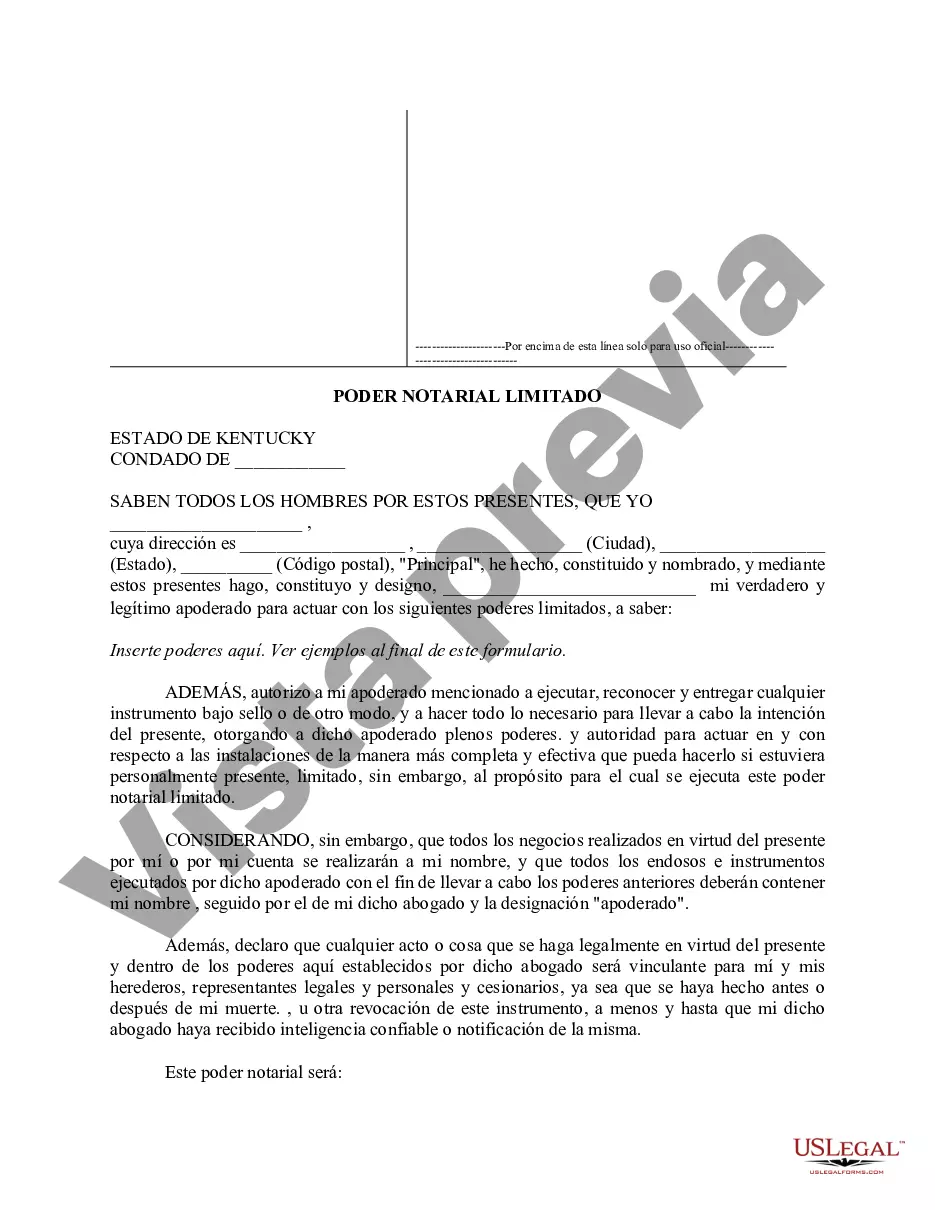

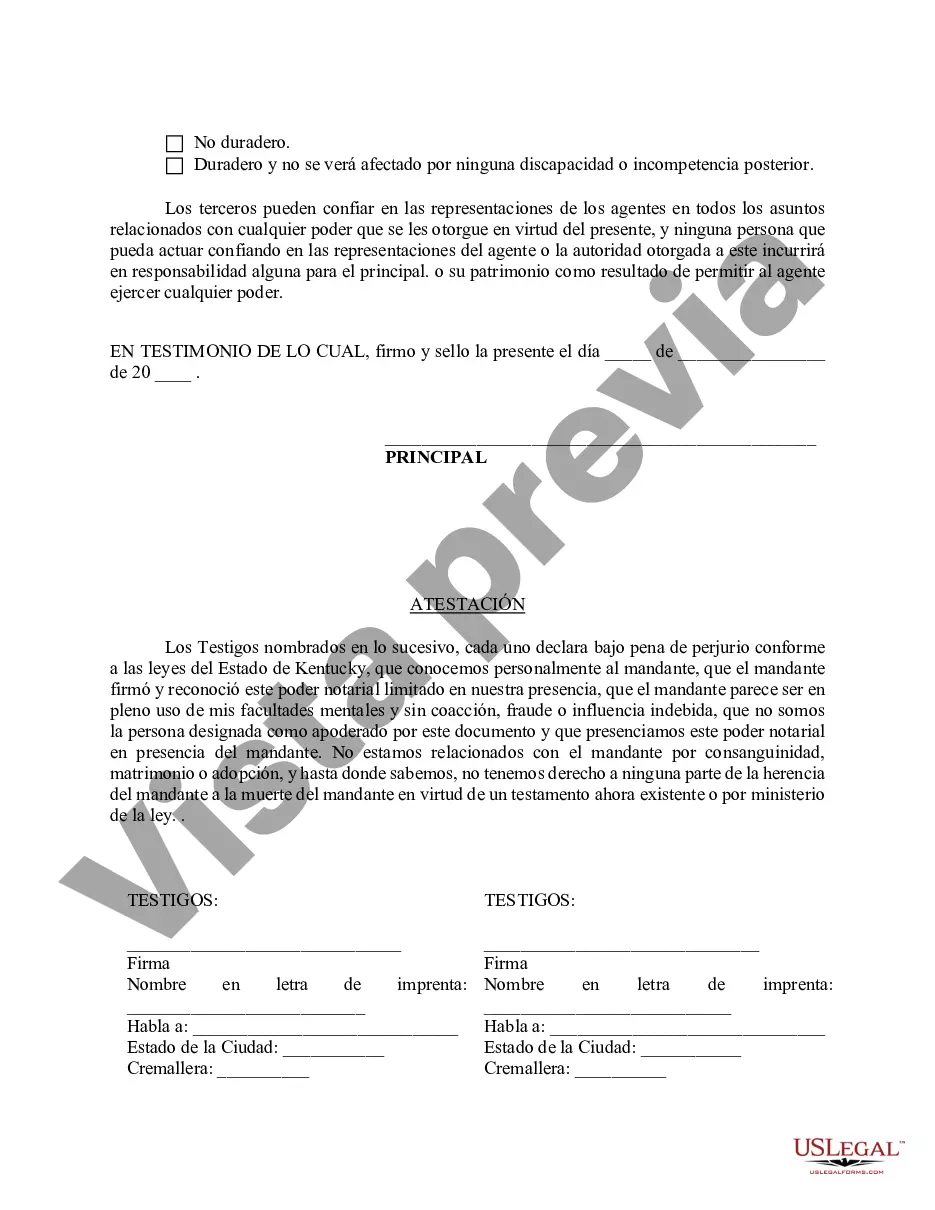

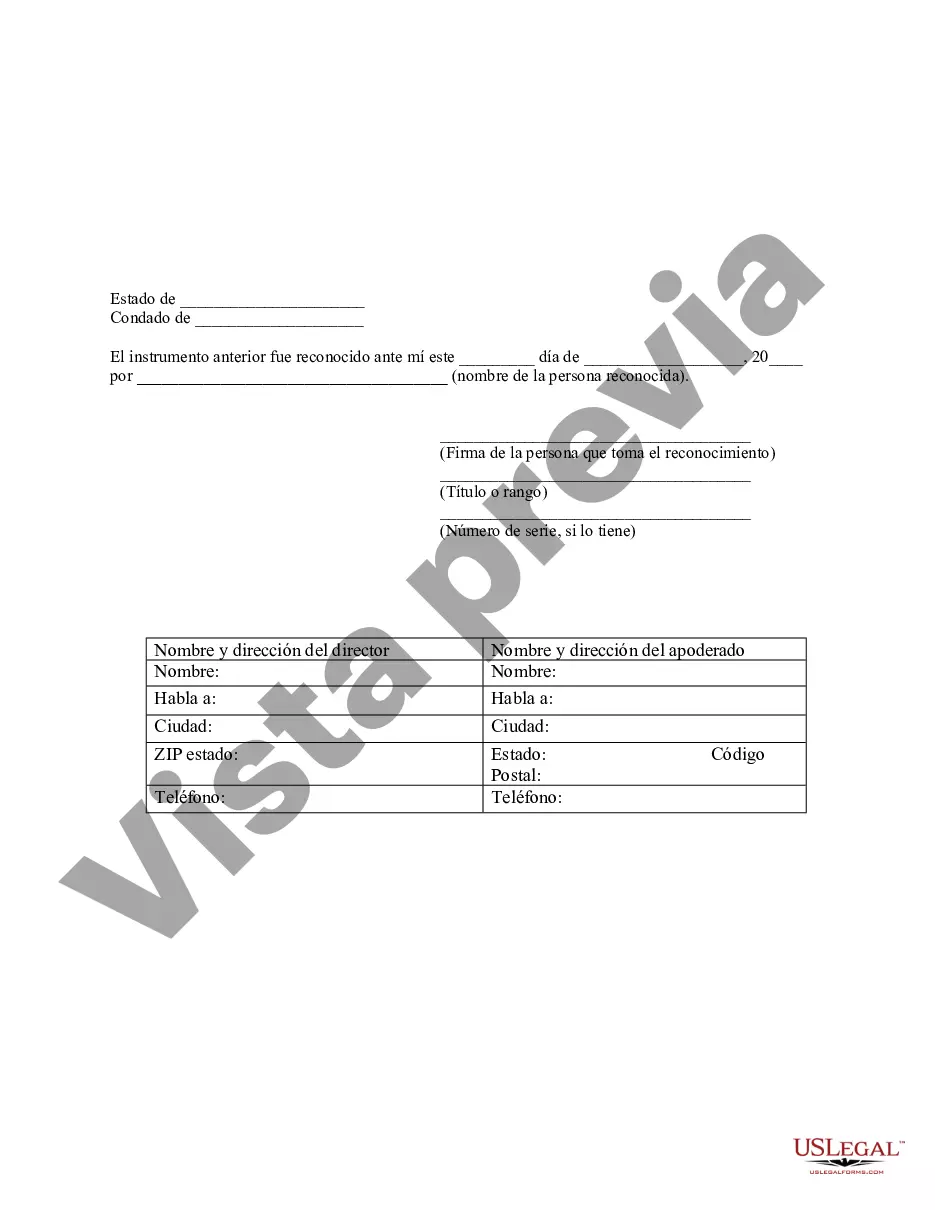

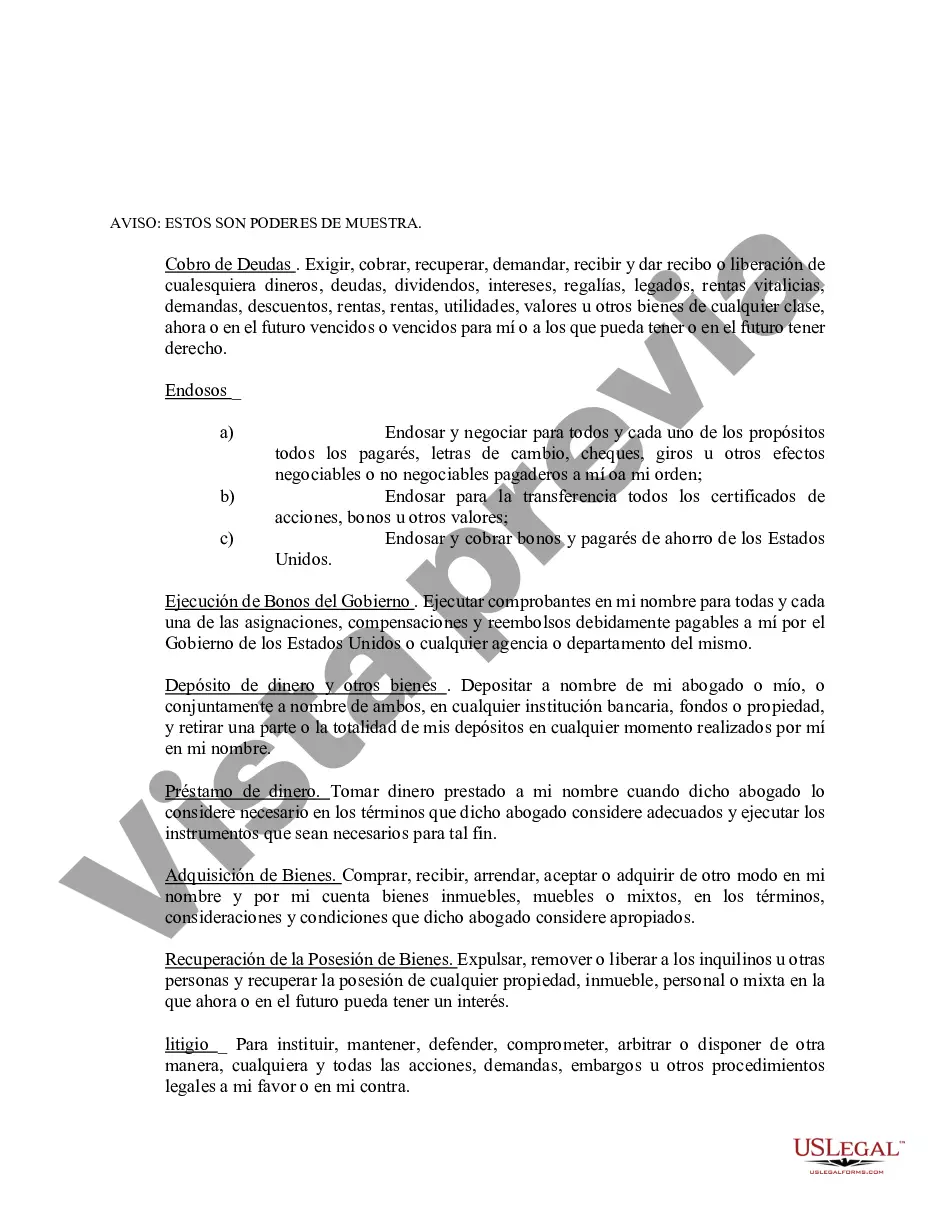

This is a limited power of attorney for Kentucky. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Kentucky powers with withholding refer to the provisions and regulations related to the withholding of income taxes from employees' wages by Kentucky power companies. This system ensures that the required amount of state income tax is deducted from employees' paychecks and remitted to the Kentucky Department of Revenue on their behalf. Kentucky powers with withholding play a vital role in ensuring the proper collection and payment of