What Is A Usufruct Account

Description

How to fill out Louisiana Grant Of Usufruct?

- If you are a returning user, log in to your account to easily download the form template you need. Confirm that your subscription is current; if not, renew it as per your chosen payment plan.

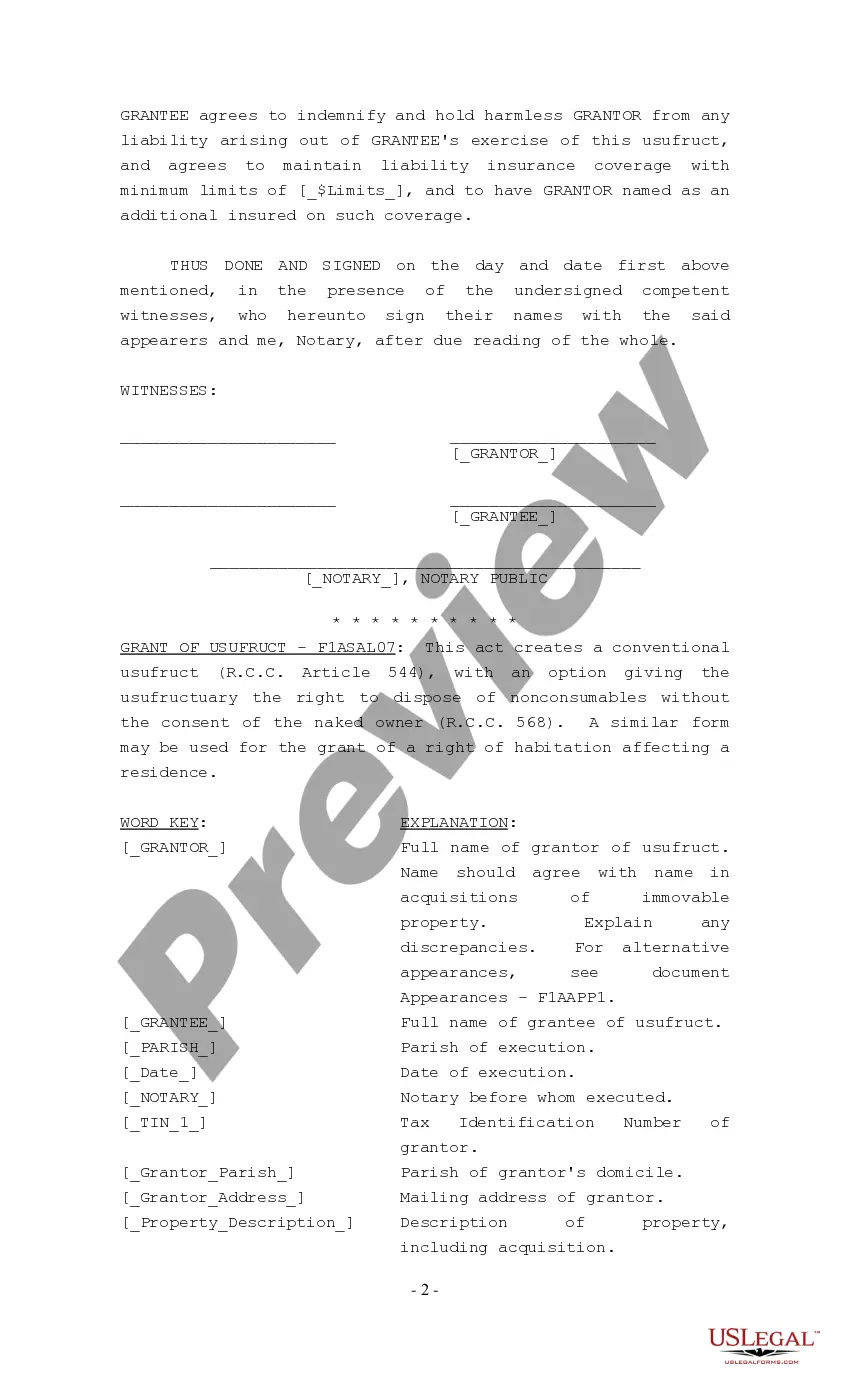

- For new users, start by reviewing the form description and preview mode. This ensures the template you select meets your needs and complies with your local jurisdiction.

- In case you find another template more suitable, utilize the Search tab to find the right one. Once you've identified a suitable document, proceed to the next step.

- Make your document purchase by clicking 'Buy Now.' Choose your preferred subscription plan, and create an account to gain access to the extensive library.

- Complete your purchase by entering your credit card information or opting for your PayPal account. This secures your subscription and access to documents.

- Finally, download your completed form and save it on your device. You can also access this document anytime in the My Forms section of your profile.

By following these steps, you can efficiently navigate the process of setting up a usufruct account using US Legal Forms. The platform not only simplifies legal processes but ensures accuracy with its comprehensive library of over 85,000 fillable templates.

Empower yourself today and streamline your legal needs by signing up with US Legal Forms!

Form popularity

FAQ

An example of a usufruct right could involve a grandparent granting a grandchild the right to live in their home for a set number of years while retaining ownership of the property. This allows the grandchild to enjoy the home without taking over ownership responsibilities. Such arrangements highlight how versatile a usufruct account can be in serving mutual interests. For personalized advice, consulting legal experts can offer tailored insights.

