Kansas Llc Operating Agreement Requirements

Description

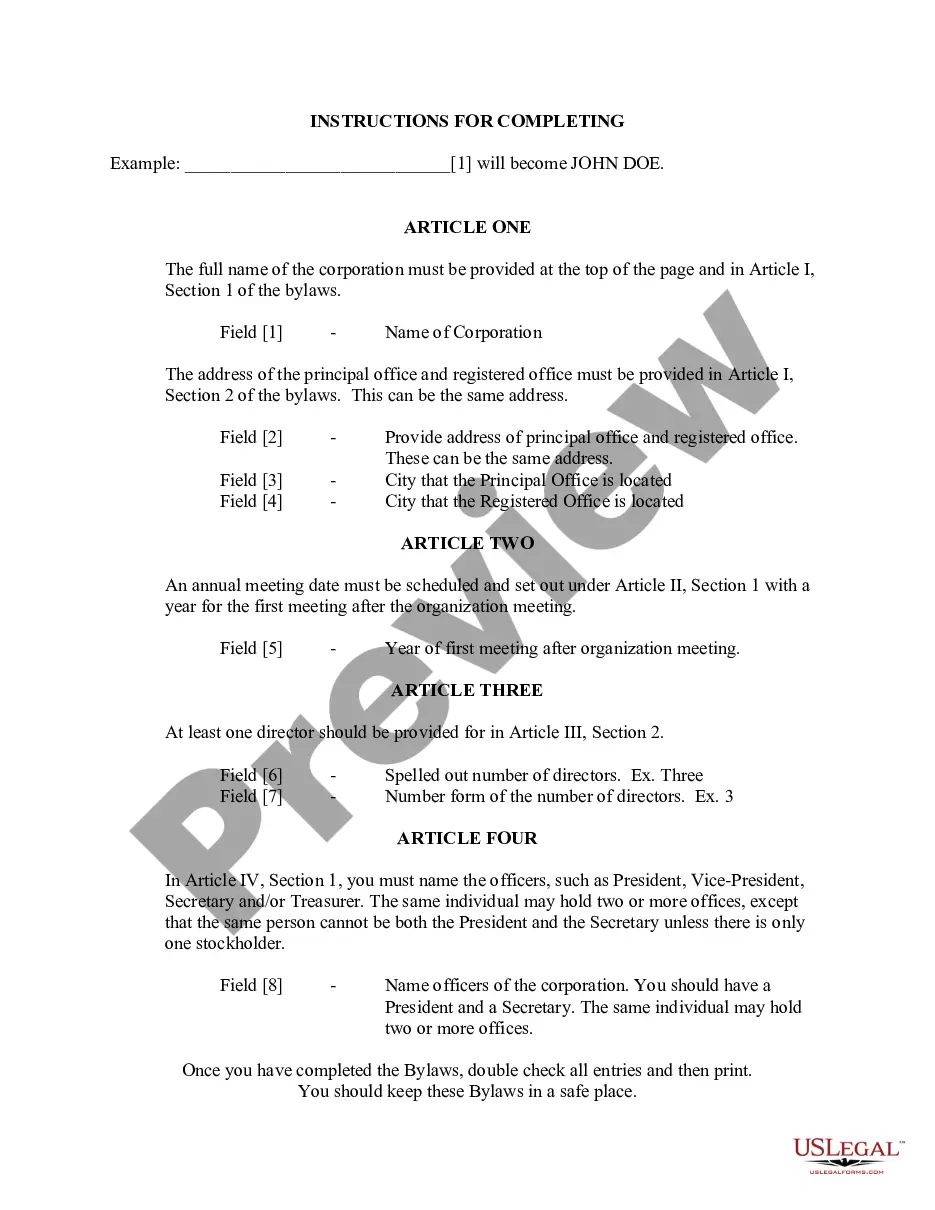

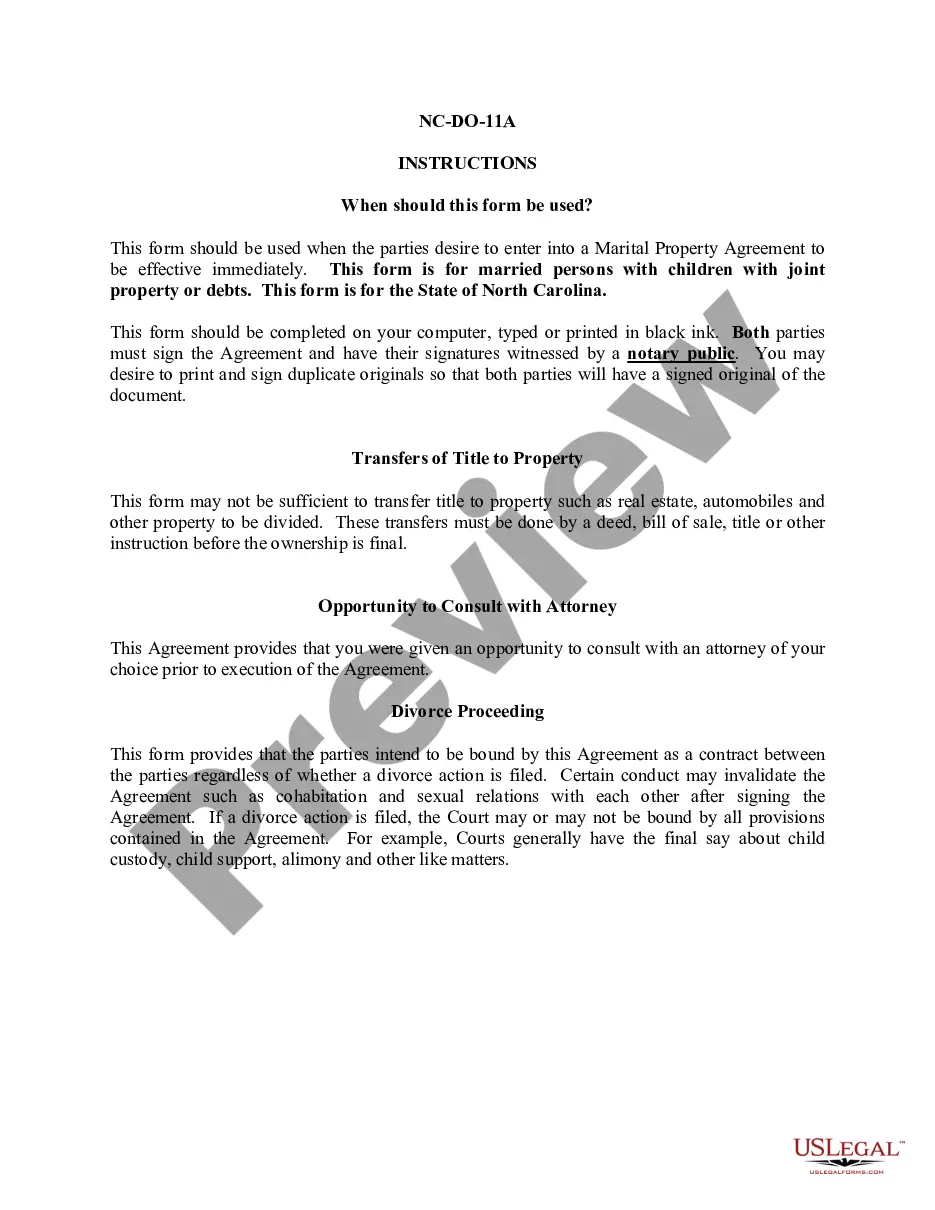

How to fill out Kansas Limited Liability Company LLC Operating Agreement?

Creating legal documents from the ground up can frequently be overwhelming.

Specific situations may require extensive research and significant financial investment.

If you’re seeking a more straightforward and cost-effective method of drafting Kansas LLC Operating Agreement Requirements or any other paperwork without the hassle, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can immediately obtain state- and county-specific templates meticulously prepared by our legal professionals.

Ensure that the selected form adheres to the regulations and laws of your specific state and county. Choose the appropriate subscription plan to obtain the Kansas LLC Operating Agreement Requirements. Download the document, then fill it out, validate it, and print it. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and simplify your form-filling process!

- Utilize our site whenever you require dependable and trustworthy services to swiftly locate and download the Kansas LLC Operating Agreement Requirements.

- If you’re a returning user and have set up an account with us before, simply Log In, find the form, and download it or retrieve it anytime later in the My documents section.

- No account? No worries. It only takes a few minutes to register and browse the catalog.

- Before diving straight into downloading Kansas LLC Operating Agreement Requirements, consider these suggestions.

- Review the document preview and descriptions to confirm you have located the desired document.

Form popularity

FAQ

A Kansas LLC Operating Agreement is a written contract between the LLC Members (LLC owners). This legal document includes detailed information about LLC ownership structure, who owns the company and how the LLC is managed.

A Kansas single-member LLC operating agreement is a legal document that is designed specifically for a sole proprietor, whereas the single owner of a business will have the ability to set forth their company policies, procedures as well, the recording of their daily activities related to the business.

Starting an LLC in Kansas. ... Decide on a name for your business. ... Assign an agent for service of process. ... Get an Employer Identification Number (EIN) from the IRS. ... Create an operating agreement. ... Make sure that your LLC, should it offer professional services, meets Kansas state legal requirements.

Do you need an operating agreement in Kansas? No, it's not legally required in Kansas under § 17-76,134. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

Your LLC must file a IRS Form 1065 and a Kansas Partnership Return (Form K-120S). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the Kansas Department of Revenue to pay your Kansas income tax. Check with your accountant to make sure you file all the correct documents.