Kentucky File For Divorce

Description

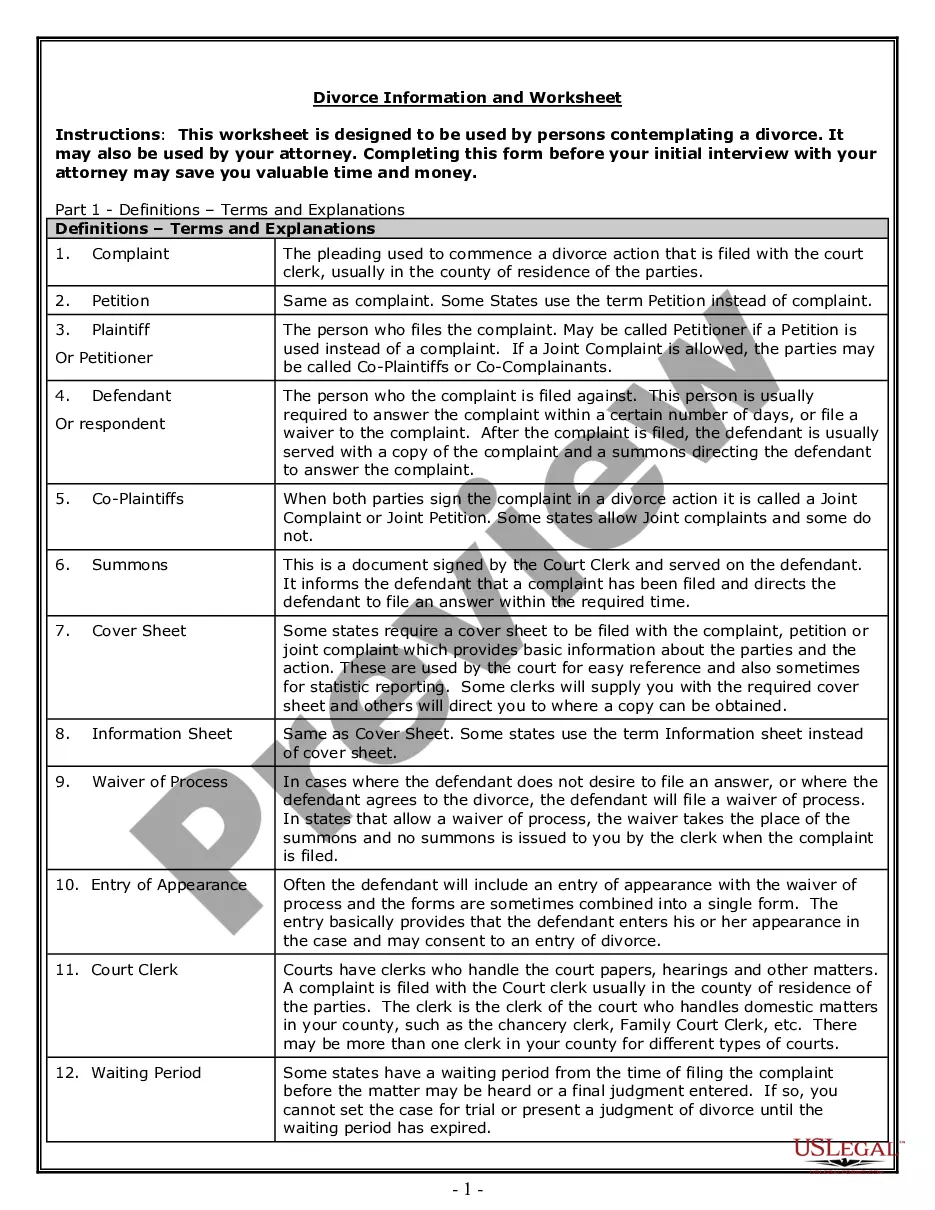

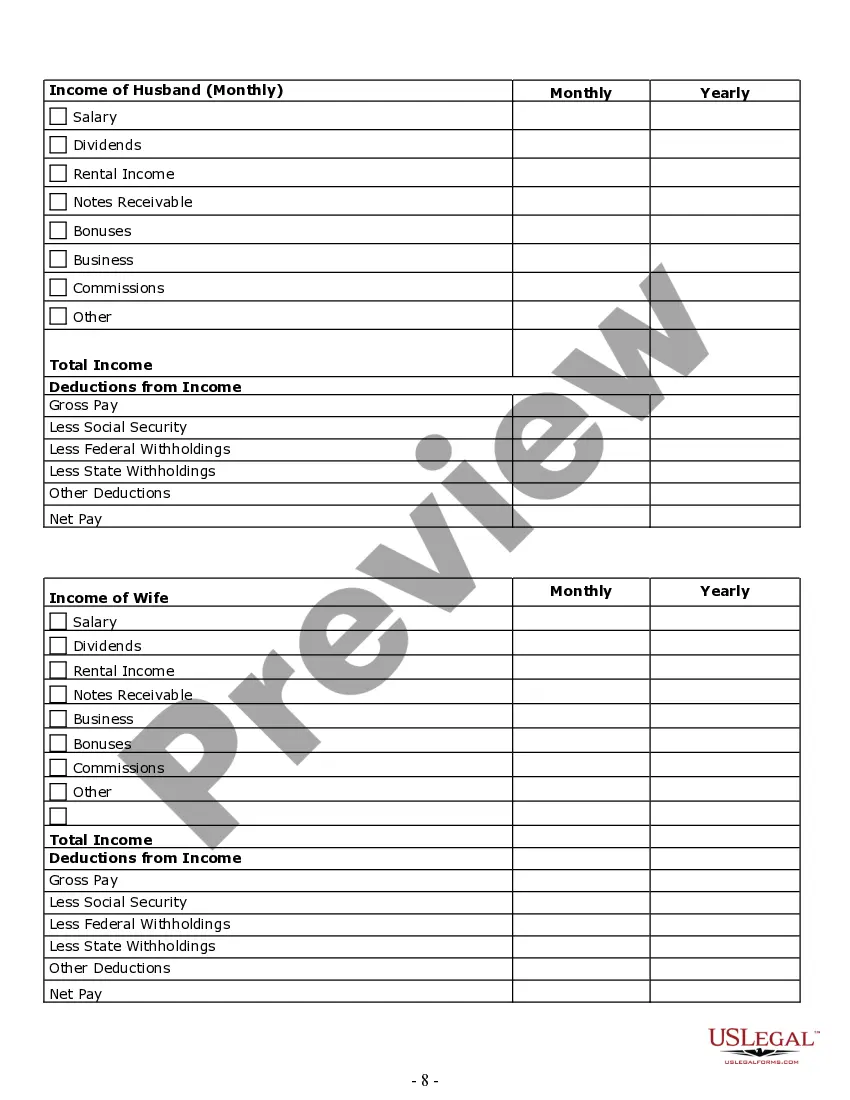

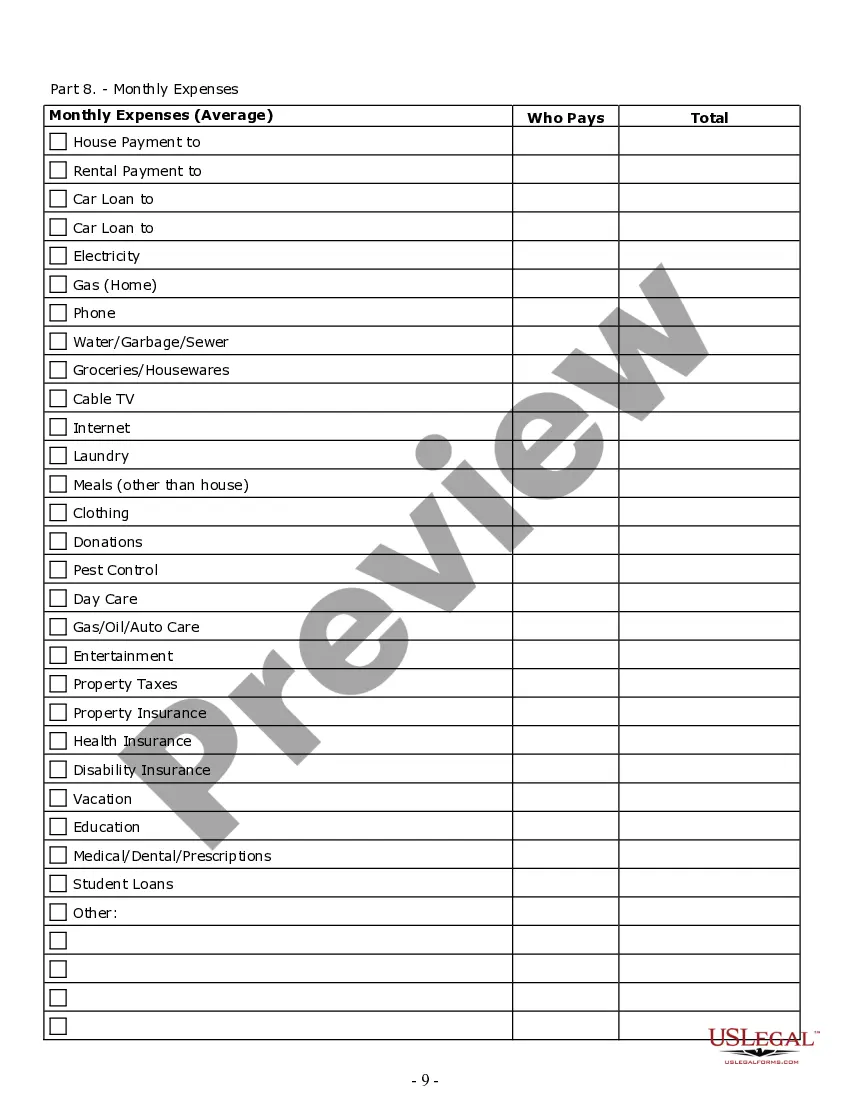

How to fill out Kentucky Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Regardless of whether it is for corporate reasons or personal affairs, everyone must deal with legal issues at some point in their lives.

Completing legal documentation requires meticulous focus, starting with selecting the correct form template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it manually. With a comprehensive US Legal Forms catalog available, you don’t have to waste time searching for the right template online. Utilize the library’s easy navigation to locate the appropriate template for any situation.

- For instance, if you select an incorrect version of the Kentucky Divorce Filing, it will be rejected upon submission.

- Thus, it is essential to obtain a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Kentucky Divorce Filing template, follow these straightforward steps.

- Search for the sample you require using the search bar or the catalog navigation.

- Review the form’s details to ensure it fits your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to find the Kentucky Divorce Filing sample you need.

- Download the template when it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you desire and download the Kentucky Divorce Filing.

Form popularity

FAQ

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender's interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage's terms should remain the same.

The process to discharge a mortgage by affidavit begins when a mortgage is still on record 30 days after the payoff is received. ing to Title 46 Section -11.2c, if the final payment is made via certified check or cashier's check, the mortgage will be deemed paid upon receipt of the check by the mortgagee.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

What Does Assignment Of Mortgage Mean? An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Both the Courts and several years of case law hold that the actual mortgage is a nullity. It is the note that controls the ownership of the loan, and by operation of fiction, whoever holds the note will hold an equity right to foreclosure irrespective of who holds or has the mortgage.