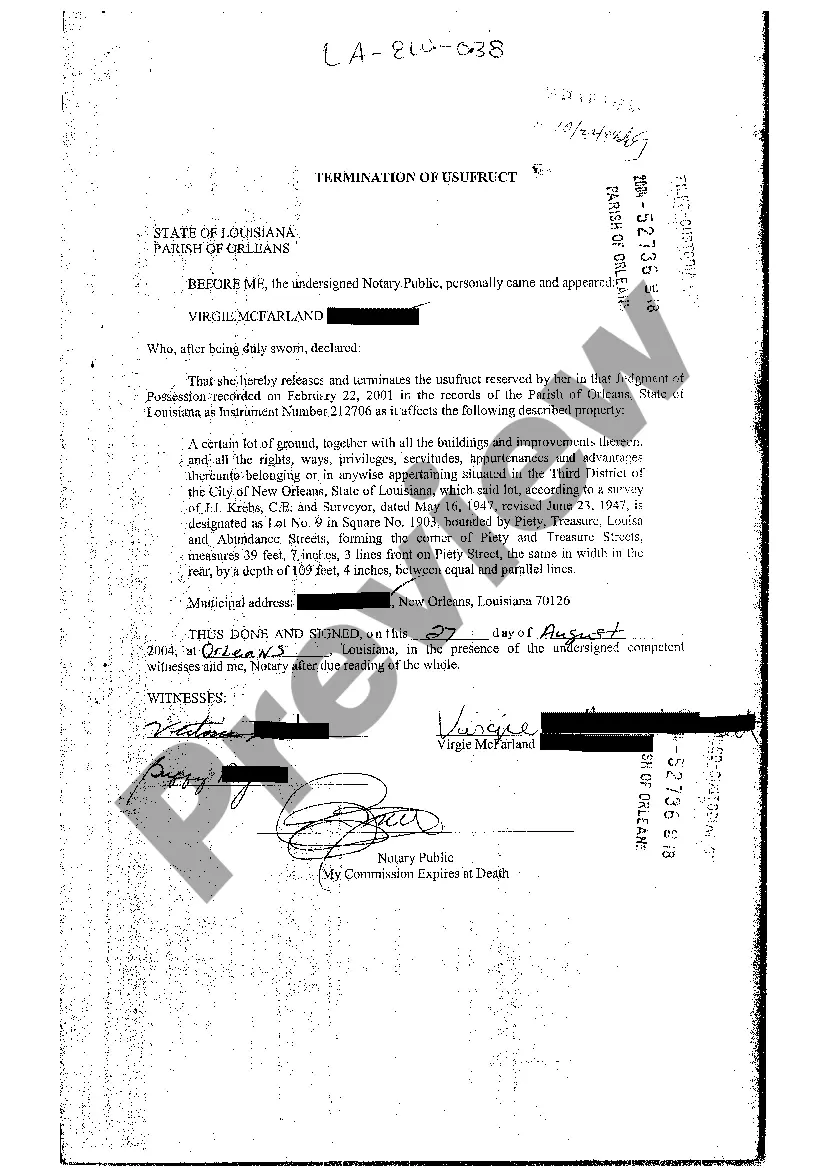

The duration of a usufruct can vary based on the terms agreed upon by the parties involved, but it often lasts for a specified period or until the usufructuary's death. Some usufructs may be established for a lifetime, while others may be limited to a few years. It’s advisable to clearly articulate the duration in any agreements regarding a usufruct account to avoid ambiguities. Legal consultations can provide further guidance on establishing these timelines.

An example of usufruct rights includes the ability to reside in a house or utilize land for farming without owning the property. The usufructuary can enjoy these benefits while respecting the owner’s rights. This relationship illustrates how usufruct rights function in practice. If you're considering establishing a usufruct account, understanding these rights clearly can facilitate smoother arrangements.

Typically, the usufructuary is responsible for paying property taxes, as they benefit from the use of the property during the usufruct period. However, legal agreements can sometimes outline different responsibilities or arrangements. Thus, it's essential to review your specific usufruct account details for clarity on tax obligations. Engaging with legal professionals can help navigate these responsibilities effectively.

In most cases, the usufructuary cannot sell items from the property without permission from the owner. A usufruct allows the usufructuary to use and enjoy the property, but ownership rights remain with the original owner. This distinction is crucial when considering any transactions involving property. If you have any specific concerns, consulting with a legal expert can clarify the boundaries of your rights in relation to a usufruct account.

Usufruct is a legal arrangement that allows individuals to use and enjoy property owned by someone else. Its primary purpose is to manage inheritance and protect the interests of both the usufructuary and the owner. By allowing someone to benefit from the property while preserving ownership rights, usufruct serves as a crucial tool in estate planning. If you want to establish or better understand what a usufruct account can do for your assets, explore resources available on platforms like USLegalForms.

In Louisiana, the duration of usufruct can vary and is typically determined by the terms set in a will or an agreement. Generally, it can last for a specified period or until the death of the usufructuary. This provision aids in estate planning, ensuring that the property is managed effectively during the usufructuary's lifetime. To understand how this duration impacts your situation, consider seeking advice on what a usufruct account entails.

An usufructuary in Louisiana has specific rights over property but cannot sell it outright without permission. While they can use and benefit from the property, selling requires the consent of both the bare owner and a judicial authority. This ensures that the rights of the original owner are protected while allowing the usufructuary to manage the property efficiently. Knowing the limitations around what a usufruct account allows can save you from potential legal disputes.

In Louisiana, a usufruct refers to a legal right that allows one person to use and benefit from another person's property. Essentially, it means that the usufructuary can enjoy the property, receive income, or harvest fruits, without owning it outright. This distinction is important in estate planning and property management, particularly when considering how assets are distributed after death. Understanding what a usufruct account entails can help you navigate these complexities.

In Louisiana, a usufruct allows one party to use another person's property while the owner retains ownership. This legal arrangement involves the right to enjoy the benefits of the property, such as rental income, for a specified duration or until a particular event occurs. It's important to understand that the usufructuary is responsible for maintaining the property during this time. To explore more about how to set up what is a usufruct account, US Legal Forms provides resources and templates that can guide you through the process.