Kansas 60 Lien With Secretary Of State

Description

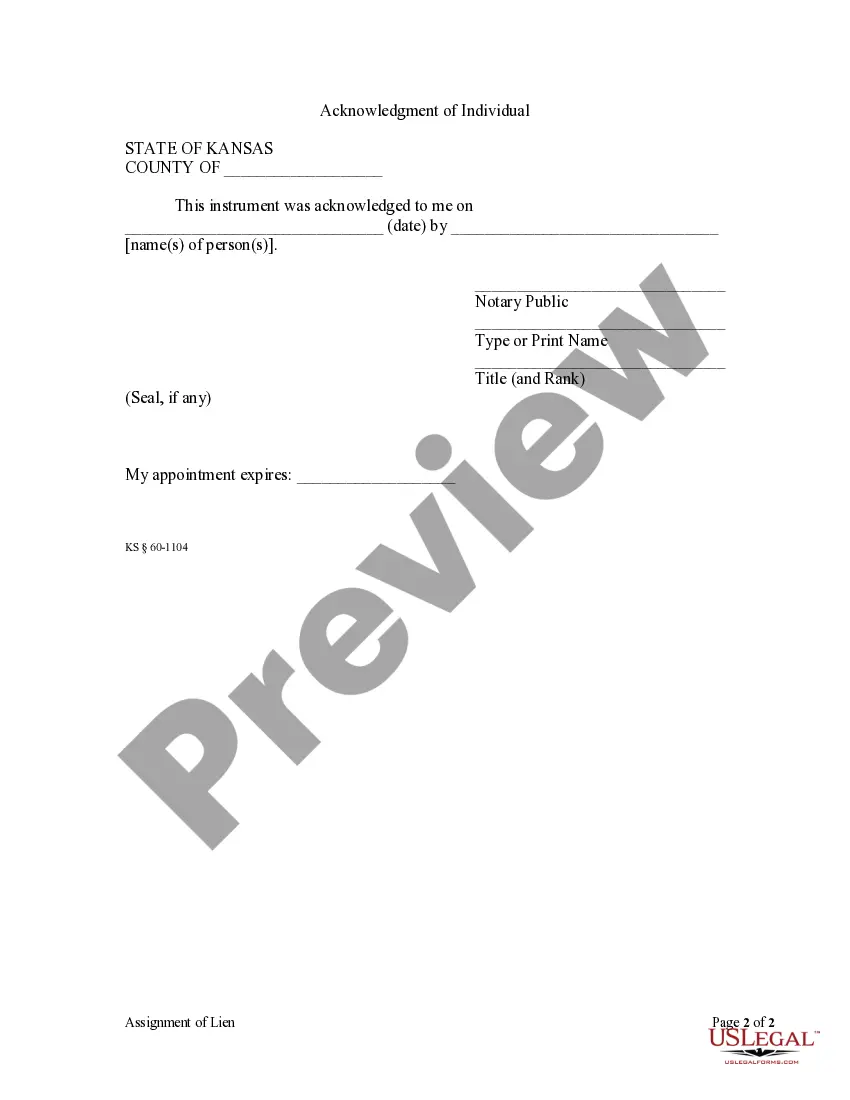

How to fill out Kansas Assignment Of Lien - Individual?

- If you already have an account, log in and access your library. Confirm your subscription is active before downloading the required form template.

- For new users, start by checking the preview mode and description of the Kansas 60 lien form to ensure it aligns with your needs and local jurisdiction.

- Should you find a discrepancy or need a different template, use the Search tab to locate the correct form that fits your criteria.

- Next, proceed by selecting your preferred subscription plan and click the Buy Now button to purchase the document.

- Complete your transaction by entering your payment details, either via credit card or PayPal, to secure your subscription.

- Finally, download your form and save it to your device for easy access. You can also find it anytime in the My Forms section of your account.

US Legal Forms stands out with its extensive library containing over 85,000 fillable legal forms. With resources that empower both individuals and attorneys, navigating legal processes has never been easier.

Start your journey today and ensure your legal documents are handled correctly. Visit US Legal Forms now!

Form popularity

FAQ

To place a lien on property in Kansas, you will need to prepare specific legal documents and file them with the county register of deeds. The process usually includes completing a Kansas 60 lien with secretary of state form to officially record your claim. It is advisable to seek assistance from professionals to ensure compliance with legal requirements during this process.

In Kansas, you should file a lien within a certain time frame to maintain its validity; typically, you have until four months after the debt arises to file a Kansas 60 lien with secretary of state. This window ensures that the creditor's claim remains enforceable. Filing within the stipulated period protects the creditor's interests effectively.

In Kansas, generally, a lien can be placed on your car by a creditor or lender who has a legal interest in the vehicle. This typically occurs in situations involving financing or leasing. If someone has a legitimate claim, they can file a Kansas 60 lien with secretary of state to secure their interest in your car.

Statute 60 1101 in Kansas pertains to the creation and enforcement of liens. It outlines the legal foundation for how different types of liens operate within the state. Familiarizing yourself with this statute can empower you to navigate the complexities of liens effectively. For detailed procedures, the Kansas 60 lien with secretary of state provides essential resources that can help clarify this statute's application.

A lien typically requires a valid debt, a debtor's default, and proper documentation. You must follow the legal steps to ensure the lien is enforceable. Understanding these conditions can help you effectively manage your financial agreements and obligations. The Kansas 60 lien with secretary of state can assist you in understanding and meeting these requirements.

To place a lien on your property in Kansas, you must first create a lien document that outlines the debt and other relevant details. Next, file this document with the Kansas secretary of state. This process helps ensure your rights are protected and can provide you with a reliable means of collecting a debt, making the Kansas 60 lien with secretary of state a crucial resource.

Yes, you can put a lien on property that you own, provided you meet the necessary legal requirements. This process typically involves documenting the debt and filing the lien with the appropriate authority. If you need assistance navigating this process, consider using the Kansas 60 lien with secretary of state for guidance and support.

In Kansas, a lien is generally valid for a period of five years. After this duration, if the lien holder does not take action to renew it, the lien will expire. Staying informed about the specifics will help you manage your interests effectively. Utilize the Kansas 60 lien with secretary of state for the latest updates on lien validity.

Yes, a contractor can pursue legal action without a formal contract in Kansas, especially if there is sufficient evidence of an agreement. However, success may depend on demonstrating the existence of a verbal or implied contract. If you find yourself in this situation, seek assistance from uslegalforms to better understand your rights and options.

To file a lien in Kansas, you must first prepare the necessary documentation, including detailed information about the work performed and unpaid amounts. Then, submit your Kansas 60 lien with the secretary of state, adhering to the required format and timelines. For a smoother process, consider using uslegalforms for templates and guidance.