Name Change With Irs

Description

How to fill out Georgia Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- Log in to your US Legal Forms account if you are a returning user and navigate to the name change section to download the required template.

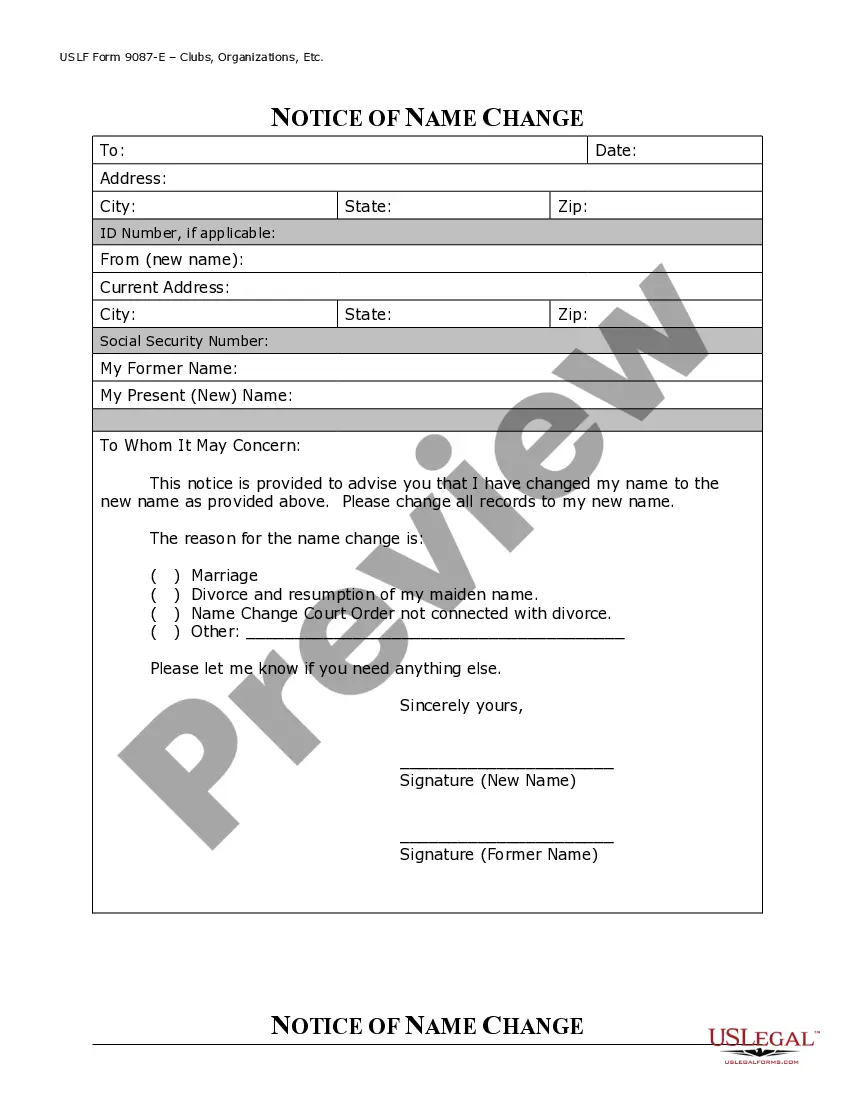

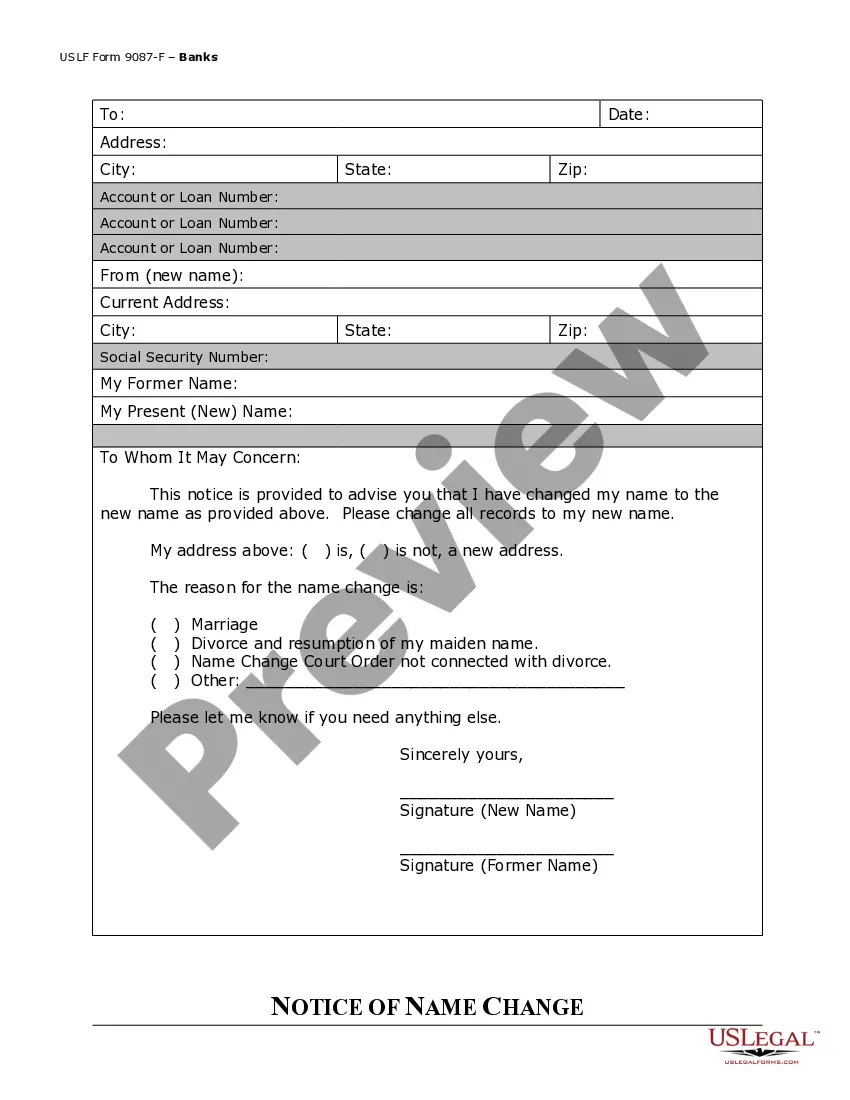

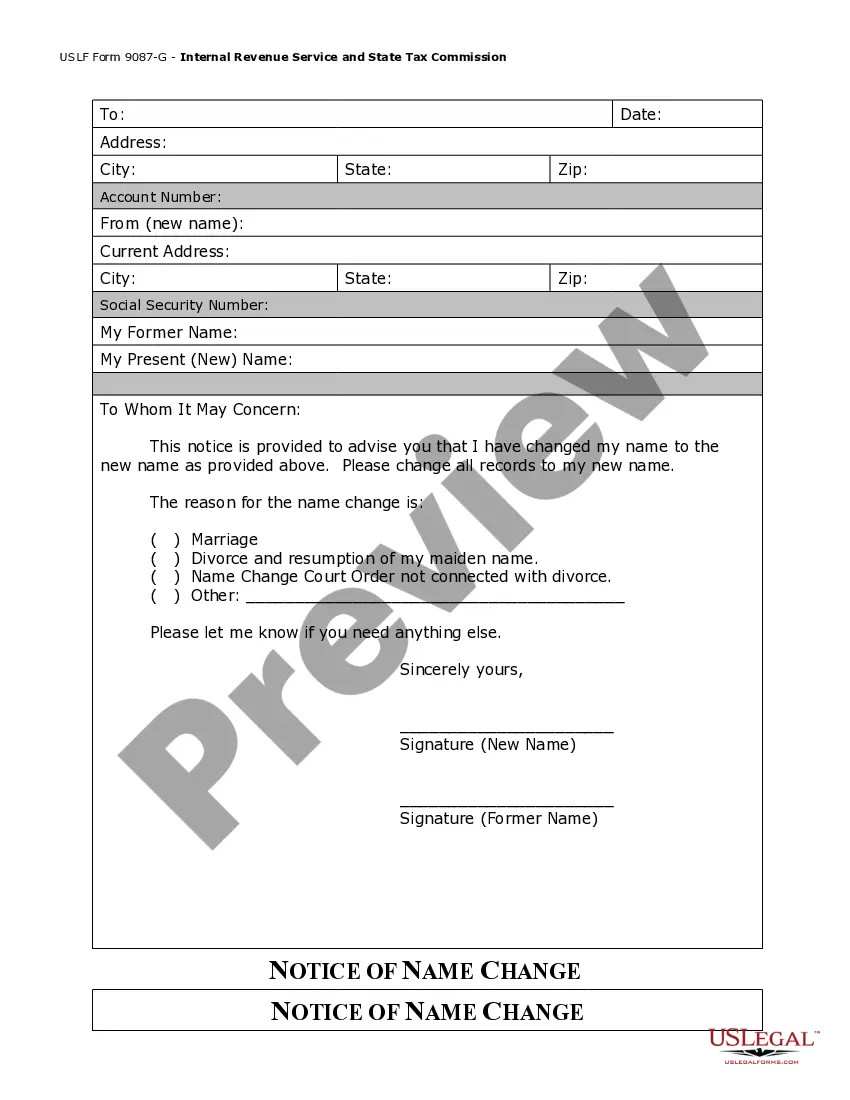

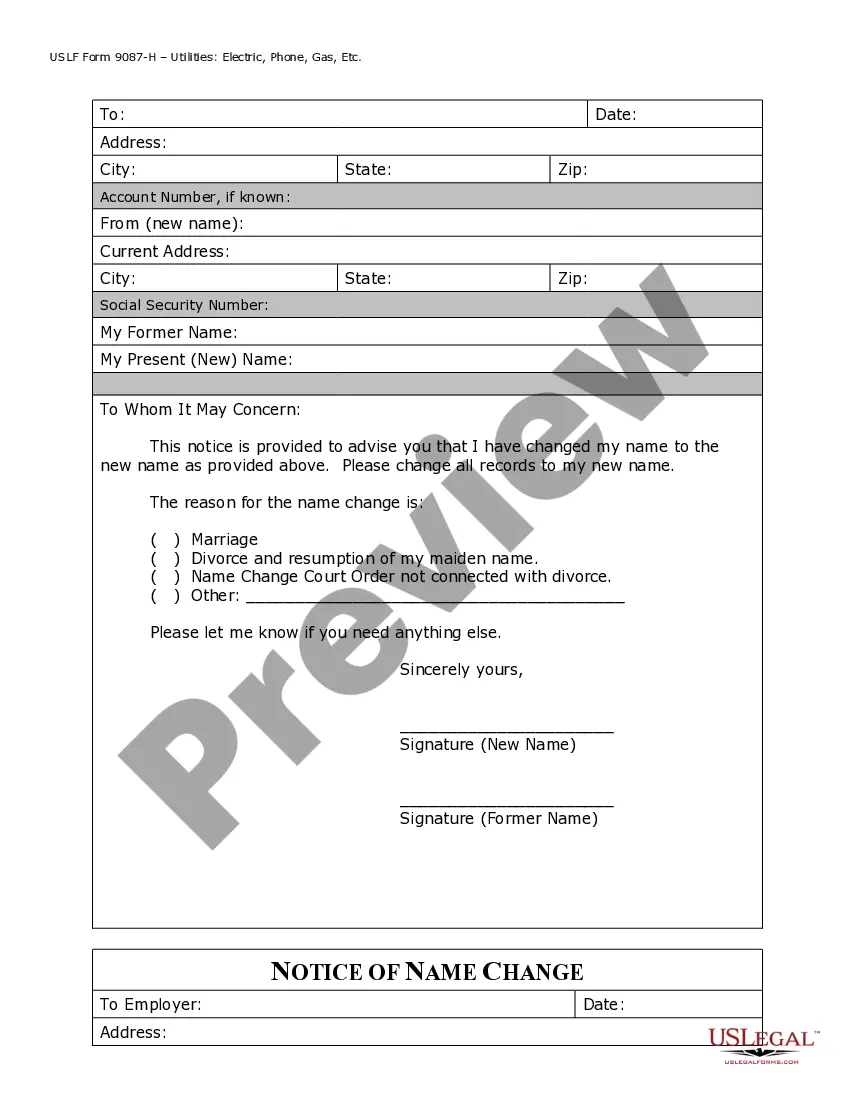

- If you're new to US Legal Forms, start by checking the preview mode and description of available forms to ensure suitability for your needs.

- Should you need another template, use the Search tab to find the correct document that aligns with your local jurisdiction.

- Select the form that meets your requirements and click on the Buy Now button to choose a subscription plan.

- Complete your purchase by entering your payment information, either through a credit card or your PayPal account.

- Download your completed form to your device and access it anytime from the My Forms section in your profile.

Using US Legal Forms not only grants access to a vast range of legal documents but also offers premium expert assistance for any questions you may have during the completion process.

Empower your legal journey by leveraging US Legal Forms today. Start simplifying your name change process and ensure you stay compliant with IRS regulations!

Form popularity

FAQ

To notify the Department of Revenue of a name change, you typically need to fill out a specific form provided by your state's Department of Revenue. This may vary by state, so check the local requirements. After updating your information with the Department of Revenue, ensure that you also reflect this name change with IRS for consistent records. U.S. Legal Forms can guide you through the necessary steps and paperwork.

To inform the IRS of a name change, you should ensure that your name matches the records of Social Security. You can do this by filing your tax return under your new name and indicating your name change with your next submission. If you change your name legally and want to ensure the IRS updates your records, you may also consider filing Form 8822. This process is crucial for a smooth experience, especially when handling a name change with IRS.

To notify Social Security of a name change, you need to complete an application for a new Social Security card. You can do this online or in person at your local Social Security office. Make sure to provide proof of your name change, such as a marriage certificate or court order. Updating your records is important to ensure that your information matches, especially when it comes to filing taxes and any name change with IRS.