Promissory Note Template Georgia With Co-maker

Description

How to fill out Georgia Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Navigating through the red tape of traditional documents and forms can be challenging, particularly for those who do not engage in this work professionally.

Selecting the appropriate template for a Georgia Promissory Note Template With Co-maker may consume a significant amount of time, as it must be legitimate and precise down to the last number.

However, you will spend considerably less time locating an appropriate template if it originates from a trustworthy resource.

- US Legal Forms is a platform that streamlines the search for the correct forms online.

- US Legal Forms serves as a one-stop shop to find the latest document samples, verify their applicability, and download them for completion.

- It boasts a repository of over 85,000 forms applicable across various professional fields.

- When seeking a Georgia Promissory Note Template With Co-maker, you can trust its authenticity since all forms are validated.

- By registering for an account at US Legal Forms, you will have access to all the necessary samples at your fingertips.

- You can store them in your history or include them in the My documents collection.

- Retrieve your saved forms from any device by clicking Log In on the library site.

- If you have not yet created an account, you can still search for the template you need.

Form popularity

FAQ

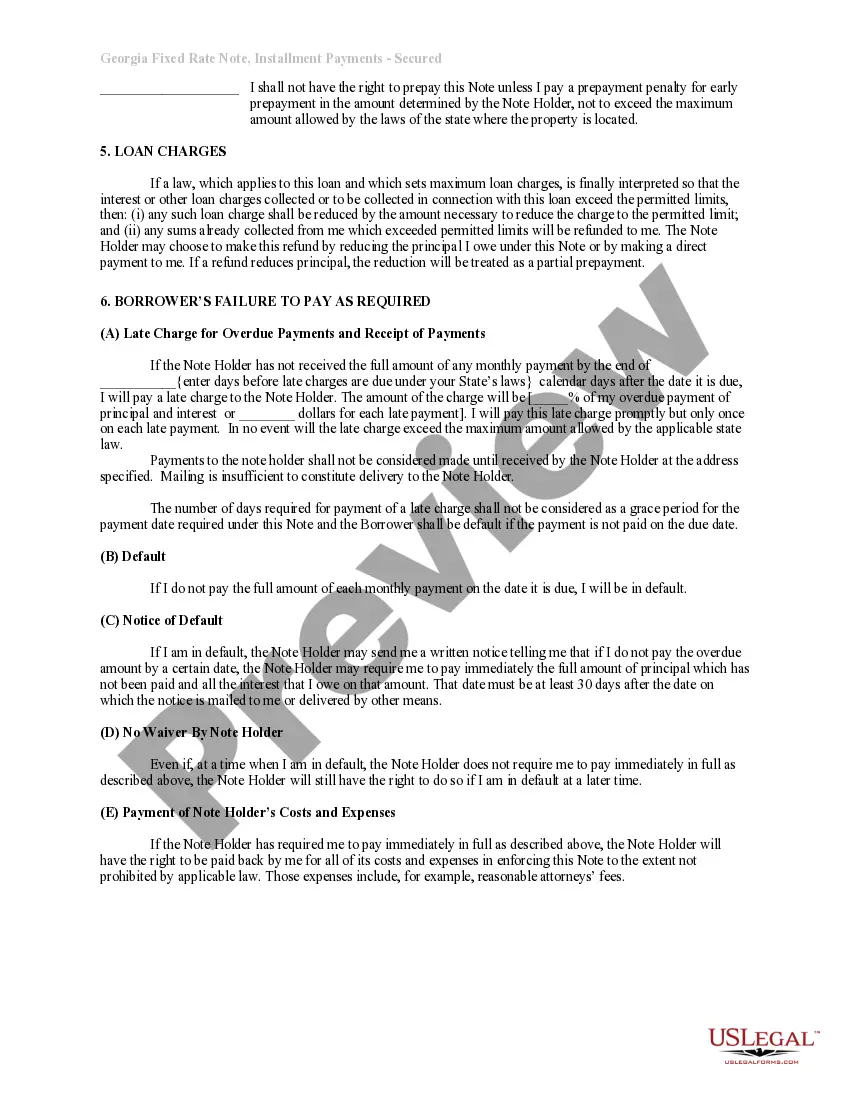

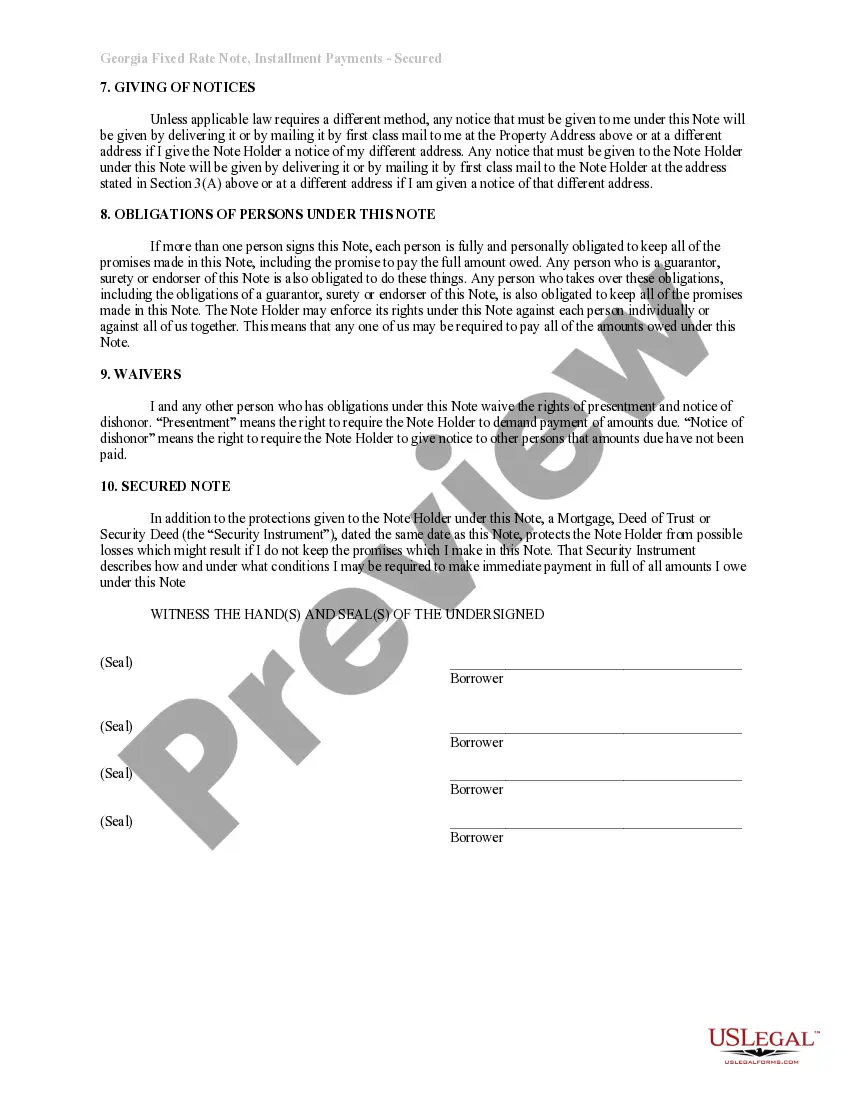

In order for the promissory note to be valid, the borrower needs to sign it. The lender may require the borrower to sign this document in front of a notary to guarantee the signature.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

The promissory note is commonly only signed by the maker since the holder is not making any commitment under the note. Even in the case of a loan, the transfer of funds is separate from the note itself. It's important to note that a promissory note is not a substitute for a formal contract.

A Georgia promissory note must be signed and dated by the borrower and a witness. It should also be notarized.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.