Kansas 60 Lien With Transfer Ownership

Description

How to fill out Kansas Assignment Of Lien - Individual?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; if not, renew it as necessary.

- For new users, start by browsing the form library. Use the Preview mode and read the form description to confirm you've selected the right document for your local jurisdiction.

- If the current template doesn’t fit your needs, utilize the Search tab to find another suitable form.

- Proceed to purchase the form by clicking on the Buy Now button. Choose a subscription plan that works best for you and create an account to access the resources.

- Enter your payment information, using either your credit card or PayPal account, to finalize your subscription.

- Once purchased, download your Kansas 60 lien with transfer ownership form. You can access it anytime via the My Forms section in your account.

Completing your Kansas 60 lien with transfer ownership doesn’t have to be difficult. With US Legal Forms, you can count on a vast selection of templates and expert assistance for form completion.

Start your legal journey today by visiting US Legal Forms and discover how easy it is to access the documents you need!

Form popularity

FAQ

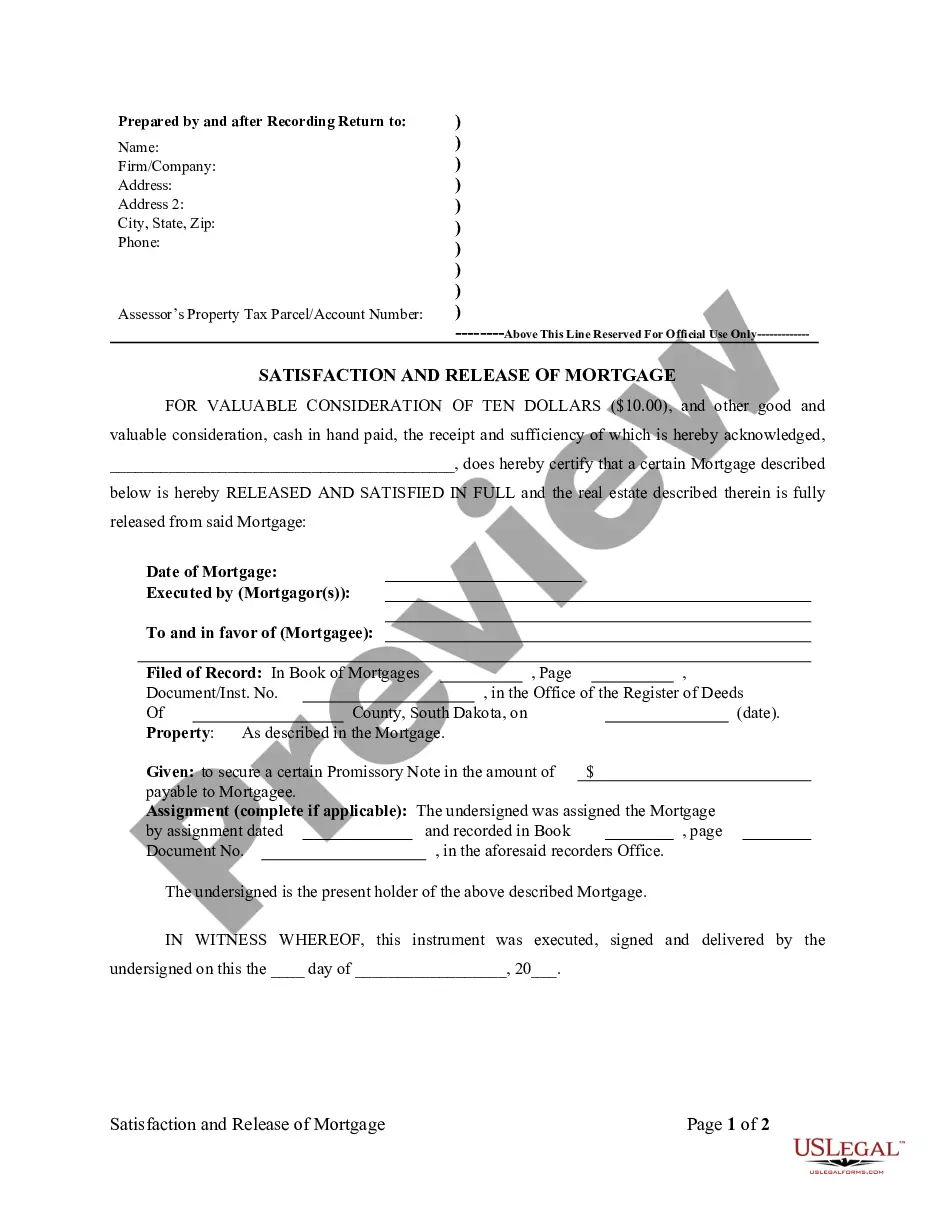

A lien transfer occurs when the legal rights of a lienholder are passed to another party. This process can involve a mutual agreement between the original lienholder and the new party, documented through a lien assignment document. For a Kansas 60 lien with transfer ownership, it's essential to ensure that the transfer is properly documented and recorded to maintain legal rights. Using platforms like uslegalforms can help you navigate the documentation easily.

When a lien is placed on you, it means a creditor has a legal claim to your property due to an unpaid debt. This process often limits your ability to sell or transfer ownership of the property without addressing the lien first. In the case of a Kansas 60 lien with transfer ownership, you will need to resolve the lien with the creditor before you can transfer ownership legally. Understanding your lien situation is crucial for making informed financial decisions.

A lien can indeed be transferred to another person, but it requires a formal process. The current lienholder must draft a lien assignment document to transfer the Kansas 60 lien with transfer ownership to the new lienholder. Once both parties sign the document, it must be recorded with the county to ensure it is legally binding and enforceable.

