Subcontractors Without Insurance

Description

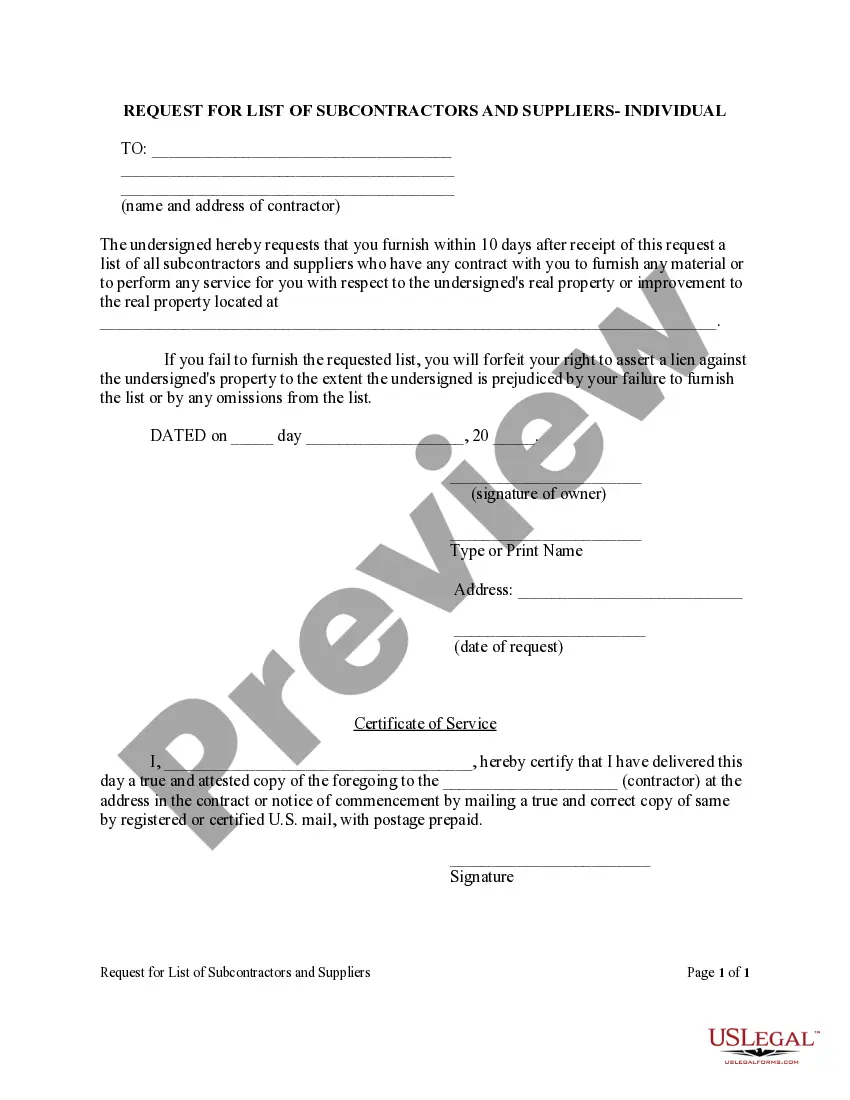

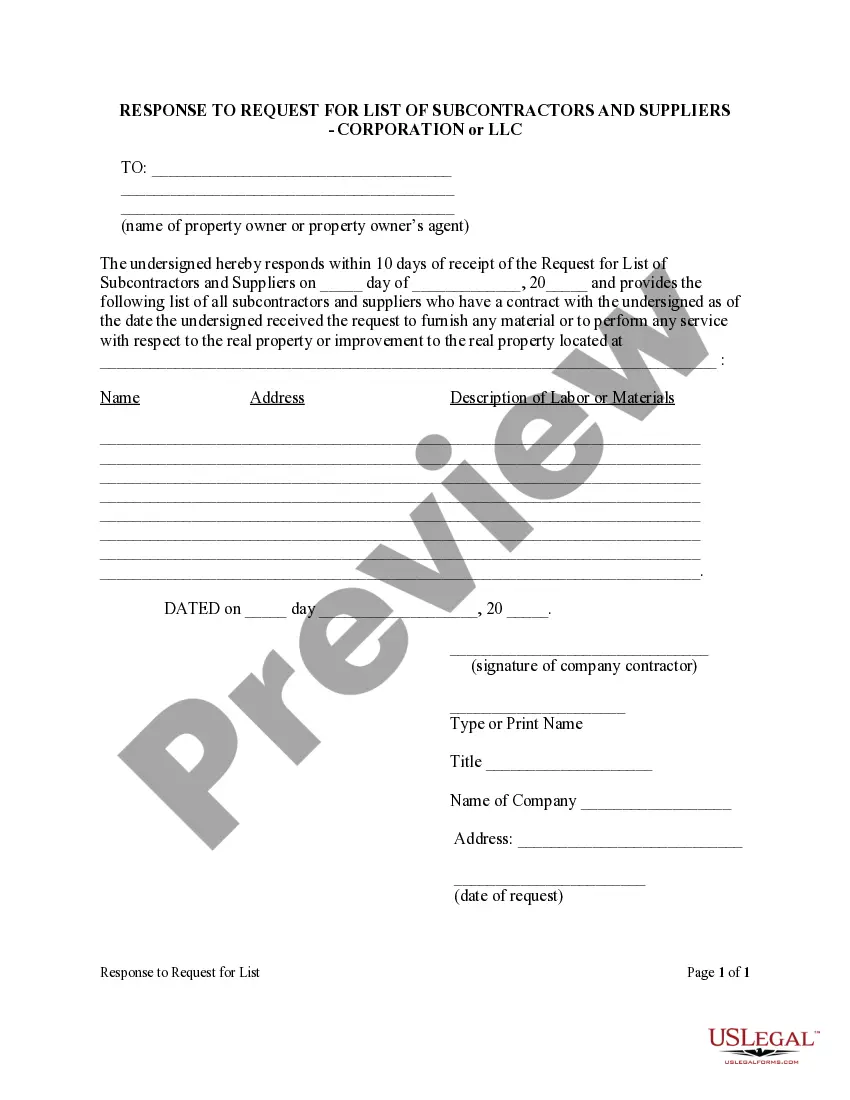

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

Regardless of whether you frequently handle documents or occasionally need to submit a legal report, it is crucial to have a reliable source of information where all samples are pertinent and current.

The first step when utilizing a Subcontractors Without Insurance is to confirm that you have the latest version, as it determines if it can be submitted.

If you wish to make your search for the most recent document samples easier, look for them on US Legal Forms.

1. Use the search menu to locate the form you need. 2. Review the Subcontractors Without Insurance preview and outline to ensure it is exactly what you seek. 3. After verifying the form, click Buy Now. 4. Choose a subscription plan that suits you. 5. Create an account or Log In to your existing one. 6. Provide your credit card details or PayPal account to complete the transaction. 7. Select your desired file format for download and confirm it. 8. Eliminate the uncertainty of managing legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that offers nearly every sample form you may need.

- Look for the templates you require, verify their relevance immediately, and learn more about how to use them.

- With US Legal Forms, you gain access to over 85,000 document templates across various fields.

- Acquire the Subcontractors Without Insurance samples in just a few clicks and save them at any time in your account.

- Having a US Legal Forms account will grant you access to all necessary samples with ease and less hassle.

- Simply click Log In in the website header and access the My documents section, where all the forms you require are readily available without needing to spend time searching for the appropriate template or checking its legitimacy.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

A subcontractor receives a portion of what the contractor earns for an overall job. Contractors receive payment per job or by the hour. As a contractor, you a receive 1099 form, and the IRS determines if a worker is a contractor or an employee.

In short, someone who sets their wage, hours, and chooses the jobs they take on is a subcontractor, while someone whose employer specifies their wage, hours, and work tasks is an employee.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

Typically, a contractor works under a contractual agreement to provide services, labor or materials to complete a project. Subcontractors are businesses or individuals that carry out work for a contractor as part of the larger contracted project.