Receipt And Release Form Estate Withholding Tax

Definition and meaning

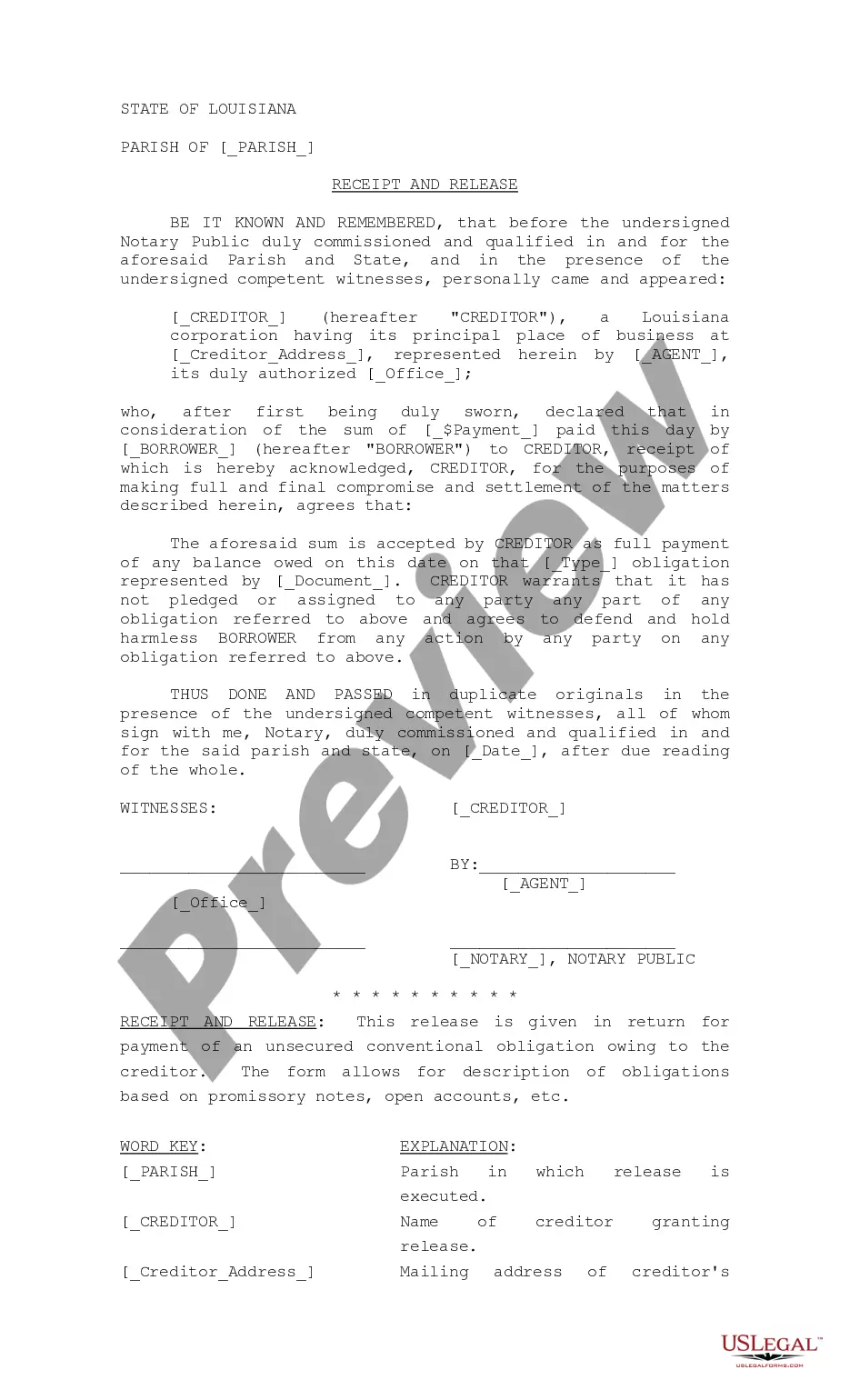

The Receipt and Release Form for estate withholding tax is a legal document that serves as a formal acknowledgment from a creditor, confirming the receipt of payment from a borrower. This document is particularly significant in estate management, where debts or obligations must be settled before assets are distributed. It essentially releases the borrower from any further claims related to the specified obligation, ensuring that the estate is cleared of that particular debt.

