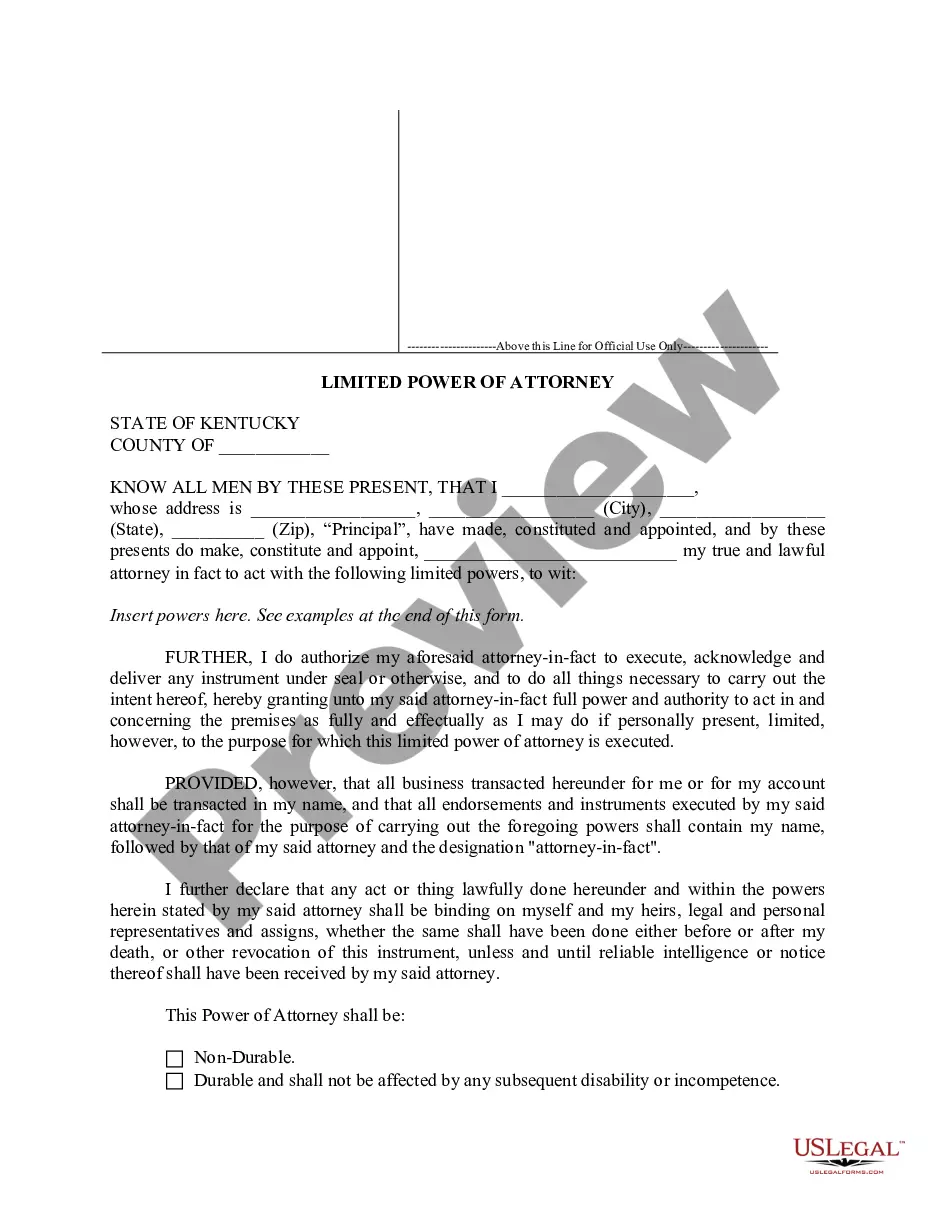

Kentucky Powers With Formula

Description

How to fill out Kentucky Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

It’s well-known that you can’t transform into a legal specialist instantly, nor can you swiftly learn how to draft Kentucky Powers With Formula without having a specific background.

Assembling legal documents is a lengthy process necessitating specialized training and expertise. So why not entrust the preparation of the Kentucky Powers With Formula to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can access everything from court documents to templates for internal communication.

Restart your search if you need any additional form.