individual income taxes. Employers who are considered Kentucky power companies are responsible for calculating and withholding the correct amount of income tax from their employees' wages based on the state and federal tax laws. It is important to note that there are different types of Kentucky powers with withholding, depending on specific factors. Here are some of the key types: 1. Standard Withholding: This is the most common type of Kentucky powers withholding. It applies to regular wages paid to employees and follows the standard income tax rate schedule provided by the Kentucky Department of Revenue. 2. Supplemental Wage Withholding: Supplemental wages include bonuses, commissions, overtime pay, and other forms of extra compensation that are not part of regular wages. Kentucky power companies may have specific rules and rates for withholding taxes on supplemental wages. 3. Nonresident Withholding: This type applies to employees who are nonresidents of Kentucky but receive income from work performed within the state. Nonresidents working for Kentucky power companies may be subject to different withholding rates or exemptions. 4. Withholding Allowances: Employees can claim withholding allowances on their W-4 form to adjust the amount of income tax withheld from their wages. The Kentucky Department of Revenue provides guidelines for employers regarding the correct calculation of withholding based on these allowances. 5. Annual Reconciliation: Kentucky power companies are required to reconcile their withholding amounts annually. This process involves reporting the total amount of state income tax withheld from employees and submitting the appropriate forms to the Kentucky Department of Revenue. Overall, Kentucky powers with withholding ensure compliance with the state's income tax laws and facilitate the proper collection of taxes from employees by power companies. Employers must remain updated on the latest regulations and rates determined by the Kentucky Department of Revenue to accurately calculate and withhold income taxes from employees' wages.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.