How to complete a form

To complete the Receipt and Release Form for estate withholding tax, follow these steps:

- Gather information: Collect details about the creditor, borrower, and the obligation being settled.

- Fill in the form: Enter the names of the creditor and borrower, the date of the receipt, the amount paid, and the type of obligation being released.

- Sign and date: Both parties must sign to acknowledge the transaction and the release of obligations.

- Notarization: Have the form notarized to provide legal validation.

Ensure that all details are accurate to avoid any future disputes.

Who should use this form

This form is ideal for individuals or entities who have settled a debt related to an estate, and need to formally document the release of that obligation. Common users include:

- Executors of estates seeking to settle debts before asset distribution.

- Borrowers who have paid off debts and require a formal receipt.

- Creditors looking to confirm that a payment has been received and to release claims against the borrower.

Key components of the form

The Receipt and Release Form for estate withholding tax includes several critical components:

- Creditor Information: Details about the creditor, including name and address.

- Borrower Information: The name of the individual or entity paying the debt.

- Payment Details: The amount paid and the date of payment.

- Description of the Obligation: A brief description of the type of obligation, such as a loan or account.

- Signatures: Signatures of both parties and acknowledgment by a notary public.

Each section must be completed accurately to ensure the validity of the document.

Benefits of using this form online

Utilizing an online template for the Receipt and Release Form offers numerous advantages:

- Convenience: Access the form anytime and anywhere.

- Time-saving: Fill out the form quickly without the need for a physical visit to a legal office.

- Guidance: Online platforms often provide instructions and tips to help users complete the form correctly.

- Cost-effective: Downloadable forms may be less expensive than traditional legal services.

These benefits make online access appealing for users who prefer a straightforward approach.

Common mistakes to avoid when using this form

When filling out the Receipt and Release Form, avoid these common pitfalls:

- Incomplete Information: Ensure all fields are completed accurately.

- Incorrect Signatures: Both parties must sign; oversights can invalidate the document.

- Failing to Notarize: Notarization may be required for the release to be legally binding.

- Using Incorrect Payment Amounts: Double-check the payment amount to ensure accuracy.

Being cautious can prevent legal complications down the line.

How to fill out Louisiana Receipt And Release?

Individuals often link legal documentation with intricate matters that require the attention of an expert.

In a way, this is correct, as creating a Receipt And Release Form Estate Withholding Tax necessitates significant knowledge of subject matter, including local and regional laws.

However, with US Legal Forms, everything has become simpler: a curated collection of ready-to-use legal documents for any life and business scenario relevant to state regulations is now available online for everyone.

You can print your document or upload it to an online editor for quicker completion. All templates in our repository are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Experience all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current documents organized by state and application area, so searching for the Receipt And Release Form Estate Withholding Tax or any specific template only takes a few moments.

- Users with an active subscription must Log In to their account and select Download to get the document.

- New users will have to create an account and subscribe before downloading any legal paperwork.

- Here’s a detailed process on how to obtain the Receipt And Release Form Estate Withholding Tax.

- Review the content on the page thoroughly to ensure it meets your needs.

- Read the form description or view it using the Preview option.

- If the previous form does not meet your requirements, search for another sample using the Search field at the top.

- Click Buy Now once you locate the suitable Receipt And Release Form Estate Withholding Tax.

- Select a subscription plan that fits your requirements and budget.

- Create an account or Log In to proceed to the payment page.

- Complete the payment for your subscription through PayPal or using your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

Executors file this form to report the final estate tax value of property distributed or to be distributed from the estate, if the estate tax return is filed after July 2015. This form, along with a copy of every Schedule A, is used to report values to the IRS.

For those who wish to continue to receive estate tax closing letters, estates and their authorized representatives may call the IRS at (866) 699-4083 to request an estate tax closing letter no earlier than four months after the filing of the estate tax return.

The decedent's final return includes income and deductions through the date of death, but certain elections, such as deducting medical costs paid after death, should be considered. It is the responsibility of the decedent's executor or personal representative to file the decedent's final Form 1040.

An estate tax closing letter is a form letter that the Internal Revenue Service (IRS) will send to you after your IRS Form 706 has been reviewed and accepted. Form 706 is a rather lengthy return that the executor of an estate will file after the death of an individual.

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $11.7 million for decedents who died in 2021 ($12.06 million in 2022), or 2.