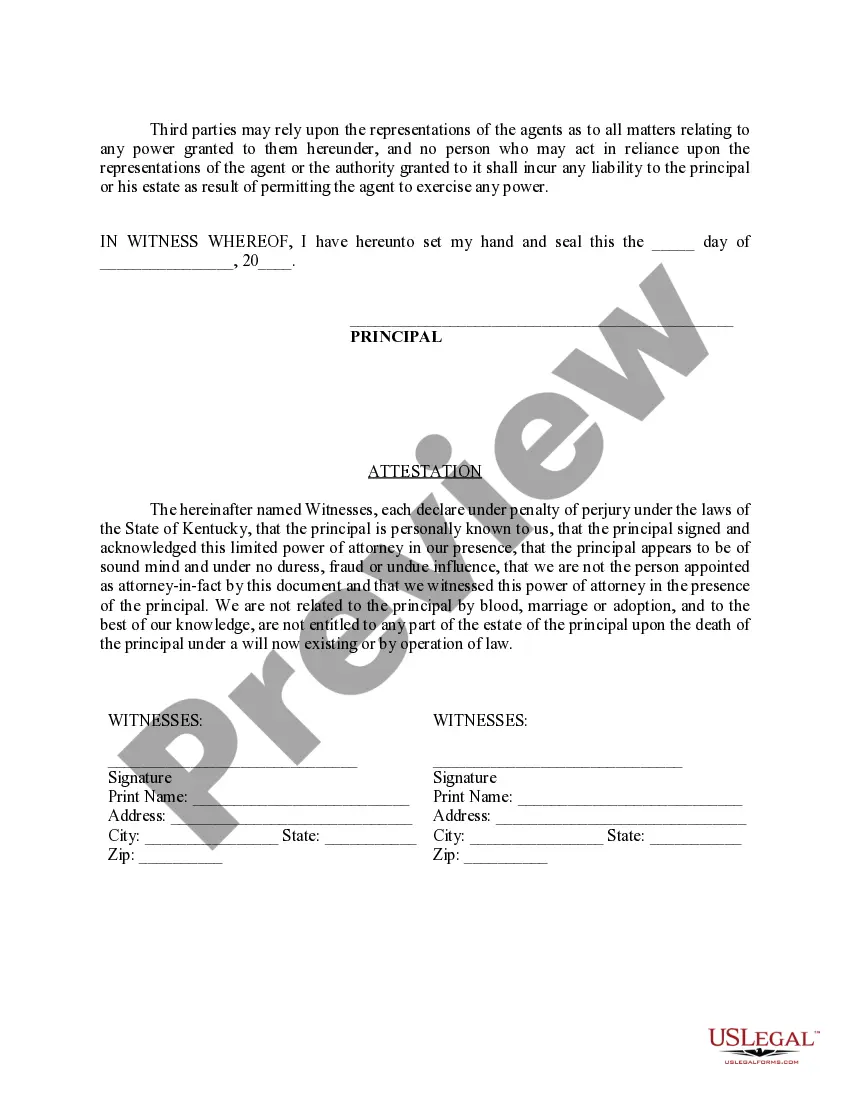

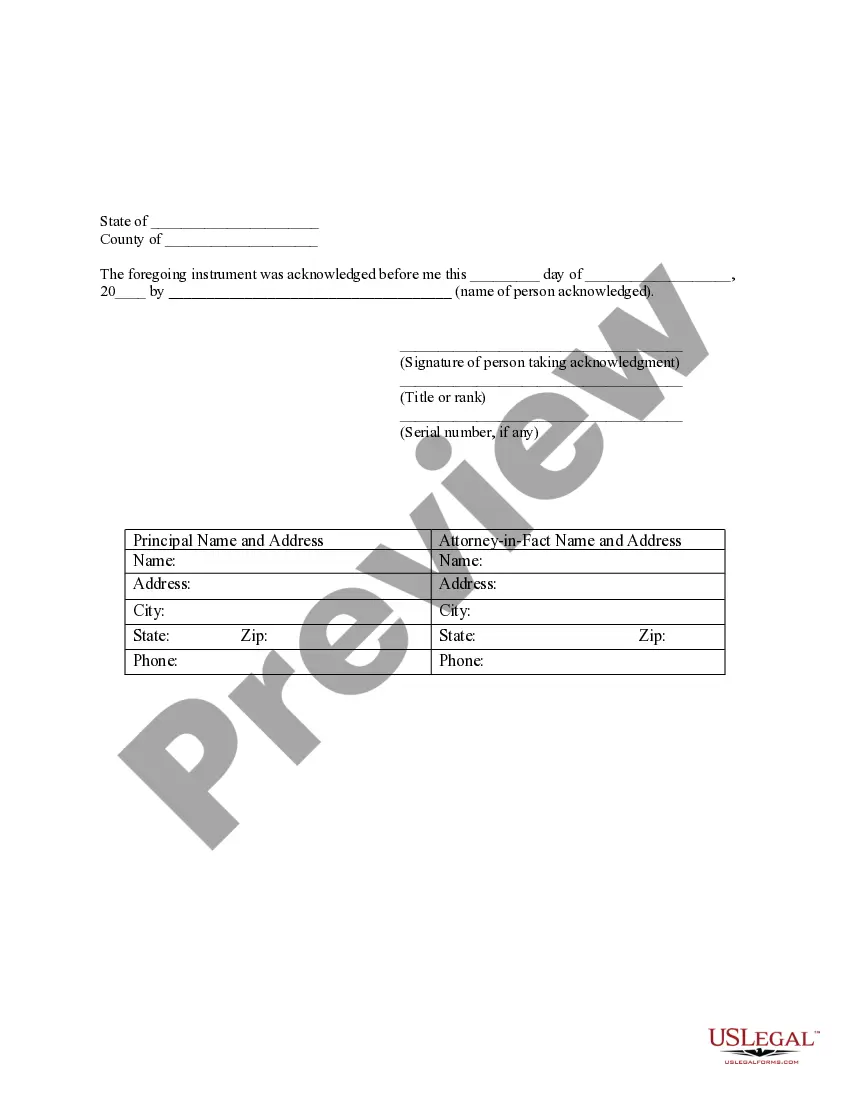

Establish a free account and choose a subscription plan to purchase the template. Click Buy now. Once the transaction is completed, you can download the Kentucky Powers With Formula, fill it out, print it, and send or mail it to the designated individuals or organizations.