Filling out the back of a Kansas car title is simple. You must enter the details of the new owner, including their name and address, under the 'Assignment of Title' section. If there's a Kansas 60 lien with transfer ownership, make sure to also indicate the lienholder's information. Finally, both parties should sign and date the title to complete the process.

To perform a title transfer with a Kansas 60 lien with transfer ownership, you first need to obtain the lien release from the lienholder. Once you have the release, both the seller and the buyer must fill out the title transfer section on the back of the car title. After that, submit the completed title along with any necessary fees to your local county treasurer's office. This process ensures that the lien is properly recorded and that ownership transfers smoothly.

Yes, you can sell a car with a lien on it, but it involves a few important steps. You must notify the buyer about the existing Kansas 60 lien with transfer ownership before finalizing the sale. It's crucial to arrange for the lien payoff during the transaction to ensure a smooth transfer. Utilizing services like USLegalForms can help you navigate the complexity of lien transfers and ensure all legal requirements are met.

Transferring a vehicle with a Kansas 60 lien with transfer ownership requires careful steps. First, you must contact the lienholder to inform them about your intention to transfer the vehicle. They may require payment of the outstanding balance or consent before allowing the transfer. After obtaining the necessary approvals, you can complete the transfer paperwork, making sure to check with your local Department of Motor Vehicles for any specific requirements.

Trading in a car without a lien release can be challenging, as dealerships typically require proof that the lien is cleared. If you cannot provide the lien release, the dealership may not finalize the trade-in. Exploring your options regarding your Kansas 60 lien with transfer ownership can help you find a solution. Consider using platforms like US Legal Forms to navigate this process.

In Minnesota, you must provide the current title, a completed title transfer application, and identification. If there's a lien, you'll also require the lien release. Each requirement ensures a smooth transition of ownership. If you are confused about the Kansas 60 lien with transfer ownership, resources like US Legal Forms can provide the clarity you need.

To transfer ownership of a title in Kansas, first complete the assignment of title on the back of the document. Ensure you have the necessary lien release, if applicable, and gather identification and proof of residency. Visit your local county treasurer's office to submit the paperwork. Utilizing a platform like US Legal Forms can simplify this process, especially when handling a Kansas 60 lien with transfer ownership.