Florida Rental Application With 20 Down

Description

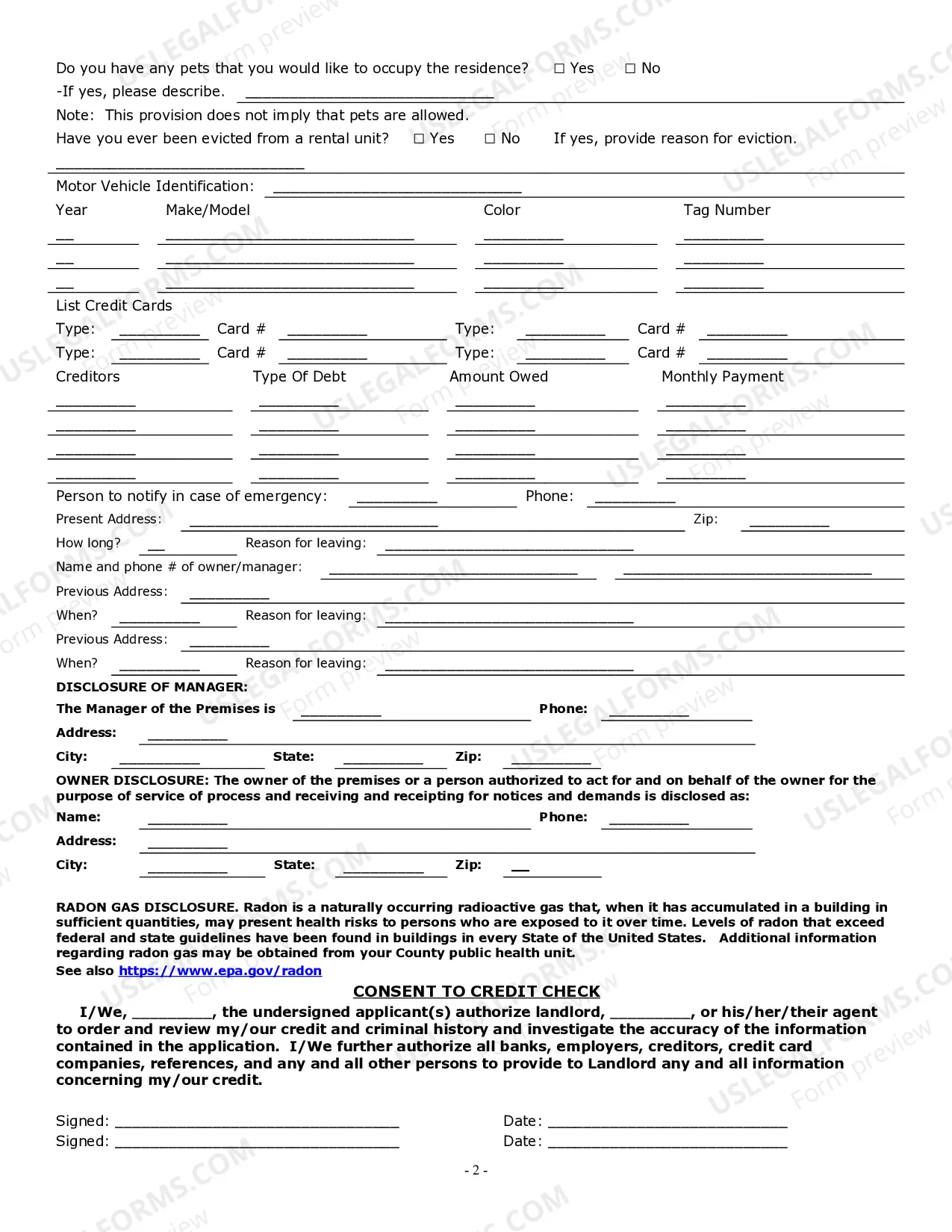

How to fill out Florida Residential Rental Lease Application?

It’s well known that one cannot become a legal expert instantly, nor can one quickly understand how to efficiently create a Florida Rental Application With 20 Down without possessing a specialized skill set. Crafting legal documents is a lengthy procedure that demands specific training and expertise. So why not entrust the preparation of the Florida Rental Application With 20 Down to the experts.

With US Legal Forms, which boasts one of the most comprehensive legal document collections, you can locate everything from court forms to templates for internal communication. We recognize how vital it is to comply with and follow federal and state laws and regulations. That’s why, on our platform, all documents are location-specific and current.

Here’s how you can begin using our website and acquire the document you require in just a few minutes.

You can regain access to your documents from the My documents section at any time. If you are an existing customer, you can simply Log In and find and download the template from the same section.

Regardless of the reason for your paperwork—be it financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Identify the document you need using the search bar at the top of the page.

- View it (if this option is available) and read the accompanying description to confirm whether Florida Rental Application With 20 Down is what you are looking for.

- Initiate your search again if you require a different form.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. After the payment is completed, you can download the Florida Rental Application With 20 Down, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

To avoid a 20% down payment on an investment property, consider exploring alternative financing options such as FHA loans or local programs that support first-time investors. Some lenders may offer lower down payment options if you have excellent credit or if the property qualifies under specific criteria. When submitting your Florida rental application with 20 down, highlighting your financial strengths can help you negotiate better terms.

The 3x rent rule in Florida states that tenants should earn three times the monthly rent to qualify for a rental property. This guideline helps landlords ensure that potential tenants can afford the rent comfortably. When filling out your Florida rental application with 20 down, demonstrating your income can assure landlords of your financial stability. Adhering to this rule can significantly improve your chances of securing a rental.

While the traditional minimum down payment for a rental property is 20%, some lenders may offer programs that allow for lower payments. It is crucial to present your Florida rental application with 20 down to maximize your chances of approval. Always consult with a real estate expert to explore your financing options and find the best deal.

Red flags on a rental application can include inconsistent income, a history of evictions, or poor credit scores. Additionally, any discrepancies in the information provided can raise concerns for landlords. To avoid these issues, ensure your Florida rental application with 20 down is accurate and complete. Transparency can help you stand out positively.

For an investment property in Florida, the minimum down payment is usually around 20%. However, some lenders may allow lower payments depending on your creditworthiness and the overall market conditions. A well-prepared Florida rental application with 20 down can strengthen your position when negotiating with lenders. Always shop around for the best financing options.

The $35000 down payment assistance program in Florida helps eligible buyers afford a home by providing financial support for down payments. This program can be particularly beneficial for those filling out a Florida rental application with 20 down, as it makes homeownership more accessible. By utilizing this assistance, you can lower your initial costs and invest your savings in other areas. For details on how to apply, visit the local housing authority or explore resources on the uslegalforms platform.

To rent in Florida, landlords often look for a minimum credit score of around 620. However, some may accept lower scores if you have a strong rental history or a larger down payment. When applying for a Florida rental application with 20 down, demonstrating financial responsibility through credit can strengthen your position. Always check with the specific landlord or property management for their requirements.