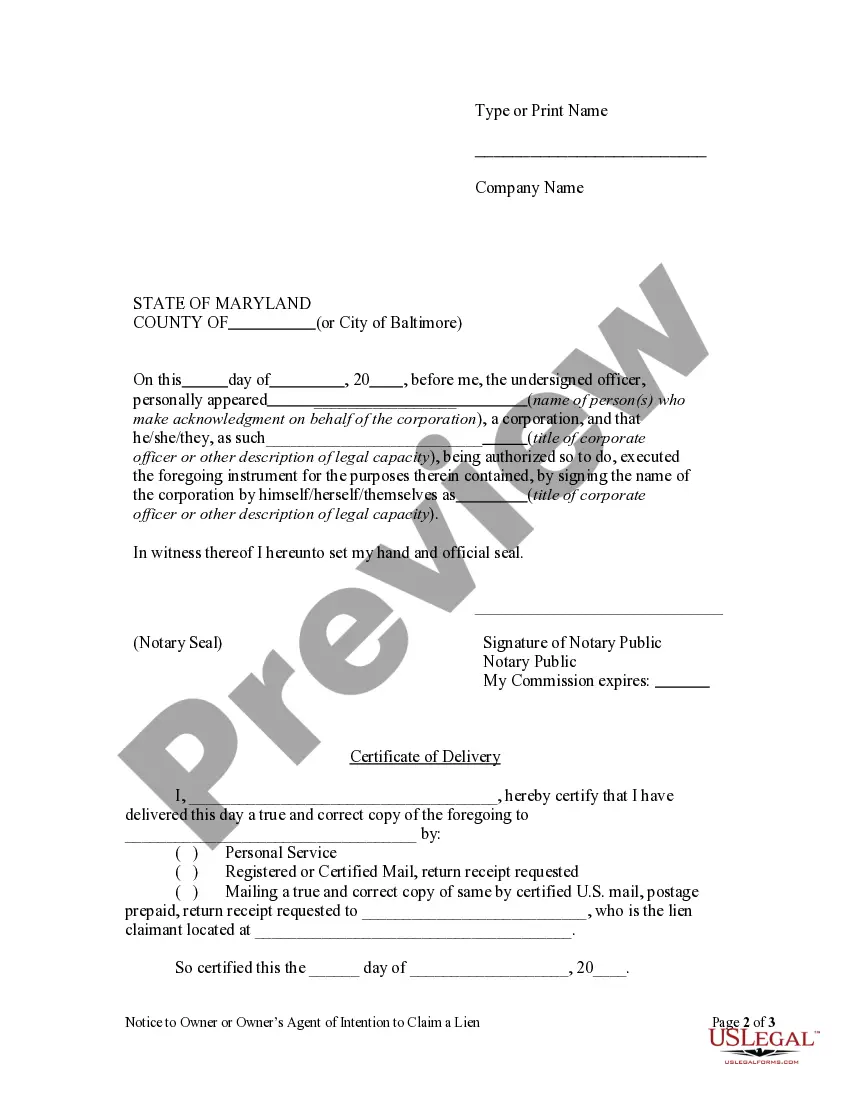

To foreclose on a tax lien property in Maryland, you must follow a legal process that includes notifying the property owner and filing a suit in court. It's advisable to gather all necessary documentation before starting this process. Consulting with a legal professional or utilizing resources from US Legal Forms can simplify your journey through the Maryland tax lien foreclosure process.

Maryland can collect taxes dating back up to 12 years. This time frame applies to various tax debts, including property taxes. Therefore, if you owe taxes, it's important to address them promptly to avoid complications in the Maryland tax lien foreclosure process.

A tax lien in Maryland typically lasts for 12 years from the date the tax becomes due. After 12 years, the lien is no longer enforceable unless renewed. Being aware of this timeline can help you manage your financial obligations effectively during the Maryland tax lien foreclosure process.

Yes, liens can expire in Maryland, but it depends on their type. For tax liens, they generally last for 12 years but can be renewed if the tax remains unpaid. It’s crucial to monitor your property’s tax status to avoid complications during the Maryland tax lien foreclosure process.

Foreclosing on a tax lien in Maryland involves a specific legal process. After the lien matures, the holder must file a petition in the circuit court. Successfully navigating this process may require assistance, either from an attorney or through platforms like US Legal Forms, which provide resources and documents for the Maryland tax lien foreclosure process.