- Recognize how crucial compliance and adherence to federal and state regulations are.

- That’s why, on our platform, all forms are region-specific and current.

- Here’s how to begin with our platform and acquire the document you need in just minutes.

- Locate the document you require using the search bar at the top of the page.

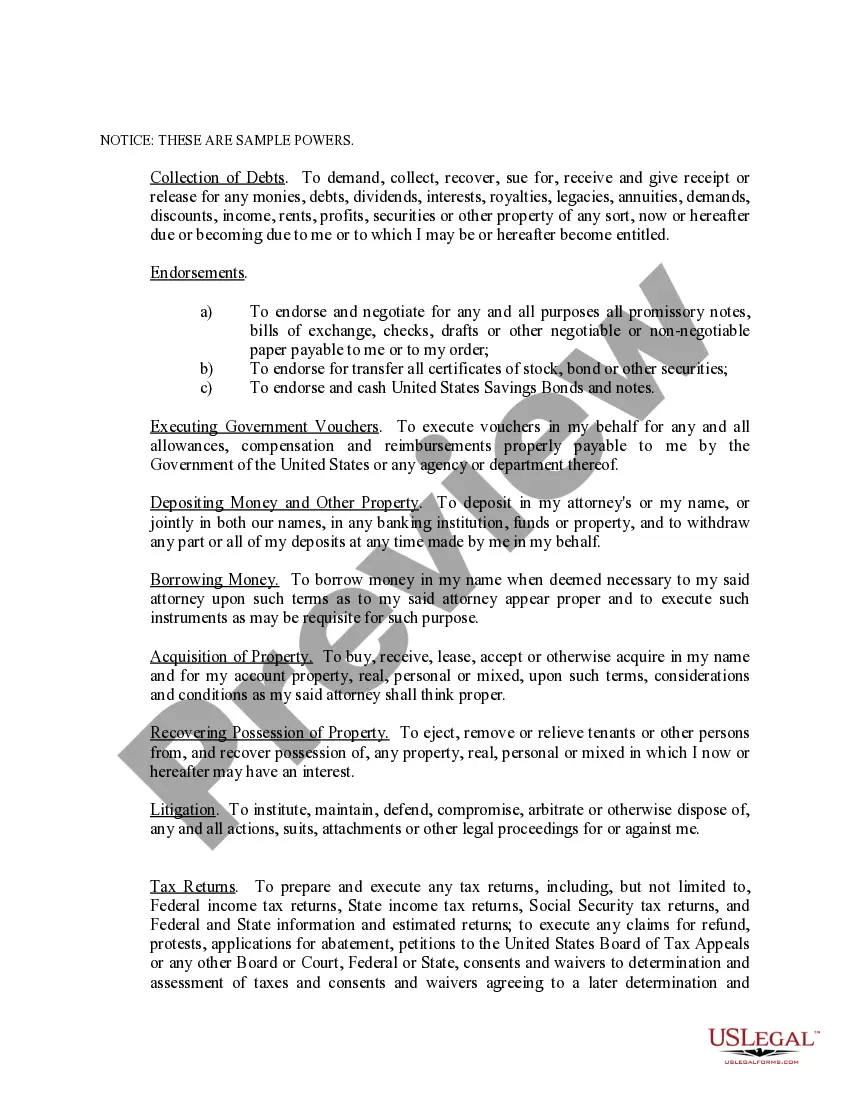

- Preview it (if this option is available) and review the supporting description to confirm whether Kentucky Powers With Formula is what you’re looking for.

Form popularity

FAQ

Form K-5 Log In A user ID and password are required to file Form K-5. If you use WRAPS to file your Withholding Tax return, or you use eFile to file your Sales Tax or other returns, you can use your current log in information to file Form K-5.

The amount of LLET is based on the amount of business a company does in Kentucky. This is measured by the company's Kentucky gross receipts or its Kentucky gross profits. Kentucky gross receipts is calculated by figuring the total receipts earned in the state after returns and allowances.

Form K-5 Log In A user ID and password are required to file Form K-5. If you use WRAPS to file your Withholding Tax return, or you use eFile to file your Sales Tax or other returns, you can use your current log in information to file Form K-5.

Effective , Kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after January 1, 2021. (103 KAR 0) To register and file online, please visit wraps.ky.gov.

Compute tax on wages using the 4.5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.